Quick Portfolio Update

It’s been quite a week of earnings as a number of our portfolio holdings reported their Q3 numbers including Alphabet, Costar, Amazon and Microsoft. We’ve seen quite a bit of volatility coming into the Q3 print and even more after numbers were reported this week. A common theme I’m seeing is companies are getting punished harder by not beating expected figures from the Street compared to getting rewarded on the up-side for beating expected Street estimates. It’s clear there is a lot of fear in the market and investors are looking for any reason to sell and move to cash and bonds and hide at a beach somewhere. That’s great for us as it presents a potential opportunity to buy their shares from them at a discount.

Based on the above four holdings from the earnings week, investors initially rewarded Microsoft with an after earnings move of about 4%, but this has since been reversed with the stock being down 3.7% as of this writing. Some of the other businesses took large share price hits after the print dropping 4.5% to roughly 10% in some cases. We’ll dig into the details further on in the post.

I received quite a few texts and emails this week regarding the price movements in some of these names and others. The majority of these texts and emails were effectively just a copy/paste of a news article headlines with no data or additional work looking into the fundamentals, the reported figures, company transcripts, generating assumptions based on some market research and attempting to model out cash flows, nothing.

I find it’s always a great reminder of the famous Warren Buffet quote.

“The Key to Investing Is Capitalizing on 'People Doing Dumb Things” - Warren Buffett

Smart people can do extremely dumb things when they let their emotions get the better of them when Mr. Market decides to have one of its common little fits. I’m always amazed at how someone can get into a particular name for all the right reasons, but then as soon as the price drops (even in the short-term), it can influence their whole perception of the company. At times it can be almost comical, but it’s something as investors we should love to hear, as it presents a great opportunity for us to make money off the speculators masquerading as investors.

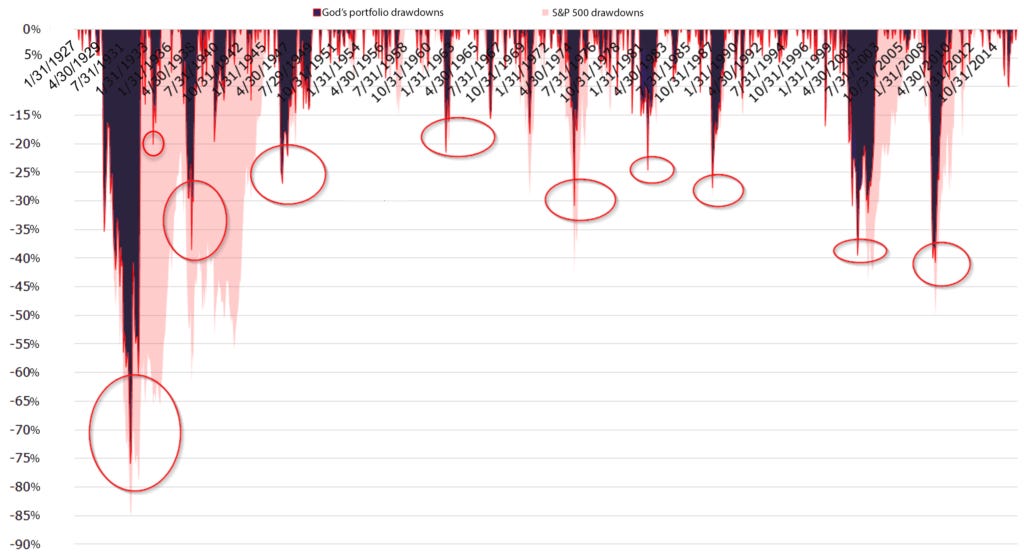

Drawdowns are common in big winners

Just how common are drawdowns in the market and for some of the best performing stocks ever? I decided to present the extreme to really hammer my point home. In July 2020, Hendrick Bessembinder, a finance professor at Arizona State University published a series of papers showing that the stocks that generated the highest returns and wealth for shareholders over the decade went through deep share price reversals — multiple times in some cases.

“What he found from his research was that, on average, the most successful 100 stocks created $US219 billion of wealth over a decade-long horizon. However, shareholders had to endure a maximum drawdown in the same decade of 33% that lasted for 10 months.”1

The additional interesting point, was that if you were a shareholder in the decade preceding the stocks decade of greatest performance, you would have suffered a maximum drawdown of 52% lasting 22 months on average, on your way to generating extreme wealth for yourself if you just simply held on and didn’t let your emotions and price movement dictate your decisions.

To take this to an even further extreme, in 2016 Wesley Gray, Phd, an asset manager and former US Marine, published a paper, which showed the drawdowns of what he called the “God Portfolio.” This portfolio was a list of the best performing stocks from 1926 - 2016. The God’s portfolio compounded at more than 29% per year! Now obviously that is incredible performance, but what’s even more incredible is the drawdowns an investor would have had to endure, even with the hindsight of knowing which stocks would be the best performers.

The chart below illustrates this perfectly; it clearly shows the extreme drawdown on some of the worlds best performing stocks. It also shows the resilience of businesses over a long holding period. Stocks truly are the safest place to generate wealth if held.

If you’re a true long-term investor your goal should be to find, buy and hold great compounders, but it is impossible to avoid drawdowns along the journey.

Thoughts on Alphabet

A good exercise I learned early on, was to take the companies in your portfolio and list out various fundamental metrics of the company over a number of years either on paper or in excel. In other words, take a time period, say from year 2000-2010 and list out things such as revenue growth, earnings growth, cash from operations and/or free cash flow growth, share count growth or shrink, ROIC, ROE, etc. Take a step back and look at the numbers over time and ask yourself, “just seeing these figures of the business, would I ever sell this company?” The answer every single time, is no, assuming you’ve added a great company to your portfolio. But you get the idea, it’s amazing how the news headlines can take you off course from generating wealth for yourself.

A quick look some highlights from Alphabets most recent Q3 earnings report:

Revenue of $76.7 billion, a 11% increase compared to Q3 2022.

Net income of $19.7 billion, a 42% increase compared to Q3 2022.

YTD cash flow from operations growth of 22%, compared to the first 9 months of 2022.

Return on invested capital of 22%.

Cash on hand of $120 billion compared to long-term debt of $13.7 billion.

Youtube grew 12% and is seeing large increases in users watching Youtube instead of traditional TV or Netflix with the subscriber growth in NFL Sunday Ticket.

Google Cloud revenue of $8.4 billion, a 22% increased compared to Q3 2022 and grew operating profit 300% compared to Q3 2022.

Repurchased $15.8 billion worth of its own stock, an increase compared to the $15.4 billion repurchased on year prior

Now, just simply looking at the numbers above is this a company you would want to own? For me its an absolute yes, but what happened to the stock after reporting figures? A 9.51% drop after earnings on October 25th and another 2.6% drop on October 26th. Or in other words, a loss of market cap of about $170 billion USD.

Now before we get into why the sell-off occurred I think it’s important to let everyone know what Google is and what it isn’t. Google is a digital advertising company. Plain and simple. It generates 90+ % of its revenue and earnings from ads, even though they do offer some enterprise products and services, this is not an enterprise software company offering subscriptions like Microsoft. As an investor or reader, you need to understand this. If you own Google, you fully understand their advertising business model and you believe its the best platform for digital ad growth. If not, you should sell the stock and own something else.

Now on to the sell-off. The stock sold off roughly 10% in a day due to the fact that Google cloud revenue came in at $8.4 billion instead of the expected $8.6 billion. Now a couple reasons why this is laughable.

Alphabet does not provide guidance for it’s Google Cloud division. Any revenue or earnings estimates you see or read on the internet for Google cloud are set by analysts based on their models and best guesses, not management.

The assumption was that because Google cloud grew at “only” 22% and Azure grew at 29% in Q3, that must mean that Microsoft took share from Google. It also must mean that Google is behind on AI and their cloud product is awful compared to Azure.

You know we are living in crazy times when a extremely high margin business, with a revenue run rate approaching $50 billion a year growing 22% is a bad result. The other thing I think investors missed is the simple fact that the division grew 22%. If they grew 22% they could have done it in a number of ways:

Increased pricing.

Additional products and services to customers.

Gaining new customers.

At 22% growth they must have gained new customers, so the question is, who did Google Cloud gain customers from? Oracle? IBM? Amazon? The key thing to remember here, is the cloud is a huge market. Microsoft, Amazon and Google are all going to be massive winners here. It’s an extremely high margin business, the customers are sticky meaning once you land them they don’t leave for a long-time if ever, and over time AI related products and services will only add to this growth and profitability.

I thought it would be interesting to show the 10 worst drawdowns in Alphabet’s history, which also includes how long each one lasted. I’ve been a shareholder since 2012 so I’ve been through a few of these, but I hope it illustrates why taking a long-term view is important. Some of these drawdowns, were back after just 2-3 months. Truly incredible. If you remember back just a few short months ago, when Alphabet shares dropped to as low as $80 a share after ChatGPT was released and the Google Bard demo flopped. Investors were saying it’s over for the company then and Microsoft will eat its lunch. The stock months later was at $140 a share. After earnings again this time, investors are yet again saying the company is dead. Stock is currently at $126 as of writing, we’ll see where it is a few months to a few years from now.

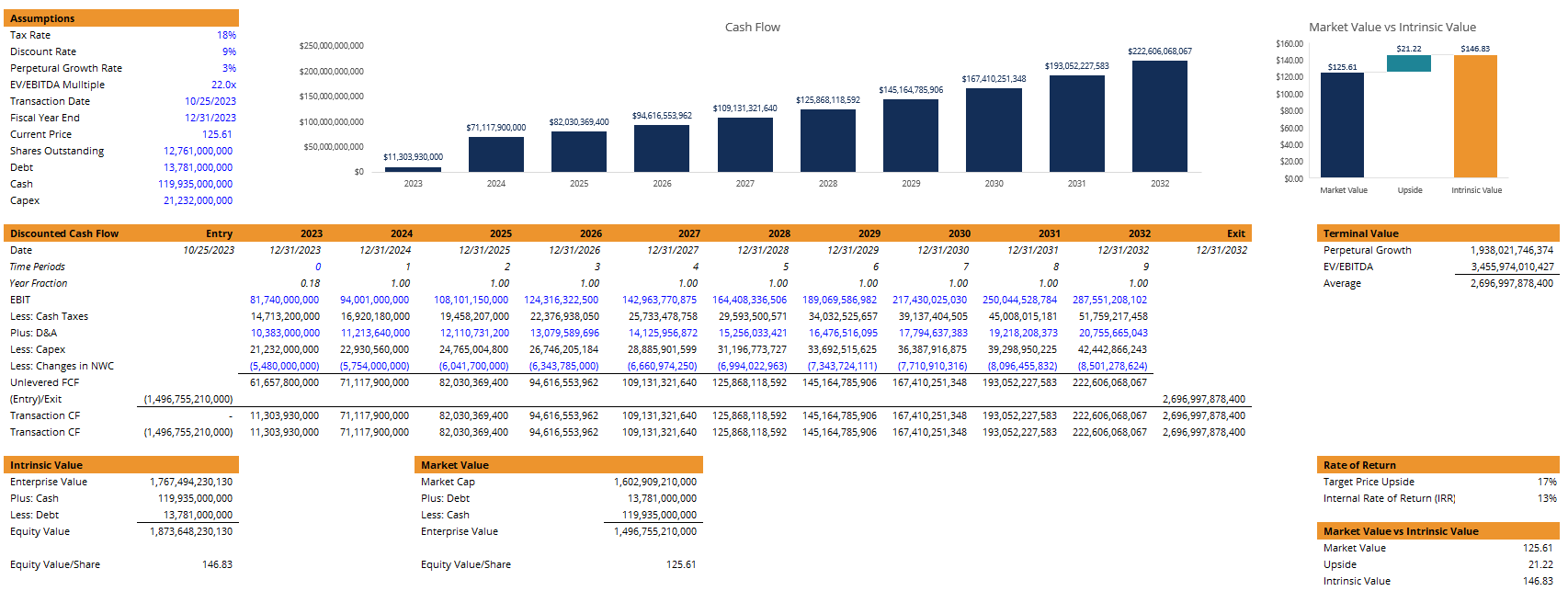

I don’t plan on making any changes to my position in Alphabet, even with the price drop. Based on the company fundamentals and the continued growth of the core business, the future cash flows I’m estimating are as follows:

Based on the above, I’m estimating the intrinsic value at about $147 per share. I don’t put much weight into these simple DCF models, but I do find them quite fun to make and then debate the assumptions with other investors. The model is showing a potential to generate a IRR of 13% from today’s price, which wouldn’t be a horrible result. I’ve been a long-term holder of the stock since 2012, and I made another large purchase of the shares at roughly $84 per share.

I already have a allocation to the business that I’m comfortable with and I don’t see any deterioration in the business based on the Q3 figures and will happily continue to hold my shares for the long-term

Summary

There will continue to be volatility for the long-term holder of compounding businesses. There is no real protection from stock drawdowns if you are planning on holding over the long-term. In a world where is hard to find a competitive edge over other investors, as I’ve stated in the past, your source of outperformance can be your ability to sit through drawdowns calmly and do nothing.

Drawdowns: Even “god’s portfolio” can’t avoid them. Montaka Global. (2022, April 5). https://montaka.com/accept-the-drawdowns/