The text below is taken from our Spring 2025 investor letter. We would like to remind our premium subscribers that the full version of the letter, including a discussion of each investment in our portfolio and the reasons behind it, will be available on or about April 6th.

Brown & Brown (NYSE:BRO) - We invested in Brown & Brown (albeit at a lower expected forward IRR expectation than our usual 20%) due to its position as a leading specialist serial acquirer in the resilient insurance brokerage sector. The industry's strong fundamentals, driven by recurring premiums and the essential nature of insurance, provide stability across economic cycles. Furthermore, ongoing technological advancements and regulatory changes are fueling demand for distribution platforms and tech solutions, creating attractive organic and acquisition-driven growth opportunities. This robust environment, characterized by frequent M&A activity and consistently high valuations, makes insurance brokers, especially Brown & Brown, a compelling investment. The sector's stable cash flow and strategic importance support elevated valuation multiples, and we anticipate that the management's and employees' consistent execution, driven by aligned financial interests, will result in a significantly higher terminal value and exit multiple than the street currently forecasts.

Brown & Brown operates as a diversified insurance agency, wholesale brokerage, and service organization with a history dating back to 1939. Headquartered in Daytona Beach and Tampa, Florida, the company focuses on marketing and selling insurance products and services, primarily within the property, casualty, and employee benefits sectors.

Notably, Brown & Brown acts as an agent and broker, meaning it does not assume underwriting risks. Instead, it provides customers with quality insurance contracts and customized risk management solutions. The company's revenue generation is primarily through commissions paid by insurance companies and fees charged to customers for specific services. Contingent commissions, which are profit-sharing arrangements based on the underwriting results of insurance carriers, also contribute to their revenue stream.

Brown & Brown employs a decentralized sales and service model, empowering local teams to make decisions that best support their customers and communities, while still benefiting from the resources of a global organization. The company's culture is built on principles of honesty, integrity, superior capabilities, and grit, fostering teamwork and a competitive spirit. A key aspect of their culture is a meritocracy, where teammates are rewarded and elevated based on their hard work and achievements. This emphasis on performance and individual contribution likely drives motivation and productivity within the organization. The company maintains strategic partnerships with over 300 insurance carriers across various coverage lines . They also invest significantly in their technological infrastructure, including AI-driven risk assessment platforms and real-time policy management systems, demonstrating a commitment to innovation and efficiency. Their client service model is personalized, with specialized account management teams catering to different insurance verticals. Brown & Brown primarily targets mid-market commercial businesses, as well as individual and personal insurance clients. Fee-based advisory services also contribute to the company's revenue stream, adding to a diversified service offering beyond traditional commission-based brokerage.

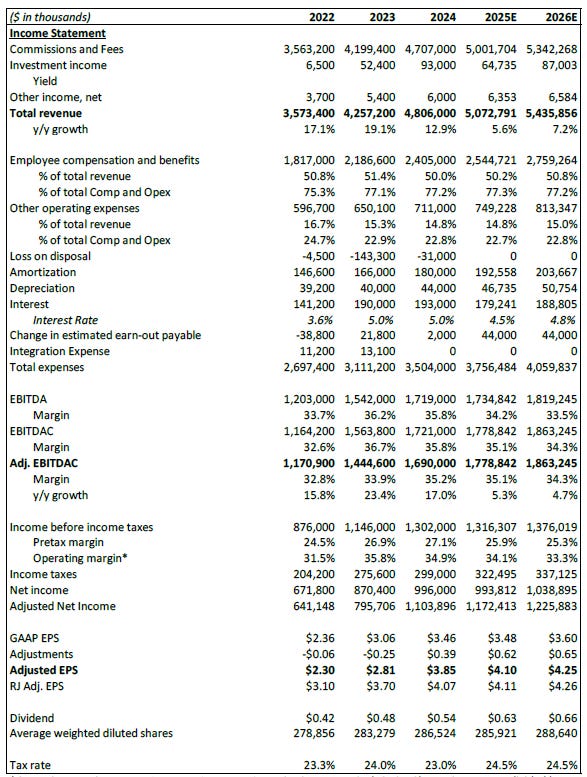

While management has flagged potential difficulties for 2025, including a $90 million deferred tax headwind affecting Q2 2025 FCF, Q4 2024 demonstrated robust performance with exceptional headline organic growth of 13.8%, well above street estimates. Guidance points to lower contingent commissions, broadly consistent adjusted EBITDAC margins, interest expenses between $170 and $180 million, a 24-25% tax rate, and Net Interest Income of $65 to $70 million.

The retail segment saw 4.4% organic growth year-over-year, boosted by higher contingent commissions. Total revenue increased by 9.5% due to acquisitions, with BRO completing 10 acquisitions in Q4 2024, adding an estimated $137M in annual revenue. Management noted a strong acquisition pipeline, particularly for smaller and mid-sized deals as interest rates fall. Commercial lines rate increases moderated to 2%-7% year-over-year in Q4.

The programs segment experienced exceptional 38.6% organic growth year-over-year, fueled by new business, exposure unit growth, and hurricane claim revenue (a one-time factor). The EBITDAC margin expanded significantly by 6.6% year-over-year to 47.9% in Q4, driven by better expense management and some business divestitures.

The wholesale segment reported 7.1% organic growth year-over-year, reflecting new business and exposure growth across all lines. However, the EBITDAC margin decreased by 1.4% year-over-year to 25.7% due to full-year incentives and one-time costs. Casualty lines saw rate increases of 5-10%, while professional lines rates decreased by 5-10% in Q4. Catastrophe property rates decreased significantly by 10-20% in Q4, as highlighted by management.

Admitted P&C rates saw a slight sequential moderation, increasing 2-7% year-over-year for most lines. Workers' compensation rates were flat to down 5% year-over-year in most states. Non-catastrophe property rates were flat to up 5% year-over-year, and professional liability rates were flat to up 5% year-over-year.

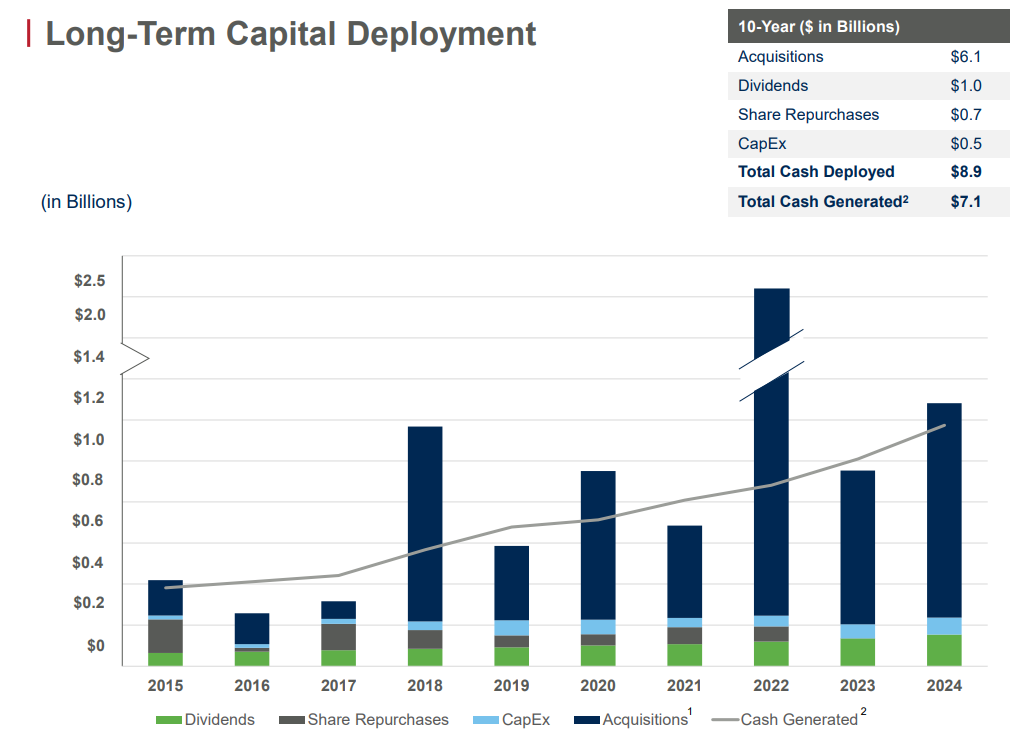

On the capital allocation front, Brown & Brown is well-known for its strategy of acquiring companies, but the long-term chart also reveals its history of opportunistic stock buybacks during periods of lower valuation. Looking ahead, while we expect reinvestment opportunities to remain plentiful, we see potential for increased share repurchases to contribute to shareholder returns in the future.

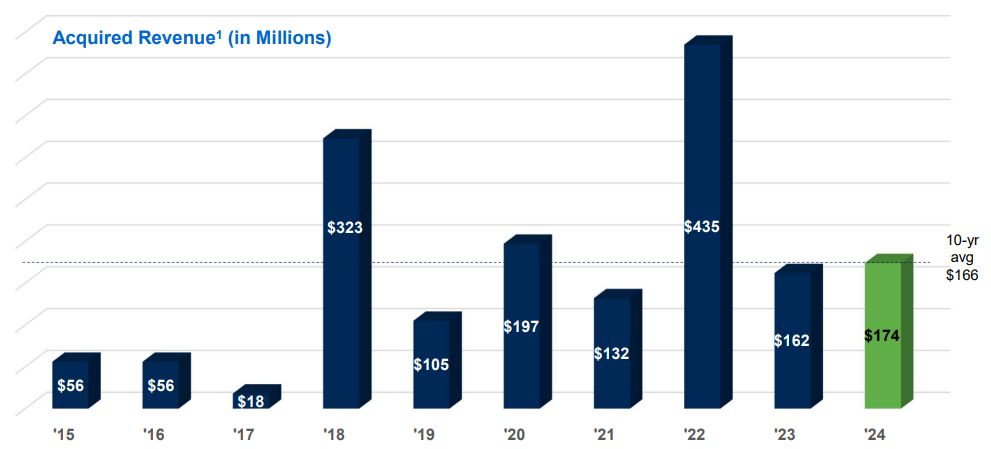

Our distinct perspective hinges on the substantial global reinvestment potential and our divergence from consensus EPS and adjusted EBITDAC growth forecasts. This view is supported by the increasing market share gains of smaller insurance brokers at the expense of larger, multinational players, who are increasingly reliant on acquisitions to recover lost ground. Small-cap brokers have significantly expanded their market share from 2.5% in 2020 to ~4% in 2024, translating to a 62.3% revenue increase, while large-cap brokers have seen a decline from 27.2% to 26.3% over the same period. We believe Brown & Brown's strategy of acquiring small to medium-sized brokerage businesses, averaging $166 million in annual acquired revenue over the last decade, positions them to capitalize on this trend, particularly in international markets where roll-up strategies are gaining traction as smaller broker valuations become more attractive.

While we typically approach international expansion narratives with caution, Brown & Brown has demonstrated its capability to deploy substantial capital in Europe, identifying businesses of comparable quality to those in the U.S.

Looking at street estimates for EPS and EBITDAC margins, Raymond James' analysis is representative. They have a 2025 target price of $120 for BRO, implying a valuation of about 20x their 2025 EV/adjusted EBITDAC. Compared to the peer average of roughly 19.5x 2025 EV/adjusted EBITDAC, they justify the slight discount due to an anticipated moderate reduction in net income and FCF in 2025 versus 2024. Additionally, some analysts project a forward IRR of around 10%, primarily based on the expectation that rate decreases will dampen Brown & Brown's organic growth and bring its multiple in line with its peers.

We believe this short-term view overlooks the long-term potential. While acknowledging our reliance on management's execution, their track record of superior organic growth compared to peers, combined with significant reinvestment opportunities in North America and Western Europe, leads us to expect this stock to continue compounding above the S&P 500. Overall, we see the valuation as reasonable and anticipate the stock will deliver returns commensurate with the business's performance. We are particularly attracted to Brown & Brown's low economic sensitivity and expanding competitive advantage, factors we've observed to be more critical than simply possessing a wide moat. We plan to share a comprehensive investment memo, including our IRR projections, in Q2 2025.

Legal & Disclaimer

The information contained in this publication is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed here based on such investors own review of publicly available information and should not rely on the information contained herein.

The information contained in this publication has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.