Q3 2024 Summary

HEICO Corporation reported record-breaking financial results for the third quarter of fiscal year 2024. Consolidated operating income and net sales increased by 45% and 37%, respectively, compared to the same period last year. Net income rose by 34% to $136.6 million, or $0.97 per diluted share.

The Flight Support Group achieved record-breaking net sales and operating income, with increases of 68% and 72%, respectively. This growth was driven by strong organic growth of 15%, primarily due to increased demand for the group's commercial aerospace products and services, as well as the positive impact of recent acquisitions.

Consolidated EBITDA increased by 45% to $261.4 million, and the net debt-to-EBITDA ratio improved to 2.11x. HEICO's acquisition pipeline remains robust, and the company plans to continue its strategy of opportunistic acquisitions to expand its cash-generating capabilities. Cash flow from operating activities increased by 47% to $214 million.

In addition to these financial highlights, HEICO announced several acquisitions during the quarter, including the acquisition of exclusive perpetual licenses from Honeywell International and the aerial delivery and descent divisions of Capewell Aerial Systems.

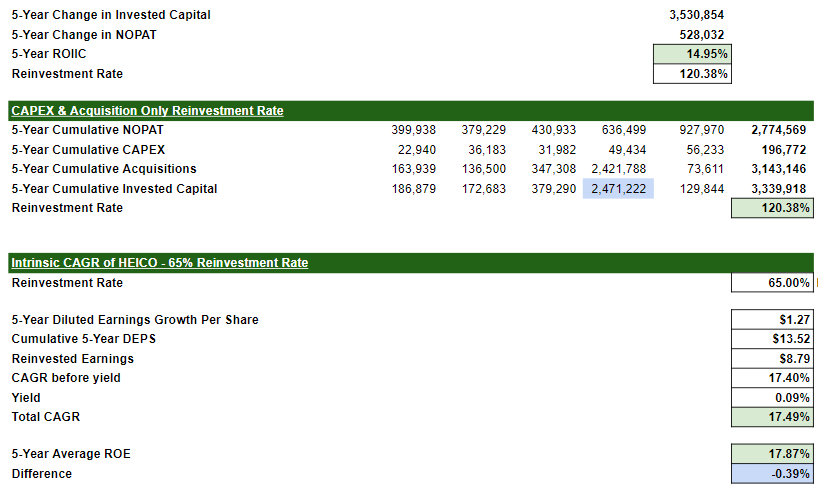

Goodwill can be excluded from the invested capital calculation to get a look at true underlying organic ROIC.

Reinvestment rate the past 5 years is above 100% due to debt used to fund Wencor.

assume management can reinvest 65% going forward the next 5 years, which could in theory generate a 17% CAGR in intrinsic value.

End Markets & Organic Growth

Organic growth acceleration: The Flight Support Group (FSG) has experienced a significant increase in organic growth rate compared to the previous two quarters.

Factors contributing to growth: The growth is attributed to both the maturing integration of HEICO and Wencor and strong market demand.

Market conditions: Despite concerns about overcapacity in the airline industry, HEICO has not seen any significant impact on its order patterns.

Commercial OE production: There has been a slight slowdown in orders for commercial OE products due to slower production ramps at Airbus and Boeing, but this has been offset by strength in the defense market.

M&A pipeline: HEICO's M&A pipeline remains robust, with a focus on non-private equity deals.

Blended organic growth: The blended organic growth rate for the company as a whole was slightly over 7% in the quarter.

“The reason why the incredible 17% growth rate was so outstanding is because of really two factors. One, we continue to win in the marketplace. And HEICO is an accumulation or a combination of a lot of individual businesses working as hard as they can, planning years in advance, developing these products, having them on the shelf and being able to hit the demand and get them sold when the market needs them. The second would definitely be due to the addition of Wencor and the broadening of our product line. I think in speaking with our customers, we’re viewed as a much more complete supplier. I mean, HEICO today has transitioned tremendously over the last many decades. our customers are very confident in purchasing additional products from us, whether it is parts, distribution, PMA, repair. And I think we are growing our market share. So it's really, I think, yes, a strong market, but more I think really focusing on the detail by our businesses and the broadening of the product-line through Wencor and the 737 and 777 display unit acquisitions.”

FSG vs ESG - Volume vs Pricing

FSG organic growth: The FSG's organic growth rate remains strong, primarily driven by volume increases.

Price increases: While some price increases have been passed along to customers, the majority of the growth is due to volume.

Future outlook for FSG: The FSG is expected to continue to perform well, with potential for market share gains if the market slows down.

ETG organic growth: The ETG's organic growth has been volatile, averaging around 0% over the past few quarters.

ETG outlook: The ETG is expected to experience stronger growth in fiscal year 2025, driven by a recovering market and a strong order book.

“The number of airlines have sort of trimmed back their purchases. They, if you will, in hindsight, I think over-ordered a bit in 2023, took more than they needed in 2023. So we do have anecdotal evidence of certain customers cutting back this year. But that was really offset by strength at other customers. So I think we continue to do very well. And that really -- that gets to the sort of the beauty of the HEICO model in that we've got all these individual business units who have -- who control their own destiny.”

Wencor & Margin Outlook

Wencor integration: The integration of Wencor has been successful, with organic growth at Wencor remaining consistent with the overall growth of the FSG.

Expanded product offerings: The combination of HEICO and Wencor has led to an increased product offering, which has positively impacted growth.

Capewell acquisition: The Capewell acquisition is expected to contribute to the Specialty Products Group, providing a niche and higher-margin product line.

Margin outlook: HEICO expects to maintain or improve its operating margins over the next three to five years, driven by continued growth and operational efficiencies.

ETG Markets & Leverage

ETG growth outlook: The Electronic Technologies Group (ETG) is expected to experience strong growth in the coming year, driven by defense and commercial aviation markets.

Defense market: The defense market accounts for approximately 40% of ETG's segment and is experiencing double-digit growth.

Other markets: Other markets are seeing some softness, but are expected to bottom out and recover in the coming fiscal year.

Leverage target: HEICO aims to maintain its leverage below three times while continuing to pursue acquisitions. The company focuses on acquiring high-margin businesses to minimize the impact on leverage.

Working Capital & GAAP Margins

Working capital: HEICO has been focused on maintaining strong customer service and supporting market demand, which has led to a higher inventory build. The company is now working to slow the growth of inventory while maintaining sufficient levels to meet customer needs.

FSG margins: The FSG's margins have experienced some fluctuations, but overall they have remained strong. The company expects margins to continue to be within a certain range.

Acquisition impact: The recent acquisition of the 737NG and 777 display unit business has contributed to the increase in inventory levels.

Sequential margin drop: The sequential drop in GAAP margins is not unusual and is primarily due to shifts in product mix.

Overall margin performance: HEICO is pleased with the overall performance of the FSG's margins, particularly considering the impact of the Wencor acquisition.

Supply Chain Impacts & Medical Markets within ETG

Supply chain challenges: The supply chain for the repair business continues to be challenging, with many vendors struggling to meet demand.

Inventory backlog: HEICO has a large backlog of past-due orders due to supply chain issues.

Industry-wide challenges: The aviation industry is facing broader supply chain challenges, including difficulties in hiring and retaining workers.

Impact on business: The supply chain challenges have impacted HEICO's repair business, but the company remains confident in its growth prospects.

Medical and other markets: The medical and other markets within ETG have experienced some fluctuations. The medical market is expected to normalize in the coming quarters, while the broader economy may be impacting the other markets.

Inventory destocking: HEICO believes that inventory destocking in the medical market is nearing completion.

Future outlook: The company is optimistic about the future outlook for both the repair business and the medical and other markets.

Impairment Charge & Capewell Acquisition

Impairment charge: The impairment charge within the ETG segment was due to a decline in revenue projections for a specific business.

Contingent consideration reversal: The contingent consideration reversal was due to a change in circumstances that made it unlikely that the earn-out objectives would be met.

Capewell acquisition: The Capewell acquisition is expected to be a good fit for HEICO, with potential for growth in the aerial delivery and descent solutions market.

Financial impact of Capewell acquisition: The cash usage for the Capewell acquisition is expected to be immaterial and the acquisition is not dilutive to segment margins.

Strategic fit of Capewell: Capewell's products are considered critical for safety and are expected to benefit from the growing demand for autonomous vehicles and military solutions.

FSG Growth & Honeywell Product Line Impact

FSG organic growth: The FSG's organic growth rate has exceeded industry growth rates, driven by factors such as market share gains and the acquisition of Wencor.

Growth opportunities: The FSG sees opportunities for continued growth through market share gains and the expansion of its product offerings.

Honeywell product line impact: The Honeywell product line contributed approximately $217 million in sales during the third quarter.

Legacy business potential: HEICO is excited about the potential of the legacy business, which is expected to be transformative for the company.

Customer response: Customers have been very positive about HEICO's entry into the cockpit display business.

More on Impairment, Cash Margins, End Markets & Wencor

Impairment charge and contingent liability: The impairment charge and contingent liability within the ETG segment netted out, resulting in a minimal impact on operating margin.

Cash margins: The slight decrease in cash margins year-over-year in the ETG segment was primarily due to lower volume in the other electronic products market.

Defense markets: The ETG's defense markets have been performing well, with double-digit growth.

Non-defense markets: The non-defense markets within ETG have experienced some softness, but are expected to recover.

Wencor integration: HEICO has successfully integrated Wencor into its operations, leveraging Wencor's expertise and leveraging the combined strengths of both companies to offer a broader range of products and services to customers.

Customer relationships: HEICO maintains strong relationships with its customers and continues to focus on providing excellent customer service and support.

Future outlook: HEICO remains optimistic about its future prospects, with opportunities for continued growth and success in both the defense and commercial aerospace markets.

FSG Growth, Airline Fleet Changes & Competition

FSG growth outlook: The FSG is expected to continue to outgrow the market, driven by factors such as market share gains, synergies from the Wencor acquisition, and the increasing complexity and maintenance requirements of newer aircraft.

Impact of airline fleet changes: While the retirement of older aircraft may create some headwinds for the FSG, the growth in newer, more complex aircraft is expected to mitigate these effects.

Capewell and TransDigm: Capewell and TransDigm are complementary companies, with Capewell offering a range of products for aerial descent and cockpit egress.

Long-term outlook: HEICO remains optimistic about its long-term prospects, with a focus on innovation, product development, and maintaining a strong market position.

Aftermarket Growth, Space Business & Talent Development

FSG aftermarket growth: The FSG's aftermarket growth has been broad-based, with no significant differences observed between product types or sales channels.

Wencor integration: HEICO and Wencor are continuing to integrate their operations, with opportunities for further collaboration and synergies.

Future growth potential: The FSG is expected to continue to grow at a strong pace, driven by market share gains, product development, and operational efficiencies.

ETG space business: The ETG's space business has remained relatively flat for the year, but is expected to continue to grow in the future.

Talent development: HEICO is focused on developing its talent to support future growth and acquisitions.

Capewell Development and Display Business

Capewell acquisition: The acquisition of Capewell is seen as a positive development, with the company's products being highly regarded for safety and quality.

Display business: HEICO's acquisition of the display unit business from Honeywell is expected to be a successful venture, offering significant opportunities for integration and growth.

Market potential: The market for cockpit displays is seen as having strong potential, with HEICO's expertise and capabilities positioning it well to compete in this space.

Acquisition Reinvestment

“I can tell you that our pipeline today remains incredibly robust. We have a lot of projects in the work. Our acquisitions teams are nonstop running around the country. I can tell you that on all of our recent acquisitions I think HEICO's reputation has been key to getting all of those deals done and has made us a particularly attractive counterparty for our sellers and partners.”

“The pipeline is very full. And we are looking at actually too many acquisitions right now. It's taking full time of the staff and it's -- we're looking more for non private equity deals. That's more in our best interest, although we do see some private equity. The problem is they are priced very high.”