Summary of Financial Results and Outlook for Brown & Brown, Inc.

Financial Performance for Q2 2024:

Revenue: $1.178 billion, increased 12.5% year-over-year.

Organic growth: 10%.

Adjusted EBITDAC margin: Improved 150 basis points to 35.7%.

Adjusted EPS: Grew 17.7% to $0.93.

Acquisitions: Completed 10 acquisitions with estimated annual revenues of $13 million.

Numbers above may change as I study the insurance brokerage industry more.

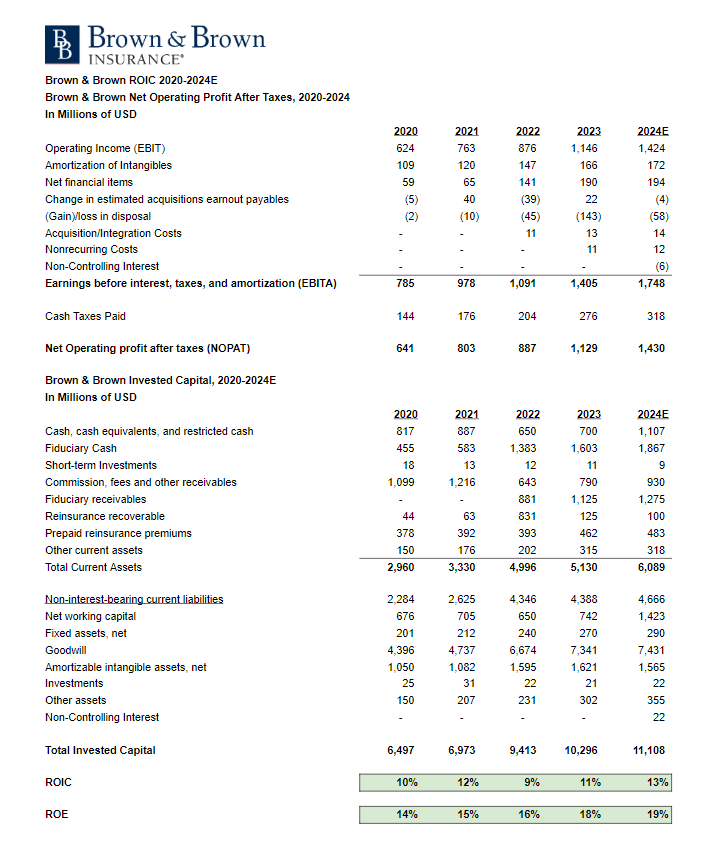

Okay to look at this business excluding the fiduciary cash, and excluding the interest income earned from this cash.

Also okay to exclude goodwill to see the underlying performance of the business.

Intrinsic CAGR calculation is in line with 5-year ROE.

Little too much to expect 85% reinvestment rate, but there is lots of room for more acquisitions so it’s possible.

Economic Outlook:

Inflation: Inflation is moderating but remains elevated.

Consumer spending: Consumers continue to spend, driving demand for products and services.

Business investment: Businesses are investing in their companies and new construction projects.

Hiring: Businesses continue to hire employees, but at a slower pace than in the past.

Insurance Pricing:

Employee benefits: Rates up 7% to 9%, driving demand for consulting services.

Admitted P&C: Rates up 5% to 10% for most lines.

Workers' compensation: Rates down 5% to 10% due to low unemployment.

Non-CAT property: Rates moderated, with some accounts seeing increases.

Primary and excess casualty: Rates increased 1% to 10%.

E&S market: CAT property rates moderated, with some accounts seeing increases.

Segment Performance:

Retail: Organic growth of 7.3%, driven by new customer wins and strong retention.

Programs: Organic growth of 15.4%, driven by new business and expansion of existing customers.

Wholesale brokerage: Organic growth of 11%, driven by new business and strong performance in binding and personalized businesses.

Financial Highlights:

EBITDAC margin: Expanded 150 basis points to 35.7%.

Diluted net income per share: Increased 17.7% to $0.93.

Cash generation: Strong cash generation of over $370 million in the first six months.

Capital structure: Issued $600 million of 10-year senior notes and paid down debt.

Dividend increase: Increased dividends per share by 13%.

Business Outlook:

Insurance pricing: Admitted market rates are expected to remain relatively stable, while E&S market rates may experience some moderation.

M&A activity: Brown & Brown remains active in the M&A market and is well-positioned for acquisitions.

Financial performance: Brown & Brown expects to deliver another year of strong financial performance, with adjusted EBITDAC margin improvement of 50 to 100 basis points.

Property Insurance, M&A & Outlook

Property insurance: The pricing for property insurance has been under pressure, with rates decreasing for many accounts. However, accounts with significant losses may experience rate increases.

Casualty insurance: Casualty insurance rates are expected to continue to increase, driven by factors such as higher legal judgments and rising inflation.

M&A market: The M&A market for insurance companies remains competitive, with private equity firms remaining active.

Brown & Brown's strategy: Brown & Brown is focused on building relationships, ensuring cultural alignment, and delivering strong financial returns.

Economic outlook: The economic outlook for the second half of the year is expected to remain positive, with continued growth and inflation moderation.

Industry trends: The insurance industry continues to face challenges such as rising legal judgments and inflation, which are putting pressure on pricing.

E&S market: There is a trend of some accounts moving from the standard market to the E&S market, driven by factors such as pricing and capacity constraints.

Drivers of Recent Organic Growth

Organic Growth:

Brown & Brown's organic growth is driven by a combination of factors, including:

New business wins: The company is successfully acquiring new customers and expanding its client base.

Customer retention: Brown & Brown is retaining existing customers and deepening relationships.

Market share gains: The company is gaining market share in various segments.

Market Dynamics:

Pricing pressure: Certain lines of coverage, such as property, are facing increasing pricing pressure.

Economic conditions: The overall economic environment is impacting the insurance market, with some lines of coverage experiencing higher demand and others experiencing lower demand.

“From a standpoint of organic growth, the growth that we are seeing here domestically in our businesses is very similar to the growth that we're seeing in our international businesses.”

Wholesale Brokerage Segment:

Pricing pressures: The wholesale brokerage segment is facing some headwinds due to pricing pressures in certain lines of coverage, such as property.

Diversification: The segment's diversification across various lines of coverage helps to mitigate the impact of pricing pressures.

Strong execution: Brown & Brown's strong execution and focus on building relationships are expected to drive continued growth in the wholesale brokerage segment.

Margins

Margin guidance: The company's guidance for adjusted EBITDAC margin improvement for 2024 is 50 to 100 basis points. This range is influenced by various factors, including contingent commissions, storm activity, and economic conditions.

Captive losses: The company's captives may experience losses due to storm activity, which could impact margins.

Casualty insurance pricing: The company is experiencing significant pricing pressure in the casualty insurance market, which is at its highest level in decades.

Programs segment outlook: The programs segment is expected to continue to experience strong growth, driven by new business wins, customer expansion, and the favorable pricing environment for certain lines of coverage.

Commission Adjustments & Investment Income

Commission adjustments: The decline in contingent commissions in the retail segment was primarily due to market conditions and pricing pressures in certain lines of coverage, particularly auto.

The impact of contingent commissions on the retail segment is expected to remain relatively isolated and not significantly impact other segments.

Investment income: The company's investment income is influenced by interest rates and the amount of cash available for investment. The company has a higher cash balance at the end of June, which contributed to increased investment income in the quarter.

Market share gains: Brown & Brown has made significant strides in gaining market share in recent years, particularly in the upper-middle market and large accounts segment.

UK Operations & Growth

U.K. operations: Brown & Brown's U.K. operations have experienced strong growth, driven by a combination of organic growth and acquisitions.

Market dynamics: The U.K. insurance market is undergoing consolidation, presenting opportunities for growth.

Company culture: Brown & Brown's company culture resonates well with the U.K. market, emphasizing ownership, leadership, and a long-term perspective.

Growth prospects: The company's growth prospects in the U.K. are positive, with opportunities for organic growth and acquisitions.

Quintes Holding B.V. Aquisition

Quintus Background:

Founded in 2012

Headquarters in Wattenberg, Netherlands

Operates through a hub-and-spoke model with 18 locations

Focuses on retail broking, MGA, and pensions

Key Features:

Decentralized sales and service model

Strong local relationships

Wide range of offerings (agriculture, motor, cyber, employee benefits)

Scalable distribution platform

Experienced team (over 700 professionals)

Successful acquisition track record

Financial Projections:

Revenues are projected to be between €110 million and €120 million in 2025.

EBITDA is projected to be between €37 million and €42 million in 2025.

Transaction expected to be accretive to adjusted diluted net earnings per share.

Purchase price is just over €700 million.

Strategic Alignment:

Quintus's strategic goals align with Brown and Brown's.

Strong management team and geographic presence.

Proven acquisition strategy.

Growth potential in the region.