Financial Results Summary for Q1 of Fiscal 2025

Net Earnings and Adjusted Earnings:

Net earnings attributable to shareholders were $790.8 million ($0.83/share diluted).

Adjusted net earnings were $790.8 million, down from $838 million in the previous year.

Adjusted diluted net earnings per share decreased by 3.5% to $0.83.

Revenue and Gross Profit:

Merchandise and service revenues increased by 5.4% to $232 million, driven by acquisitions.

Merchandise and service gross profits increased by 5.5% to $82 million, also driven by acquisitions.

Gross margin decreased in the United States due to promotional investments but increased in Canada due to product mix.

Gross margin in Europe and other regions decreased slightly, but would have increased without the impact of Total Energy integration.

Fuel Margin:

Raw transportation fuel gross margin decreased in the United States and Canada but increased in Europe and other regions.

Overall, fuel margins remained healthy.

SG&A and Adjusted EBITDA:

Normalized operating expenses increased by 3.8% due to inflation and technology investments.

Adjusted EBITDA increased by 4.8% due to acquisitions, partially offset by softness in traffic and fuel demand.

Other Financial Metrics:

Income tax rate increased to 23.1%.

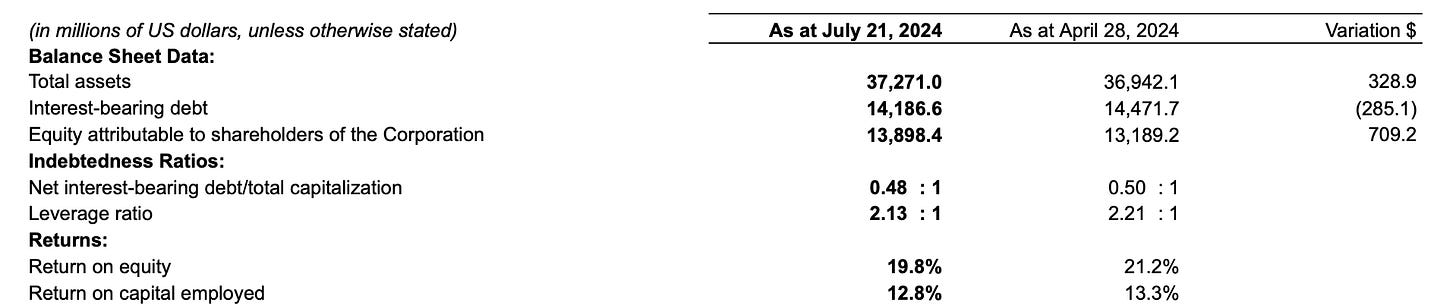

Return on equity was 19.8%.

Return on capital employed was 12.8%.

Leverage ratio decreased to 2.13.

The company repurchased 8.7 million shares and repaid CAD 700 million in debt.

A quarterly dividend of CAD 0.175 per share was declared.

M&A

The company has historically maintained a disciplined financial approach, evident in the recent Get Go transaction, which was acquired at a single-digit multiple. The company prioritizes returns, aiming for a 15% return on capital employed within three years.

Synergies are a crucial factor in evaluating potential acquisitions. The company's target corporate leverage level is 2.25 times, but they believe they can temporarily increase this to 3.75 times without affecting their credit rating. However, they emphasize a disciplined approach to leverage, with a focus on quick deleveraging.

The company's strong balance sheet, robust syndicate of banks and partners, and historical ability to deleverage quickly provide confidence in their ability to execute future acquisitions while maintaining financial discipline.

Confident in ability to finance 7&I deal. My thought is most likely they will find a way to do a deal for the US C-stores only, which will appease regulators and the Japanese.

Attributed the majority of the $127 million EBITDA growth in the quarter to the Total acquisition. They noted a positive sequential improvement compared to the fourth quarter, indicating a positive trend in the integration and synergy realization efforts.

US Same Store Sales & Tobacco

Focus on beverage promotions during the prime summer beverage season. These promotions increased unit sales and briefly improved overall traffic, but came at the expense of margins. The company does not expect to maintain this level of promotional investment in future quarters.

Regarding tobacco, the company noted signs of stabilization in cigarette sales. However, when including strong growth in other nicotine products and their outperformance of the industry in cigarette sales, the overall tobacco category would have contributed positively to same-store sales. Excluding all tobacco products, same-store sales would have been negative 0.6%.

the company observed faster growth in the total tobacco category compared to their overall basket size. This suggests continued momentum in "other nicotine products," experiencing high single-digit growth in both the U.S. and Europe.

Acknowledged that some competitors are experiencing a wider range of same-store sales performance, both positive and negative, when excluding cigarettes. They attributed their own pressure to a strategic decision to heavily invest in the cold beverage category, impacting the average basket size. While this impacted short-term same-store performance, the company believes it generated a positive response in terms of traffic and unit sales.

Regarding cigarette sales stabilization, the company clarified that this refers specifically to their performance, which is outperforming broader industry data. They attribute this outperformance to price optimization efforts using digital tools and partnerships with major vendors.

Q2 2025 SSS performance: Remained consistent with the previous two quarters. They anticipate that the performance will improve as they lap maintenance-related challenges from the prior year. The company expressed confidence in their ability to gain market share and drive additional customer visits through their loyalty programs.

Regarding gross margin, the company expects a rebound in the coming quarters. While they made significant investments in summer promotions, they plan to implement strategies like supplier funding and loyalty program optimization to improve margins. This is particularly expected in the U.S.

Consumer Health

The company discussed the current state of consumer spending and traffic within their network. While they have observed some pressure on these metrics, they believe they are outperforming their peers and gaining market share within the convenience space.

The company attributed the decline in consumer spending to a stretched consumer, evidenced by fewer store visits, smaller basket sizes, and lower average fuel fill-ups. To address this, the company is leveraging their scale and vendor relationships to offer value on products that resonate with their customers.

Key initiatives include focusing on meal bundles, leveraging their food service expertise, and expanding their private label offerings. The company has seen strong growth in private label sales across all geographies and plans to introduce over 100 new private label products this year.

SG&A Expenses in Q1 2025

The organic increase in SG&A expenses was slightly higher than recent historical trends. The company clarified that it remains confident in their ability to achieve their goal of beating inflation by 1% in SG&A growth over the next five years.

A significant portion of the Q1 SG&A increase relates to investments in technology initiatives aimed at becoming a more digitally engaged retailer. These investments are part of their strategic roadmap and are expected to contribute to their long-term goals.

Despite the Q1 increase, the company highlighted positive developments in productivity, including a decrease in labor hours and progress in their shared service center initiatives. These initiatives are aligned with their €800 million fit-to-serve goal over the next five years.

Europe Excluding TotalEnergies

While merchandise same-store sales remained positive at 0.9%, this represented a slight decline compared to previous quarters. The company acknowledged experiencing some of the same macro-economic pressures impacting their U.S.business, with traffic being a challenge.

Despite these challenges, the company highlighted continued strong performance in Europe. They emphasized their focus on key categories like beverages, food, and "other nicotine products," which are experiencing good growth in the region. Overall, the company expressed confidence in the continued strong performance of their European business.

In the previous quarter, concerns were raised about depressed fuel margins in Germany impacting earnings contribution. While the company acknowledged that German cost per liter remains low, they reiterated their long-term view of margin improvement in that market. They attributed the sequential improvement in Total's earnings contribution primarily to the successful execution of synergies on the non-fuel sales side (“Box”) and cost adjustments aligning with their existing model.

GetGo Acquisition

Highlighted the high-quality assets and strong performance of the business. Regarding food sales, GetGo represents 15-20% of their total merchandise sales. The company expressed excitement about the potential for reverse synergies, particularly in areas like loyalty programs, food initiatives, and procurement.

The company emphasized the partnership-based approach to the acquisition, highlighting the shared cultural values with GetGo's leadership. They intend to collaborate with GetGo to grow their grocery stores while providing convenience and fuel services. This partnership includes plans for joint loyalty programs and operational efficiencies in areas like warehousing and commissary.

While the company did not provide specific guidance on EBITDA growth, they suggested a conservative estimate of 30% based on their historical performance.

Inner Circle Loyalty Program & Netherlands Tobacco

Inner Circle, in the U.S., has contributed to market share gains. While the impact varies across business units due to differing maturity levels, the program is generally seen as a positive driver of market share and competitive advantage.

Regarding the tobacco category in Europe, the company confirmed that they are seeing a 40-50% uplift in volumes in the Netherlands following the ban on sales at grocery stores. They have also expanded their product range in this market.