The Three Pillars of Advantage: Navigating the Stock Market Maze

The allure of the stock market lies in the potential for exceptional returns, but with so many investors chasing the same prize, how can anyone truly gain an edge? The answer lies not in a single magic bullet, but in a strategic approach that leverages three key advantages: analytical prowess, access to information, and a long-term perspective. Let's delve into each of these pillars, exploring their strengths and limitations in the dynamic world of finance and then discuss how one might go about applying these pillars to investments.

The Discerning Eye: Analytical Advantage

Imagine a vast ocean of data – company reports, financial metrics and economic indicators. An analytical advantage allows investors to navigate these waters with skill, identifying patterns, uncovering hidden trends, and interpreting information within a broader context. This advantage isn't about possessing a secret formula; it's about developing a keen eye for detail, the ability to critically evaluate data, and the skill to build a holistic picture of a company's health and future prospects.

Sharpening the Analytical Toolkit: There are several ways to cultivate this advantage. Studying various investment philosophies – can provide a framework for analyzing companies within your circle of competence Additionally, familiarizing oneself with financial statements and key metrics like return on invested capital, the likely reinvestment rates going forward and the cost to generate a dollar of earnings, allows for a deeper understanding of a company's financial performance and risk profile.

Limitations: The Ever-Evolving Market: The market's efficiency acts as a constant challenge. Publicly available information is quickly incorporated into stock prices, making it difficult to unearth truly groundbreaking insights. Additionally, unforeseen events and unpredictable changes in consumer behavior can throw even the most meticulous analysis off course. Black swan events, like the 2008 financial crisis or technological change can fundamentally reshape entire industries, rendering past performance a less reliable indicator of future success.

The Information Game: Navigating the Knowledge Landscape

Informational advantage refers to the possession of knowledge that isn't readily available to the general public. This could include industry-specific insights from industry conferences or networking events, early warnings on regulatory changes gleaned from government sources, or proprietary research conducted. In a perfect world, such knowledge translates to a significant edge.

Tread Carefully: The increasing transparency in today's market makes it difficult to maintain an exclusive information advantage for long. Even seemingly "secret" information can leak quickly, leveling the playing field. The rise of social media and citizen journalism has democratized access to information, making it even more crucial for investors to critically evaluate the sources and motivations behind any purportedly exclusive knowledge.

Beyond Exclusivity: Alternative Information Strategies: Even without exclusive information, there are ways to leverage an informational advantage. Attending industry conferences or participating in investment forums can provide valuable insights into industry trends and company outlooks. Additionally, some lesser-known sources, such as reaching out directly to industry experts, shareholders and current and past employees of the company you’re looking at can shed additional colour on an investment thesis.

The Long Game: Time Horizon Advantage

Many investors get caught up in the frantic pursuit of short-term gains, fixated on quarterly results and the next big "catalyst." This short-termism creates an opportunity for those with a different perspective: the long-term investor. By focusing on a company's fundamentals, its competitive edge, and its ability to weather market fluctuations, investors with a long-term horizon can identify undervalued stocks with the potential for significant growth over time.

Patience is Key: Unlike the short-term trader who can react quickly to market movements, the long-term investor must possess a significant degree of patience. Stock prices can be volatile in the short term, and even fundamentally strong companies can experience periods of decline. The ability to maintain conviction in one's investment thesis through these inevitable downturns is crucial for success. It’s important to continue to look at how the company itself is performing. A company can continue to increase intrinsic value over time, but the stock can be down or flat for extended periods of time.

Out of the three pillars above, I’d argue the time horizon advantage is the strongest advantage an individual investor can process, but may also be the most difficult one to maintain due to the psychological toll it can take on people over time. I’m always amazed when I’m diving deep into a new idea and find out the vast amount of knowledge that people have already accumulated about a name. The information and analytical edge, if it does exist, comes and goes very quickly.

However, what if there was a way to get access to private market opportunities where you could invest alongside aligned insiders, and take advantage of opportunities that other investors don’t have information on?

Publicly Traded Serial Acquirers: Masters of the Private Market Maze

The private market sizzles with potential – a breeding ground for innovative companies, disruptive technologies, and the promise of explosive growth. But for many investors, gaining access to these hidden gems can be a frustrating exercise in exclusion. Here's where publicly traded serial acquirers (PTSAs) emerge as the new cavalry, offering a compelling solution for investors seeking a piece of the private market pie.

PTSAs function as investment vehicles that raise capital through an initial public offering (IPO). But unlike traditional companies that use IPO proceeds for internal growth, PTSAs strategically deploy these funds to acquire a series of private companies. This strategy allows investors in the PTSA to gain diversified exposure to the private market, bypassing the hurdles and complexities of directly investing in these ventures.

So, how do PTSAs navigate the labyrinthine private market and unearth these hidden treasures? Here's a deeper dive into their key strategies:

Speed Demons in a Slow Lane: Compared to the often-glacial pace of traditional private equity firms, PTSAs are the gazelles of the acquisition world. They possess the significant advantage of having readily available capital, allowing them to move with lightning speed and decisive action when presented with an attractive target. A lot of these targets are part of a vast database and acquisitions usually occur long after a relationship has already been established with the business owners. As many privately held companies reach a stage where significant capital is required for expansion, new market entry, or competitor acquisition, the original founders often face a dilemma. Taking on debt may not be appealing, and yet they prioritize the well-being of both the business and its employees. In such scenarios, a PTSA can often serve as a suitable long-term owner.

Public Market Halo Effect & A Permanent Home : For private companies, a major allure of being acquired by a PTSA lies in the legitimacy and access to public markets that such a union bestows. Being scooped up by a publicly traded entity significantly enhances a company's profile, attracts top talent who crave the visibility recognition of their work. This "public market halo effect" serves as a powerful tool for PTSAs, allowing them to attract promising private companies that might otherwise be hesitant to be acquired by a traditional private equity firm with a reputation for short-term ownership and eventual exits.

Expertise is King (and Queen): At the helm of most successful PTSAs are seasoned investors with a wealth of experience in identifying and evaluating high-quality businesses at cheap to fair valuations. They leverage this expertise and their vast network of contacts within the private market worlds to source potential acquisition targets internally before they hit the mainstream radar.

Deal-making Dexterity: Unlike private equity firms with a rigid one-size-fits-all approach, PTSAs possess the flexibility to tailor deal structures to the specific needs and aspirations of the target company's leadership. This adaptability can be a key differentiator. PTSAs can offer a mix of cash and stock in a deal, allowing founders to retain a significant ownership stake in the combined entity and participate in the future upside of the merged company. This flexibility fosters a sense of partnership and alignment of interests, as opposed to the purely transactional nature of some traditional private equity acquisitions.

Shared Best Practices: Many of the private companies CEO’s, once acquired by a PTSA, will attend conferences where they can share knowledge from their experience with other founders and even have their own ideas challenged leading to stronger companies.

Long-Term Tango, Not a Short-Term Fling: A critical distinction between PTSAs and private equity firms lies in their investment horizons. While some private equity firms might be laser-focused on short-term returns and a quick exit strategy, PTSAs are typically incentivized to invest in the long-term growth of their acquisitions. This alignment of interests fosters a strong partnership between the acquirer and the acquired, with both parties focused on building a sustainable and successful enterprise. Imagine it as a long-term tango, rather than a fleeting fling.

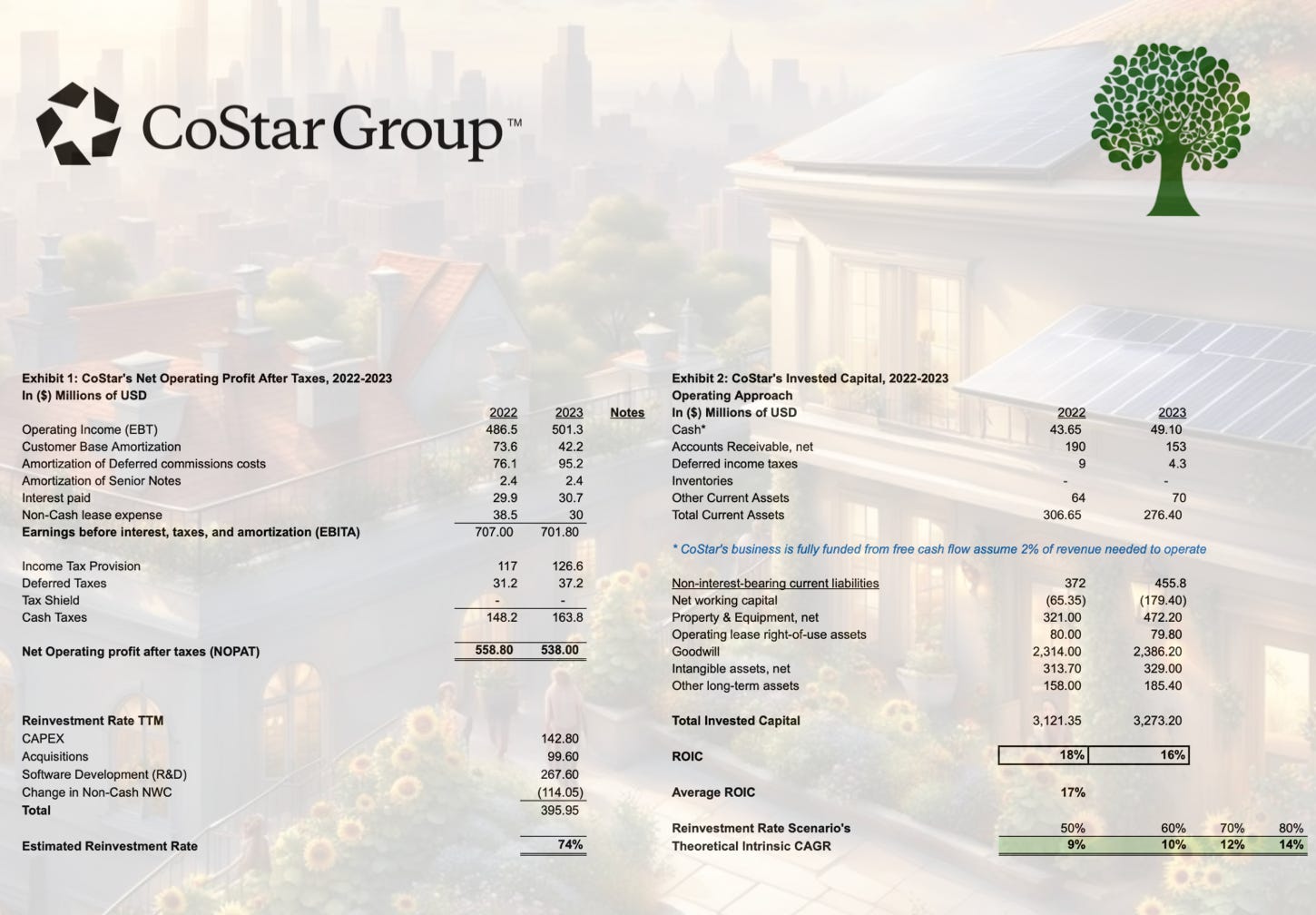

I own a number of companies that have the “serial acquirer” label attached to them such as Constellation Software, Topicus, Lumine Group and HEICO, but I also own some names that do make private market acquisitions and work to improve and grow the business over time using shared best practices. One of those names is CoStar, quite the under-appreciated company in my opinion. An example of a recent acquisition they made is Homes.com, which is now the # 2 home buying portal with 567% year-over-year traffic growth. Below I share some of my estimates for return on invested capital and reinvestment rate scenario’s going forward. In should be noted that in the reinvestment rate calculation, I didn’t include the amount that CoStar is putting into marketing. Even though in theory, this will lead to more traffic and revenue, its hard for me to put an estimate on this, so it was excluded and actually creates a more conservative reinvestment rate.

While capital allocation by PTSA insiders adds a layer of risk, it can also be a way for individual investors to circumvent the shrinking informational edge in today's markets. By leveraging the expertise of these acquirers, we gain access to attractive private market opportunities that might otherwise be out of reach.

My portfolio over time has drifted towards specifically targeting acquirers with a strong track record of identifying and closing deals involving high-potential small and medium-sized enterprises (SMEs). These features allow them to unlock significant value for investors.

The key to superior returns lies in a long-term focus on companies with robust growth prospects and a consistent ability to generate high returns on invested capital. Ideally, these companies can achieve growth organically while also having access to a pool of acquisition targets that offer attractive valuations compared to publicly traded peers. This combination helps to maintain high returns on capital and delivers value for long-term shareholders like ourselves.