Unlock our entire content library with a paid subscription! For just $0.55 a day (annual plan), you'll gain full access to all our investment memos, past updates, and all future content.

Original Investment Thesis

PMA Parts Usage Acceleration

The adoption of Parts Manufacturer Approval (PMA) significantly increased in the 1990s following enhanced FAA enforcement regarding unapproved parts. Our investment thesis centered on the growing population of out-of-warranty aircraft flight hours (aircraft older than 6 years) within global fleets, coupled with the industry's need for diversified parts sourcing. Given that PMA parts represent a relatively small portion (1.5-2.5%) of the total commercial aircraft parts market, we anticipated substantial growth. HEICO, as the leading producer of PMA non-OEM aerospace parts, we felt was strategically positioned to capitalize on these favorable market trends.

A Clear Reinvestment Runway

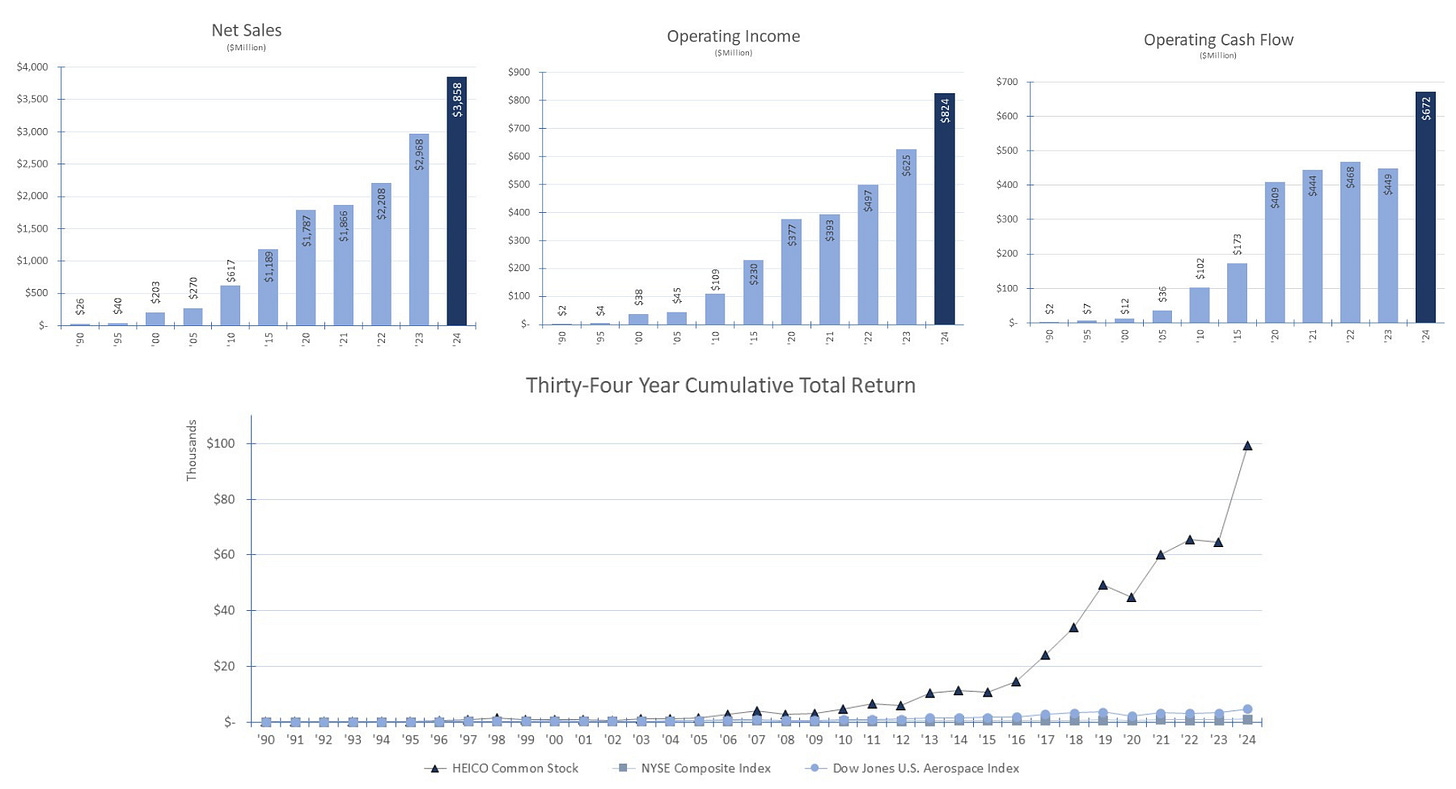

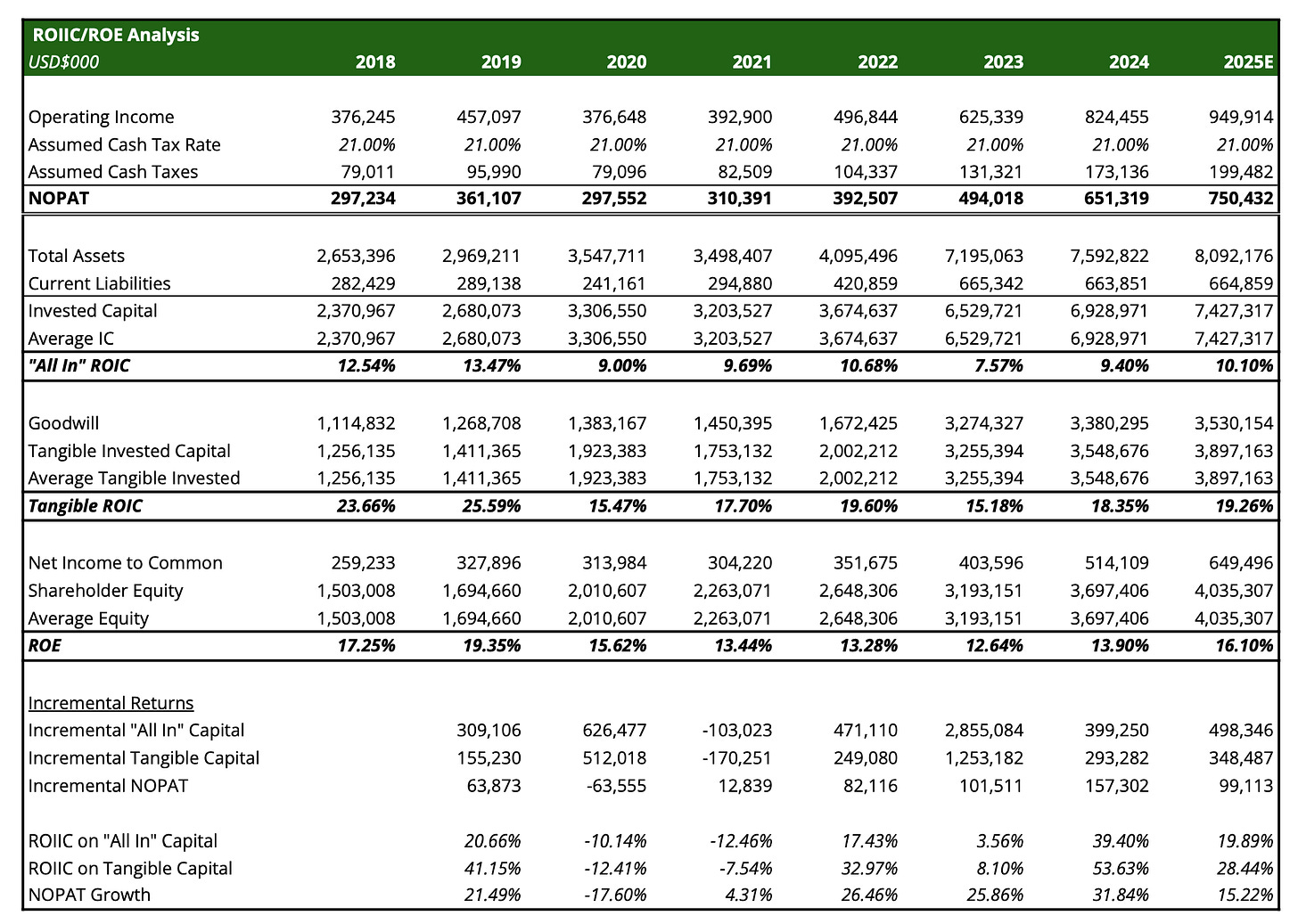

Our investment thesis also recognized HEICO's strategic advantage in reinvesting operating cash flow into acquisitions, enabled by its low capital expenditure requirements (approximately 1.5% of sales) and running them in a decentralized way. Acquisitions are integral to HEICO's growth, evidenced by 98 acquisitions since 1990. Notably, the August 2023 acquisition of Wencor Group from Warburg Pincus for $1.9 billion in cash and $150 million in Class A common stock (13x NTM EBITDA) represented HEICO's largest acquisition to date, adding $725 million in annual revenue at low 20% EBITDA margins. Prior to Wencor, HEICO reinvested approximately 73% of its capital in acquisitions and 18% in R&D, yielding a 91% reinvestment rate before capex. We projected HEICO could sustain a 70% reinvestment rate of operating cash flow, driving growth and increasing return on invested tangible capital (ROIIC) over the long term (see valuation section).

Sidecar Investment Opportunity with the Mendelsons

A core component of our investment thesis rests on the alignment of interests with HEICO's management team. With approximately 14% ownership held by management and a significant stake held by employees, there is a strong convergence of shareholder and management objectives. Performance-based incentives, tied to net income, EBITDA (not BS earnings in HEICO’s case), and operating cash flow targets, further solidify this alignment. Executive compensation is structured with a balanced approach, comprising approximately 10% salary, 50% option awards, 25% non-equity incentive compensation, and 15% retirement plan contributions.

Summary of Q2 Results

HEICO (NYSE: HEI), a leading aerospace and electronics company, continues to demonstrate robust financial performance driven by strong organic growth, strategic acquisitions, and a favourable market environment. The company's unique decentralized operating model and deep entrenchment in critical aviation and defense markets position it well for sustained growth and shareholder value creation. We maintain our positive outlook on HEICO's ability to capitalize on increasing demand across its diversified portfolio.

Q2 Fiscal 2025 Highlights (Period Ended April 30, 2025):

HEICO delivered another quarter of record results, significantly exceeding expectations.

Top-Line Growth: Consolidated net sales surged by 15% YoY This increase was primarily driven by strong 14% organic growth across all product lines and the beneficial impact of profitable fiscal 2024 and 2025 acquisitions.

Profitability Expansion: Consolidated operating income increased 19% YoY to a record, translating to an improved operating margin of 22.6% (vs. 21.9% in Q2 FY24). Net income rose 27% to $156.8 million, or $1.12 per diluted share, surpassing consensus estimates.

Strong Cash Generation: Cash flow from operating activities dramatically increased 45% YoY to $204.7 million (up from $141.1 million). Consolidated EBITDA grew 18% to $297.7 million (up from $252.4 million). Management noted that their "cash margin" (EBITA) across segments is a key metric they track, as it most closely correlates to cash generation.

Deleveraging: The net debt-to-EBITDA ratio improved to a healthy 1.86x as of April 30, 2025, down from 2.06x at October 31, 2024, highlighting prudent financial management and a commitment to maintaining a strong financial position.

Segmental Performance:

Flight Support Group (FSG): This segment posted exceptional results, with net sales growing 19% to a record $767.1 million and operating income climbing 24% to a record $185 million. Key drivers included robust 14% organic growth, propelled by a remarkable 16% organic growth in aftermarket parts and distribution businesses. Organic growth in component repair was 11%, and specialty products grew 9%. Management attributed this strength to accelerated market acceptance of their products, quick turnaround times, and the ability to offer a compelling value proposition combining OEM parts, HEICO parts, and extensive DER repairs through their 21 component repair stations – the largest independent network in the world. The continued success of the Wencor integration, operating as a standalone business with "cooperation, cash, capabilities, and consistency without consolidation," further bolstered performance. Notably, FSG's organic defense net sales increased 18%, benefiting from heightened U.S. and allied defense spending, particularly in missile defense manufacturing where significant backlog is reported. The FSG's operating margin improved to 24.1% in Q2 fiscal 2025, with a cash operating margin (EBITA) of approximately 27%, an increase of 110 basis points YoY.

Electronic Technologies Group (ETG): ETG reported a 7% increase in net sales to $342.2 million, with 4% organic growth. This growth was mainly attributable to increased demand for space, aerospace, and other electronics products. While defense product net sales were slightly down this quarter compared to a tough prior-year comparable (Q2 FY24 saw 20%+ organic growth in defense), management highlighted record backlog in ETG, particularly in defense, which points to strong anticipated growth in the second half of fiscal 2025. "Other electronics" organic net sales saw mid-single-digit growth, indicating a positive turnaround in order volumes after multiple quarters of inventory destocking at customers. The ETG maintained strong underlying profitability with an operating margin of 22.8%, and 26.7% before acquisition-related intangibles amortization, which consumed about 390 basis points of the operating margin. Management considers these excellent margins on a true operating business basis.

Strategic Execution:

Acquisition Pipeline Active: HEICO remains highly active in its acquisition strategy, completing its fourth acquisition of fiscal 2025 with the purchase of Rosen Aviation LLC in April. This acquisition, which designs and manufactures in-flight entertainment products (principally cabin displays and control panels) for business and aviation markets, is expected to be earnings-accretive within its first year and was funded by cash provided by operating activities. Management emphasized their disciplined approach to acquisitions, prioritizing transactions that are "financially prudent, accretive to earnings, and enhance long-term value."

Decentralized Model Driving Efficiency: The company's decentralized operating structure continues to be a core competitive advantage. This model allows for specialized focus and efficient operations, contributing to expanding margins while simultaneously delivering cost savings and "lightning quick turnaround times" to customers. This structure, which includes the largest independent component repair network, enables the integration of various product offerings and services, leading to accelerated market share gains.

Customer Relationships and Pricing Strategy: Management reiterated their commitment to long-term customer relationships. While acknowledging the opportunity to raise prices more aggressively given OEM price increases and the value HEICO provides, the company intentionally restrains price increases beyond cost pass-throughs. This strategy, cultivated over decades, aims to foster customer loyalty and continuous increased business, ultimately benefiting shareholders through volume and market share gains.

Outlook:

Management remains confident in achieving continued net sales growth across both FSG and ETG for the remainder of fiscal 2025, primarily fueled by strong organic demand for most products. They aim to accelerate growth for recently completed acquisitions and position themselves to capitalize on future opportunities. The ongoing alignment with a pro-business administration, coupled with HEICO's diversified market exposure and strong balance sheet, provides a solid foundation for sustained market share gains and long-term value creation. Operating cash flow is expected to remain robust, with working capital investment potentially flat to slightly down in the back half of the year as strategic inventory builds for the first half bleed off.