Unlock our complete content library with a paid subscription! For just $0.55 a day with our annual plan, you'll get access to everything listed below, plus future content.

Summary

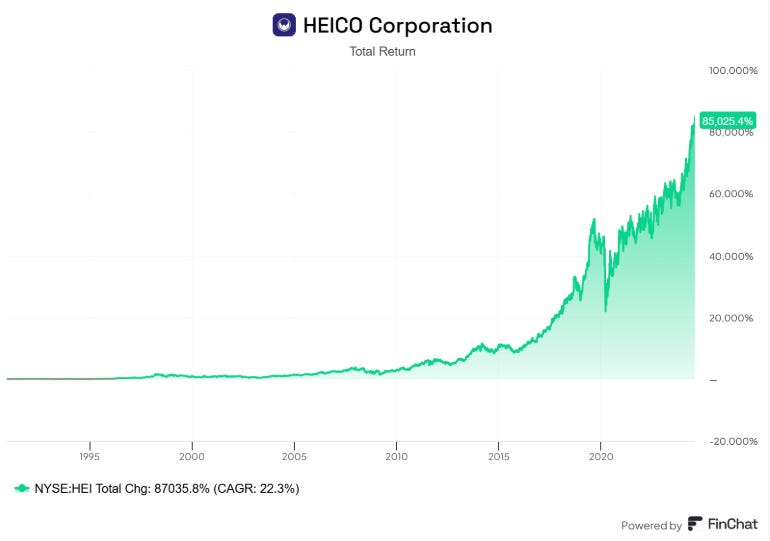

HEICO (HEI/HEI.A) delivered strong first-quarter 2025 results, driving a significant market reaction. The stock surged 13.88% on February 27th and an additional 2.19% on February 28th, resulting in a year-to-date gain of 11.59%, significantly outperforming the S&P 500 and Nasdaq 100. This rally appears to correct a prior undervaluation, attributed to misplaced concerns regarding potential impacts from government spending (the electronics technology segment has about 50% of their organic growth tied to defense and space) which at the time management told analysts was immaterial and would actually be positive for the business. HEICO's long-term performance remains exceptional, boasting a 22.3% CAGR since 1990 and an 18.8% CAGR over the past five years.

When we purchased HEICO years ago, our original thesis was as follows:

Investment Thesis

PMA Parts Usage Acceleration

The adoption of Parts Manufacturer Approval (PMA) significantly increased in the 1990s following enhanced FAA enforcement regarding unapproved parts. Our investment thesis centered on the growing population of out-of-warranty aircraft flight hours (aircraft older than 6 years) within global fleets, coupled with the industry's need for diversified parts sourcing. Given that PMA parts represent a relatively small portion (1.5-2.5%) of the total commercial aircraft parts market, we anticipated substantial growth. HEICO, as the leading producer of PMA non-OEM aerospace parts, we felt was strategically positioned to capitalize on these favorable market trends.

A Clear Reinvestment Runway

Our investment thesis also recognized HEICO's strategic advantage in reinvesting operating cash flow into acquisitions, enabled by its low capital expenditure requirements (approximately 1.5% of sales) and running them in a decentralized way. Acquisitions are integral to HEICO's growth, evidenced by 98 acquisitions since 1990. Notably, the August 2023 acquisition of Wencor Group from Warburg Pincus for $1.9 billion in cash and $150 million in Class A common stock (13x NTM EBITDA) represented HEICO's largest acquisition to date, adding $725 million in annual revenue at low 20% EBITDA margins. Prior to Wencor, HEICO reinvested approximately 73% of its capital in acquisitions and 18% in R&D, yielding a 91% reinvestment rate before capex. We projected HEICO could sustain a 70% reinvestment rate of operating cash flow, driving growth and increasing return on invested tangible capital (ROIIC) over the long term (see valuation section).

Sidecar Investment Opportunity with the Mendelsons

A core component of our investment thesis rests on the alignment of interests with HEICO's management team. With approximately 14% ownership held by management and a significant stake held by employees, there is a strong convergence of shareholder and management objectives. Performance-based incentives, tied to net income, EBITDA (not BS earnings in HEICO’s case), and operating cash flow targets, further solidify this alignment. Executive compensation is structured with a balanced approach, comprising approximately 10% salary, 50% option awards, 25% non-equity incentive compensation, and 15% retirement plan contributions.