FOURTH QUARTER 2024 HIGHLIGHTS

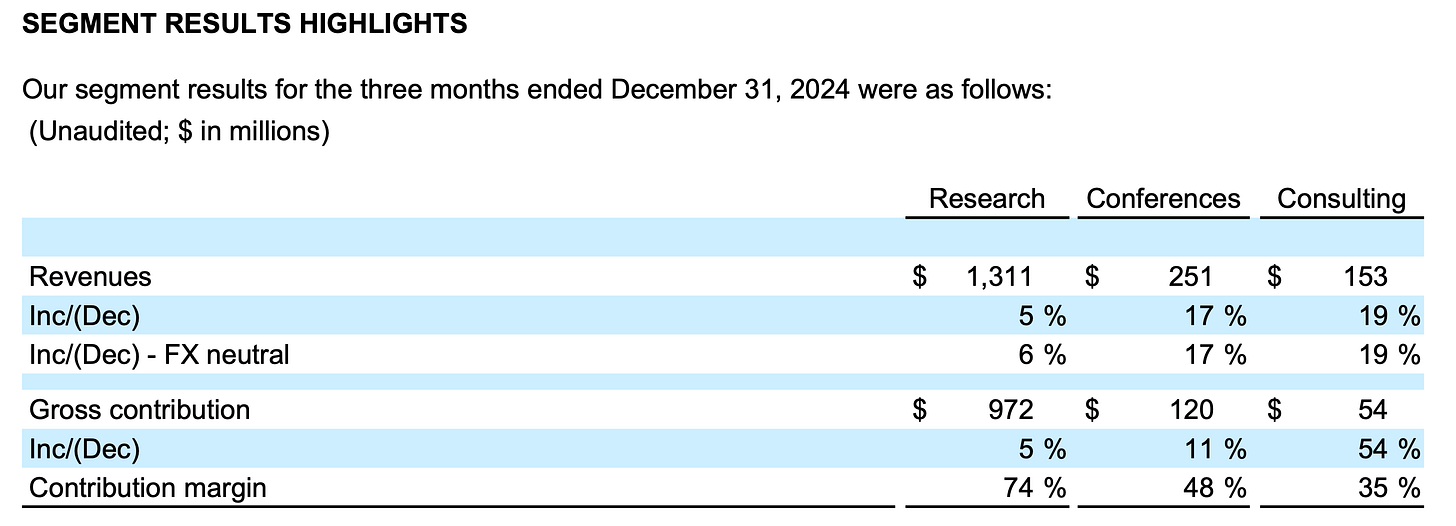

Revenues: $1.7 billion, +8% as reported and FX neutral.

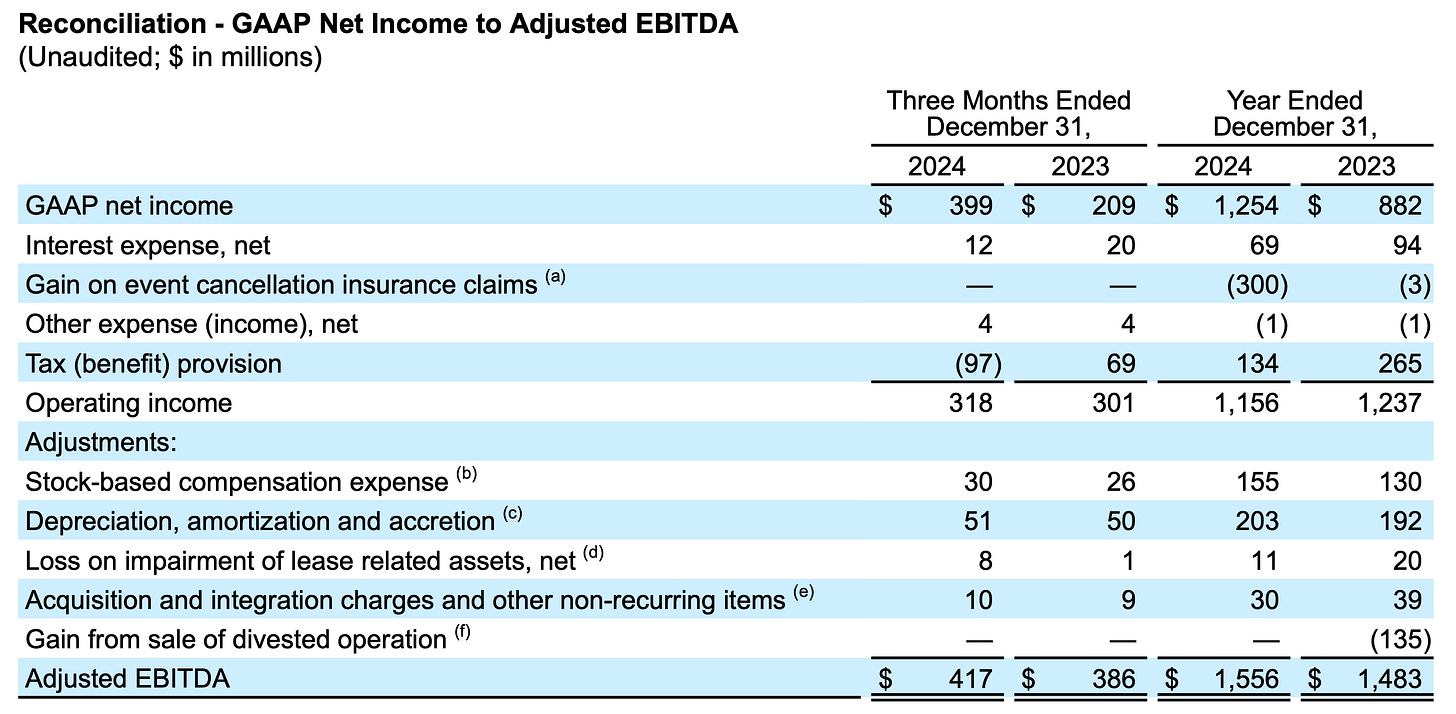

Net income: $399 million, +91%; adjusted EBITDA: $417 million, +8% as reported, +9% FX neutral.

Diluted EPS: $5.11, +94%; adjusted EPS: $5.45, +79%.

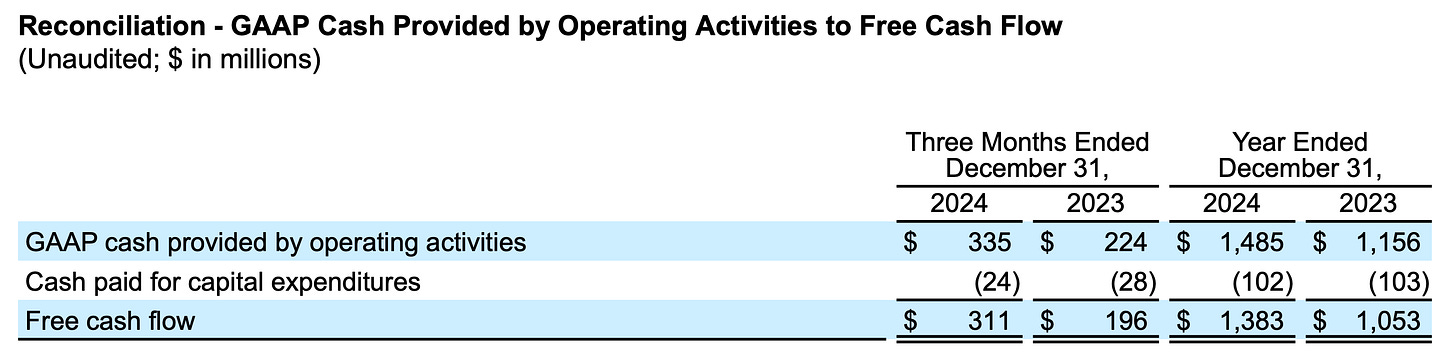

Operating cash flow: $335 million, +50%; free cash flow: $311 million, +59%.

FULL YEAR 2024 HIGHLIGHTS

Revenues: $6.3 billion, +6% as reported and FX neutral.

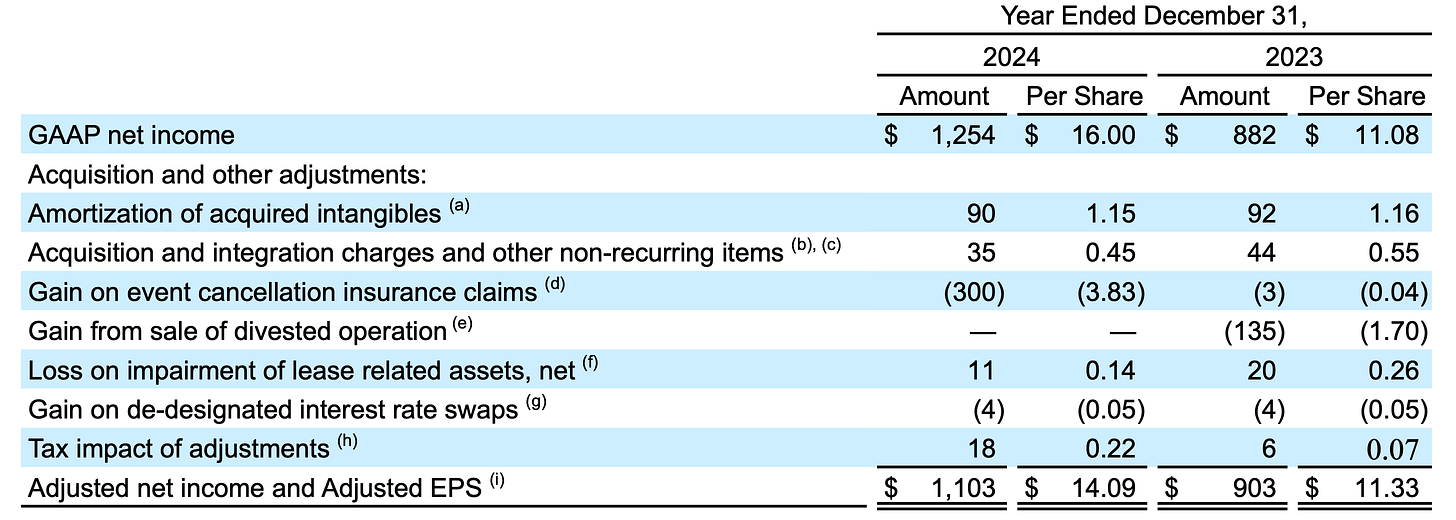

Net income: $1.3 billion, +42%; adjusted EBITDA: $1.6 billion, +5% as reported, +6% FX neutral.

Diluted EPS: $16.00, +44%; adjusted EPS: $14.09, +24%.

Operating cash flow: $1.5 billion, +28%; free cash flow: $1.4 billion, +31%.

Repurchased 1.6 million common shares for $0.7 billion; 1% reduction in outstanding share count YoY.

Over the past 4 years, it's been over $4 billion.

2025 MANAGEMENT COMMENTS

Management expects a 2 percentage point headwind to revenue and EBITDA growth for the full year 2025.

Research guidance assumes ongoing CV acceleration throughout 2025. First-quarter and first-half net contract value increase (NCVI) are crucial for 2025 revenue growth. Given the importance of Q1 for renewals, management has adopted a cautious approach to NCVI phasing. Regarding the U.S. Federal Government, they concluded 2024 with approximately $270 million in CV (5% of total CV), spread across numerous agencies and departments. About 85% of this U.S. Federal CV resides within GTS. Almost all federal contracts are one-year agreements with staggered renewal dates throughout the year.

the point in bold above is something analysts are focusing way too much attention to. Not a concern from a long-term FCF per share forecast.

Anticipate the Conferences segment's gross margins will peak in the second quarter. Strong revenue visibility for 2025, with most of our projected revenue already secured through contracts.

Mid-to-high single-digit sales headcount growth for 2025.

Plan to significantly increase our Global Business Sales (GBS) quota-bearing headcount (QBH) in 2025, with double-digit growth. Prepared to accelerate hiring further if conditions warrant.

As usual overall guidance is overly conservative on purpose. Sell-Side analysts will model the company based on management guide numbers and then adjust FCF projections as “earnings surprises” occur going forward.

CONTRACT VALUE HIGHLIGHTS

Global Technology Sales Contract Value (GTS CV): $4.0 billion, +7% YoY FX Neutral

Global Business Sales Contract Value (GBS CV): $1.2 billion, +12% YoY FX Neutral

RESEARCH METRICS

CAPITAL STRUCTURE

Strong Balance Sheet: IT maintains a very strong balance sheet with:

$2.6 billion of liquidity.

Low levels of leverage.

Effectively fixed interest rates.

Share Repurchases:

Q4 share repurchases: $102 million.

Full-year share repurchases: More than $735 million.

Remaining repurchase authorization (end of December): More than $900 million.

Expectation of continued authorization renewals by the Board.

RENEWALS

The biggest driver of forward year subscription revenue growth is going to be the end of year prior year CV growth. 80% to 85% of how much revenue actually flows through into the following year. Q1 is a heavy renewal quarter or a little bit heavier than average and it is our lowest new business quarter.

Fourth quarter is largest new business quarter, have the most conferences, build the most pipelines and sell the most new business.

2025 OPERATING EXPENSES

Implied operating expense growth that management has baked into 2025 plan is around 9% year-over-year operating expense growth.

GARTNER AI OPPORTUNITY

AI Opportunity: AI presents a significant opportunity for Gartner, primarily by helping clients navigate the uncertainty surrounding its adoption. Gartner is uniquely positioned to advise both enterprise function leaders and tech vendors on AI strategies.

Gartner's Internal AI Initiatives: Gartner is actively exploring and implementing AI (including generative AI) across numerous internal initiatives, ranging from advanced statistical techniques to training and client-facing applications like translation.

Productivity Gains: While no single AI application will deliver massive productivity gains, the cumulative effect of many small improvements (e.g., 5% gains) is expected to be substantial. Gartner's approach is one of continuous improvement and innovation, with AI as a key component.

Client Focus: The greatest benefit for Gartner lies in helping clients effectively leverage AI. The high degree of uncertainty surrounding AI adoption creates strong demand for Gartner's guidance and insights. This is a major driver of potential growth for the company.

WHY GTS GROWTH SLOWER THAN GBS GROWTH?

GTS headcount growth is being moderated to prioritize productivity gains, especially within the tech vendor segment. Management believes there's potential to increase productivity alongside headcount growth.

Management seems to think there will be strong spending from tech vendors over the next few years.

M&A PIPELINE

Strong cash position, balance sheet flexibility, and substantial annual free cash flow (over $1 billion) allow IT to pursue both share repurchases and M&A simultaneously.

Approach to buybacks and M&A should not be interpreted as a choice between the two. Furthermore, our M&A strategy focuses on small to medium-sized tuck-in acquisitions, not large-scale transformations like the one eight years ago.

GTS WALLET RETNETION IMPROVEMENTS

No change in selling environment so this was simply due to execution. Great to see.

management did mention this was related to hiring the right people and the quality of their training.

TIMING OF HIRING

Hiring in 2024 was heavily concentrated in the latter part of the year. The 2025 plan is to distribute hiring more evenly throughout the year. However, the actual number of hires per quarter may fluctuate, as IT prioritizeS finding the right talent over meeting specific deadlines.

PRICE INCREASES

Targeted Price Increases: Price increases, effective November 1st, averaged slightly below 4%. However, pricing is strategically adjusted by product and geography, with more aggressive increases in higher-inflation markets.

Wage Inflation Consideration: Pricing decisions are heavily influenced by local wage inflation to ensure compensation costs are covered.

Minimal Pushback: Client pushback on the price increase has been minimal. Gartner emphasizes continuous product and service improvement to justify the modest annual price adjustments.

SELLING ENVIRONMENTS

Europe: The European selling environment has remained stable, consistent with the latter half of 2024.

China: China remains a challenging market, particularly with larger clients. While some progress has been made with mid-sized clients in the second half of 2024, overall performance in China was consistent throughout the year.

CONTRACT VALUE GROWTH

Contract Value (CV) growth is projected to surpass 7.8% by the end of 2025. While growth may not be perfectly linear, the overall trend is expected to be upward. The company aims to achieve double-digit CV growth, progressing towards its medium-term target of 12% to 16%.

management is hesitant with guidance commentary, but they are quite confident CV growth will accelerate in 2025.

ROIIC/ROE CHECKUP