Summary

Gartner (IT) reported its first-quarter 2025 earnings on May 6, 2025. The company's results slightly exceeded low expectations prior to the announcement, leading to an ~2% increase in its stock price on the morning of the report. Gartner is demonstrating resilience in a challenging environment. In the first quarter, contract value increased by 7%, or 8% when excluding the impact of federal contract value headwinds. The company's first-quarter revenue, EBITDA, EPS, and free cash flow surpassed expectations. Gartner also increased headcount within its sales organizations by 4%.

During the quarter, the broader selling environment experienced a shift as many company decision-makers began adapting to the evolving global macroeconomic conditions. Consequently, the company is updating its guidance ($135M downward revision to revenue) to incorporate the first-quarter performance, the altered macroeconomic landscape, the favourable impact of foreign exchange rate movements, and its own expense management capabilities.

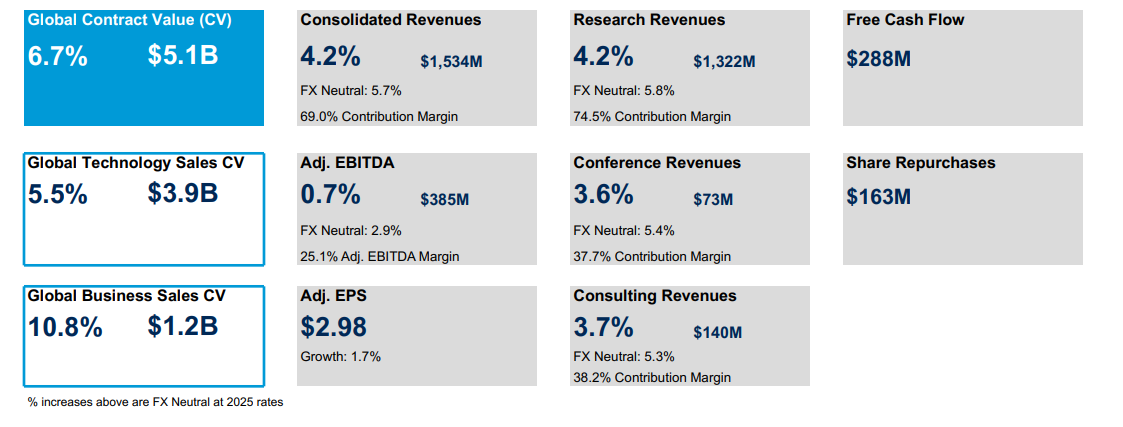

In the first quarter, the company repurchased $163 million of its stock, maintaining financial flexibility as the market absorbs the macroeconomic shifts. The company remains interested in further share repurchases, which it will undertake opportunistically.

Q1 2025 Highlights

Revenues: $1.5 billion, showing a +4.2% increase as reported, and a +5.7% increase on an FX neutral basis.

Net Income: $211 million, representing a +0.2% increase as reported.

Adjusted EBITDA: $385 million, indicating a +0.7% increase as reported, and a +2.9% increase on an FX neutral basis.

Diluted EPS: $2.71, a +1.5% increase.

Adjusted EPS: $2.98, a +1.7% increase.

Operating Cash Flow: $314 million, a significant +66.0% increase.

Free Cash Flow: $288 million, showing a substantial +73.3% increase.

Differentiated View

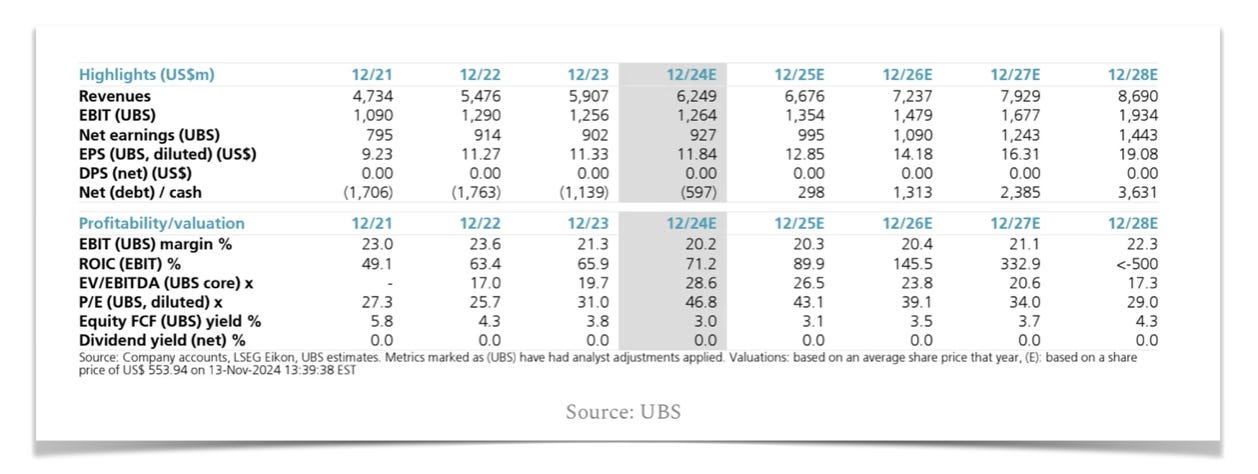

Our differentiated view is centered on the potential for significant margin expansion. We believe Gartner's past operational practices, specifically a lack of stringent expense management, provide a clear pathway to improved profitability. Prior to the pandemic, the market valued Gartner's rapid revenue growth, evidenced by the correlation between EBITDA multiples and organic revenue growth in the business services sector. Consequently, the company's SG&A expenses grew at an average rate of 1% above revenue growth from 2010 to 2024.

The observed growth in sales headcount was a deliberate strategy to enhance contract value growth As previously outlined, we consider the expansion of quota-carrying sales personnel as a critical investment. This investment is anticipated to generate significant future CV growth, with projected cash flow breakeven occurring within the early stages of the second year following the investment's implementation.

In 2021, Gartner announced a pivotal shift in its sales strategy, decoupling sales headcount growth from CV growth by a three-point reduction. Our analysis suggests that this crucial strategic change has not been adequately modeled by sell-side analysts. A reverse DCF exercise reveals that consensus forecasts appear to reflect the 12-16% CV growth guidance, but fail to account for the resulting operating leverage improvements as they are forecasting out EBIT margins at 22%.

A review of recent analyst notes and their corresponding projections supports our perspective on how the company's operating margins are being viewed and forecasted. The prevailing consensus reflects an EBIT margin range of 19-20%.

We posit that Gartner can sustain its top-line growth trajectory by strategically moderating sales headcount growth to three percentage points below contract value growth. For instance, with a 14% CV growth rate, sales headcount would increase by 11%. This recalibration of their economic model will drive significant margin expansion. Historical data from 2010-2024, where SG&A grew 1% faster than revenue on average, suggests that by reducing sales headcount growth by three points, S&M expenses could grow 2% slower than CV & revenue growth.

Given Gartner's increased scale, this leverage is expected. We believe management's conservative EBITDA margin guidance is intentionally understated, reflecting lessons learned from the CEB acquisition integration. To validate this, we have developed a five-year forward margin bridge, projecting adjusted EBITDA margins from the 2024 baseline:

Assuming modest gross margin expansion and consistent G&A leverage, mirroring the 2-3% point reduction in S&M growth, we project ~200 basis points of annual margin expansion.

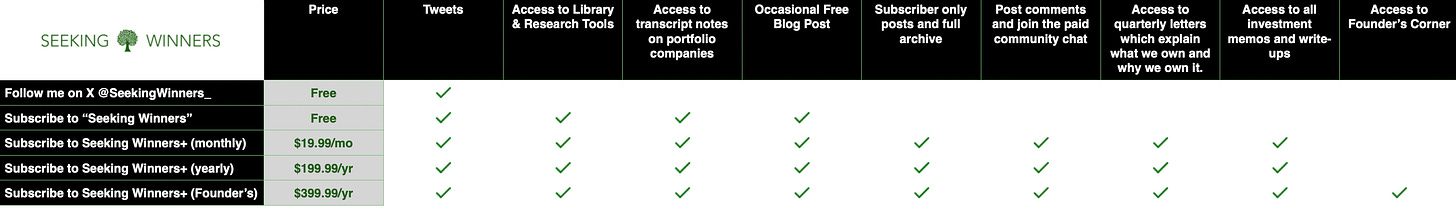

If you’d like to continuing reading posts like this, unlock our complete content library with a paid subscription! For just $0.55 a day with our annual plan, you'll get access to everything listed below, plus future content.