Gartner

The Ratings Agency of Tech

We would like to acknowledge Brendan Nemeth and Gables Equity for bringing the Gartner opportunity to our attention. Their extensive due diligence and ongoing support throughout our research process were invaluable in deepening our understanding of the business. For further information regarding Gables Equity's investment approach, please refer to their website linked here.

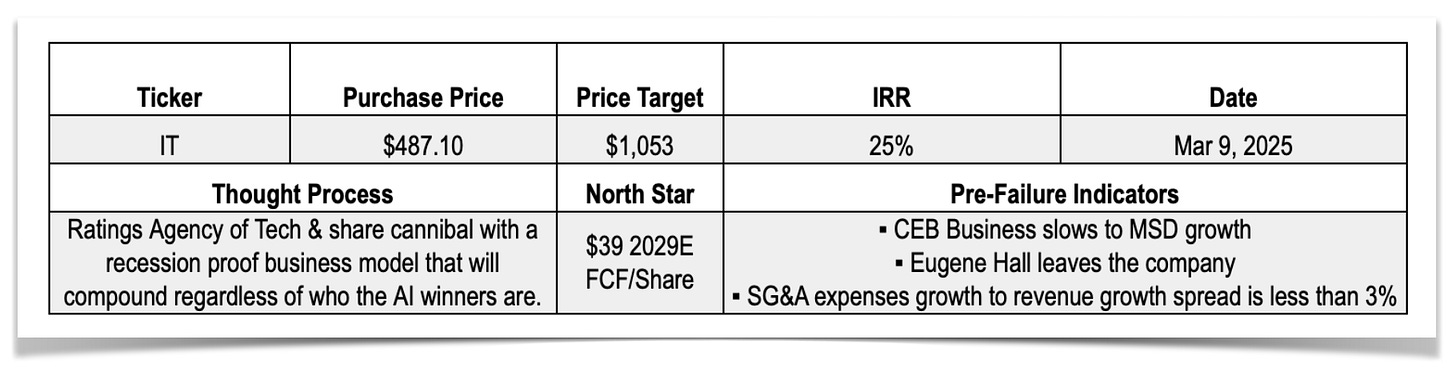

Investment Thesis

The Ratings Agency of Tech

We believe Gartner is the preeminent authority in technology research, effectively functioning as the 'ratings agency of tech' as one investor described it to us. Its unparalleled scale and market dominance, significantly exceeding Forrester's, solidify its position as the indispensable, independent source for technology buyers. Gartner's revenue of $6.2 billion dwarfs Forrester's $432.5 million; in fact, Gartner's annual revenue growth is approximately equal to Forrester's total yearly earnings. The inherent need for neutral validation in critical technology investments, coupled with the industry's tendency to consolidate around a single standard (Gartner's Magic Quadrant), creates a powerful competitive moat. This dynamic ensures Gartner's sustained growth and reinforces its leadership in a market driven by continuous technological disruption.

Gartner's research offers a powerful, yet often underappreciated, value proposition: enabling faster decision-making, driving vendor cost efficiencies, and providing crucial risk mitigation. This 'hidden' value requires skilled sales execution to resonate with C-level executives. Gartner's strategic investment in a strong, aggressive sales force acts as a catalyst, unlocking this value and driving consistent revenue growth. We view their sales capabilities as a critical asset and a key driver of future performance.

Recession Resistant Share Cannibal

Gartner's business model is a paragon of recurring revenue and financial stability. Its subscription structure, featuring multi-year contracts and upfront annual payments, provides exceptional revenue visibility. The company's pricing power of 3-7%, demonstrated by consistent annual increases, further strengthens its financial performance as Gartner has no issues covering inflation. The inherent scalability of its research, coupled with upfront payments, drives strong operating leverage and free cash flow conversion. Notably, Gartner's resilience during past economic downturns, and its evolving business mix, position it for continued stability and defensiveness, making it an ideal investment for long-term, predictable growth. The predictable and robust cash flow generated by Gartner's business model enables a consistent and increasing share buyback program, driving significant shareholder value through sustained share count reduction.

A $200 Billion Growth Opportunity

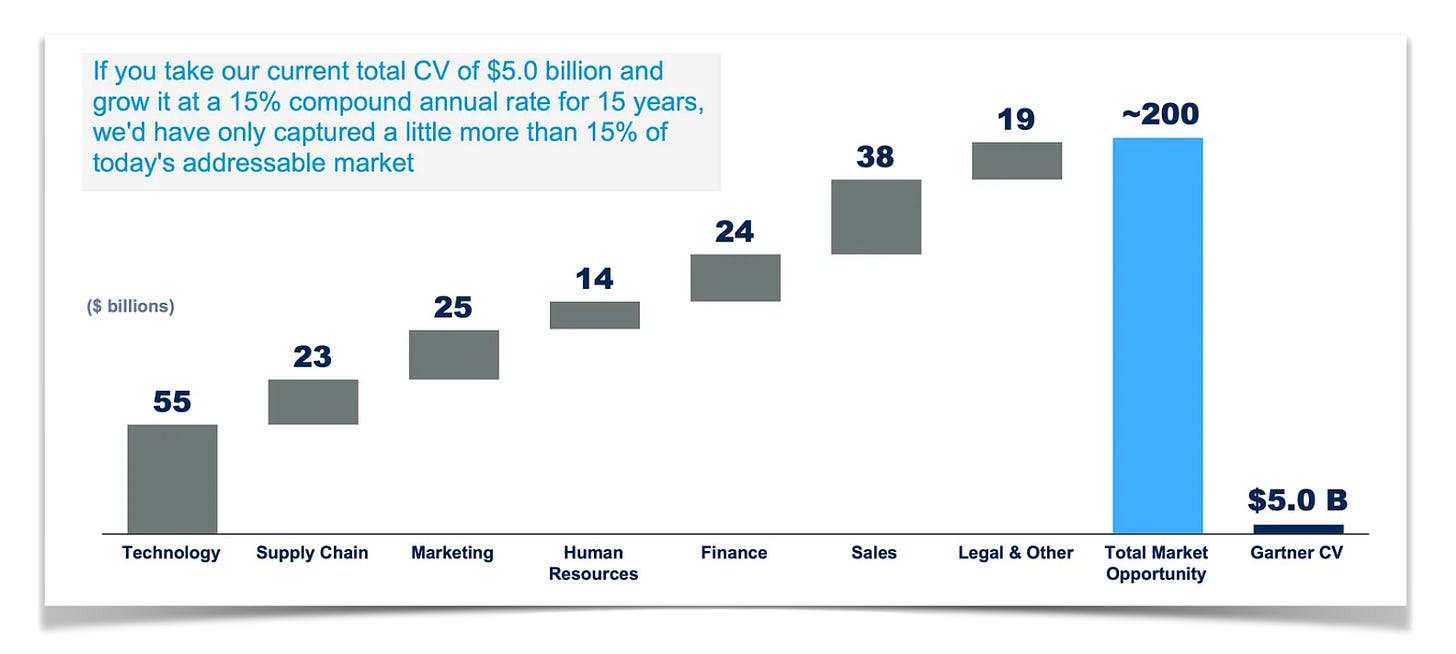

Gartner operates within a vast and significantly under-penetrated market, targeting 150,000 global enterprises with annual revenues exceeding $100 million and technology budgets of $10-50 million. This translates to a $200 billion total addressable market, segmented into $55 billion for technology solutions (GTS) and $145 billion for business solutions (GBS). Current client spending demonstrates substantial room for expansion: GTS clients average $250,000 annually, representing fewer than 0.25% of their sales and only 5 user seats compared to Gartner's recommended 5-10. Similarly, GBS clients average $200,000 annually, supporting just 4 user seats across key business functions, while the potential for penetration across these verticals remains significant. This substantial gap between current and potential client spending, combined with the large addressable market, provides a compelling runway for sustained revenue growth.

The Case for Margin Outperformance

Gartner's sales-centric business model drives its sustained growth. We believe management is deliberately managing margin expectations conservatively, leading to a significant underestimation of the company's operating leverage. The 2021 strategic shift to decouple sales headcount growth from CV growth represents a key inflection point, creating substantial potential for margin expansion. We believe the sell-side is failing to adequately model the impact of this change, particularly as CV growth accelerates towards management's medium-term guidance. This creates an opportunity for investors to capitalize on the resulting margin upside, which we ultimately believe will lead to $39 2029E FCF/Share.

Business Description

Gartner, Inc. (NYSE: IT) was established in 1979 by Gideon Gartner, a former IBM employee, initially focusing on providing strategic IT product selection guidance to corporate clients. Leveraging deep industry knowledge, Gartner quickly established a reputation for insightful analysis, even prompting legal action from IBM in the early 1980s, which was eventually settled out of court. This early validation highlighted the value of Gartner's proprietary insights. The company expanded its service offerings, culminating in a 1987 IPO. Subsequent ownership changes, including a brief period under Saatchi & Saatchi and a management-led buyout with Bain Capital and Dun & Bradstreet, led to a re-IPO in 1993.

Through a combination of organic growth and strategic acquisitions, Gartner achieved a 24% CAGR in sales through 2001, reaching $963 million. The company experienced an 11% revenue decline during the post-dotcom downturn, highlighting its sensitivity to IT spending cycles. The appointment of Eugene Hall as CEO in 2004 marked a pivotal shift. Hall implemented a growth strategy focused on investing in proprietary research to deliver actionable and objective insights to address critical decision-making challenges for key executives, while also expanding the sales force to proactively drive demand for Gartner's essential, yet often underappreciated, services. Gartner strategically employed M&A to enhance capabilities, expand geographically, and enter new verticals, acquiring Meta Group in 2005, AMR Research in 2010, IDEAS International in 2012, and Nubera and Capterra in 2015.

The transformative $3.3 billion acquisition of CEB in 2017 significantly diversified Gartner's offerings into HR, Sales, Finance, and Legal verticals. This particular acquisition introduced a period of investor uncertainty for Gartner. Skepticism arose from CEB's historical low single-digit revenue growth and its focus on non-technology-specific business insights for Finance, HR, Sales, Marketing, and Legal executives. Concerns were amplified by Gartner's explicit guidance of a three-year ramp-up period for sales representative productivity, a timeline many investors deemed too lengthy for acceptable returns.

However, Gartner's proven ability to extend its successful sales processes beyond its core technology focus, as demonstrated by the post-acquisition 24% CAGR of AMR was on display here as well. The anticipated three-year integration and turnaround of CEB, now Global Business Services (GBS), unfolded as management projected. Following a period of margin compression due to investments in sales force expansion and product re-architecture, GBS achieved 9% growth in Q4 2019, validating Gartner's acquisition rationale. However, the onset of the COVID-19 pandemic in 2020 significantly impacted Gartner's conference business, which experienced a 75% revenue decline due to event cancellations. Despite this, Gartner demonstrated the resilience of its research businesses, achieving 4% contract value growth in both GTS and GBS. By Q1 2021, the successful turnaround of GBS became evident, with constant currency contract growth accelerating to 11.6%, followed by 18.1% in Q2, and 22.3% in Q3, showcasing a clear upward trajectory and confirming the strategic value of the CEB acquisition.

Gartner operates as a critical, subscription-based advisory resource for over 13,000 enterprises across approximately 90 countries, serving diverse business functions, industries, and enterprise sizes. Leveraging a team of roughly 2,500 research experts, Gartner delivers actionable and objective insights to executives and decision-makers across key functional areas, including IT, HR, supply chain, marketing, legal, and finance, addressing their most pressing challenges. This research, coupled with direct analyst access, is provided through subscription agreements with minimum twelve-month terms, and a significant portion exceeding multi-year contracts, paid annually in advance. Beyond its core research offering, Gartner provides consulting services for tailored analysis and implementation support, as well as industry-specific events and symposiums that facilitate deeper insights and peer networking.

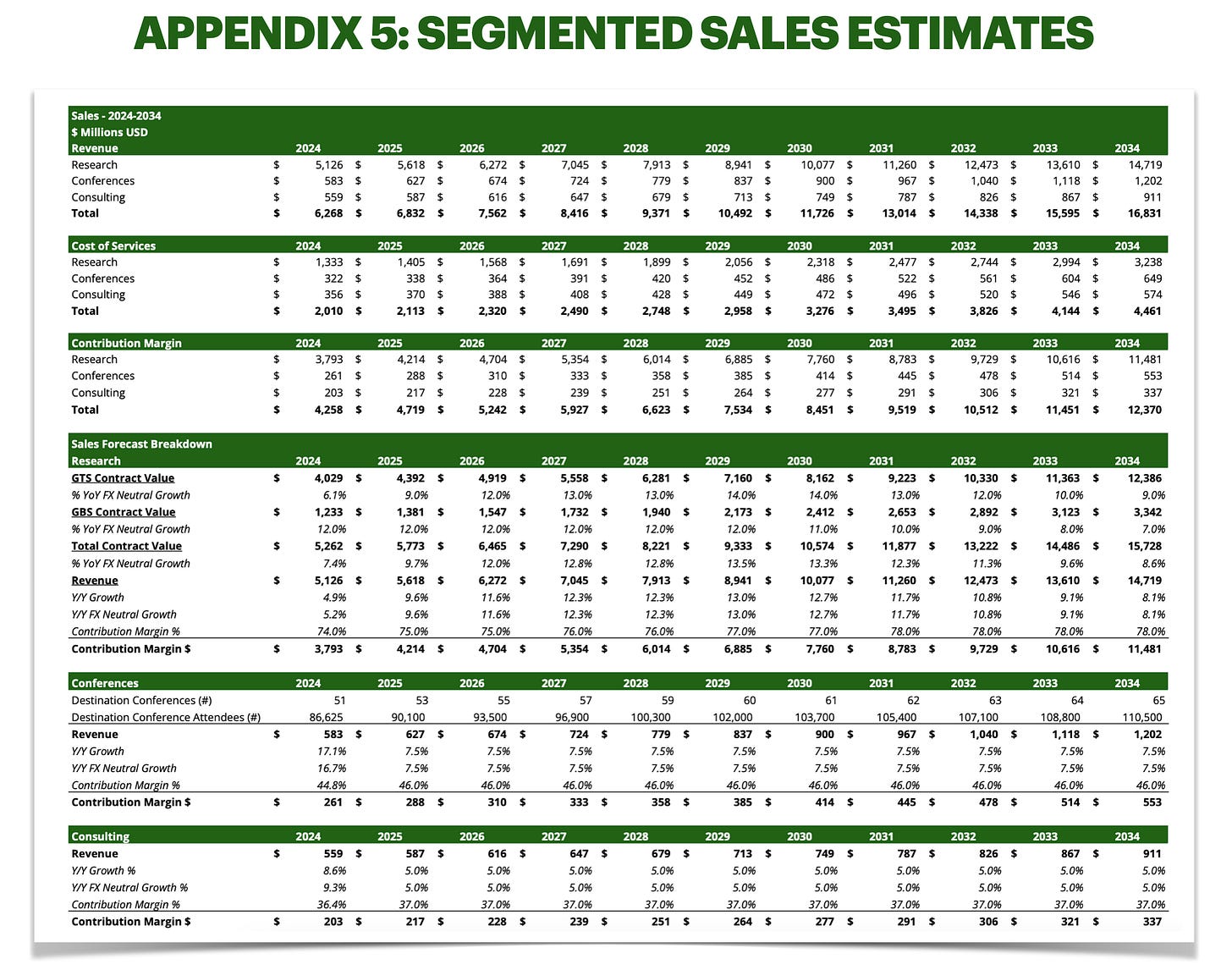

Gartner's revenue streams are segmented into three primary business lines: Research, Conferences, and Consulting. The Research segment forms the cornerstone of the business, contributing 82% of 2024 revenues and 90% of gross profits. Consulting represents 9% of sales and 4% of gross profits, while Conferences also account for 9% of sales and 6% of gross profits. Notably, the Research segment demonstrates the highest resilience, while the Conferences segment exhibits the greatest cyclicality. Consulting, positioned between the two, displayed moderate cyclicality, experiencing a 15% revenue decline during the global financial crisis but demonstrated greater stability during the COVID-19 pandemic with only a 4% revenue reduction.

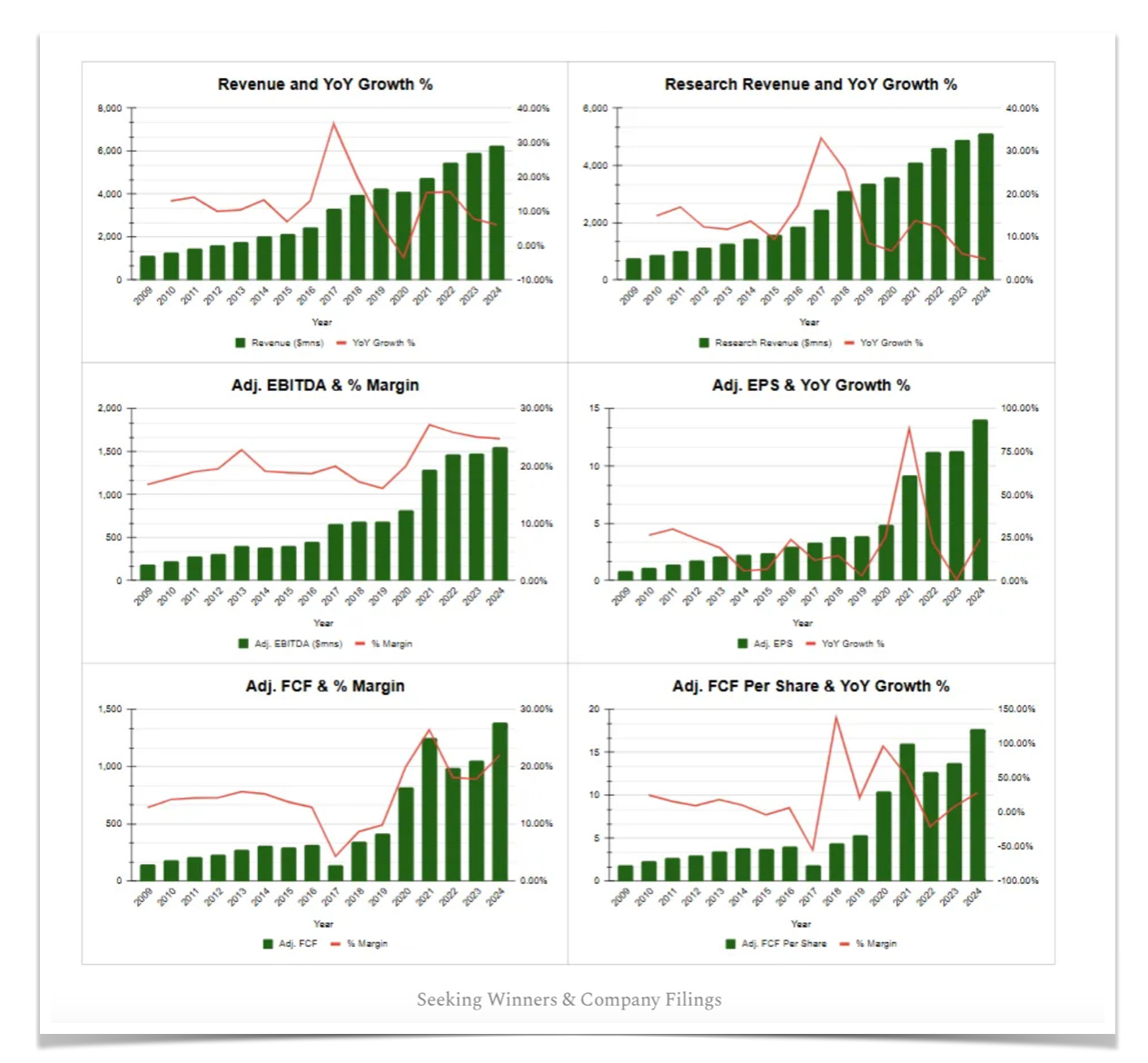

Financial Overview & Unit Economics

Gartner, arguably the best public services business within the high-quality business services sector, an industry renowned for its predictable, recurring revenue growth typically double that of GDP, solid EBITDA margins, minimal capital expenditure requirements, and resilience across economic cycles, all contributing to premium valuations compared to the broader market. Gartner distinguishes itself through its industry-leading revenue growth, particularly within its core Research segment, which targets a medium term 12-16% Contract Value increase, significantly outpacing peer growth. This rapid expansion is driven by a strategic pursuit of a large, underpenetrated market, necessitating substantial investment in a high-touch sales model to effectively sell high-value subscriptions.

While this people-intensive approach currently results in lower EBITDA margins compared to peers such as SPGI, VRSK, MCO, etc., (~20% versus peers north of 40%), we think this shields Gartner from potential disruption as the data they are collecting through interviews is one-of-a-kind. Gartner's growth strategy necessitates a significant investment in human capital, requiring continuous expansion of its analyst workforce and a corresponding increase in general and administrative expenses, particularly in recruitment, which can cause a lag effect in margins temporarily while sales reps reach 100% productivity (again more on this later).

Gartner has demonstrated exceptional and reliable growth, consistently delivering strong double-digit increases in revenue, adjusted EBITDA, adjusted EPS, and free cash flow since 2007, with only two minor revenue declines during major economic downturns in 2009 and 2020.

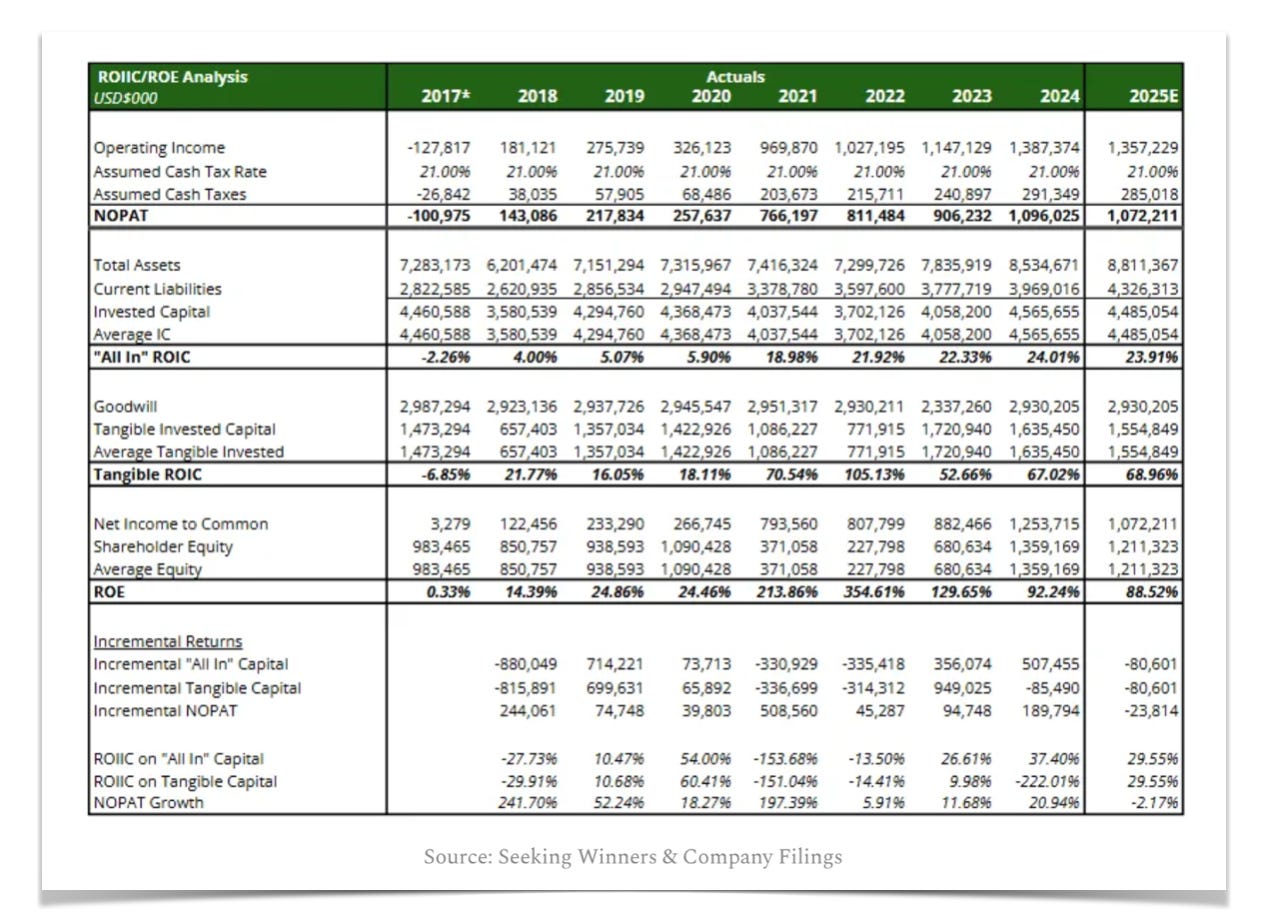

Its capital-light structure and favourable working capital, driven by upfront customer payments, result in consistently robust free cash flow, significantly exceeding net income typically by 140% due to deferred revenue. The company boasts outstanding returns on capital, with return on “All In” capital reaching 24% in 2024 and even better, ROIIC reaching 37.40% in 2024.

Inside Gartner's Double-Digit Organic Growth Engine

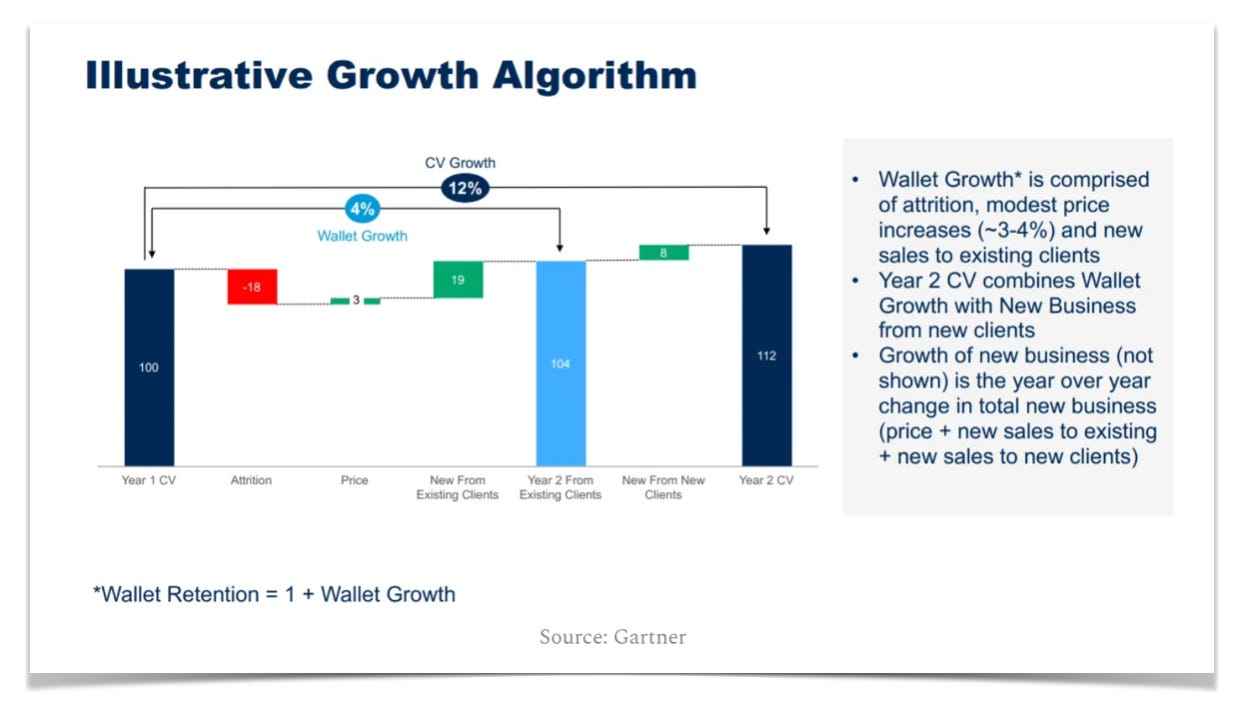

Gartner's contract value growth stems from price adjustments, expanding business with existing clients, and acquiring new customers. While the reported 16% client attrition may seem substantial, it significantly overstates actual losses. Due to employee turnover and license transfers, Gartner records both a loss and a gain when a position is filled, rather than a simple continuation. Given average employee tenure and consistent CV growth, we believe the true attrition rate is considerably lower, likely around half the reported figure. Achieving a 14% CAGR in CV for a decade with a true 16% loss would require an unsustainable 36% annual growth in upsells and new business.

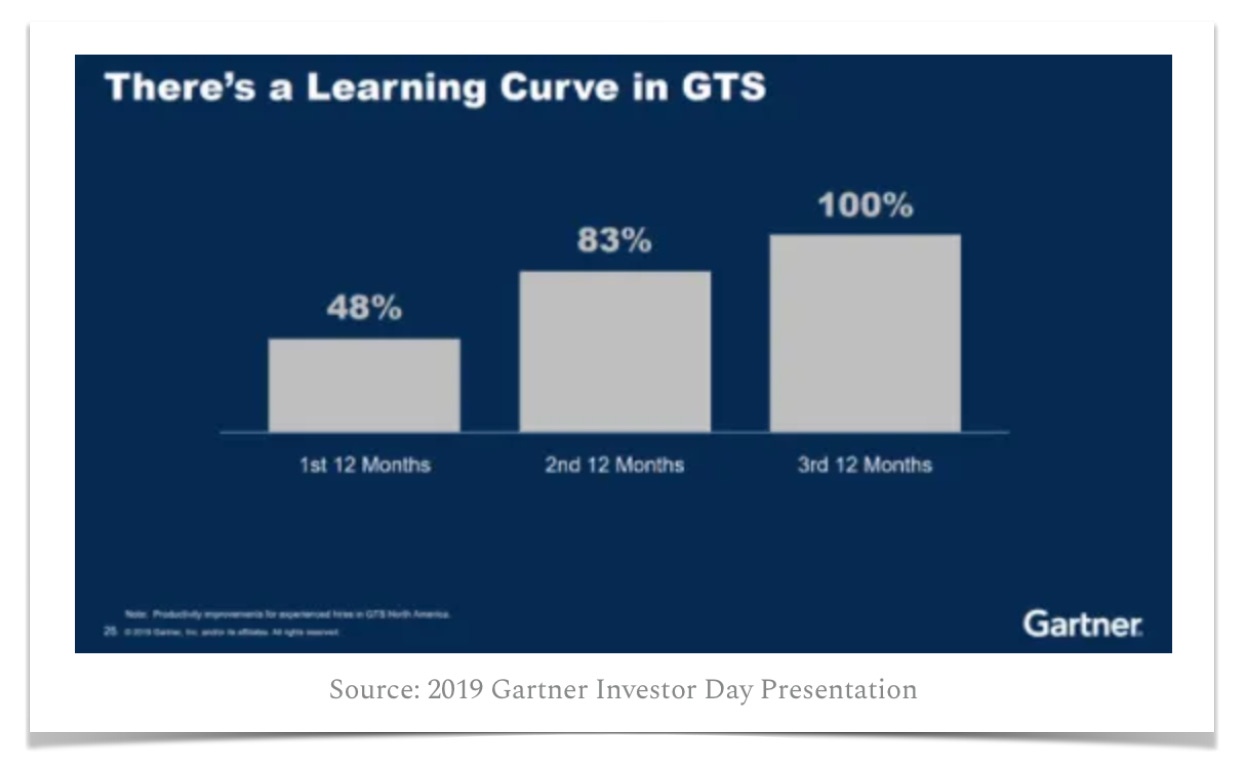

Gartner's superior sales management has proven to be the critical driver of their sustained growth. While their alignment with the thriving technology industry is beneficial, it is their sales execution that truly differentiates them. CEO Eugene Hall underscored the significance of their rigorous salesforce training during the 2019 Investor Day:

“Gartner has invested in a robust recruiting engine that is hiring tenured sales professionals as well as recruiting from college campuses. We steadily have grown sales headcount 15% annually, and to ensure we nurture and develop that talent, we offer best in class training. This includes a 6-week sales academy which focuses on the sales excellence playbook for both driving retention and growth. Our research growth is fueled through seat-based solutions versus enterprise agreements so we accelerated this transition as well, introducing seat-based offering across all major functions. Along with these product changes and the additional value they offer, we eliminated discounting. And we then established a rhythm of consistent price increases.”

- Eugene Hall

Before Eugene Hall's arrival in 2004, Gartner's growth was stagnant. He identified the enterprise-level agreement (ELA) model as a key impediment. ELAs limited upsell opportunities, as clients perceived they had already purchased comprehensive access. Furthermore, utilization was low, with only a fraction of employees leveraging Gartner's resources, and sales teams lacked incentives to drive broader adoption. Hall transitioned Gartner to a seat-based licensing model, akin to the SaaS transformations seen at companies like Microsoft & Adobe. At the 2019 Investor Day, he elaborated on this pivotal change.

"With an enterprise agreement they all had access to our content. But very few actually leveraged that access. We discovered that those who used our content most, were almost always located in the same division or geography as the person who signed the contract. Beyond that, many never even knew they had access. Even worse, because there was no contract value growth potential once an enterprise agreement was sold, Gartner salespeople were not motivated to support these clients locally, even though they needed our help. Moving to seat-based solutions dramatically increased our ability to deliver value to our clients, while also accelerating our growth. Our opportunity expanded exponentially overnight. In previous conversations with my sales teams, I'd asked them at that time, how many prospects they had? Before the change, they were giving me a count of enterprise prospects, 10 or 20. After the change to seat-based, they were able to give me names of individuals in each of those enterprises that now numbered in the hundreds. This transition from enterprise to seat-based was game changing for us back then and it is game changing for us now in GBS, representing new business, migration and retention improvement opportunity"

- Eugene Hall

To reinforce a value-driven sales approach, Hall implemented a strict no-discounting policy, directing salespeople to prioritize demonstrating the service's worth over negotiating price reductions.

"So when we go to a client, we've had a policy since shortly after I joined of no discounting. And the reason for that is that it's a sales tactical decision and the reason we did it is not just because of the additional revenue we get from it, but it forces the discussion with the client to be about the value you're going to provide. If salespeople can discount first there's a lot of internal energy that goes around deciding how big the discount should be. And then secondly, when a salesperson is opposite the client, there's a lot of discussion on how big the discount should be. We want our salespeople talking about the value of that we're going to provide. Because not only that helps facilitate the initial sale, it also means higher retention down the road"

- Eugene Hall

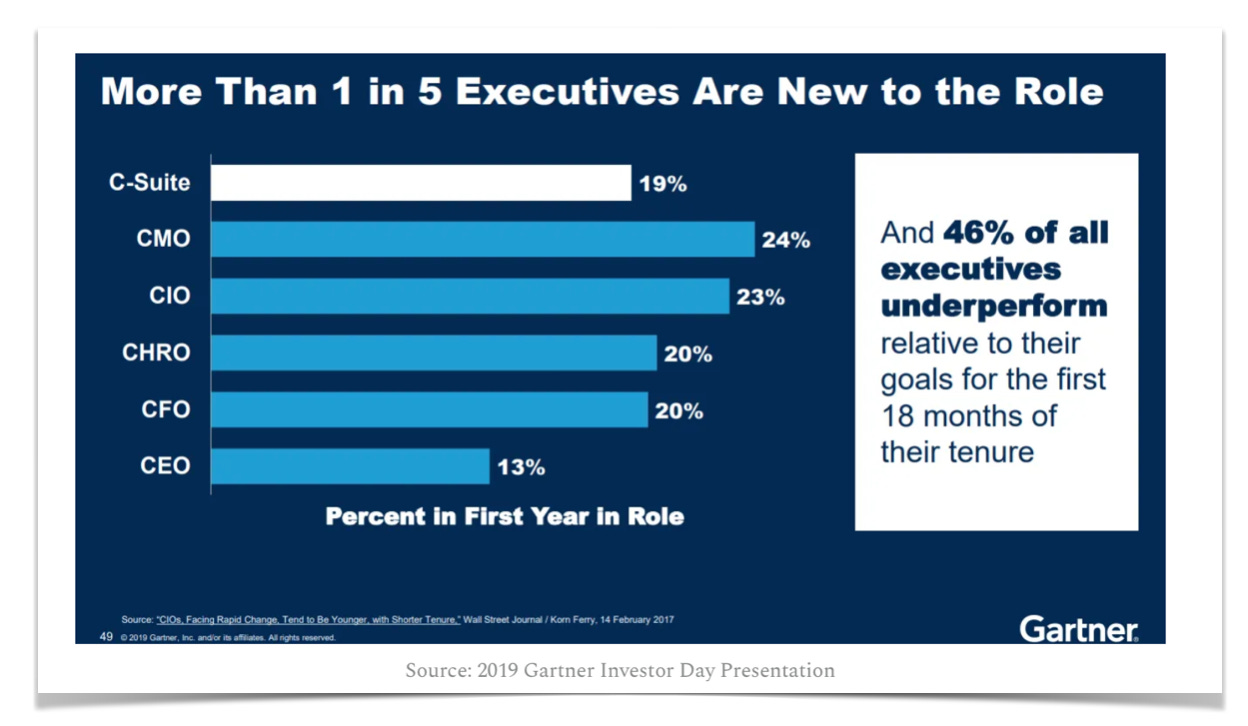

Gartner made a few good qualitative points about why their sales process is more elongated than most. Their first sell is typically to a business unit head, and 20% of these people are new to their roles every year.

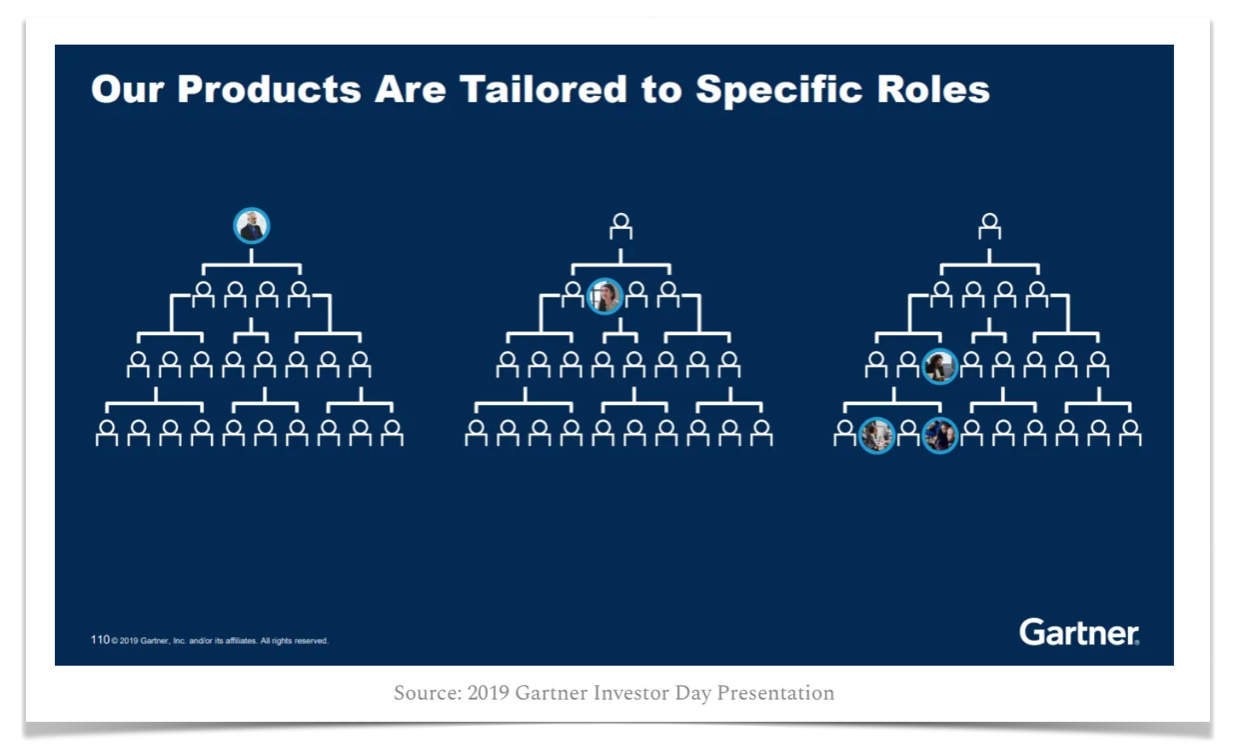

Beyond the business unit heads, Gartner also sells specific products for employees that report to division heads. Learning how to sell to these different individuals with a different product offering takes time and effort.

Sales Productivity Economics

Net Contract Value Increase (NCVI) is Gartner's leading sales metric, indicating the incremental revenue a sales representative generates in their territory, including any losses from customer attrition.

Gartner's investment in its salesforce is fundamental to its sustainable growth. As a sales-driven organization, Gartner recognizes that its research products require proactive sales efforts. Unlike comparisons with direct competitors, the primary sales challenge lies in overcoming customer inertia, demonstrating the value of research to C-level decision-makers. This necessitates a skilled and assertive sales approach to capture attention, understand priorities, and develop compelling value propositions. Gartner consistently invests in sales capacity and effectiveness through headcount expansion, enhanced training, and advanced support tools.

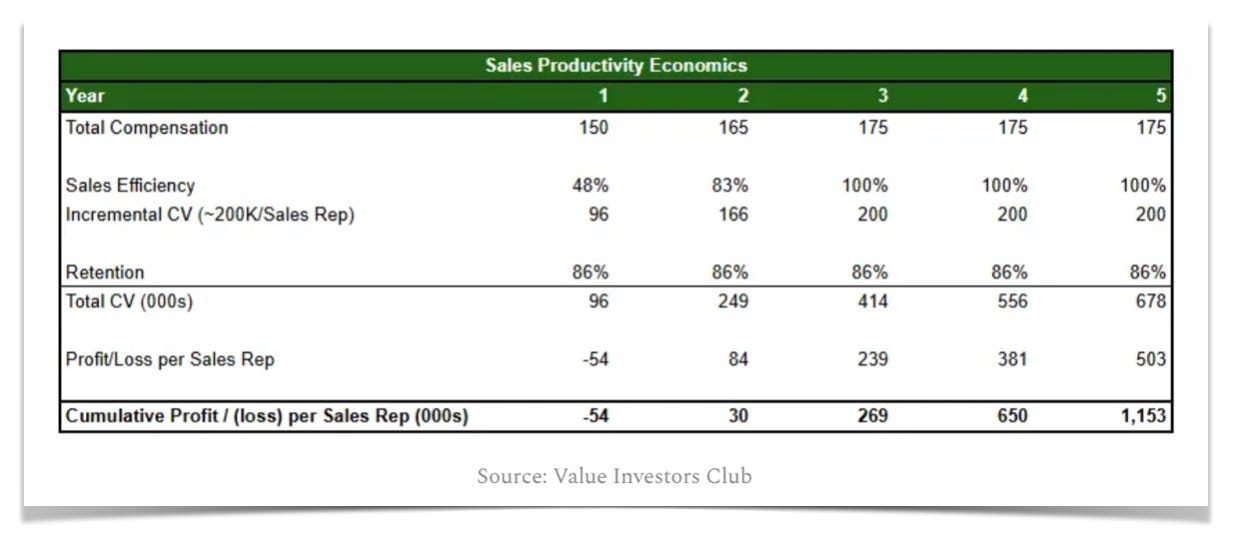

Adding sales associates demonstrates a clear ROI. Although it takes 3-6 months for a first sale and year-one productivity hovers around 50% of the average, performance accelerates rapidly thereafter. Associates achieve 83% productivity in year two and full productivity in year three. This ramp-up results in cash flow breakeven early in year two and significant profit generation thereafter, which is also why you see a lag effect depending on the year for Gartner’s GAAP EPS.

Synthesizing these elements, we can project sales productivity over a five-year period following a sales representative's hire, as illustrated below.

Total Addressable Market & Competitive Landscape

Long Growth Runway

Gartner operates within a vast and significantly under-penetrated market, targeting 150,000 global enterprises with annual revenues exceeding $100 million and technology budgets of $10-50 million. This translates to a $200 billion total addressable market, segmented into $55 billion for technology solutions (GTS) and $145 billion for business solutions (GBS). Current client spending demonstrates substantial room for expansion: GTS clients average $250,000 annually, representing fewer than 0.25% of their sales and only 5 user seats compared to Gartner's recommended 5-10. Similarly, GBS clients average $200,000 annually, supporting just 4 user seats across key business functions, while the potential for penetration across these verticals remains significant. With a historical outreach of roughly 40,000 enterprises, Gartner has achieved a near 50% conversion rate to paying customers, indicating a highly effective sales funnel and strong market demand. This substantial gap between current and potential client spending, combined with the large addressable market, provides a compelling runway for sustained revenue growth.

Gartner's value proposition is robust, particularly for those who recognize the ongoing impact of technology and disruption. The need for a neutral, expert perspective on technology is paramount, especially for high-value decisions. Companies rely on Gartner's independent analysis to mitigate risk and ensure informed investments. Furthermore, industry standardization around a single, trusted research provider is logical. Gartner's Magic Quadrant, a key annual product, is closely monitored for its influence on vendor and buyer decisions.

A Gartner license provides essential access to the latest technology trends and in-depth analysis of the 800+ companies featured across Gartner's 100+ Magic Quadrants. This access is supported by a network of over 2,500 research experts. The Magic Quadrant operates without meaningful competition. Tech vendors rationally avoid investing significant time and resources in responding to RFPs from, and working with, firms that lack Gartner's established market position. As with credit ratings, where S&P and Moody's dominate, the tech research sector has standardized around Gartner.

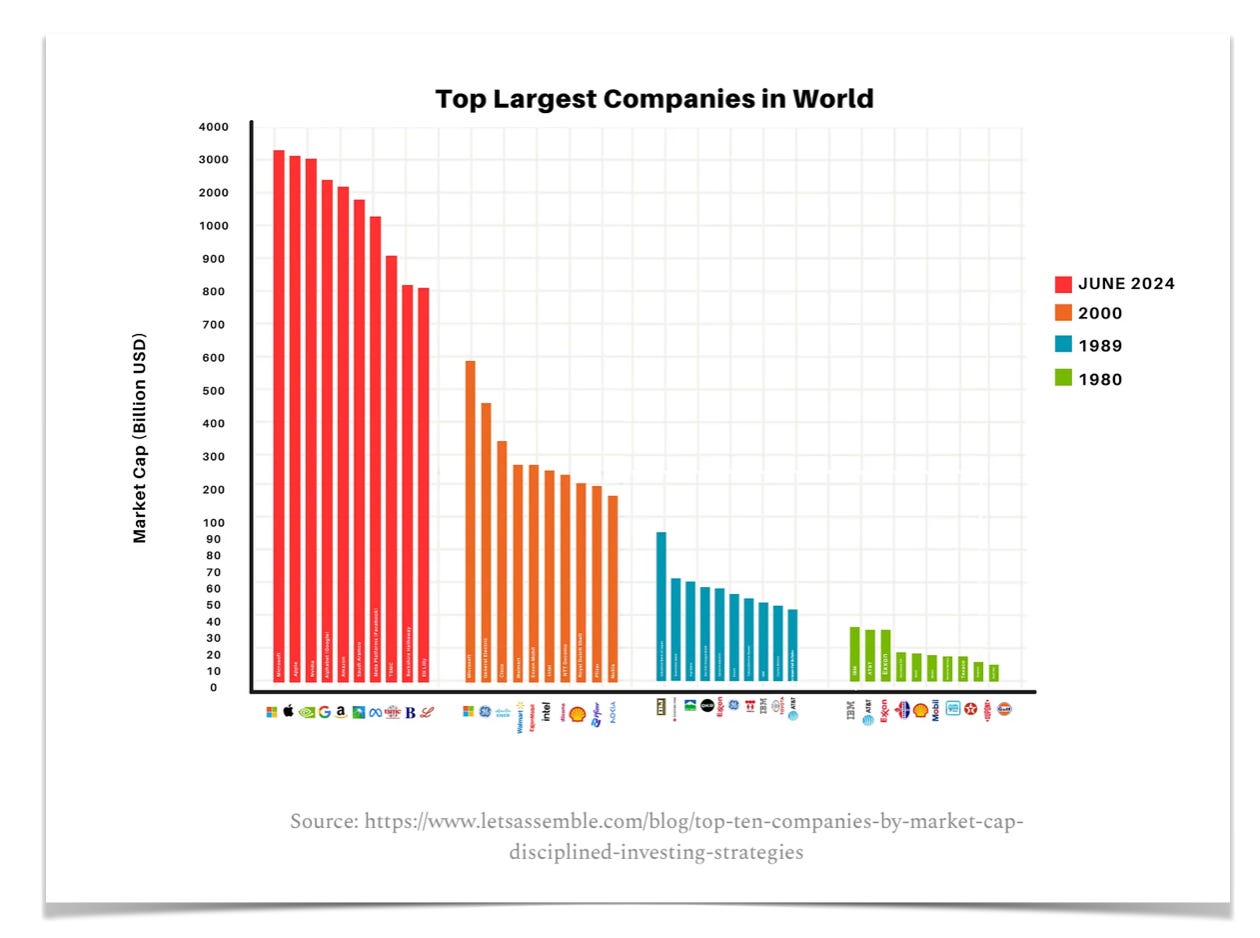

Technology's integration into all enterprise job functions is accelerating, and the pace of change is likely to intensify over the next decade. This is underscored by the unprecedented rise in technology's importance observed in the past ten years, as powerfully demonstrated by the chart, which reveals the industry's swift and profound ascendance, beyond the well-documented outperformance of technology stocks.

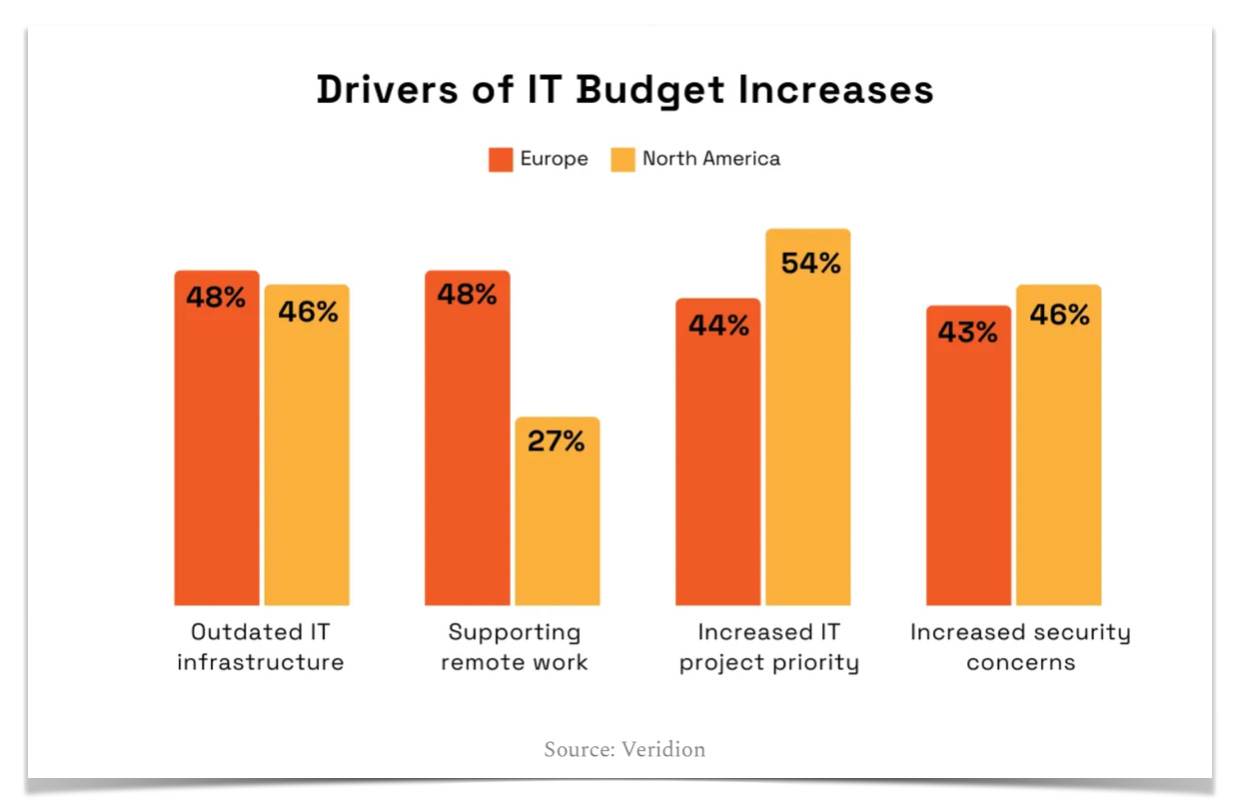

Analysis of market information indicates that US organizations are currently dedicating 7.5% of their revenue to digital transformation initiatives, with a significant emphasis on IT. This trend is anticipated to continue, presenting a favourable opportunity for Gartner, which we think will ultimately double over the next decade for the reasons below, creating a big tailwind for Gartner.

Competitive Position

Gartner's market dominance is built upon a foundation of unparalleled scale and breadth, significantly surpassing competitors like Forrester and IDC in revenue and market reach. As the leading independent authority on technology products, Gartner holds a significant market advantage. With revenues ten times that of Forrester, its closest competitor, and a twenty-fold lead in core technology research, Gartner's scale is unparalleled. Its annual incremental growth surpasses Forrester's total annual revenue.

This allows for comprehensive research coverage across a vast array of technology domains, with over 100 Magic Quadrants and numerous research reports establishing them as a singular, essential resource for technology insights. Their strong brand recognition and reputation for independence and objectivity have fostered widespread trust, with the "Gartner Magic Quadrant" becoming a widely recognized and influential industry standard. Extensive penetration into large enterprises globally has created a powerful network effect, making it difficult for companies to switch to alternative providers. The seat-based licensing model implemented by Eugene Hall has further driven widespread adoption within organizations, solidifying their market presence. Gartner's research directly influences billions of dollars in technology purchasing decisions, as companies rely on their insights to mitigate risk and optimize investments, and technology vendors actively seek favorable placement in their Magic Quadrants to enhance market visibility and sales.

This leading position is sustained by a commitment to independent and objective research, a key differentiator that builds trust and credibility for high-stakes technology decisions. Continuous investment in research capabilities, through a team of over 2,500 research experts, ensures that their insights remain current and relevant in a rapidly evolving technology landscape.

Beyond smaller independent research firms, potential competitive threats include quantitative data sets and peer review platforms. However, quantitative data's ability to displace Gartner is limited by the unique, proprietary data that informs the Magic Quadrant. This data, essential to Gartner's process, is not replicable. Without access to this information, competitors cannot effectively replicate Gartner's analysis. Gartner's Investor Relations confirms the proprietary nature of their data sets. Furthermore, relying solely on quantitative data overlooks the crucial contextual insights gained through direct interaction with industry professionals:

"The scale of our business matters and that's what really drives our moat. We service 15,000+ enterprises, we have 2.5k research analysts and 4k sales people and we aggregate all that insight. What are clients reading, what conferences are they attending, what topics are they searching for? We can aggregate that to figure out where the market is heading. What are CIOs actually searching for? We can answer that question. That is hard to replicate"

We consider the potential impact of peer review websites to be negligible. The idea that a substantial technology purchase would be based on online opinions is unrealistic. In a corporate environment, especially with significant financial commitments, professional accountability dictates that decisions be supported by credible, expert analysis. Gartner fulfills this crucial role, offering a level of assurance that peer reviews cannot provide.

The Cover Your Ass (CYA) Insurance Debate

During due diligence, a recurring counterargument from fellow buy-side analysts has been the perception that Gartner's primary value lies in providing 'CYA' insurance rather than genuine insight. This perspective questions the actual value customers place on Gartner's research, suggesting that tech companies possess sufficient internal expertise. Our response acknowledges this perception but counters that even if true, the fundamental driver – risk mitigation for CIOs – is unlikely to diminish. We contend that the demand for 'CYA' remains a persistent and potentially enduring aspect of Gartner's value proposition. No one is going to spend $100m on an ERP implementation without taking to someone like Gartner there’s too much career risk.

Differentiated View

Our differentiated view is centered on the potential for significant margin expansion. We believe Gartner's past operational practices, specifically a lack of stringent expense management, provide a clear pathway to improved profitability. Prior to the pandemic, the market valued Gartner's rapid revenue growth, evidenced by the correlation between EBITDA multiples and organic revenue growth in the business services sector. Consequently, the company's SG&A expenses grew at an average rate of 1% above revenue growth from 2010 to 2024.

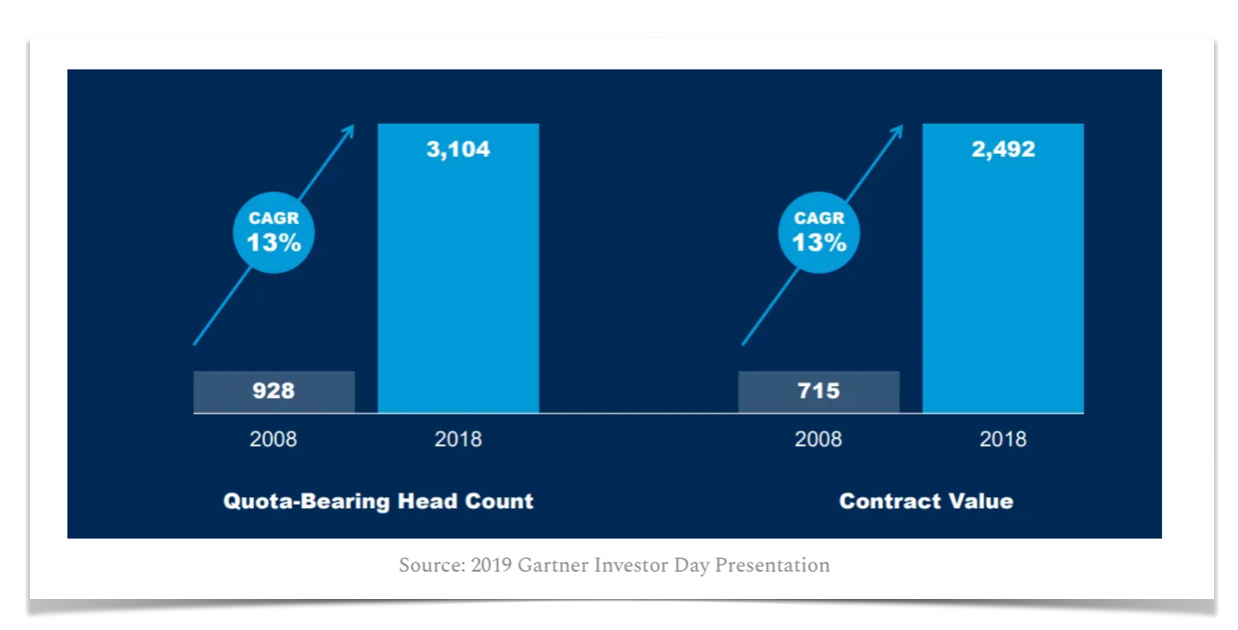

The observed growth in sales headcount was a deliberate strategy to enhance contract value growth As previously outlined, we consider the expansion of quota-carrying sales personnel as a critical investment. This investment is anticipated to generate significant future CV growth, with projected cash flow breakeven occurring within the early stages of the second year following the investment's implementation.

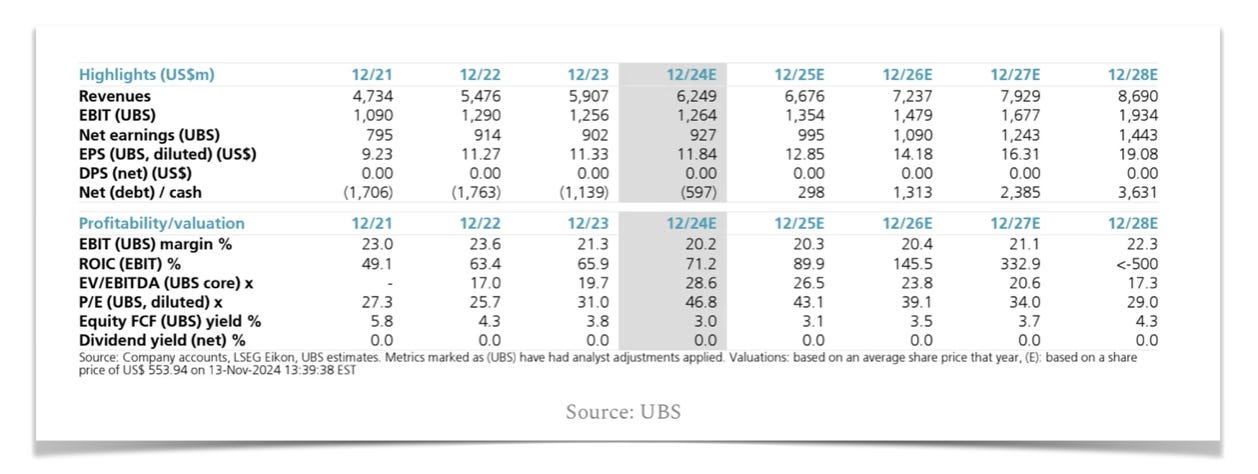

In 2021, Gartner announced a pivotal shift in its sales strategy, decoupling sales headcount growth from CV growth by a three-point reduction. Our analysis suggests that this crucial strategic change has not been adequately modeled by sell-side analysts. A reverse DCF exercise reveals that consensus forecasts appear to reflect the 12-16% CV growth guidance, but fail to account for the resulting operating leverage improvements as they are forecasting out EBIT margins at 22%.

A review of recent analyst notes and their corresponding projections supports our perspective on how the company's operating margins are being viewed and forecasted. The prevailing consensus reflects an EBIT margin range of 19-20%.

We posit that Gartner can sustain its top-line growth trajectory by strategically moderating sales headcount growth to three percentage points below contract value growth. For instance, with a 14% CV growth rate, sales headcount would increase by 11%. This recalibration of their economic model will drive significant margin expansion. Historical data from 2010-2024, where SG&A grew 1% faster than revenue on average, suggests that by reducing sales headcount growth by three points, S&M expenses could grow 2% slower than CV & revenue growth.

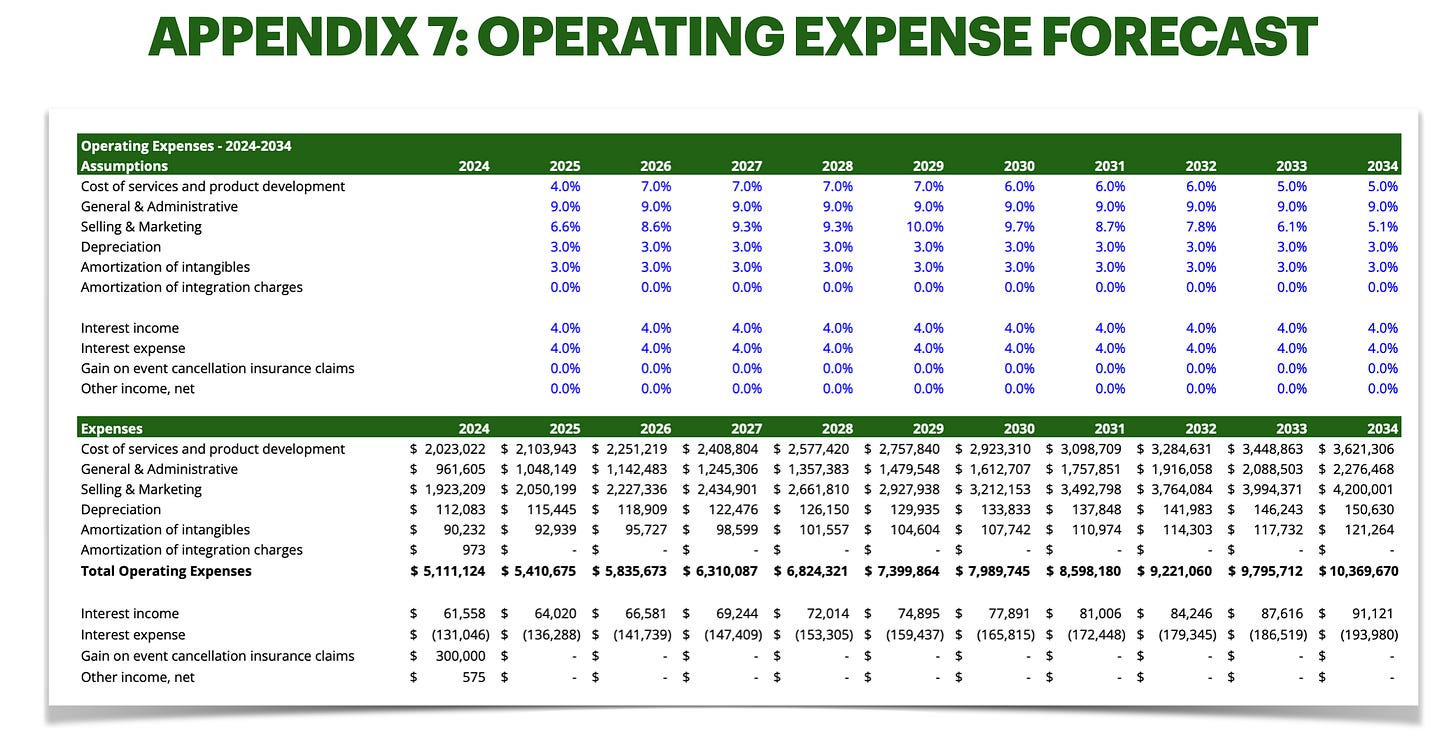

Given Gartner's increased scale, this leverage is expected. We believe management's conservative EBITDA margin guidance is intentionally understated, reflecting lessons learned from the CEB acquisition integration. To validate this, we have developed a five-year forward margin bridge, projecting adjusted EBITDA margins from the 2024 baseline:

Assuming modest gross margin expansion and consistent G&A leverage, mirroring the 2-3% point reduction in S&M growth, we project approximately 200 basis points of annual margin expansion.

Capital Allocation & Reinvestment Potential

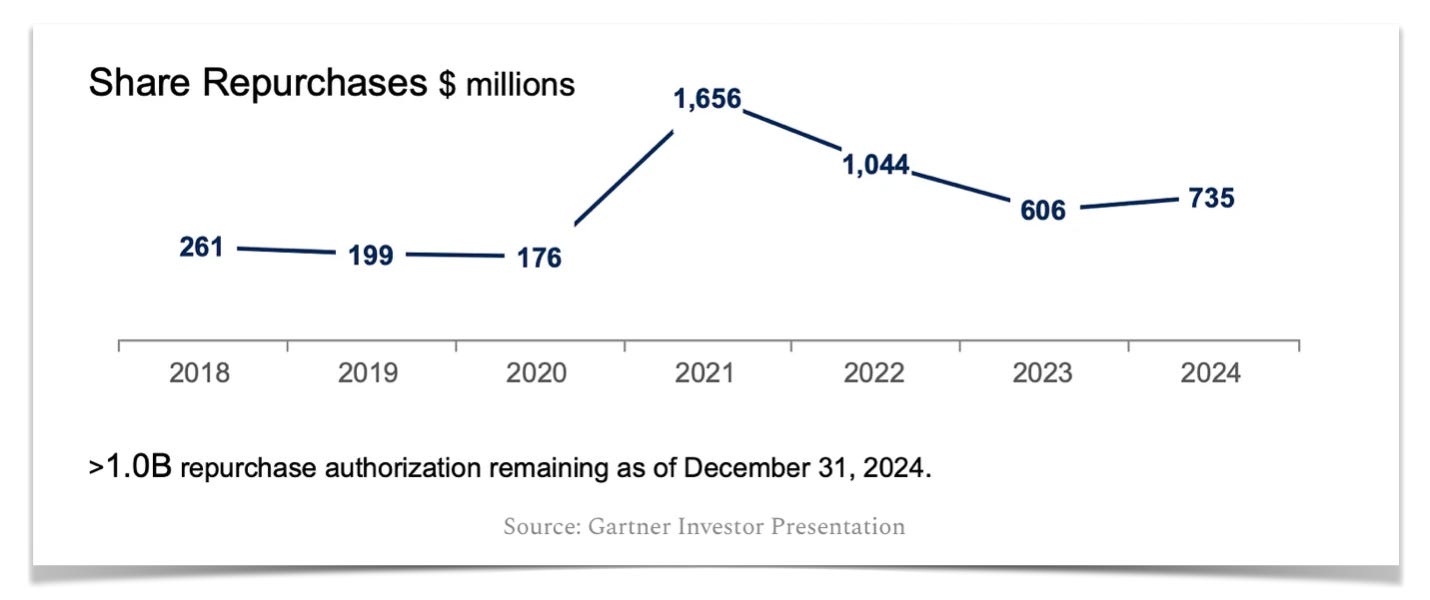

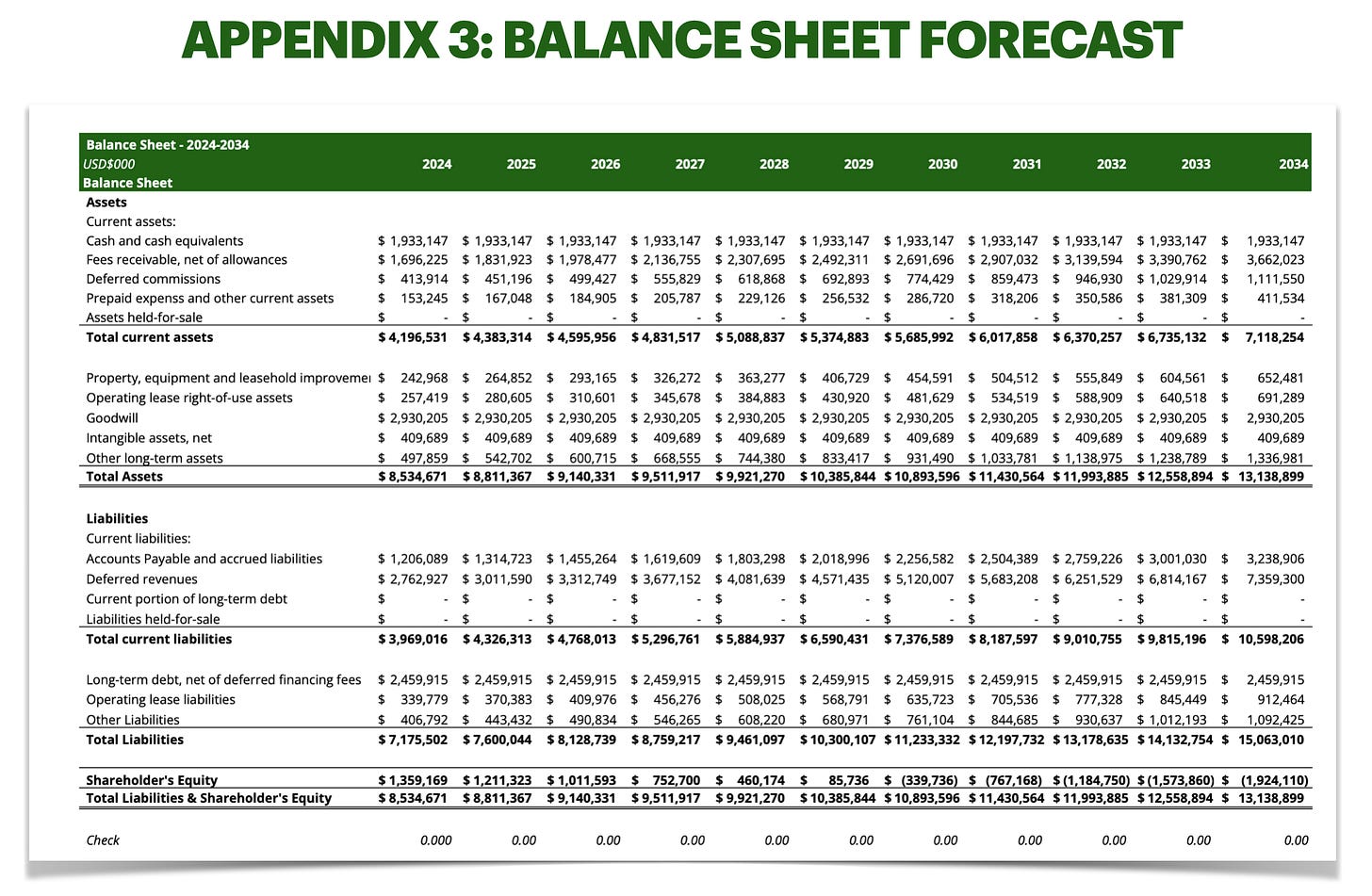

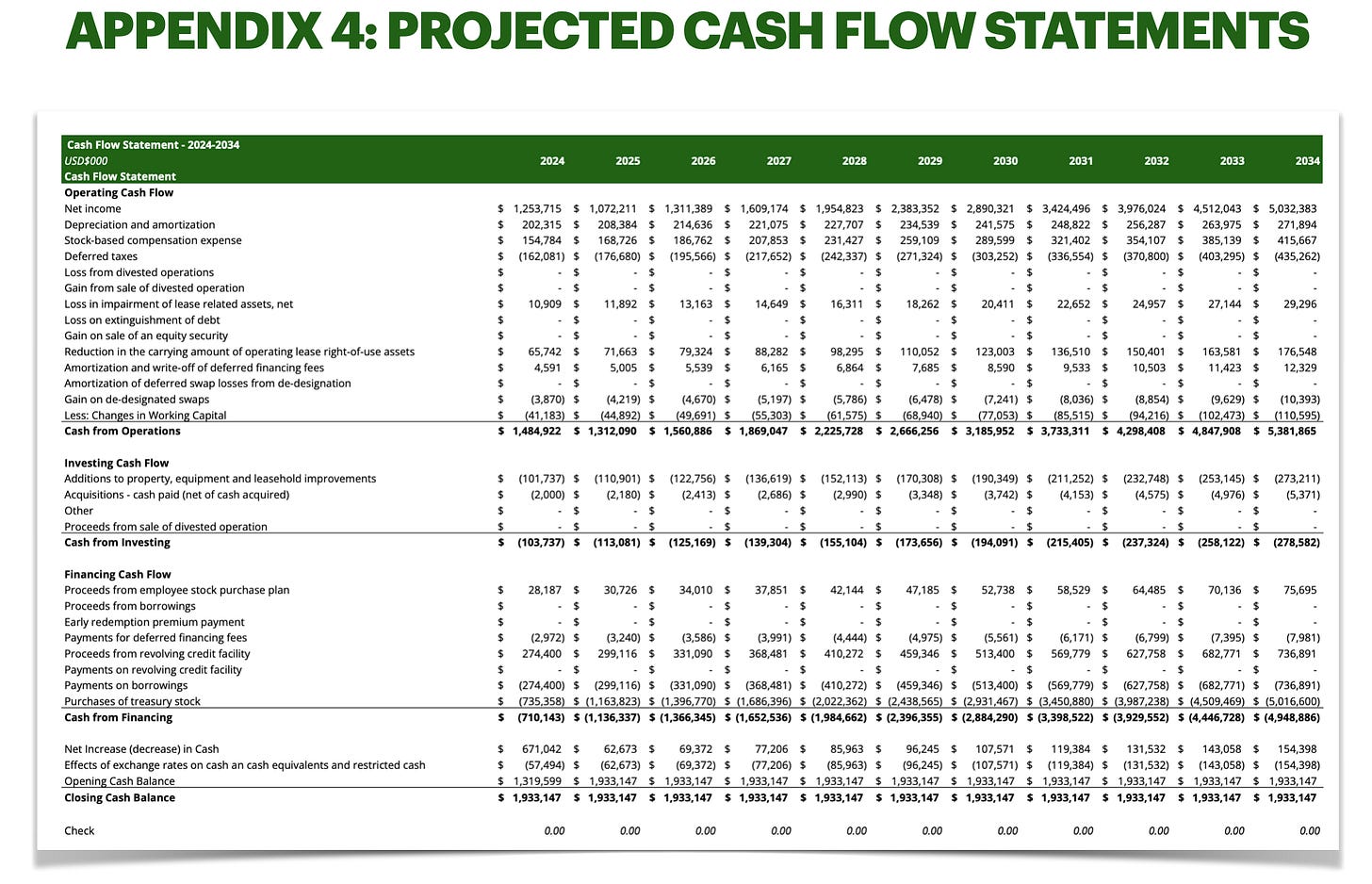

Our financial model assumes a 100% free cash flow (FCF) allocation to share repurchases. Management has consistently communicated a strategy centered on organic growth, supported by targeted tuck-in acquisitions. The primary reinvestment will be in sales quota headcount, directly driving contract value growth. This capital allocation strategy leaves residual FCF available for share buybacks.

Gartner's historical track record of significant share repurchases, demonstrated below supports this projection. With a net debt of roughly $1billion and a business model that generates substantial FCF, we anticipate Gartner will maintain its focus on share repurchases, enabling a 3-6% annual share reduction without utilizing additional leverage over our forecast period.

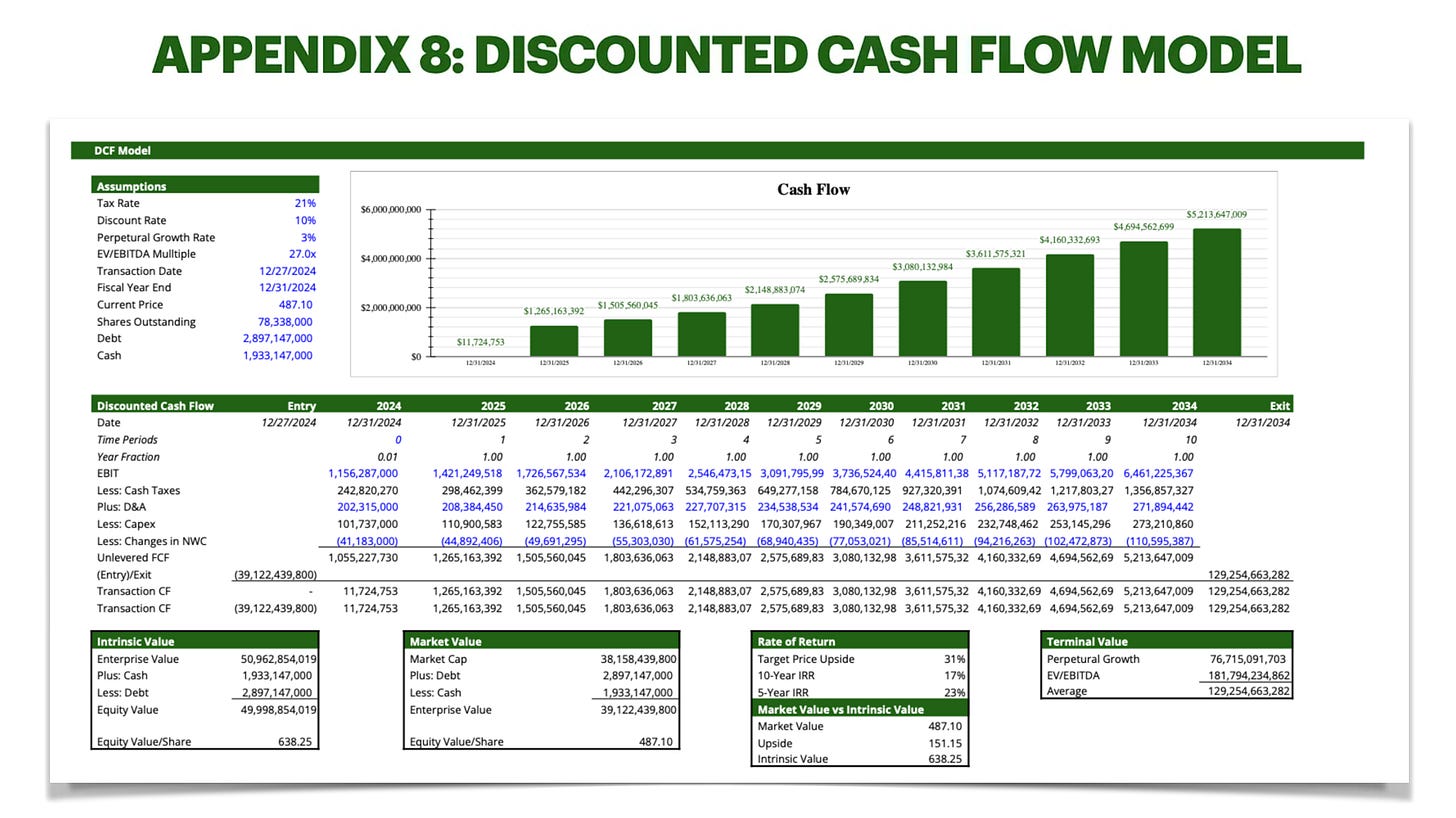

Valuation Model

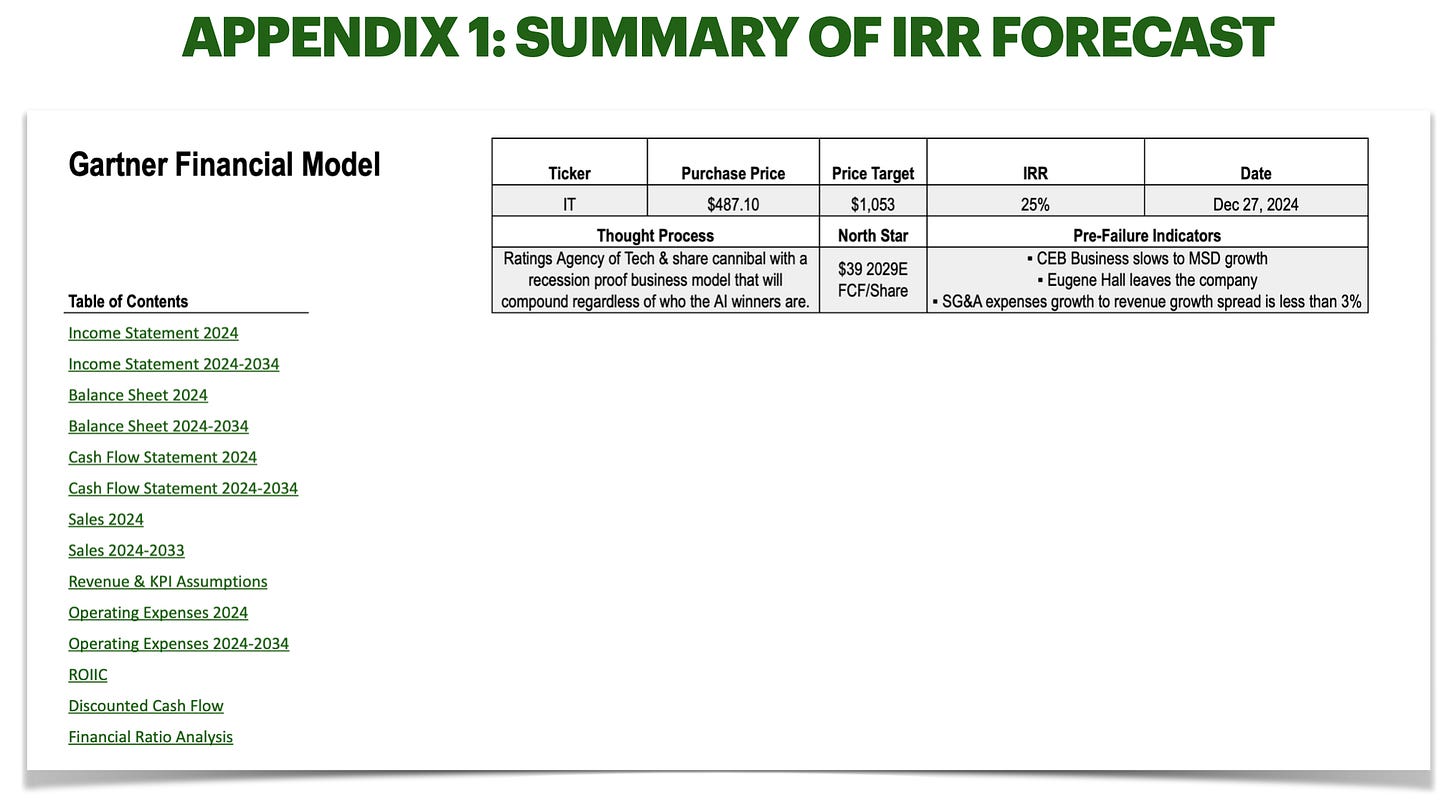

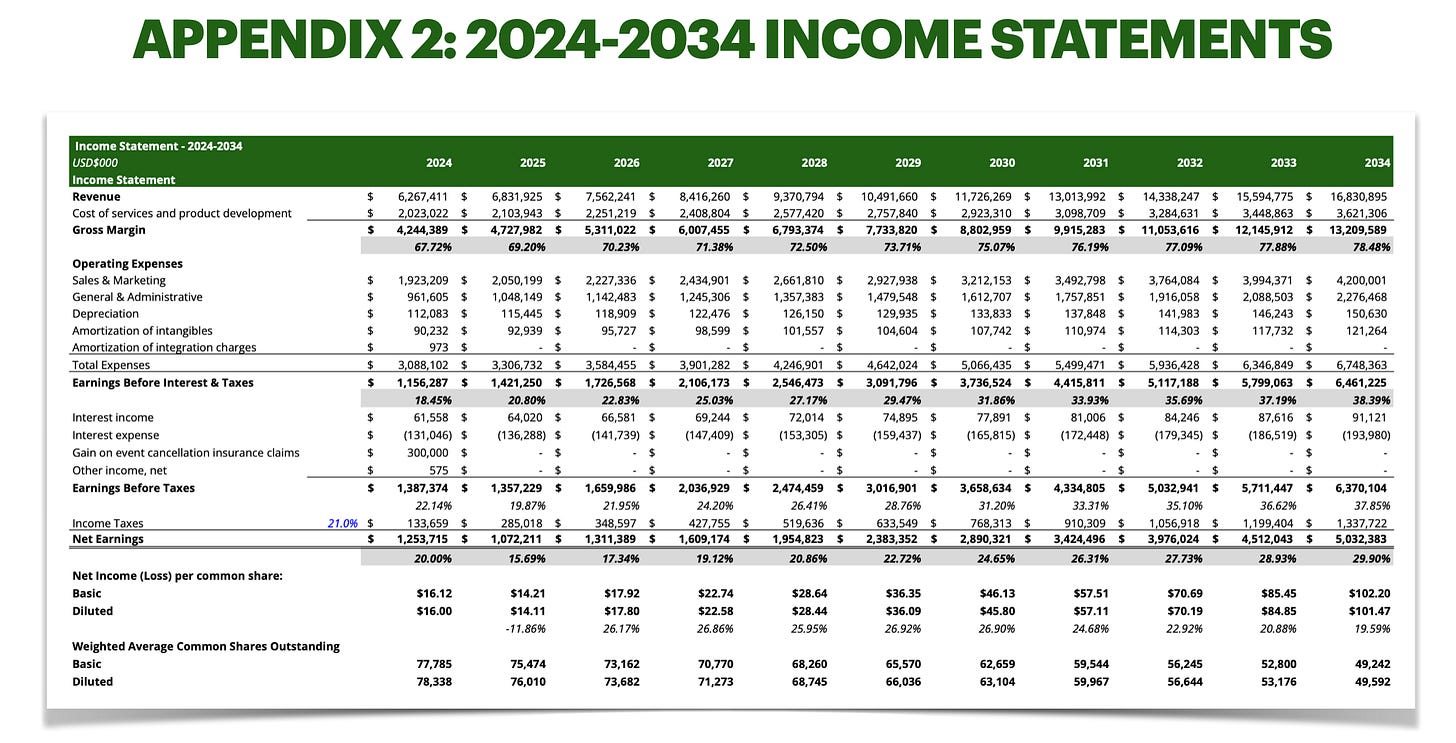

We have valued Gartner using five-year and ten-year projections, anticipating revenue growth to $10.5 billion and FCF per share of $39 by 2029. Our analysis of unit economics for investment in sales reps combined with operating leverage from S&M expenses growing at 2-3% slower than CV growth going forward supports a projection of steady-state EBIT margins exceeding 30%. We utilize a 27x exit multiple of FCF in 2029.

Based on our entry price, our base case model generates a 25% five-year IRR and a 18% ten-year IRR. The 25% IRR target is derived from an estimated share price of $1,053 in 2029 and an “intrinsic value” per share at our entry date of December 27, 2024 of $638.25. These IRR targets are derived from our comprehensive financial statement model (including income statement, balance sheet, and cash flow projections) and a discounted cash flow (DCF) model, which employs a 10% discount rate and the aforementioned 27x exit multiple. Supporting details, including a summary of our DCF analysis, are available in the appendices below.

Key Model Assumptions

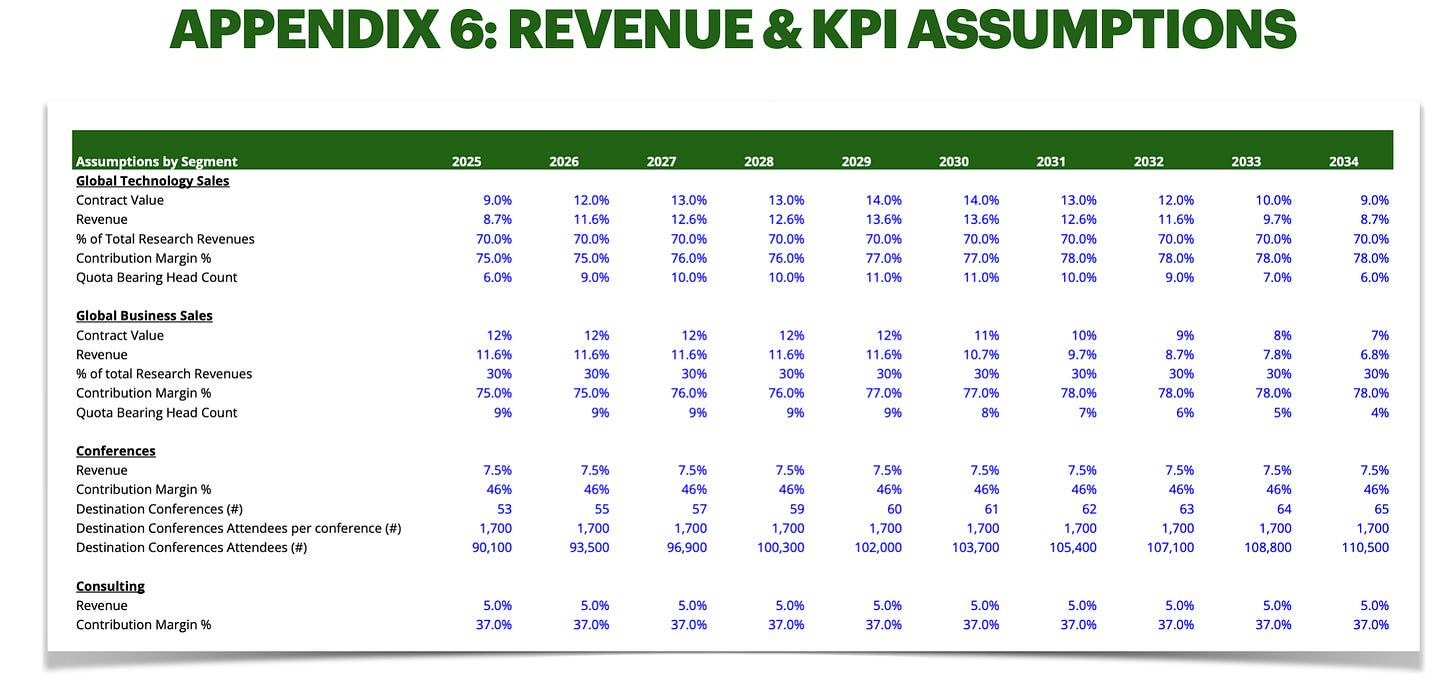

Contract Value Growth: A key element of our investment thesis rests on the sustained CV growth from investment in their sales head count quota. As tech spending normalizes globally, we expect CV growth to reach management anticipated guidance of 12-16% over the medium term.

Considering our expectation for tech vendor spending as a % of global budgeted doubling over the next decade, we’re quite confident Gartner will be able to hit their CV growth targets. We’re modelling 9% growth for GTS and 12% for GBS in 2025 and 12% growth in 2026 for both segments, which then tapers down to 9% for GTS and 7% for GBS at the end of our forecast period in 2034. We think these are reasonable given the CAGR in IT spending is estimated to be 7.5% globally and given Gartner is the clear leader, we’ve assigned a small premium to their CV growth estimates.

Our model places less emphasis on Conferences and Consulting. We project Conferences revenue to growth at 7.5% annually (55 conferences estimated in 2026). For Consulting, we anticipate 5% growth, aligning with the midpoint of their 3-8% medium-term guidance.

Gross Margins: We project segment-level gross margins based on the following assumptions. Research contribution margins are modelled to gradually increase from 75% to 78% for both GTS and GBS. For Conferences, we model margins at 46% throughout the forecast period. Finally, Consulting margins are projected at 37% throughout the forecast period.

Operating Expenses: Gartner’s strategic focus on growing S&M expenses at 2-3% slower than contract value growth will require a bit of cost discipline, which we think was ingrained into the company during and post covid-19. This part of the thesis is the biggest driver quantitatively of our 200 basis points yearly adjusted EBITDA margin improvement and we think given management history of delivering on expectations, this has given us trust they will hit this target. Although Gartner does not disclose S&M and G&A separately, they have indicated a 1:2 ratio, with G&A comprising one-third and S&M two-thirds of the combined expense. Our financial model reflects this thesis and incorporates the following projections:

G&A: We anticipate a 9% annual growth rate in G&A spending from 2025 through 2034, reflecting the maintenance needs of a growing sales head count.

S&M: We project S&M expenses to increase by 3% less than CV growth throughout the forecast period.

Free Cash Flow: For long-term valuation, Free Cash Flow per share is the most critical metric for Gartner. Their strong working capital cycle, driven by upfront billings and ratable revenue recognition, results in FCF/share exceeding EPS by 40-50%. Institutional investors predominantly value Gartner based on FCF, recognizing the enduring nature of their positive working capital dynamics and the company's increasing use of cash for share buybacks.

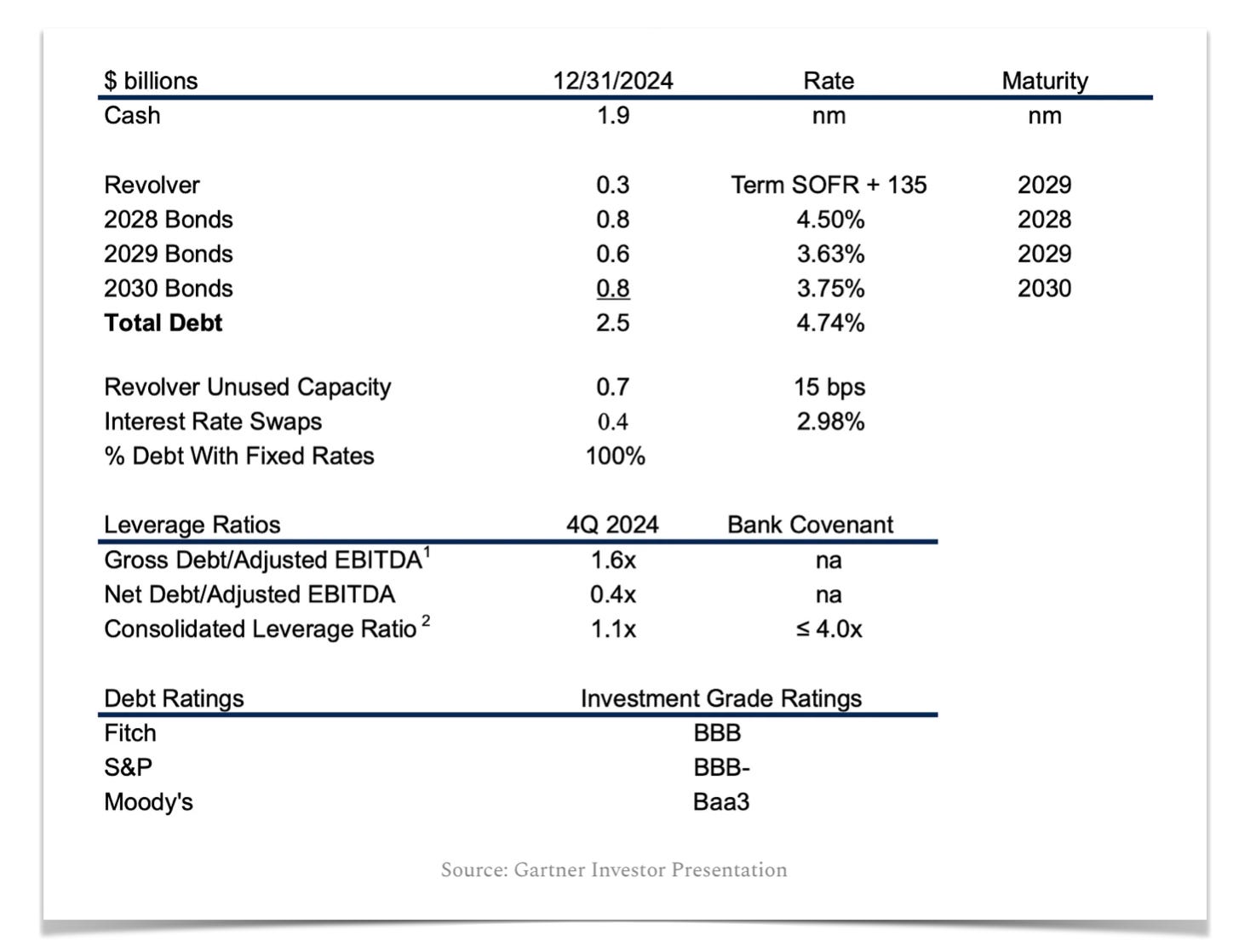

Buybacks: As detailed in the appendices, Gartner’s business model is projected to generate substantial free cash flow. Our research indicates that beyond small, strategic acquisitions, share repurchases represent the most likely use of this excess capital. Gartner has demonstrated a strong commitment to shareholder returns, deploying $4.7 billion for share repurchases over the past seven years. With a conservative net debt position of $1.0 billion (1.6x gross debt/adjusted EBITDA) and robust free cash flow generation, we anticipate Gartner will allocate 100% of its future free cash flow to share repurchases. This strategy suggests an annual buyback potential of 3-6% of outstanding shares without increasing leverage.

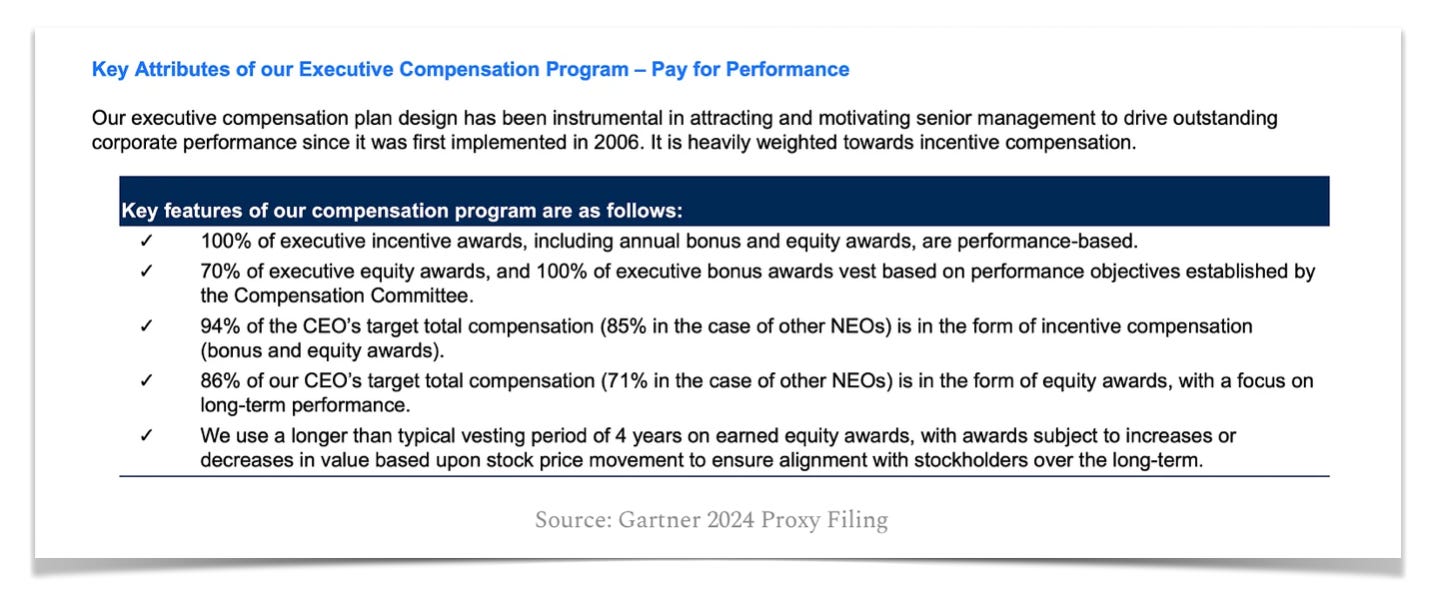

Insider Alignment

Gartner's leadership is characterized by long-tenured executives. CEO Eugene Hall, in place since 2004, architected the company's 18-year growth strategy. His prior experience includes leadership roles at ADP and McKinsey. During his tenure, Gartner has delivered approximately 20% annualized share and earnings growth, significantly outperforming market benchmarks. Mr. Hall's substantial beneficial ownership (1.7% of outstanding shares, ~$450 million) aligns his interests with shareholders. His contract extends through 2026. Executive compensation is heavily weighted towards long-term incentives tied to CV growth, with base salary and cash bonuses representing a smaller portion.

Investment Risks

We have identified three primary risks to our investment thesis, both of which we assess as manageable:

GBS Contract Value Growth Deceleration: While GBS has been experiencing double digit growth, we will be monitoring this to make sure it doesn’t dip to LSD-MSD over the next 5 years, given the GBS segment is such a large part of Gartner’s estimated TAM. Should GBS performance indicate a significant deviation from our projections, we will reassess our forward estimates.

Executive Leadership Transition: The departure of CEO Eugene Hall poses a potential risk, despite his contract extension through December 31, 2026. Former employees have highlighted his pivotal role in driving the company's success. While we do not believe Gartner's growth trajectory is solely dependent on Mr. Hall, his strategic influence is undeniable. To address this risk, we will also monitor the performance and tenure of key executives, particularly Joe Beck (EVP of GTS) and Robin Kranich (Head of HR), who have been identified as critical to the company's operations.

SG&A Expenses Can’t be leveraged: A core component of our investment thesis hinges on management's ability to achieve 12-16% Contract Value growth while managing SG&A growth 2-3 percentage points below. A deviation from this scenario would impact our margin expansion projections. However, we believe the downside risk remains limited due to Gartner's highly recurring revenue model, with over 80% of revenue derived from recurring sources. Notably, the Research segment demonstrated 4.5% organic CV growth in 2020, underscoring the resilience of their business model. This inherent stability is a key factor driving the premium valuations observed in business services stocks.

Appendices

Suggested Reading

Investment Memos

Quarterly Letters

Legal & Disclaimer

The information contained in this publication is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed here based on such investors own review of publicly available information and should not rely on the information contained herein.

The information contained in this publication has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.

Back in 2022, the consensus on the street was that Gartner was over-earning because of some of the hiring freezes and travel restrictions that came during covid (EBITDA margins, rising from 20% in 2020 to 27% in 2021). Gartner then started ramping back up sales rep hiring, which leads to CV growth and there were of course more in-person conferences post covid as well. There is always going to be a lag effect as Gartner hires sales reps, because it takes 3 years for them to ramp to full productivity. That's why you see cash flows are on average 140% higher than GAAP net income.

In summary: Don't focus on the P/E ratio for Gartner, it's not going to help you. You want to focus on cash flows. Take a peek at their deferred revenue growth. That's due to upfront cash payments, its listed as a liability on the balance sheet, but that eventually makes its way to revenue as they meet performance obligations.

Thank you for the write up. Gartner traded at less than 30x NTM PE for a large portion of 2022 and 2023. In late 2023 NTM PE seemed to spike to above 35x. Do you know why this happened? Did Gartner get rerated or any other significant event took place which increased its future growth prospects?