Computer Modelling Group

The Future of Simulation Software

Investment Thesis

Oil & Gas Industry Turning to Software to Lower Costs

The decline in conventional petroleum production over the past decade has been exacerbated by the complexities of shale oil and gas extraction. To address these challenges, the industry has increasingly turned to software and automation to streamline once-simple mechanical processes. As commodity prices fluctuate, companies have focused on improving efficiency and reducing operating costs. To achieve these goals, they are relying more heavily on software simulations to optimize production. CMG, with its decades of experience in reservoir simulation software and strong market presence, is a leader in this evolving landscape.

Organic Growth Opportunities in Carbon Capture & Storage

CMG has been strategically expanding into the energy transition market, focusing on carbon capture and storage (CCS). As the CCS industry continues to grow, driven by government incentives and a global push for net carbon neutrality, CMG is well-positioned to capitalize on this opportunity. With its core competencies and expertise, we anticipate significant growth in CCS revenue, projecting a low double-digit year-over-year increase.

New M&A Strategy Bolsters Growth Potential

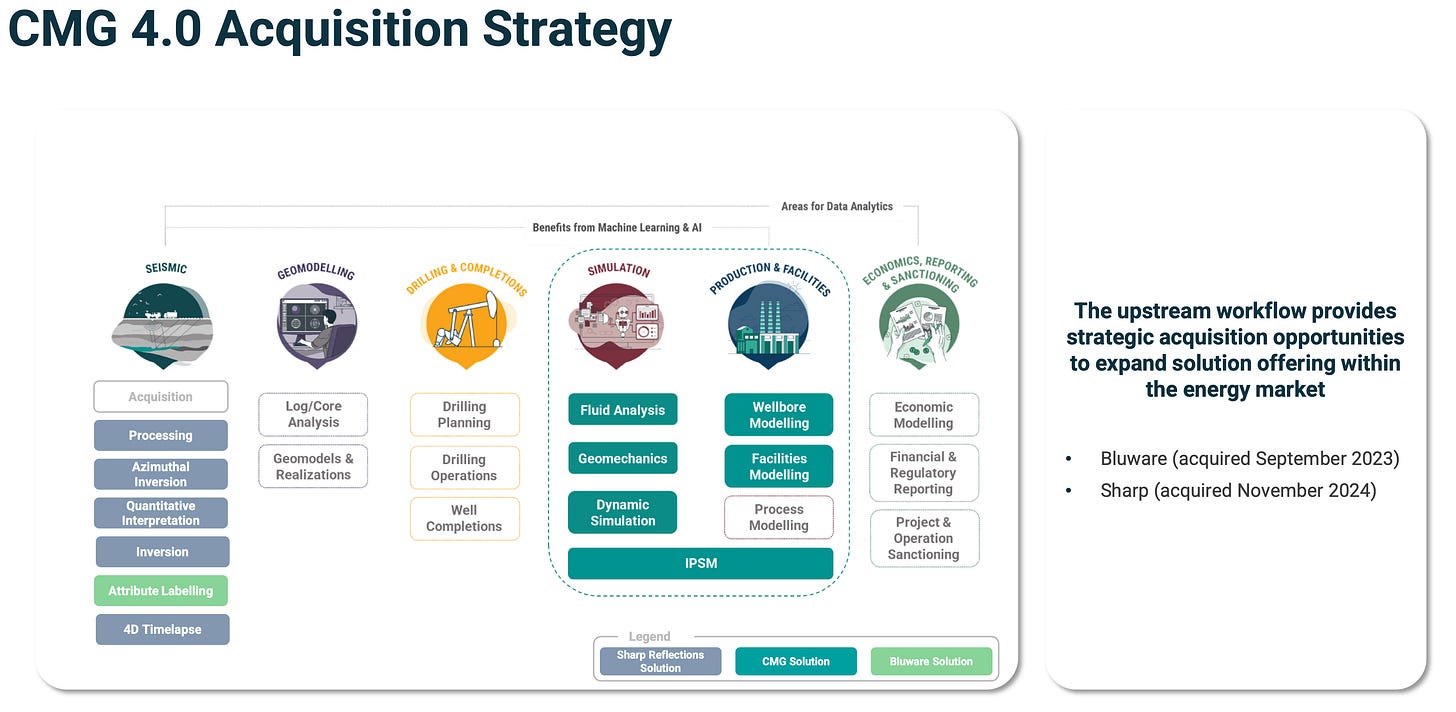

CMG is actively seeking to acquire companies with promising, but under-utilized, proprietary products. The recent acquisition of Bluware, a leader in cloud-based deep learning solutions for subsurface analysis & Sharp Reflections a leading high-performance computing platform for seismic data processing and interpretation serves as a model for future M&A activity. With a substantial portion of the global oil, gas, and chemicals applications market comprised of smaller vendors, there is ample opportunity for CMG to continue expanding its product offerings through strategic acquisitions.

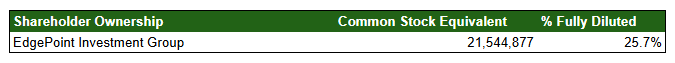

Sidecar Investment Opportunity with Constellation Directors

Mark Miller, a prominent figure in the investment community with a proven track record in acquiring vertical market software companies, joined CMG's board in 2019 and became chairman in 2022. EdgePoint, a significant shareholder holding roughly one-third of CMG, is managed by Andrew Pastor, another Constellation Software board member.

The presence of these experienced individuals from Constellation Software's board, along with their substantial shareholdings, indicates a strong potential for future growth and success.

CMG's appointment of Pramod Jain as CEO, known for his impressive track record and insightful quarterly letters, is another positive indicator. Jain's management incentives, tied to return on invested capital and growth, align the interests of insiders with those of all shareholders.

Business Description

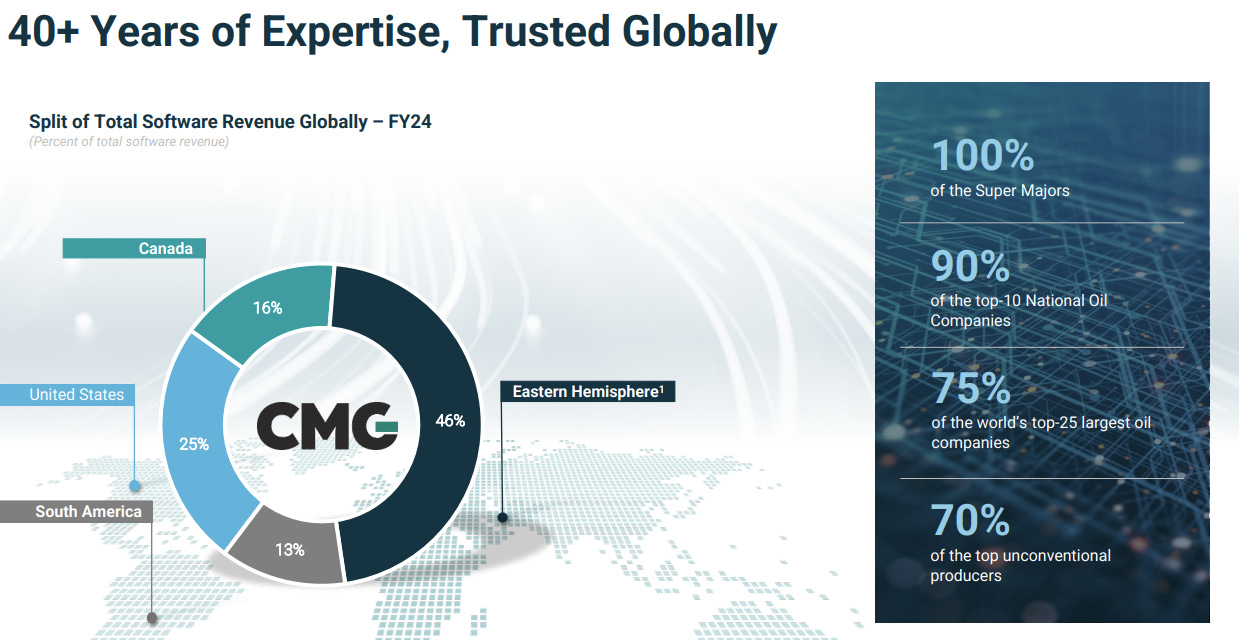

Computer Modelling Group Ltd. (CMG) founded in 1978 and headquartered in Calgary, Canada is a leading global software provider specializing in complex subsurface and surface solutions for the new energy industry. With over four decades of experience in reservoir simulation, CMG offers cutting-edge technology backed by deep industry expertise. Their commitment to innovation, coupled with exceptional customer support, has earned them a strong reputation and a loyal customer base proven by the high Net Promoter Score (NPS) of ~ 68%.

CMG's solutions are trusted by major oil and gas companies worldwide, including 90% of the top 10 national oil companies and 70% of the leading unconventional producers. Their success is driven by a combination of factors: advanced physics, continuous product development, enhanced computational performance, user-friendly interfaces, cost-effective solutions, and a knowledgeable support team.

The oil and gas industry is a specialized field that requires extensive domain knowledge. This creates significant barriers to entry for new competitors, reinforcing CMG's position as a trusted leader in the market.

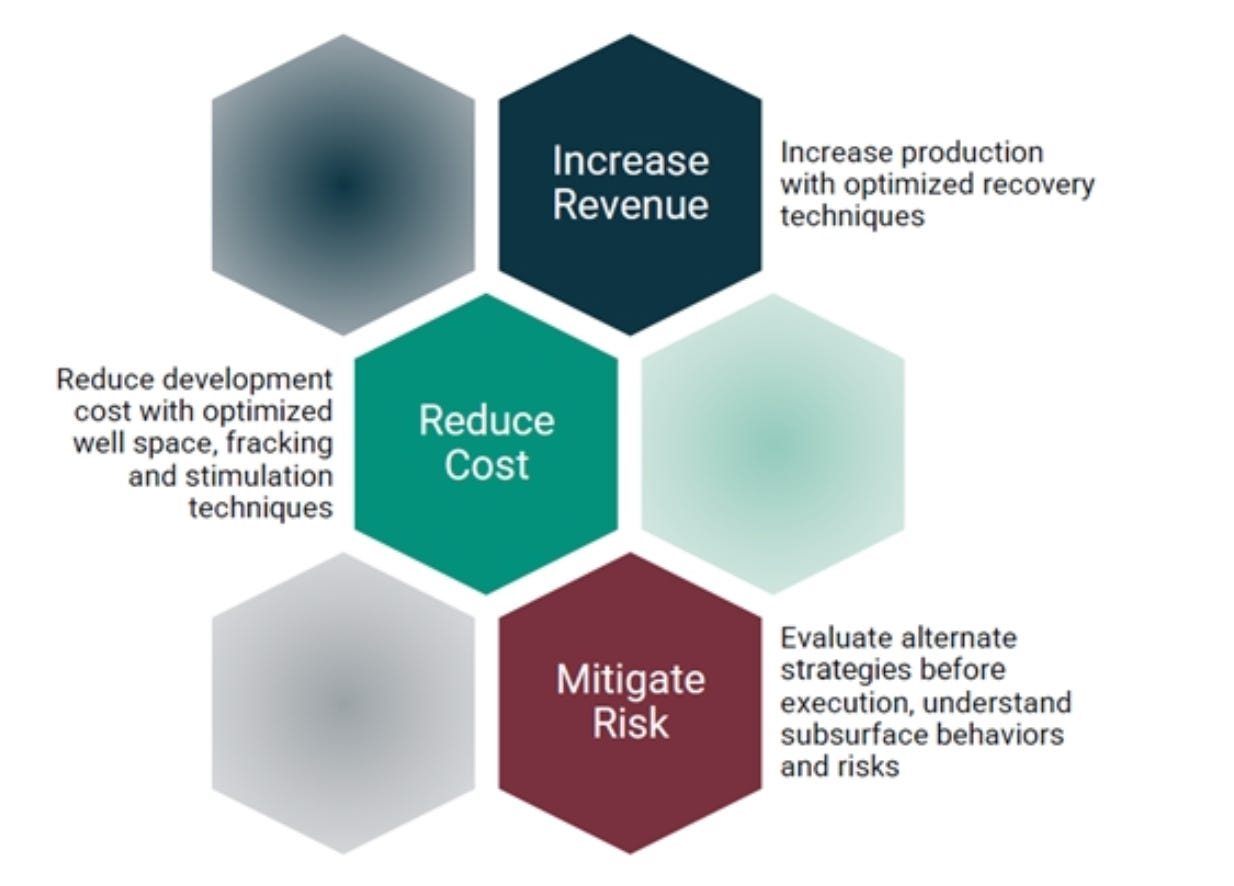

CMG's reservoir simulators are powerful tools that model the complex behaviour of oil, gas, and other fluids within underground reservoirs. By simulating fluid flow through porous rock formations, these programs help engineers, geologists, and other professionals analyze various drilling and production scenarios to optimize field performance.

CMG's software allows users to virtually explore reservoirs deep beneath the Earth's surface. By inputting geological data, users can visualize reservoir structures, identify oil and gas traps, and predict fluid flow patterns under different conditions. This information is crucial for making informed decisions about drilling locations, well operations, and economic viability.

Through reservoir simulation, professionals can gain valuable insights into the physics and chemistry of fluid flow, assess risks, and optimize production strategies. This ultimately helps to increase oil and gas recovery, reduce costs, and maximize revenue.

CMG’s reservoir simulation is critical to energy transition initiatives including carbon storage, geothermal and hydrogen. In fiscal 2024, 23% of software revenue in the CMG operating segment came from energy transition.

Finally, in 2023, the Company acquired Bluware-Headwave Ventures Inc., a software and services company specializing in cloud and interactive deep learning solutions for subsurface decision-making, including seismic interpretation.

Business Model & Offering

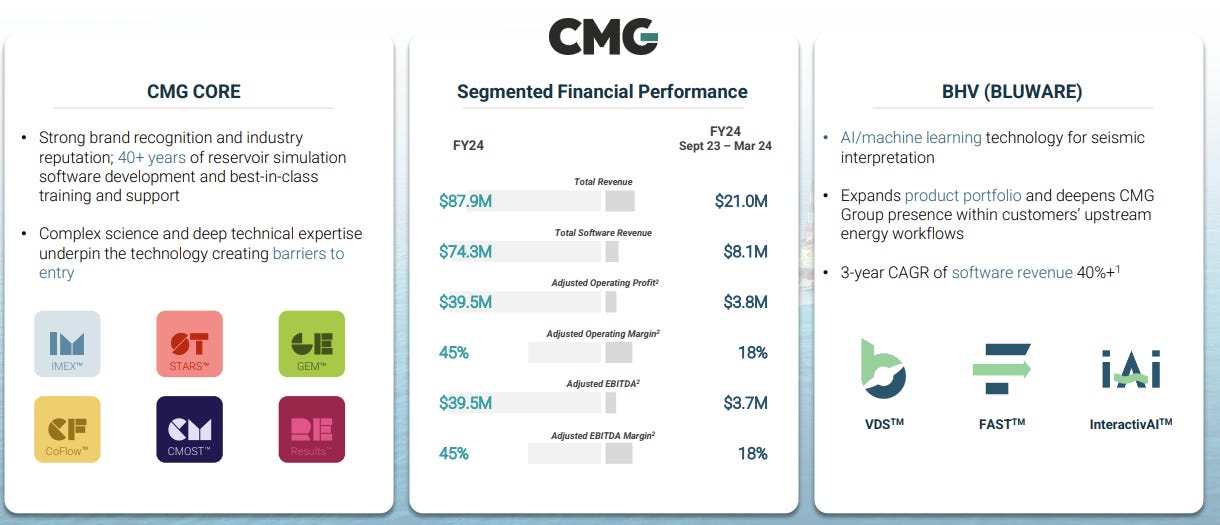

CMG currently operates with two reporting segments as seen below:

CMG Core

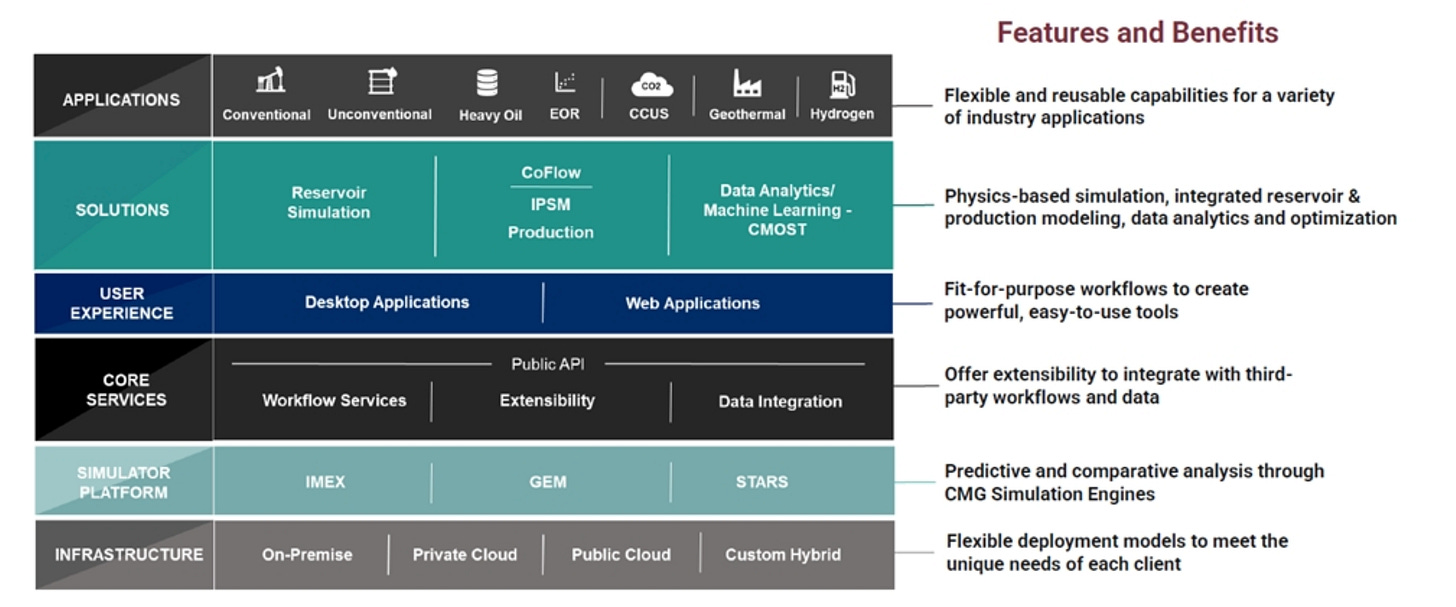

Reservoir Simulation

Reservoir simulation software, recognized as the industry-standard solution for a wide range of applications, is used in traditional oil and gas exploration and production, including enhanced oil recovery, heavy oil, and unconventional resources. Additionally, this supports companies in their energy transition with solutions for carbon capture and storage, geothermal energy, and hydrogen.

Production Simulation

Beyond reservoir simulation, CMG has developed CoFlow, a groundbreaking integrated reservoir and production system modelling (IPSM) software. Developed in partnership with Shell, CoFlow offers a unified platform for combining reservoir, production networks, and geo-mechanics. This allows engineers to make informed decisions on large, integrated oil and gas projects. By connecting surface and subsurface simulation, CoFlow provides a comprehensive solution for optimizing asset performance.

Consulting

CMG's multi-disciplinary consulting practice offers a combination of software expertise and technical competency to support reservoir development planning. Through the consulting services, they gain valuable insights into customer needs and on-field experiences, further strengthening domain expertise.

BHV (Bluware)

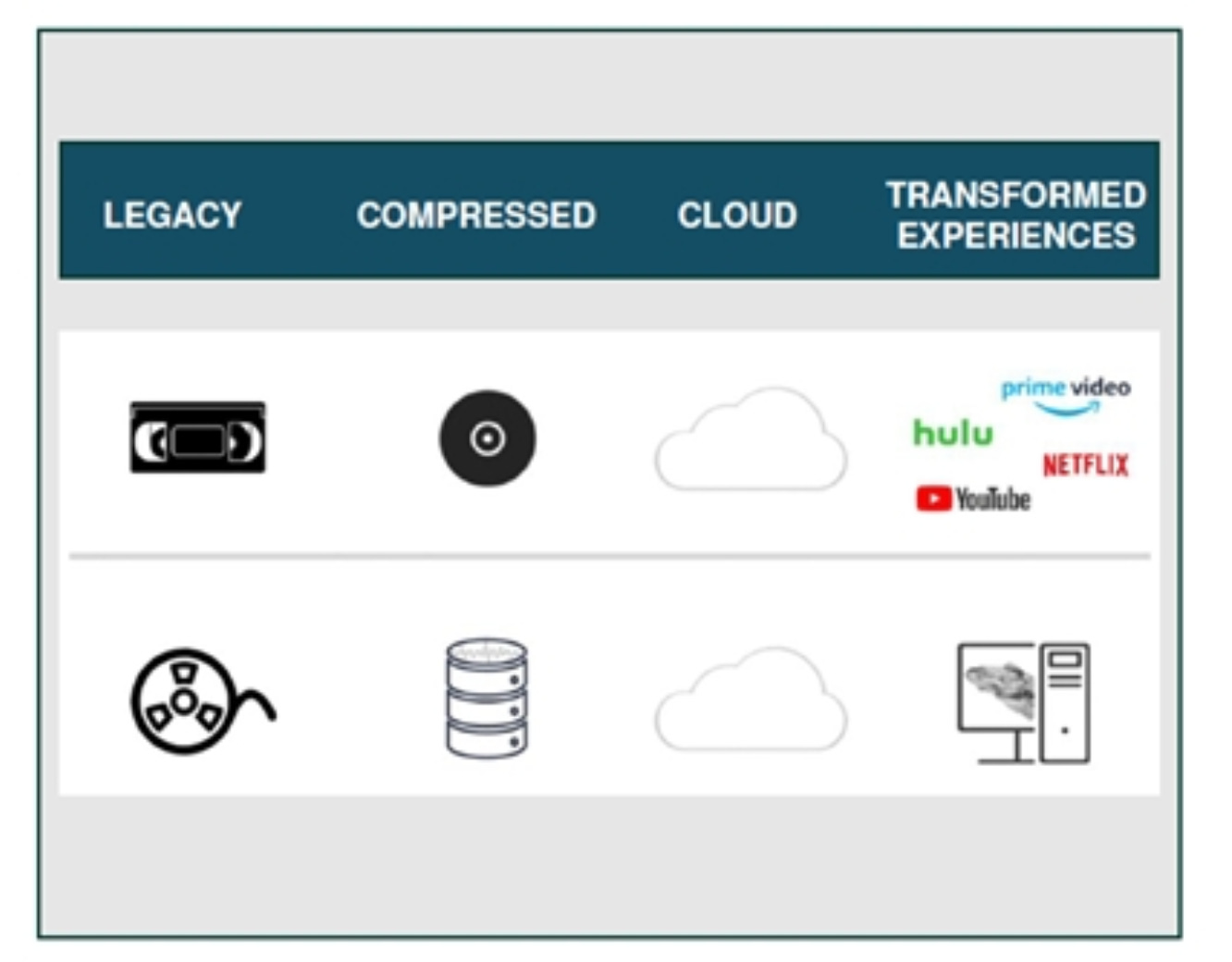

The Bluware technology portfolio is concentrated around three key software’s that are driving transformed experiences:

VDS (Volume Data Storage) - cloud storage used to compress seismic data making it adaptable and scalable

FAST - streaming subsurface data from the cloud to existing interpretation applications.

InteractivAI - A deep learning seismic interpretation tool.

Bluware's core revenue streams are generated by FAST and InteractivAI, both of which leverage a proprietary data format known as VDS, or Volume Data Storage and the largest customer of these revenue streams is currently Shell.

To illustrate the impact of VDS, consider the evolution of media consumption. We've transitioned from physical formats like VHS tapes to digital streaming platforms such as Netflix and Hulu. This shift has fundamentally transformed how we access and enjoy content, offering unparalleled convenience and flexibility.

Similarly, the oil and gas industry is undergoing a digital revolution, moving from traditional tape-based storage to cloud-based solutions. VDS plays a pivotal role in this transformation by enabling the storage and retrieval of massive amounts of subsurface data in the cloud. By unlocking the potential of these petabytes of data, the industry can gain valuable insights, optimize operations, and accelerate innovation.

A typical user of InteractivAI is a geoscientist responsible for interpreting seismic data. As they begin to label features like faults or horizons within a seismic dataset, InteractivAI leverages this input as training data for its machine learning models. This allows the application to rapidly and accurately process vast quantities of data.

This iterative process of human input and machine learning enables continuous improvement. The expert user validates the results generated by InteractivAI, and the application learns from these corrections, refining its understanding of the nuances of interpretation. This feedback loop ensures that InteractivAI becomes increasingly accurate over time.

We estimate a $100 million market opportunity for InteractivAI, primarily targeting large and mid-sized E&P companies, many of whom are already CMG clients. These companies, which frequently upload and analyze extensive seismic datasets, stand to benefit significantly from Bluware's portfolio solutions. This is particularly relevant for capital-intensive offshore exploration, which heavily relies on acquiring new seismic data.

Revenue Model

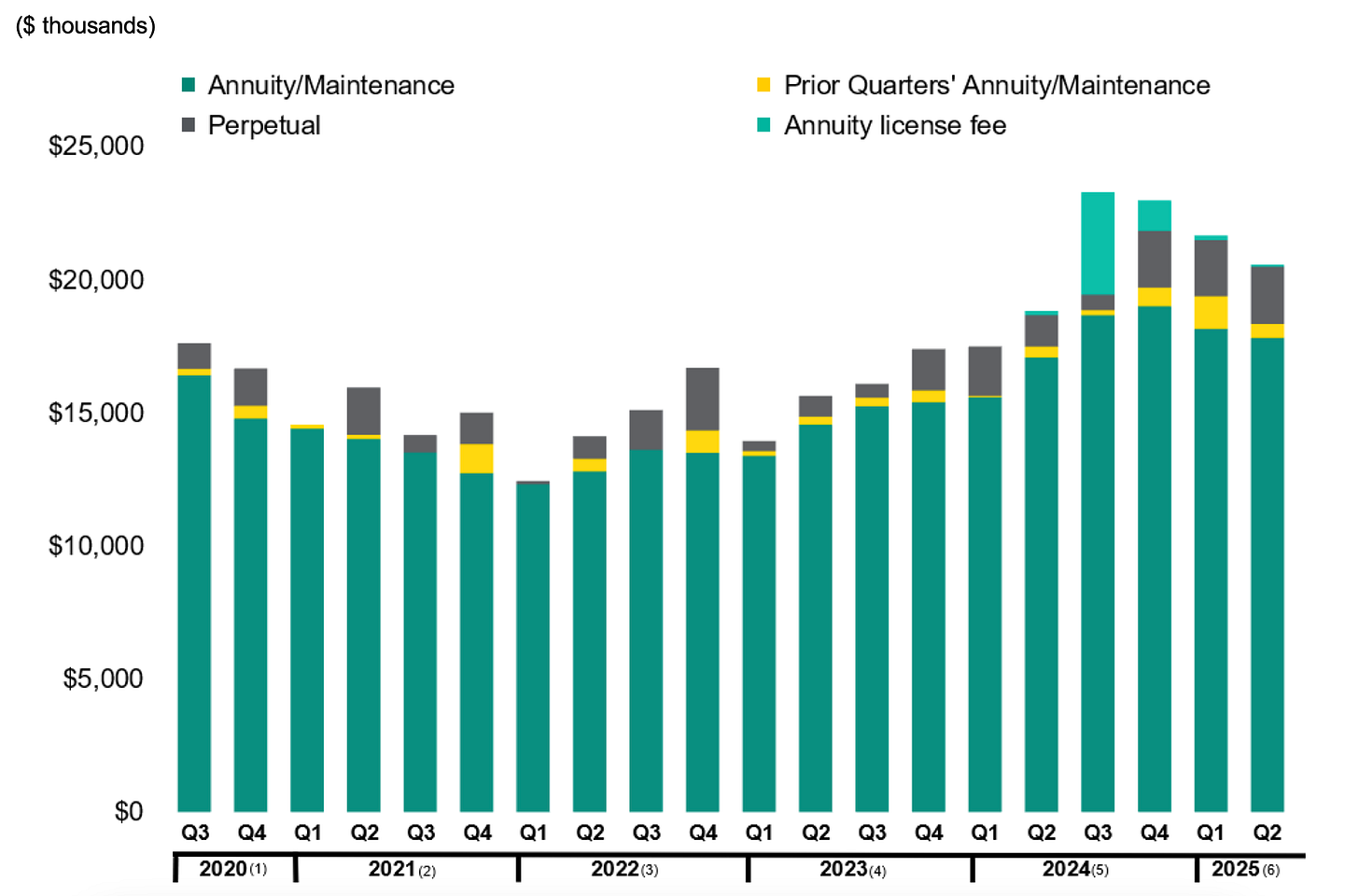

CMG's revenue model is built on two core components: software licensing and professional services. For software licensing, they provide flexible options: term licenses with recurring annuity and maintenance fees, and perpetual licenses for a single upfront payment. Both CMG and BHV divide annuity license agreement revenue equally, allocating 50% to software licensing and 50% to maintenance.

Both CMG and BHV recognize the maintenance component of annuity license agreements as straight-line revenue over the license term, recorded under Annuity/maintenance license revenue. Customers are typically invoiced for the full contractual amount upfront.

The software license component, however, has different revenue recognition treatments:

CMG: Recognized rateably over the agreement term, included in Annuity/maintenance license revenue.

BHV: Recognized upfront upon software delivery, recorded under Annuity license fee.

While both annuity/maintenance license revenue and annual license fee represent recurring revenue, the annual license fee revenue is subject to quarterly fluctuations due to agreement renewal timing, which tends to concentrate in the last two quarters of the fiscal year.

Term licenses provide ongoing access to their software and support, while perpetual licenses offer ownership rights. Approximately 95% of CMG’s software license revenue in fiscal 2023 was generated through term licenses, demonstrating their popularity. These term licenses are not only popular, but they are a sticky revenue source as well boasting 95% customer retention rates.

To meet evolving customer needs, they also offer a cloud-based solution. This provides flexible access to simulators on high-performance hardware, allowing customers to scale their usage and reduce upfront costs. The cloud-based solution is particularly attractive to customers who require on-demand access to software or have limited in-house IT resources.

Beyond software licensing, CMG offers a comprehensive range of professional services. These include specialized consulting, technical support, training, and research initiatives. These services are designed to help customers maximize the value of the software and achieve their business objectives.

CMG's software has become an integral part of many oil and gas companies' operations, demonstrating its value as an essential tool rather than a mere luxury. This strategic position allows them to quickly identify and address clients' specific needs and challenges.

As a result of the strong market position, CMG has established a steady stream of recurring revenue from their software segment (85% of total revenue in 2024).

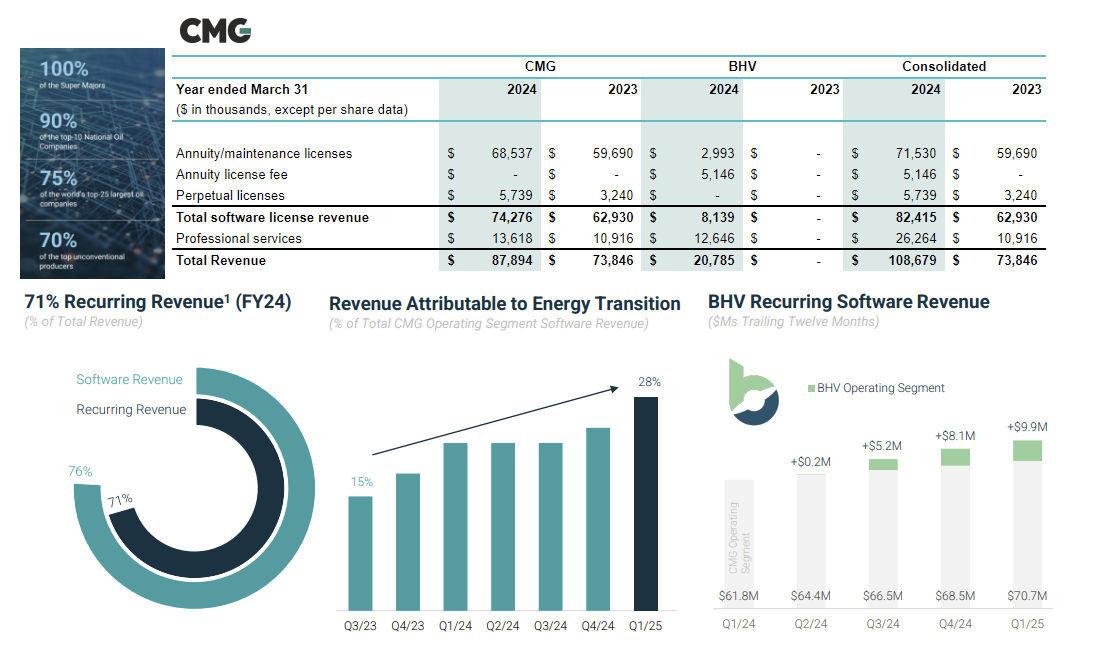

Financial Overview

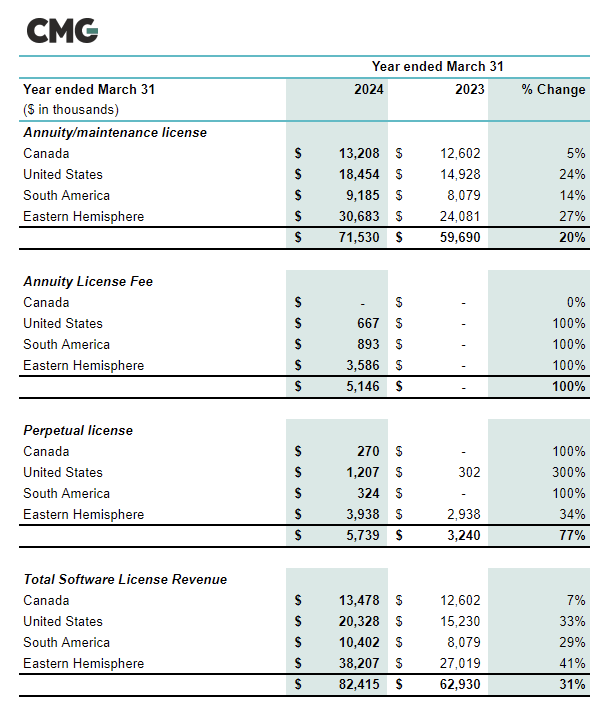

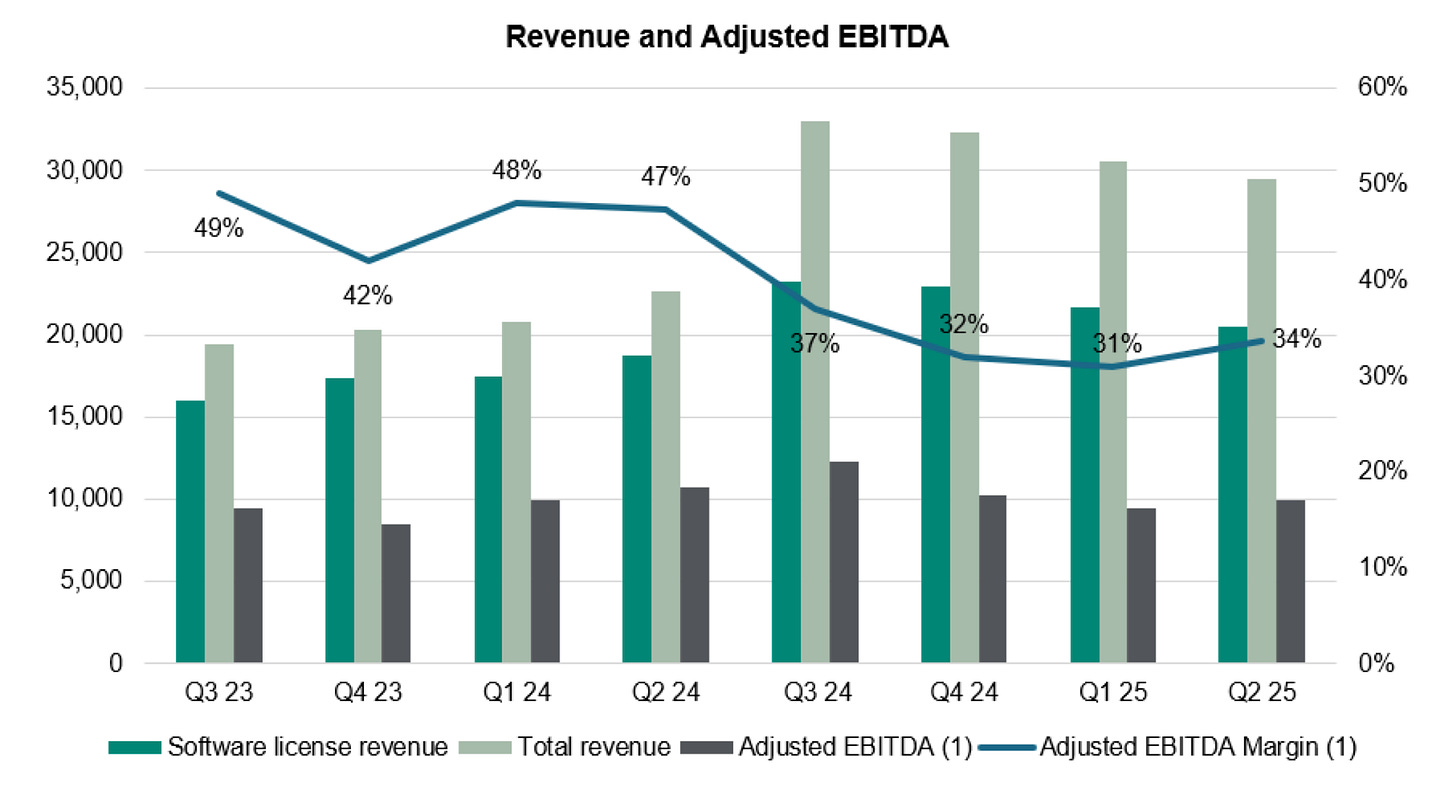

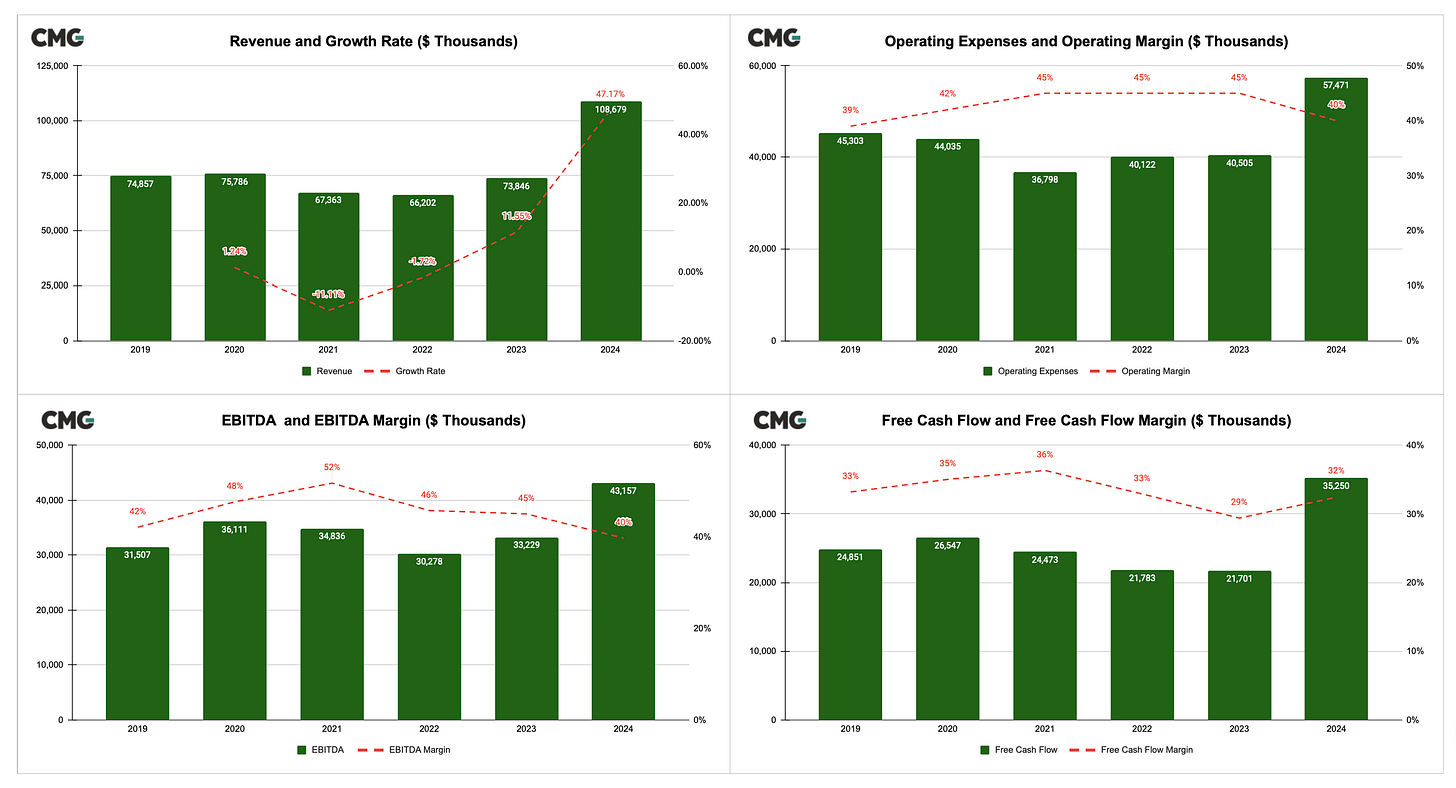

In fiscal 2024, CMG experienced significant growth driven by both the BHV acquisition and organic expansion. Total revenue increased by 47% to $108.7 million, with the BHV acquisition contributing 28% and the CMG operating segment contributing 19%. While consolidated adjusted EBITDA margin decreased slightly to 40% due to BHV's lower profit margins, net income grew by 33% and free cash flow by 62%. The company's strong cash position provides flexibility for future acquisitions.

The CMG operating segment delivered impressive organic growth of 19% fueled by increases in annuity/maintenance license revenue, perpetual licenses, and professional services. Software revenue growth was evident across all geographies, driven by pricing adjustments and new licensing for both energy transition and traditional energy. Energy transition represented 23% of CMG software revenue. Adjusted EBITDA increased by 19%, while adjusted EBITDA Margin remained stable at 45%.

BHV, while still in its early stages under CMG ownership, is performing as expected. Total revenue for the year-to-date was $20.8 million, with an adjusted EBITDA Margin of 18%. However, revenue and adjusted EBITDA margin are expected to fluctuate in the coming quarters due to the timing of contract renewals.

Skin in the Game: Aligning Incentives at CMG

Mark Miller, a well-known figure in the investment community, joined CMG's board in 2019 and became chairman in 2022. Miller's background with Constellation Software, a renowned acquirer of vertical market software companies, suggests Mark see’s some potential in CMG.

In 2021, John Billowits, another Constellation Software board member, joined CMG's board. However, he has since stepped down and been replaced by Birgit Troy. Troy brings a wealth of experience, having previously served as CFO at Lumine Group and played a key role in 16 of the company's acquisitions. Furthermore, EdgePoint, a wealth management firm led by Andrew Pastor, another Constellation board member, currently owns approximately one-third of CMG.

The presence of these prominent figures from Constellation Software on CMG's board and significant shareholdings doesn’t guarantee success, but it also doesn’t hurt to have your capital in the same boat as these folks.

Finally, and perhaps most compelling, CMG appointed Pramod Jain as CEO in May 2022. Jain's impressive track record and insightful quarterly letters are highly recommended. CMG has adopted a distinctive incentive package, similar to only three other publicly traded companies: Constellation Software, Topicus, and Lumine.

CMG's management incentives are tied to return on invested capital and growth. Additionally, bonuses are now paid in cash with a portion being used to purchase company shares on the open market, aligning the interests of insiders with those of all shareholders. To be precise, the policy states, “a portion of executive compensation previously received under share-based compensation was moved to annual incentive bonus. In fiscal 2024, 60% of the executive officers’ bonus was paid in cash and 40% of the after-tax bonus was required to be used to purchase Common Shares. The Common Shares have a lock-up period of three years and are released from escrow in equal thirds on the first, second- and third- year anniversary from the bonus award date. This change encourages executive share ownership and provides an incentive to focus on the longer-term strategic objectives of the Corporation that drive shareholder returns.”

Other nice changes are, prior to fiscal 2024, certain NEOs in the role of senior business development were eligible to receive commissions at a set percentage of regional revenues. Effective fiscal 2024, commissions are no longer paid to such NEOs, and the annual incentive payment consists solely of bonuses.

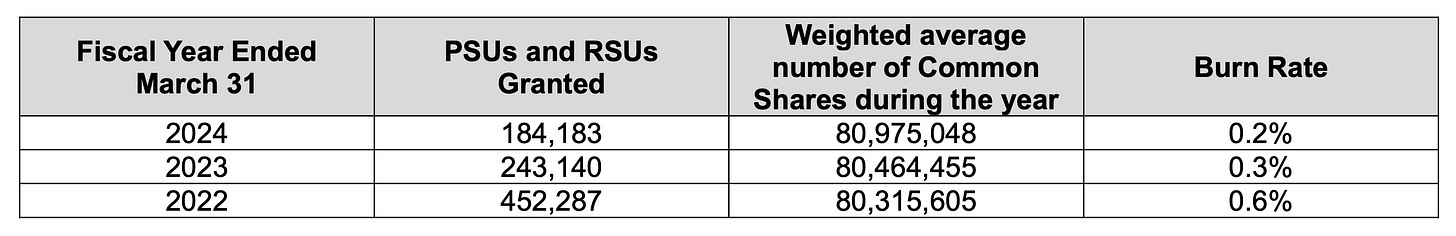

A total of 387,561 PSUs and RSUs were outstanding at March 31, 2024, which represents 0.5% of the issued and outstanding Common Shares. The implementation of the PSU & RSU Plan was intended to partially replace stock options that were granted to executives on an annual basis.

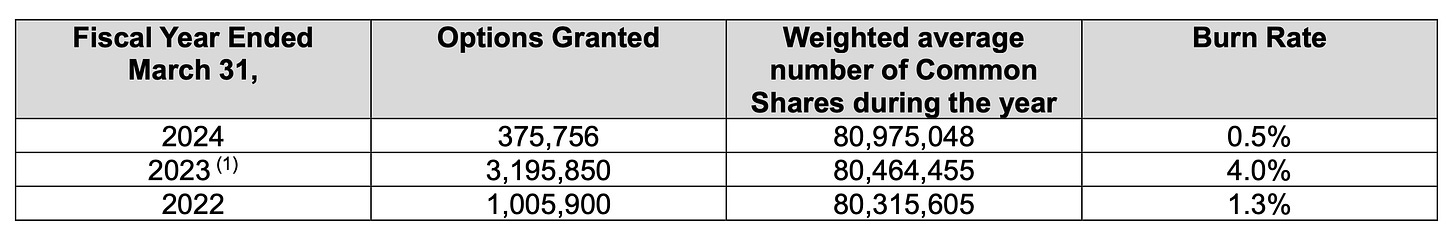

Without the one-time options during fiscal 2023, the normalized burn rate would have been 0.8%. A total of 4,392,173 options were outstanding at March 31, 2024, which represents 5.4% of the issued and outstanding Common Shares. We are very happy to see that stock options will no longer be something to consider as an investor in CMG, eliminating any dilutive effects.

Total Addressable Market & Industry Trends

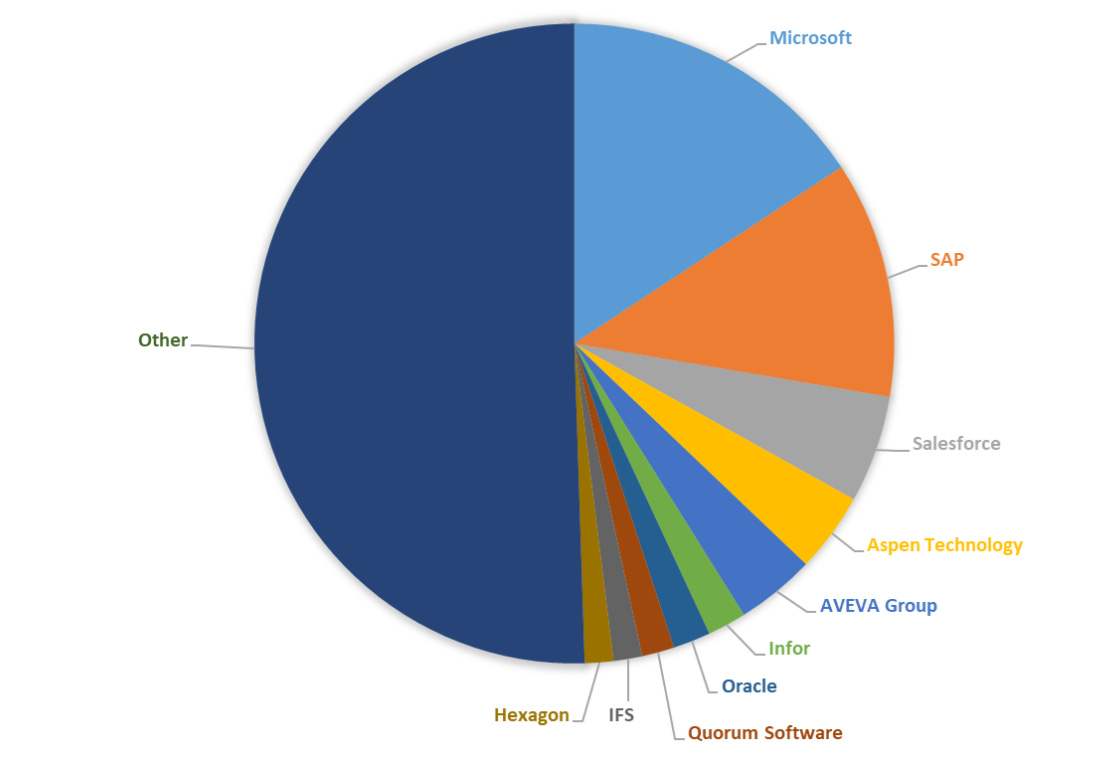

According to a 2023 Report from Apps Runs the World published June 12, 2024, the global oil, gas and chemicals software market surged to nearly $12.8 billion, growing by 9.4%. The top 10 vendors commanded a significant 49.5% market share, with Microsoft leading at 15.7%, followed by SAP, Salesforce, Aspen Technology and AVEVA Group, with the other half being smaller niche vendors.

Key Market Drivers:

Digital Transformation: The oil and gas industry is undergoing a digital revolution, with companies investing in advanced software solutions to streamline operations, reduce costs, and improve decision-making. Recent examples include Schlumberger's launch of a new digital platform in July 2024, which leverages data analytics and cloud computing to enhance performance.

Operational Efficiency: The industry's focus on operational excellence is driving the demand for software solutions that optimize production processes, manage assets, and improve safety. Halliburton's launch of a suite of software tools in August 2024, designed to improve reservoir management and drilling efficiency, highlights this trend.

Safety and Compliance: Increasingly stringent safety regulations and compliance requirements are driving the adoption of specialized software solutions to effectively manage risks and ensure regulatory adherence. BP's upgrade of its safety management system in June 2024, which included new software features to monitor and report safety incidents, demonstrates this commitment.

Advanced Data Analytics: The growing demand for advanced data analytics is enabling businesses to analyze large datasets and derive actionable insights to optimize operations and make informed decisions. TotalEnergies' launch of a new analytics platform in September 2024, which uses artificial intelligence to improve predictive maintenance and performance monitoring, highlights this trend.

Key Challenges:

Legacy System Integration: Many oil and gas companies rely on outdated legacy systems that are incompatible with modern software solutions. Integrating new software with these legacy systems can be a complex and costly process, requiring significant customization and system overhauls. This can delay the adoption of advanced technologies and hinder the realization of potential benefits.

Data Security and Compliance: The oil and gas industry handles sensitive data, including operational, financial, and safety information. Given the increasing sophistication of cyber threats and stringent industry regulations, ensuring data security and compliance is a major challenge. Companies must invest in robust security measures and compliance protocols to protect data integrity and avoid costly breaches and legal issues.

High Costs for Implementation and Maintenance: Developing and maintaining advanced oil and gas software solutions can be expensive. The initial costs of acquiring and deploying sophisticated software can be significant, and ongoing maintenance, updates, and training add to the overall cost. Smaller businesses or those with limited budgets may find it difficult to effectively leverage new technologies due to these high costs.

Rapid Technological Change: The technology landscape in the oil and gas sector is rapidly evolving, with frequent advancements and updates. Keeping up with the latest technological trends and ensuring that software remains relevant and effective can be challenging. To remain competitive, businesses must continuously adapt and invest in new technologies, which can be resource-intensive and require ongoing strategic planning.

Key Trends:

Increasing Use of Cloud-Based Solutions: The oil and gas industry is increasingly embracing cloud-based software solutions. Cloud technology offers scalability, flexibility, and cost-effectiveness, allowing businesses to access real-time data, collaborate more effectively, and reduce IT infrastructure costs. Cloud-based solutions also enable easier updates and integration with other systems, which improves operational efficiency.

Integration of AI and ML: AI and machine learning technologies are being integrated into oil and gas software to enhance data analysis and decision-making. These technologies enable predictive maintenance, optimize production processes, and improve safety by analyzing large amounts of data to identify patterns and anomalies. AI and machine learning empower businesses to make data-driven decisions, minimize downtime, and improve overall operational efficiency.

Focus on Data Analytics and Real-Time Monitoring: Data analytics and real-time monitoring are becoming increasingly critical in the oil and gas industry. Advanced data analytics tools and real-time monitoring systems help businesses gain actionable insights, track performance metrics, and respond quickly to operational issues. This trend promotes better decision-making, enhances asset management, and increases safety and compliance.

Developing Advanced Cybersecurity Measures: As the oil and gas industry becomes more digitalized, advanced cybersecurity measures are being prioritized. With increasing interconnectedness, the risk of cyberattacks grows. Companies are investing in advanced cybersecurity technologies and protocols to protect sensitive data, prevent cyberattacks, and maintain regulatory compliance. This trend reflects the industry's commitment to securing its digital infrastructure and maintaining operational integrity.

Looking at the Global Oil and Gas Software Market regionally, we find some key differences between the mature North American market and the rapidly growing Asia Pacific markets.

North America continues to dominate the global oil and gas software market, propelled by its mature and technologically advanced oil and gas industry. The United States and Canada, with their significant oil and gas operations, have a high adoption rate of advanced software solutions for exploration, production, and management. In July 2024, Schlumberger's strategic partnership with Microsoft to enhance its digital offerings and incorporate advanced data analytics into its software solutions further solidifies North America's leadership position. This move demonstrates the region's commitment to leveraging cutting-edge technologies to improve oil and gas operations.

In June 2024, the US Department of Energy's report emphasizing the importance of digital transformation in ensuring the competitiveness of the US oil and gas sector highlights the ongoing investments in software technologies to increase operational efficiency and lower costs. North America's significant investment in R&D, combined with supportive regulatory frameworks and infrastructure, ensures its continued dominance in the global oil and gas software market.

Asia Pacific is emerging as the fastest-growing region in the oil and gas software market, driven by rapid industrialization and increased investments in energy infrastructure. The region's growing demand for advanced software solutions to improve efficiency and cost-effectiveness in oil and gas operations is fueling market growth. In August 2024, Siemens' expansion into the Asia-Pacific region with a new suite of digital solutions tailored to the regional oil and gas sector underscores the region's burgeoning market and Siemens' commitment to fostering growth through innovative software solutions.

Government initiatives are also playing a significant role in driving the growth of the Asia-Pacific oil and gas software market. In May 2024, India's "Digital India" initiative announced a significant investment in digital technologies for the oil and gas sector, aiming to modernize the industry by integrating cutting-edge software solutions for exploration and production. Asia Pacific's regional economic growth, strategic investments, and supportive government policies are collectively driving the rapid expansion of the oil and gas software market in the region.

Carbon Capture Storage (CCS) Market

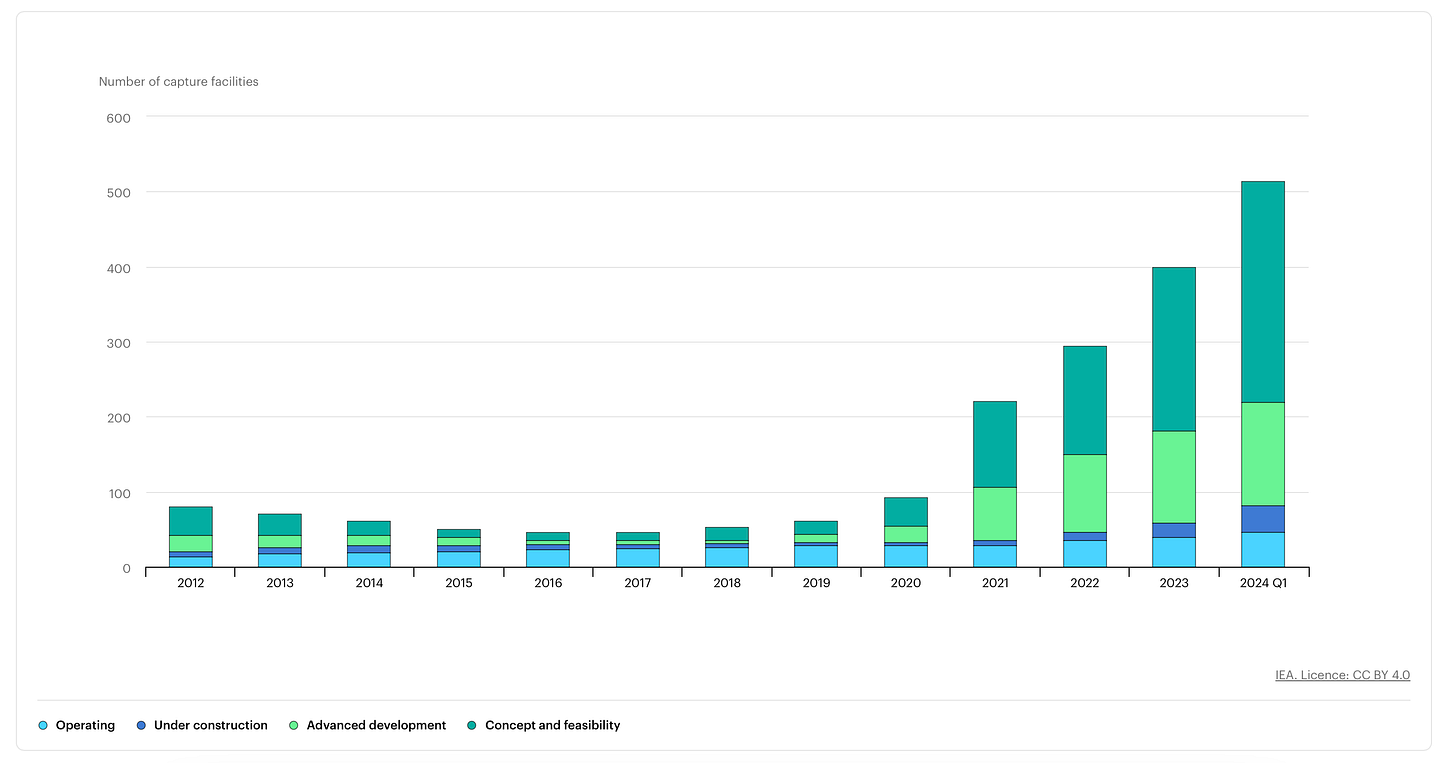

The global carbon capture and storage (CCS) market is poised for significant growth. Given the presence of 46 operational carbon capture facilities and up to 500 in development, CMG's leadership in this field positions it for substantial future growth.

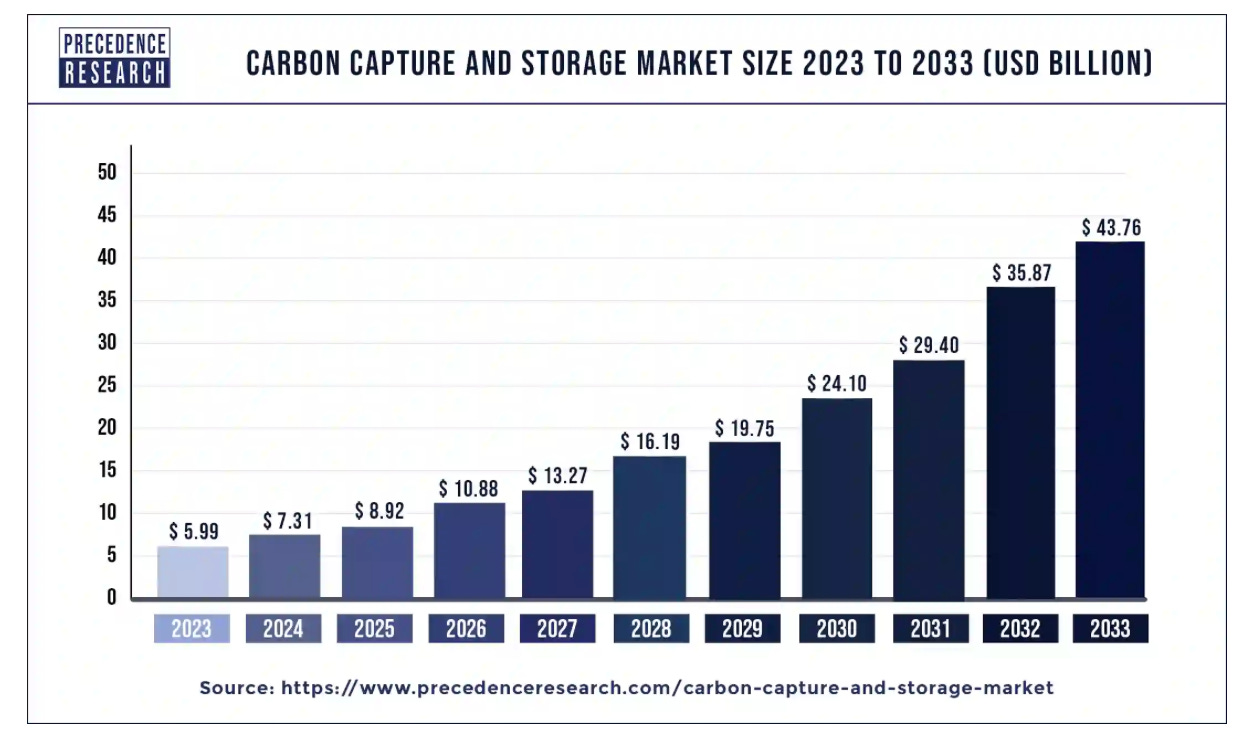

Valued at USD 5.99 billion in 2023, the market is projected to reach USD 43.76 billion by 2033, expanding at a robust CAGR of 22%. The global carbon capture and storage market is being driven by a confluence of factors. Increased industrialization and manufacturing investments are leading to higher carbon emissions, making CCS a critical solution. Government initiatives aimed at reducing greenhouse gas emissions are providing further impetus to the market. Additionally, the oil and gas industry's focus on enhanced oil recovery (EOR) techniques, which often involve injecting CO2 into oilfields, is creating additional demand for CCS. Rising energy needs and the associated increase in carbon emissions are also contributing to the market's growth. Moreover, growing societal concern about climate change and the detrimental effects of carbon emissions is driving the adoption of CCS technologies. Technological advancements in power generation and CCS processes are further enhancing the market's potential.

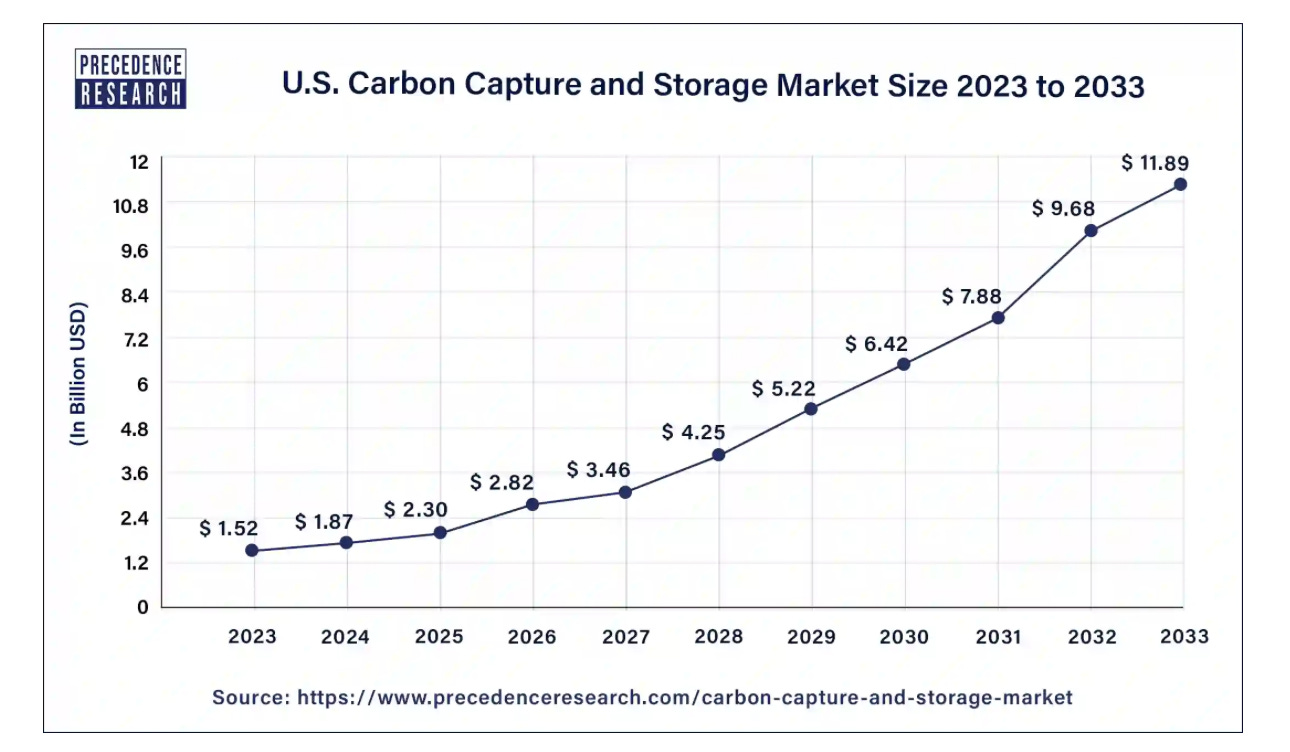

The U.S. carbon capture and storage (CCS) market is poised for rapid growth. Valued at USD 1.52 billion in 2023, the market is projected to reach USD 11.89 billion by 2033, at a compound annual growth rate (CAGR) of 22.8%.

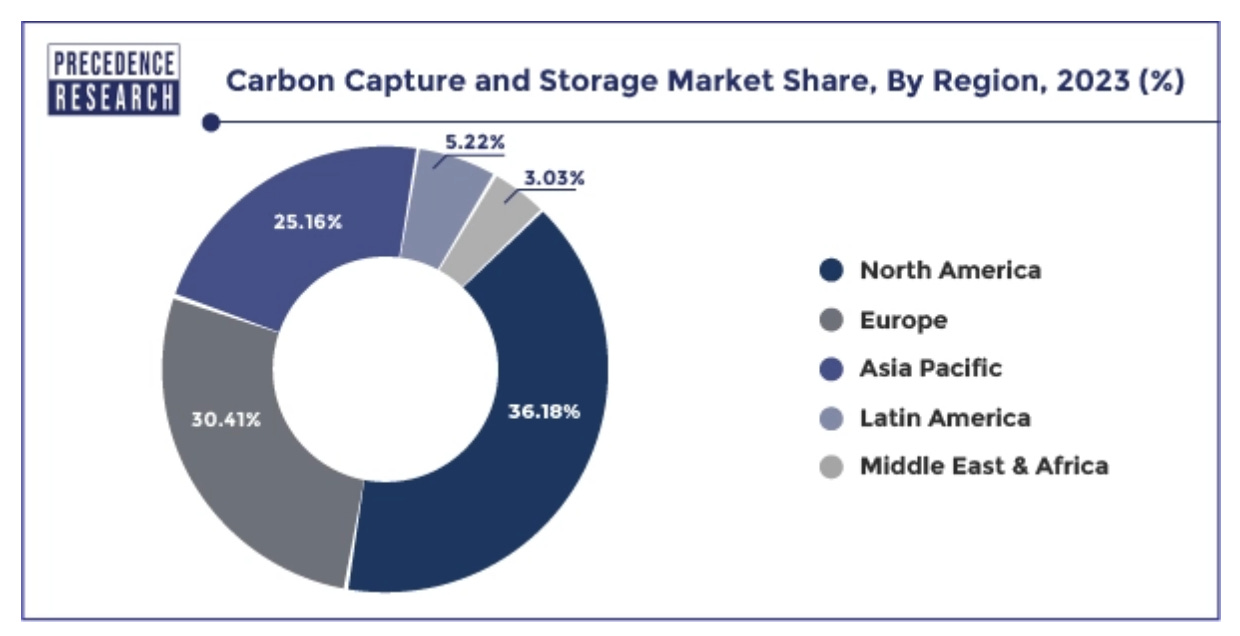

In 2023, North America dominated the global carbon capture and storage (CCS) market, accounting for over 36.18% of total sales. This dominance can be attributed to the region's expanding portfolio of existing and planned CCS projects. For instance, in October 2022, Fluor Corporation was awarded a contract to provide engineering services for Project Bison, a large-scale direct air capture (DAC) project in Wyoming, US.

Canada, with its four active CCS projects capturing 4 million tons of CO2 annually, holds the second-largest share. The country aims to sequester and store 15 million tons of CO2 by 2030, contributing to its goal of reducing greenhouse gas emissions. While Mexico had a smaller market share in 2022, its proactive government policies are expected to drive significant growth in the region.

Europe has emerged as a hub for carbon capture, utilization, and storage (CCUS) research and development. Numerous European countries are actively involved in CCU initiatives, ranging from testing phases to pilot programs. Germany and the United Kingdom have played pivotal roles in shaping Europe's CCU landscape.

The European Union's Emission Trading System has incentivized companies in the industrial and electricity sectors to reduce emissions. Rising permit prices, due to reduced emissions allowances, have further spurred the adoption of CCU technologies across Europe.

The question is, how much of the total TAM will be software? If we take a high level approach and assume that CMG, from a software perspective could command 0.5% - 1% of this total CCS market, that leads to a $220M - $440M revenue opportunity.

CMG’s Take on their TAM

To validate the third-party research, we consulted with CMG team members to gain their perspective on the total addressable market (TAM). While third-party firms often provide broad TAM estimates, CMG focused on a more specific assessment, considering only the market for their current product offerings and excluding regions where they don't operate, such as Iraq, Venezuela, and Russia.

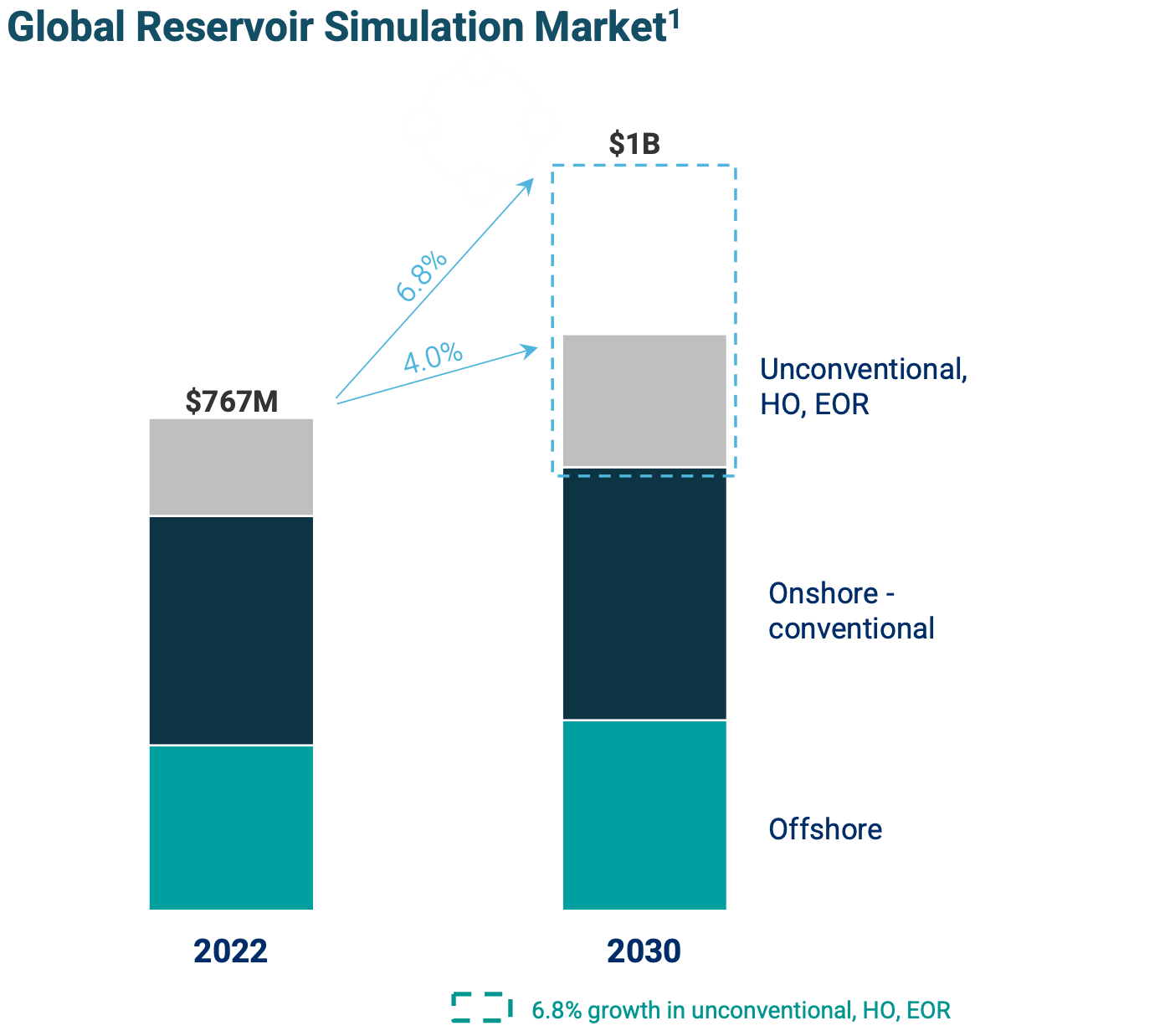

CMG's third-party firm evaluated the TAM for reservoir simulation software, excluding related areas like seismic analysis, which CMG addresses through its acquisition of Bluware. This focused approach resulted in a $1B revenue opportunity estimate for reservoir simulation software, aligning with the figure presented in the investor presentation.

This analysis highlights the significant growth potential for CMG's core software segment. Even with a conservative estimate of a $1 billion TAM by 2030, if we assume CMG earns 30% market share in the reservoir simulation software market, CMG could potentially grow its core segment revenue from $88 million today to approximately $300 million, representing a 2.5x increase. Additionally, the company estimates $100 million in revenue from CoFlow (which we think is very conservative based on the CCS market data provided above) and $30 million from InteractivAI, indicating a clear path to 4-5x the size of the business by 2030-2031 before considering any further acquisitions from its 4.0 strategy.

CMG’s Competitive Position

The reservoir simulation software industry is relatively concentrated, with three major suppliers, which are CMG Group, SLB (Schlumberger) and Rock Flow Dynamics, and several smaller players. Although there are three key players, this is effectively a duopoly industry today between CMG and Schlumberger as Rock Flow Dynamics is significantly smaller. While some competitors offer broader product portfolios, including oilfield services, CMG's focus on independent software solutions provides a unique value proposition.

Increased consolidation within the oil and gas industry is a common theme, and we ultimately believe acquisitions and mergers will create opportunities for new licensing agreements, which plays well into CMG’s new 4.0 strategy to reinvest cash flow back into accretive acquisitions.

The reservoir simulation software industry presents a significant barrier to entry. New entrants face substantial upfront costs associated with research and development. Moreover, building strong relationships with potential customers requires significant time and effort, making it challenging for new players to gain market traction.

When we look at Schlumberger, their business is broken down into four segments, of which two of those compete directly with CMG. Digital & Integration encapsulates two offering’s that compete with CMG as follows:

Digital solutions: Includes products, services, and solutions that span the energy value chain from subsurface characterization through field development and hydrocarbon production to carbon management and the integration of adjacent energy systems. Offerings are founded upon proprietary and open-source data platform technologies, industry-leading simulators and workflow tools, and include domain-specific application of innovative digital capabilities, such as artificial intelligence and machine learning. Solutions are deployable on traditional on-premise IT infrastructures, the cloud, and the edge, allowing for full market coverage irrespective of customer constraints.

Exploration data and data processing: Provides comprehensive worldwide reservoir interpretation and data processing services, enabled by a scientifically advanced platform and innovative subsurface imaging techniques for exploration data, and includes one of the industry’s most extensive exploration data libraries.

The 2nd segment is the Reservoir Performance division of SLB’s core business.

The Digital and Integration segment had revenue in 2023 of $3.8B of which $984M came from North America and the rest from international business, all of which is growing at 4%. This segment had pre-tax operating income of $1.1B or 29%.

The Reservoir performance business division had revenue in 2023 of $1.7B of growing at 3% annually, with pre-tax operating margins of 21%.

In comparison, CMG, a pure-play software company, boasts a revenue run-rate of approximately $110 million, with its core business growing at 19% and BHV growing at 28%. CMG's combined pre-tax operating margins reach 35%, even reaching 45% as acquired businesses achieve operating leverage. Despite the current dividend burden, we believe that by cutting the dividend and reinvesting cash flows into acquisitions, CMG can continue to gain market share against larger incumbent SLB.

Finally, Rock Flow Dynamics a private company, which we have limited information on, appears to be generating revenue of anywhere from $50-75M per year or roughly half the size of CMG’s business.

When discussing the competitive dynamics with CMG, they told us the following:

“The interesting thing about our market is that it is most often not exclusive. You'll find many customers who have licenses from multiple providers. This could be for various reasons, either they use certain simulators for certain types of assets, or they use one to verify output on another. Our vision would be to create a portfolio of best-in-class technologies, ultimately in an open ecosystem, where clients could choose what they want to use and have the ability to have those technologies integrate with one another. Customers don't like being held hostage to one provider. We don't have to own the entire workflow, but the more solutions we have, particularly disruptive solutions of the kind that we acquired with Bluware and Sharp, the stronger our competitive position becomes. We also believe that partnerships could play an important role in providing more functionality across the upstream workflow.”

Overall, CMG has a very strong competitive position in a duopolistic market structure with clear tailwinds at their back as the oil and gas industry continues its digital transformation journey.

Organic Growth Drivers & Cash Profitability

Organic Growth Drivers

We know from studying software that growing a software business organically is arguably the most demanding management task. It necessitates a long-term perspective and a deep understanding of both customer needs and the capabilities of their teams.

From our discussions with CMG, regarding the sales process, historically, CMG has had good success because the complexity of their software is equally matched by the sophistication of the users. CMG’s users are technically very advanced and demand "best-in-class" software that delivers accurate answers to very complex problems. That continues to be the case in the majority of their sales today. The value proposition (or ROI) for simulation is also deeply appreciated by the users. One challenge they face is that while the users deeply appreciate the value proposition, as a niche area of a larger workflow, that ROI conversation is not always elevated to the C-suite to the same degree that they might be with competing solutions which offer more of a platform strategy. This speaks to the opportunity to enhance the core CMG business through the M&A strategy that seeks to build out a portfolio of technologies within the upstream energy workflow, which we’ll touch on later in this report.

CMG has always employed (as others do also) a seeding strategy with Universities where they provide their software to students to develop the competency and confidence in the technology. When they go into industry, they are very comfortable working with CMG.

The challenges, particularly more recently in the industry, is the shift, to simpler workflows and user interfaces. One trend CMG sees is a lack of skilled employees in oil and gas who can continue to work at advanced levels of sophistication. There is more demand for easier workflows and speed and the industry is weighing the trade-offs of speed, price, and accuracy. Specifically their new approach to product development (in how they thought about Focus CCS) and the relationship with NVIDIA which is important to continue to address speed while maintaining the scientific integrity on which CMG’s reputation is built.

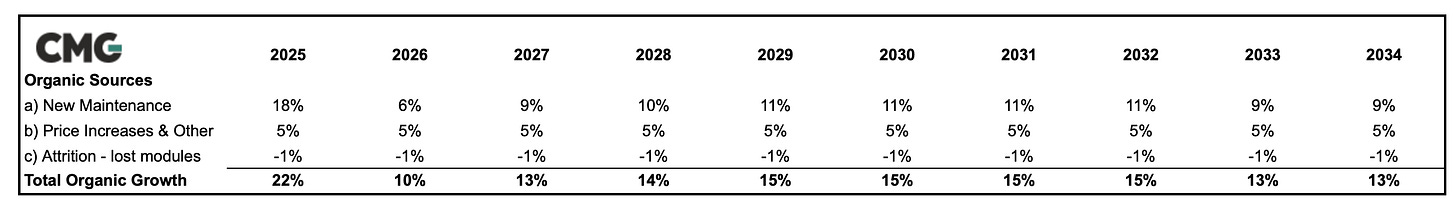

Based on this, Computer Modelling group has three sources of organic growth:

New Maintenance: this is the most important factor for CMG’s organic growth. If maintenance revenue continues to grow organically, there’s also reason to believe that the intangible assets are not deteriorating on the balance sheet. We think over time our estimates for new maintenance will be steady, due to the acquired companies diversifying CMG’s portfolio of software within the upstream energy workflow, which will make it clear to C-suite executives of the obvious P&L impact.

Price Increases & Other: I expect price increases to grow at the same pace of inflation at a rate of 2-5% annually.

Attrition - Lost Modules & Customers: CMG has stated they have a revenue retention rate of 95% meaning customers are with them for a long time, but we should still expect some negative impact from attrition. we’ll estimate 1-2% negative impact on organic growth yearly.

Although CMG doesn’t break out the sources of their organic growth, we’ve put together our estimates for organic growth between the three sources, which in total line up with management’s expectations of low double digit (LDD) to mid double digit (MDD) organic growth over time.

Cash Profitability

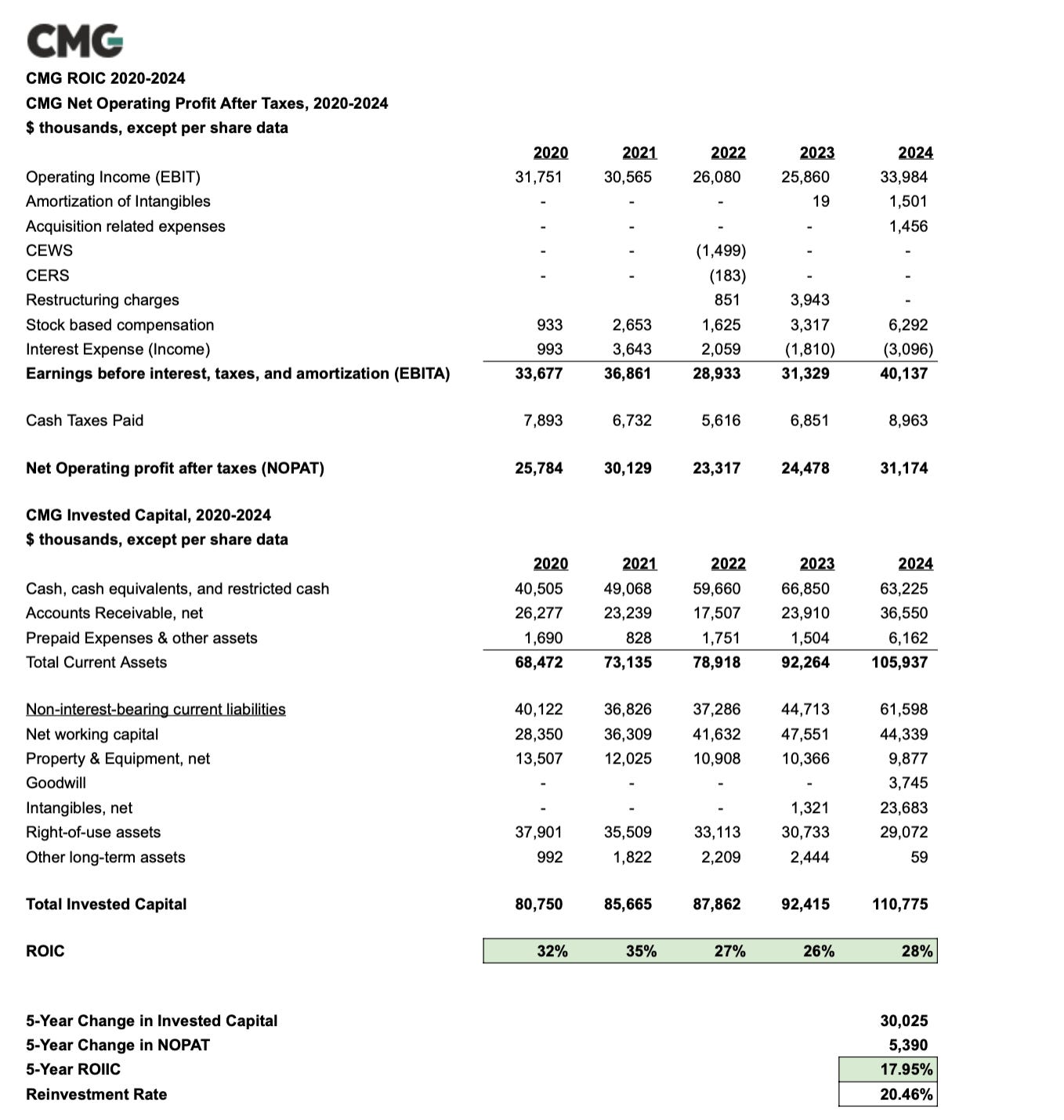

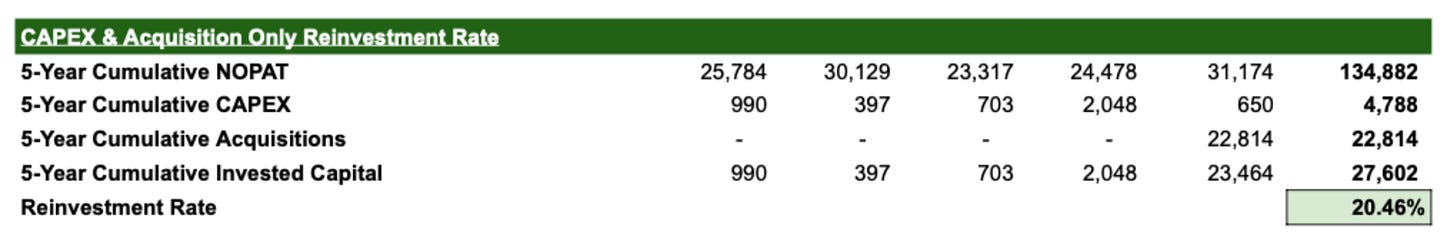

Below is our estimate of net operating profit after tax, ROIC, ROIIC and reinvestment rates.

Over the past five years, CMG has generated cumulative diluted earnings of $1.35 per share and reinvested $0.28 per share back into the business to generate effectively no earnings growth per share ($0.32 in FY2024 vs $0.30 in FY2020). Normally, this would be a sign not to invest in a company, however we know this is related to the poor historical capital allocation under old management. With Pramod now CEO of CMG, and a board of directors in place who understand how capital allocation effects stock returns over time, we expect the dividend to be cut and 100% of available free cash flow (maybe even more than 100% if leverage is used) for acquisitions.

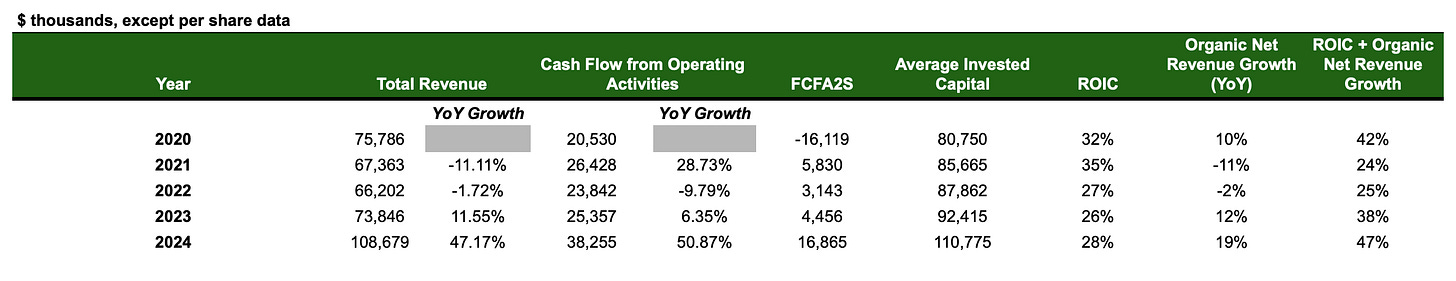

The following table of KPI’s are what we believe to be the most important profitability factors related to CMG:

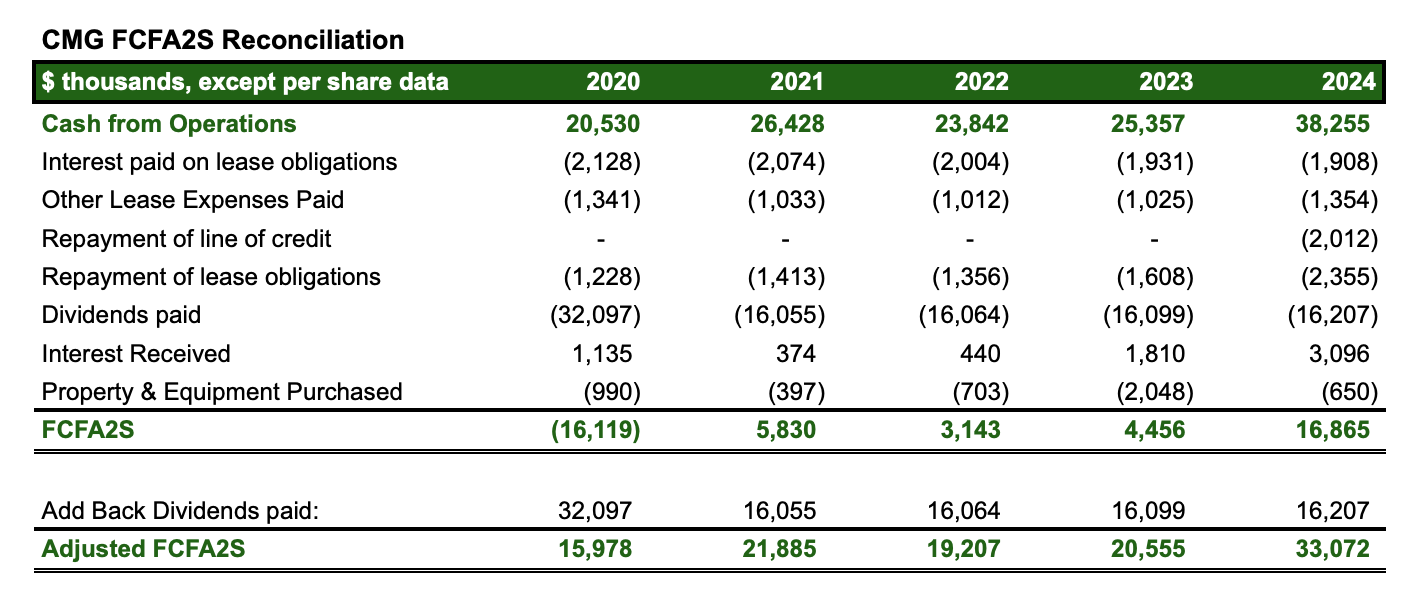

Inspired by Mark Leonard's early approach with Constellation Software, we believe CMG's new 4.0 strategy, under the guidance of its new CEO and board, has the potential to unlock significant shareholder value. By combining Organic Net Revenue Growth with ROIC, we can estimate the annual increase in shareholder value. As CMG shifts its focus to reinvesting a majority of its cash flows back into the business, we anticipate a substantial boost to shareholder returns. If, in the future, CMG is not able to deploy 100% of its free cash flow back into the business and or maintains the drag on FCFA2S with it’s unnecessary dividend, then the two metrics that become most important are free cash flow per share and adjusted net income per share.

We've presented the historical FCFA2S for the past five years, along with an adjusted version that excludes the impact of the dividend. As you can see, the dividend has been a significant drag on the company's growth. We are optimistic that by discontinuing the dividend, CMG will be able to reinvest these funds and drive substantial growth in the future.

Capital Allocation & Reinvestment Potential

CMG 4.0, a new strategic initiative launched by CEO Pramod Jain in 2022, aims to drive both organic and inorganic growth. The company has transitioned from a research-focused approach to a market-driven one, accelerating the commercialization of its software products through improved go-to-market strategies.

Organically, CMG will continue to expand its core competencies in reservoir simulation, production, and carbon capture and storage. Building on the high double-digit organic growth achieved in 2024, CMG expects to maintain a trajectory of LDD organic growth, excluding potential contributions from CoFlow.

In addition to sustained organic growth, CMG will actively pursue acquisitions of complementary software businesses in both the energy and adjacent markets. This strategic approach will enable CMG to capitalize on emerging opportunities and strengthen its market position.

CMG's recent acquisition of Sharp Reflections is a strong indicator of their commitment to our thesis. By investing additional capital at their target IRR and expanding their seismic interpretation capabilities, CMG is taking concrete steps to build an open ecosystem of new and innovative technologies. This strategic approach is focused on selecting companies that enhance critical functions in the upstream workflow. By integrating these technologies, CMG aims to provide users with a single source of truth, eliminate silos, and simplify access to critical insights.

Sharp, headquartered in Stavanger, Norway, operates globally in key markets including the UK, USA, and Germany. With a strong customer base of IOCs, NOCs, and supermajors, Sharp is well-positioned to capitalize on emerging opportunities in energy transition, such as CCS, offshore wind, and hydrogen storage.

Sharp's flagship software, Sharp Reflections, is a leading high-performance computing platform for seismic data processing and interpretation. The company's recent expansion into 4D seismic analysis further strengthens its offerings. Through collaborative partnerships with major oil and gas operators, Sharp continuously improves its software and delivers innovative solutions, including tech-enabled consulting services.

The purchase price for Sharp is €25.0 million (approximately $37.0 million) plus its net cash balance at the time of acquisition. An initial payment of €22.0 million (approximately $32.6 million) was made at closing, with the remaining €3.0 million (approximately $4.4 million) withheld. Of the withheld amount, €2.2 million (approximately $3.3 million) plus Sharp's net cash balance will be held for 60 days, while the remaining €0.8 million (approximately $1.1 million) will be held for 18 months. These amounts will be recorded as short-term and long-term acquisition holdbacks, respectively.

In the fiscal year ended July 31, 2024, Sharp generated approximately €10.0 million (approximately $14.7 million) in revenue, primarily from software sales (over 95% recurring). The company also generated €3.1 million (approximately $4.6 million) in services revenue and achieved a low double-digit Adjusted EBITDA Margin. We believe Sharp’s revenue and adjusted EBITDA can grow by 15-20% over our forecast period, which is reflected in exhibit 28.

CMG restructured operations into independent business units, each led by a dedicated leader with full P&L responsibility for core simulators, consulting services, and CoFlow initiatives. This strategic move empowers the teams to prioritize, execute, and deliver results more effectively, while allowing Pramod to focus on high-level strategic initiatives, including our acquisition strategy, which includes an hurdle IRR rate of 18-20% on acquisitions.

It seems Constellation's influence has led CMG to prioritize unlocking significant shareholder value. While it's challenging to predict future reinvestment rates, the elimination of the dividend suggests that CMG could allocate at least 80% of its cash flow towards acquisitions and R&D.

According to a 2023 Report from Apps Runs the World published June 12, 2024, the global oil, gas and chemicals software market surged to nearly $12.8 billion, growing by 9.4%. The top 10 vendors commanded a significant 49.5% market share, with Microsoft leading at 15.7%, followed by SAP, Salesforce, Aspen Technology and AVEVA Group, with the other half being smaller niche vendors. Given the vast number of potential niche acquisition targets in the oil and gas software industry, CMG is well-positioned to capitalize on growth opportunities.

The approach to M&A by Pramod is also something we admire, the following is a quoted from the 2024 annual letter:

“I am often asked about the expected pace of our acquisition strategy. How many acquisitions next year and what size? My response is always that “it depends”. It is important to stress that patience and a long-term view will matter as we take on acquisitions.

We are seeking businesses with strong growth potential and mission-critical software that expand our portfolio, while remaining disciplined in the prices we pay. I believe we succeeded in this objective with Bluware and we have a solid pipeline of opportunities we are evaluating. We have looked at various companies and have walked away from those that don’t fit with our strategy and don’t offer the financial return we are seeking.

I grew up playing cricket (not baseball, for our North American shareholders!), and in long-form cricket games (test matches or even one-day tournaments), a batsman must exercise a balance between playing offensive and defensive postures depending on the match situation. The same holds true for acquisitions for me – practicing patience but being fully aware of the trends/opportunities and ready to go on the offence when the timing is right.

The cadence of our M&A strategy may feel measured from the outside, but that does not mean a lack of opportunity. We won’t do M&A for the sake of doing M&A, even if it means patiently waiting for the right opportunities.”

Looking ahead, we envision CMG evolving into a broader simulation software company. This could involve acquiring companies specializing in car safety tests, aircraft design, or any field requiring complex physical modelling. Such a strategic shift would position CMG as a leading player in the simulation software market.

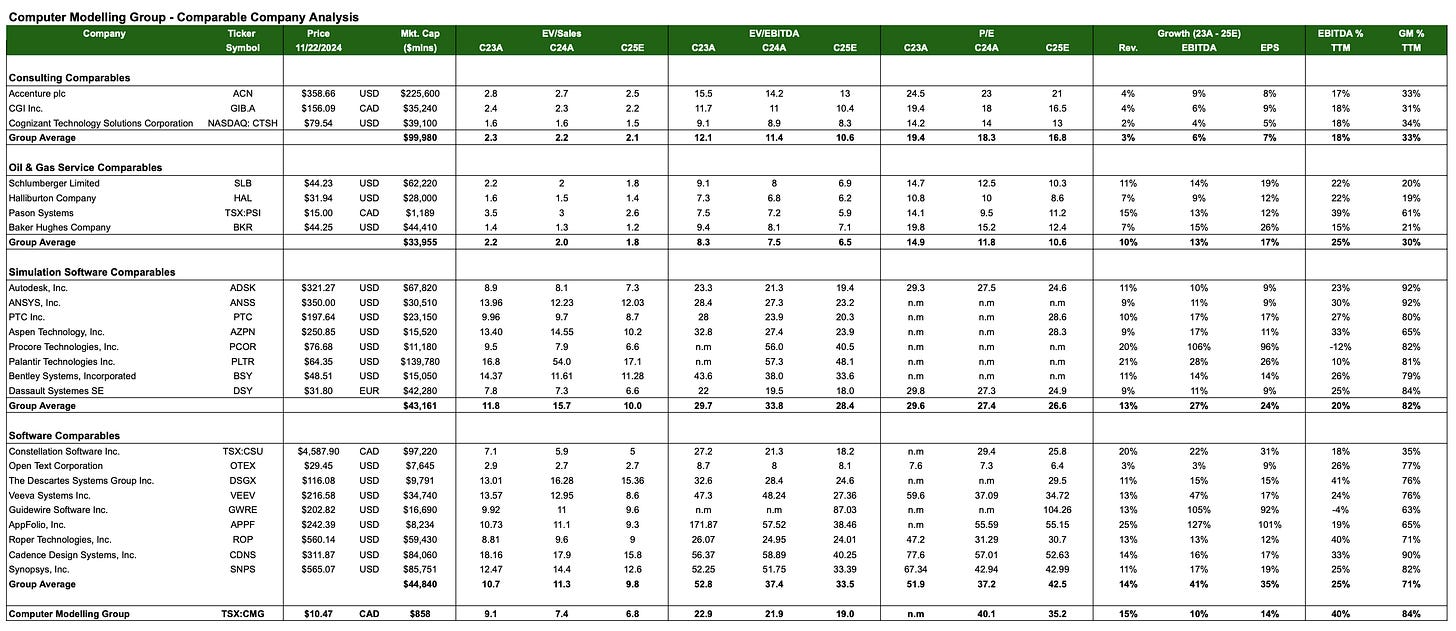

Valuation Model

Before diving into the specific drivers for CMG, we thought it would be a good idea to share the following table of how some other publicly traded businesses in the industry are being valued by the market.

As you can see from the above table, if CMG can continue to execute on it’s strategy we believe there is room to close the valuation gap when the market gains confidence in this new strategy, potentially unlocking the twin engine of FCF per share growth and multiple expansion.

The three main drivers of the valuation over time that have been discussed above are simply the following:

CMG’s M&A engine.

Organic Growth.

EBITA margins & limited wasted R&D + S&M expenses.

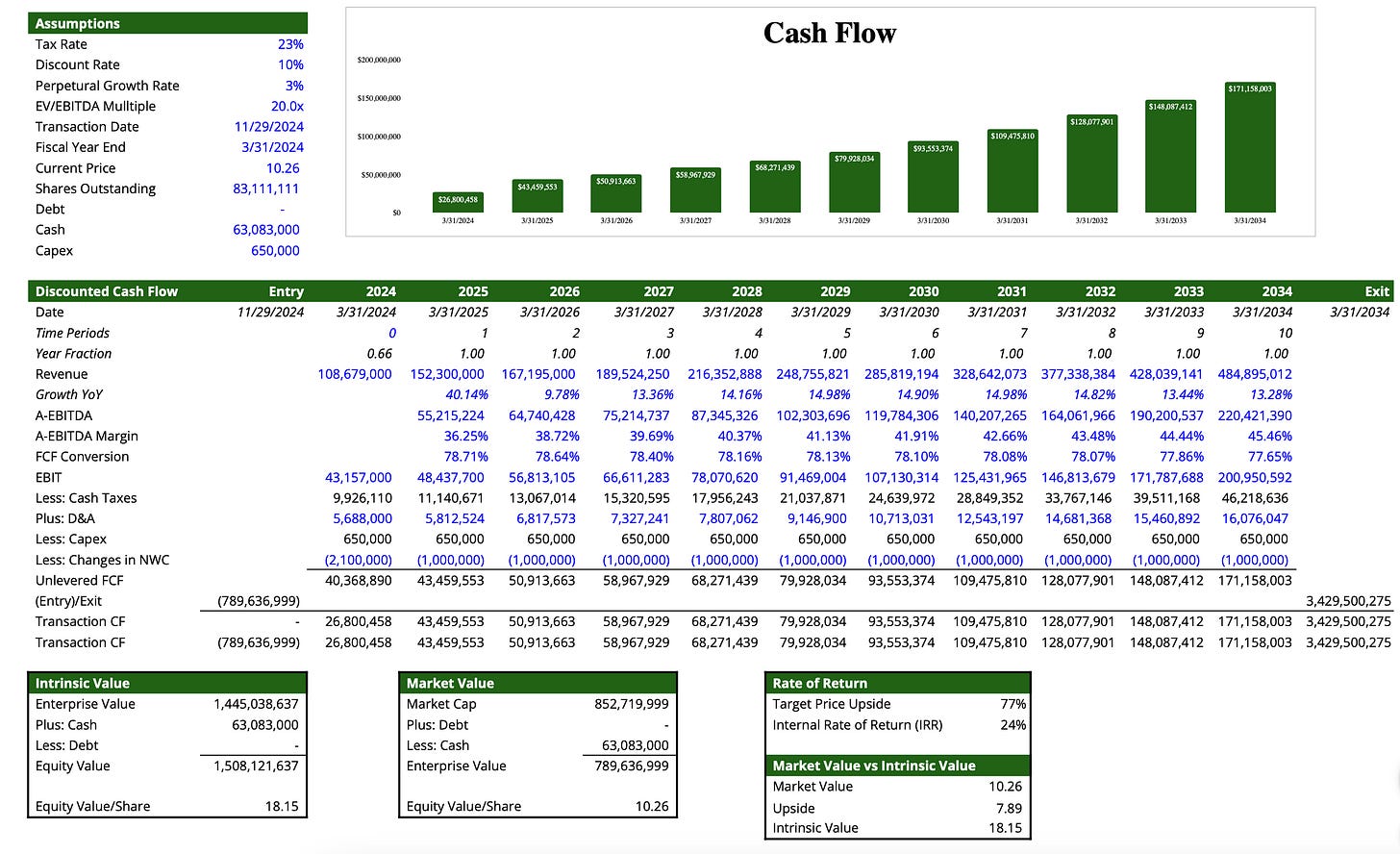

We have an estimated intrinsic value for Computer Modelling Group Ltd. of C$18.15 per share, indicating 77% upside and an IRR of 24%. Our target is based on our 10-year DCF (Exhibit 28). This would also imply 20x C2026E A-EBITDA – in-line with our comparable companies in Exhibit 27. Our DCF analysis assumes:

A low to mid-teen revenue growth for the overall revenue, in which Bluware’s & Sharps software top line accelerate from high teen to low 20s as CMG ramps up S&M investments. We also forecast the Carbon Capture & Storage segment to be another growth driver for CMG, which increases the contribution to the group’s overall result gradually.

Gross margin gradually increases to high 80s with higher scale of operations.

A-EBITDA margin is modelled to improve y/y, going from 36% to 45% between 2025 and 2034, and maintain at 45% going forward.

FCF conversion from A-EBITDA is forecasted to increase from 62% in 2025 to 74% in 2034, and remain steady from there.

A discount rate of 10% with terminal growth rate of 3%.

This yields an Equity Value of C$3,429M or C$18.15 per share based on fully diluted shares outstanding of 83,111,111 assuming all stock options are exercised.

Investment Risks

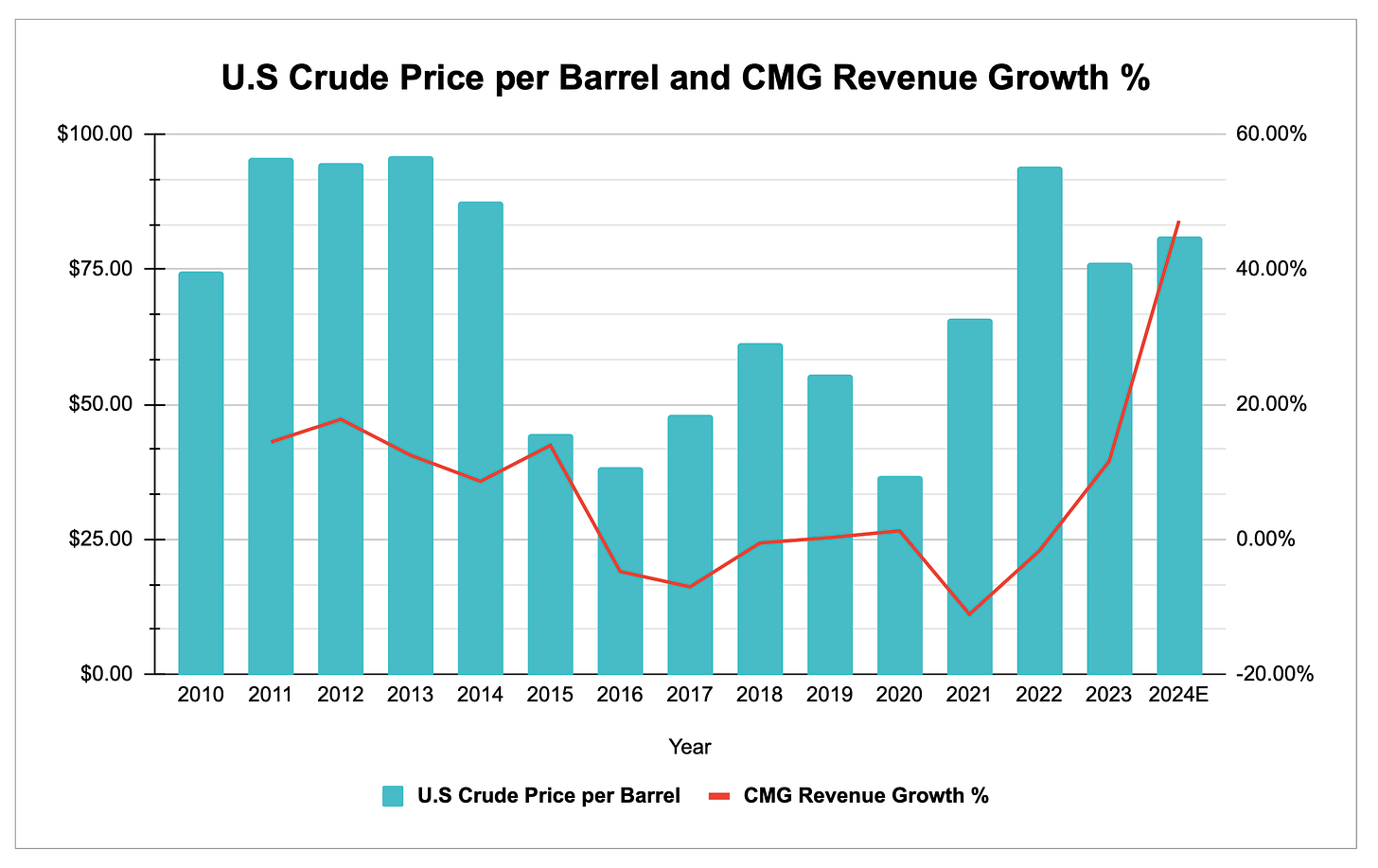

Commodity Price Risk

CMG's primary clients are oil and gas companies, whose capital and operating spending budgets can fluctuate due to commodity price volatility and economic conditions. This could negatively impact demand for CMG's products and its financial performance.

In the past, the CMG Core segment has been susceptible to fluctuations in commodity prices, as companies often reduce exploration and production expenditures during periods of decreased demand. Furthermore, this also negatively affects industry consolidation through mergers and acquisitions resulting in a reduction in user licenses. Nevertheless, a larger revenue base, diversification into energy transition and carbon capture, and a higher proportion of recurring revenue should attenuate the impact of future volatility on CMG's top-line growth. Moreover, market fluctuations tend to compel oil producers to adopt a more disciplined approach to capital allocation, thereby increasing the demand for software solutions like CMG’s that can reduce drilling risks and operating expenses.

Credit and Liquidity Risk

The Company's trade receivables are predominantly comprised of balances from customers operating within the oil and gas industry, both domestically and internationally. As the Company conducts business in approximately 60 countries globally, a portion of its customer base is located in jurisdictions characterized by greater economic and political risk than those prevalent in North America. To mitigate this risk, the Company invoices for the full license term in advance for the majority of software license sales and invoices as frequently as contractually permissible for consulting and contract research services. In instances where collectability is deemed uncertain, revenue recognition is deferred until cash is received, provided all other criteria are satisfied. Historically, the Company has not experienced significant losses attributable to individual customers or groups of customers in any specific geographic region. As of March 31, 2024, the Company assessed the credit risk associated with its accounts receivable and established an allowance for doubtful accounts of $0.5 million. The majority of this allowance relates to receivables from customers located in geopolitically unstable countries. As of March 31, 2024, the Company is exposed to a concentration of credit risk with four domestic and international customers, which collectively account for 51% of total trade and accrued receivables.

Geopolitical Risk

CMG operates in approximately 60 countries, with offices in North America, the UK, the UAE, Colombia, and Malaysia. Some of these countries have higher economic, political, and social risks than North America. As of Q2 fiscal 2025, 39% of software license revenue comes from North America, 11% comes from South America and 49% comes from the Eastern Hemisphere, which includes Europe, Asia, Australia and Africa. Over time, we’d be more comfortable as an investor seeing a higher percentage of revenue coming from North America, which we think would de-risk their current geography split.

Foreign Exchange Risk

The Company conducts business internationally and primarily prices its products in either Canadian or US dollars. This exposure to fluctuations in the exchange rate between the Canadian and US dollars gives rise to market risk. Approximately 79% of the Company's revenue for the fiscal year ended March 31, 2024, was denominated in US dollars, and at March 31, 2024, approximately US$53.3 million of the Company's working capital was denominated in US dollars. The Company does not currently employ derivative instruments to hedge its exposure to these risks. However, as approximately 46% of the Company's total costs are also denominated in US dollars, they provide a partial economic hedge against fluctuations in the exchange rate. The Company's operations are subject to currency risk arising from US dollar-denominated financial assets and liabilities. Fluctuations in the exchange rate are recognized as foreign exchange gains or losses in the consolidated statement of operations and comprehensive income. It is estimated that a one-cent change in the US dollar exchange rate would result in a net change of approximately $0.4 million to equity and net income for the fiscal year ended March 31, 2024. A weakening of the US dollar relative to the Canadian dollar would have a negative impact, while a strengthening of the US dollar would have a positive impact.

I'm very grateful for your write up. It has greatly accelerated my understanding of the company.

One question I have is how you have arrived at a 30% market share estimate for CMG in the core simulation software market? Since the investor slide you referred to indicates a reservoir simulation TAM of $767m CAD in 2022, wouldn't the company's turnover that year imply a market share that's actually closer to 10% than 30%? ($66m / $767m). Or are you assuming that the company's existing market share will expand towards 30% by 2030 based upon the growth drivers you described (increased need for unconventional and EOR, high growth CCS, etc)?

Thank you.

Thank you for sharing this, greatly appreciate.

Question, wouldn't it be frowned upon by CSU to have their people helping constellation copycats? Wouldn't CMG be considered direct competition? Or is this common practice?