Brown & Brown Q1 2025 Earnings Brief

13 acquisitions, 110 basis point EBITDAC margin improvement & 6.5% organic growth

Summary

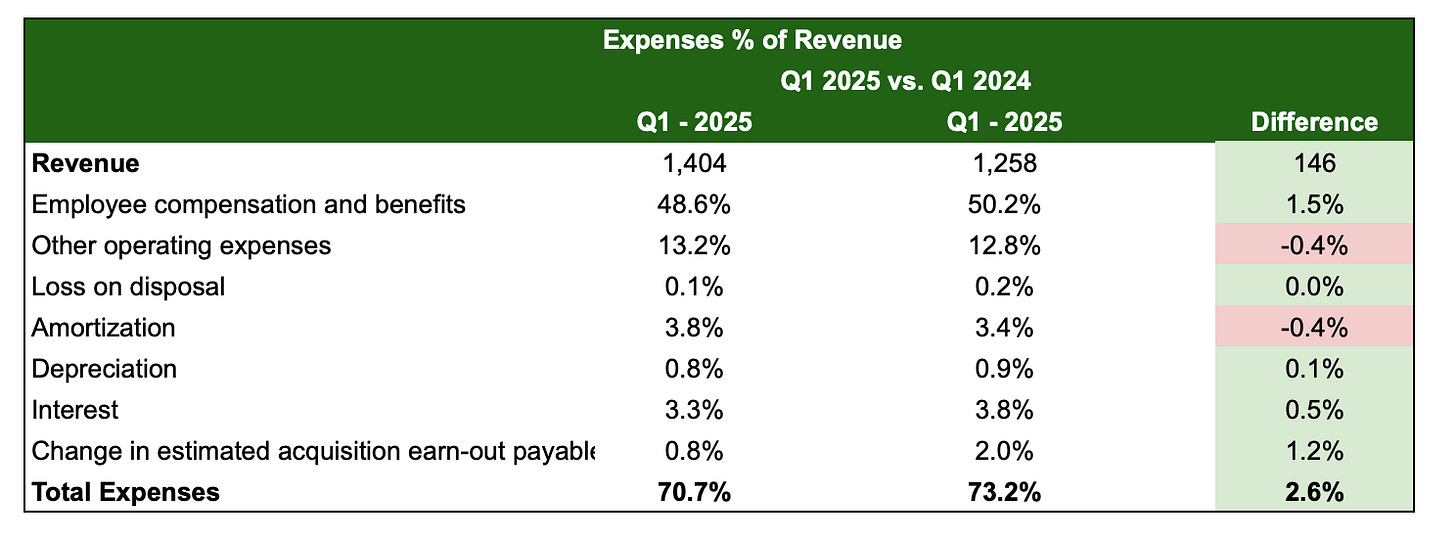

On April 28, 2025, Brown & Brown (NYSE:BRO) released its Q1 2025 results achieving a notable 11.6% total revenue growth and a healthy 6.5% organic revenue increase to $1.4 billion compared to the previous year. Profitability also saw significant improvement, with the adjusted EBITDAC margin expanding to 38.1% (due to lower interest expense associated with debt repayments) and adjusted earnings per share growing by over 13% to $1.29.

Acquisitions contributed positively, with 13 companies acquired, bringing an estimated $36 million in annual revenue. While the economic outlook presented some uncertainties regarding tariffs, inflation, and interest rates, there was a consistent level of business investment.

Insurance pricing saw continued rate increases across most lines, albeit with a slight moderation compared to the prior year. Auto and casualty lines continued to increase, while CAT property rates softened. Employee benefits consulting saw strong demand due to rising medical and pharmacy costs.

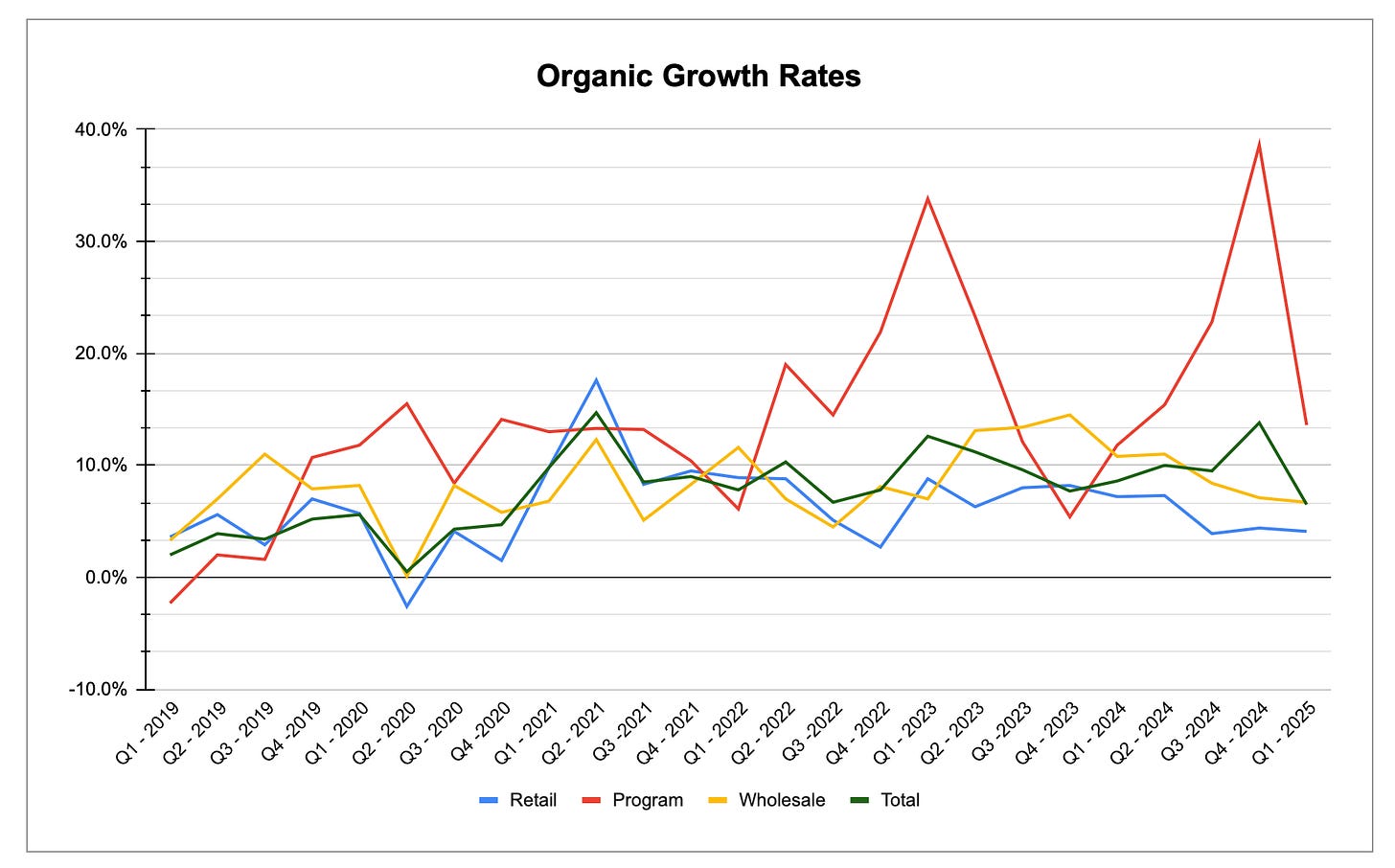

The company's three segments, Retail, Programs, and Wholesale Brokerage, all delivered solid organic growth, with Programs leading at 13.6%, followed by Wholesale (6.7%) and Retail (4.1%). Overall, the company achieved a solid first quarter even though organic growth overall was the slowest it’s been since Q4 2020. Management does anticipate much incremental organic growth in the following quarters in the captives.

Brown & Brown was only bested by AJG in Q1 2025 on organic growth, where they came in at 9.5% overall for the quarter.

Operationally, Brown & Brown generated ~$215 million in cash flow, a significant $200 million increase compared to the first quarter of 2024. This improvement was primarily due to ~$120 million in deferred 2023 taxes paid in the first quarter of 2024, coupled with ongoing working capital management and margin expansion during the current quarter. $90 million in deferred federal income taxes from the latter half of 2024, related to IRS hurricane tax relief, will be paid in the second quarter of this year and will impact future cash flow conversion.

The weighted average number of shares outstanding saw a slight increase compared to the prior year. The focus remains on strategically reducing the floating rate debt according to management.

The effective tax rate for the first quarter saw a slight increase to 21.8%, up from 19.5% in the same period last year. This rise in the tax rate was primarily due to a reduced tax benefit recognized from the vesting of restricted stock awards compared to the first quarter of the previous year.

Finally, dividends paid per share increased 15.4% when compared to the first quarter of 2024.

If you’d like to continuing reading posts like this, unlock our complete content library with a paid subscription! For just $0.55 a day with our annual plan, you'll get access to everything listed below, plus future content.