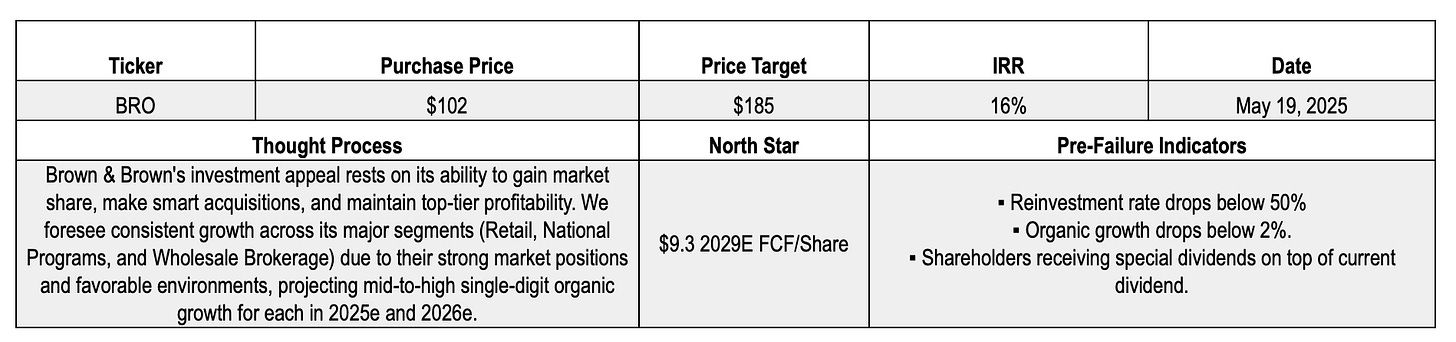

Investment Summary

Our investment thesis for Brown & Brown hinges on its proven capacity to capture market share, strategically pursue accretive M&A, and sustain industry-leading EBITDAC margins. We anticipate stable growth in its substantial Retail segment, underpinned by a healthy middle market, supporting mid-to-high single-digit organic growth in 2025e and 2026e. Similarly, the company's program management expertise in the National Program segment, targeting underserved markets, is expected to drive comparable organic growth. Finally, the robust specialty market should fuel durable growth in the Wholesale Brokerage segment, also projected to deliver mid-to-high single-digit organic growth in the coming years.

Our $185 price target reflects a 2029e EV/EBITDA multiple of approximately 18x and a 2029e P/FCF multiple of roughly 20x. This premium to peers is warranted, in our view, by Brown & Brown's industry-leading margins. We project the company will achieve ~$3,276 million in adjusted EBITDAC by 2029e, representing a ~37.9% margin. Our revenue growth estimates of ~13% and 2025e and 2026e are primarily fuelled by the robust Retail segment. This strong top-line growth, coupled with the company's exceptional margin profile, underpins our EPS forecasts of $4.14 for 2025e and $4.77 for 2026e. Despite its consistent historical performance, we believe the market under appreciates Brown & Brown's superior profitability, offering a significant runway for sustained growth and further margin expansion.

Key aspects of our positive investment thesis are:

1) European Reinvestment Opportunity

The European insurance market, a substantial €1.5 trillion sector with consistent growth, presents a compelling investment opportunity, particularly within the intermediary space where brokers command a dominant 55% of premium distribution and are steadily gaining market share, fueled by the rise of digital platforms. This evolving landscape, marked by increasing international consolidation exemplified by players like BRO strategically expanding their European footprint through significant acquisitions such as GRP and Quintes, suggests a promising trajectory for well-positioned brokers capitalizing on both organic growth and buy-and-build strategies in a market transitioning from local operations to a more globally integrated structure. Brown & Brown has a vast addressable market for M&A, estimated at 6,000 targets with a total premium volume of €24B or a total revenue opportunity of €2.4B. Given their 2024 European revenue of €417M, we think they could 5-6x their revenue in this region.

2) Favourable Tailwinds for Pricing & Margins Longer Term

We believe this company presents an attractive investment opportunity driven by its successful geographic expansion, synergistic leveraging of firm-wide capabilities, and strategic technology investments. Its established competitive advantages in employee benefits and specialty business, coupled with durable revenue growth in Programs and Wholesale Brokerage, position it for sustained long-term growth. Favourable pricing tailwinds in casualty and employee benefits further bolster our positive outlook at the current valuation.

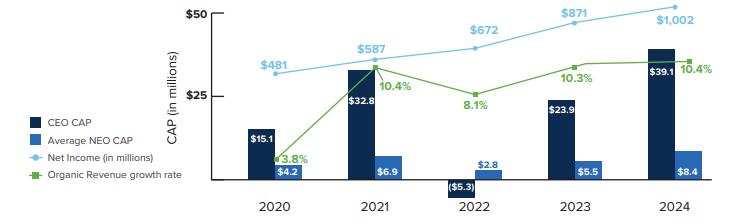

3) Shareholder Alignment

Long-term alignment with shareholders is embedded in BRO’s governance structure through significant insider ownership (~16%). Pay for performance is all driven by organic revenue growth, adjusted EBITDAC margin, adjusted EPS & total shareholder return; all of which don’t have much “fluff” in BRO’s case. Even with a reduction in stock incentive vesting periods to seven years (previously 10 to 15 years before 2013), the Company's long-term orientation remains evident in its compensation practices.

4) Defensive & Diversified

While the use of different non-GAAP metrics can obscure margin comparisons among brokers, Brown & Brown's consistently achieved 30%+ EBITDAC margin highlights its best-in-class profitability. We anticipate this strong margin will endure, driven by solid performance, growth in higher-margin businesses, and positive market trends. Although the brokerage industry exhibits durable margins overall, Brown & Brown's profitability profile is distinctly superior. The company is also less reliant on investment income. As interest rate is expected to decline, Brown & Brown's margin should be slightly less sensitive to rate movements. With a strong diversification across various industries, the company isn't significantly dependent on any single client or carrier. Consistent renewal rates, holding steady in the low-to-mid 90% range, provide a dependable stream of recurring cash flow.