AppFolio

The Future of Property Management Software

Investment Thesis

Durable Growth Model with Accelerating Profitability

Since its IPO, the company has successfully transitioned to a high-growth fintech model, with 76% of revenue now derived from high-margin financial services. This strategic shift, combined with a 10x increase in ARR to $790M by 2024, has driven substantial operating leverage. This strong operational performance, coupled with the ability to raise prices, warrants a premium FCF/share exit multiple.

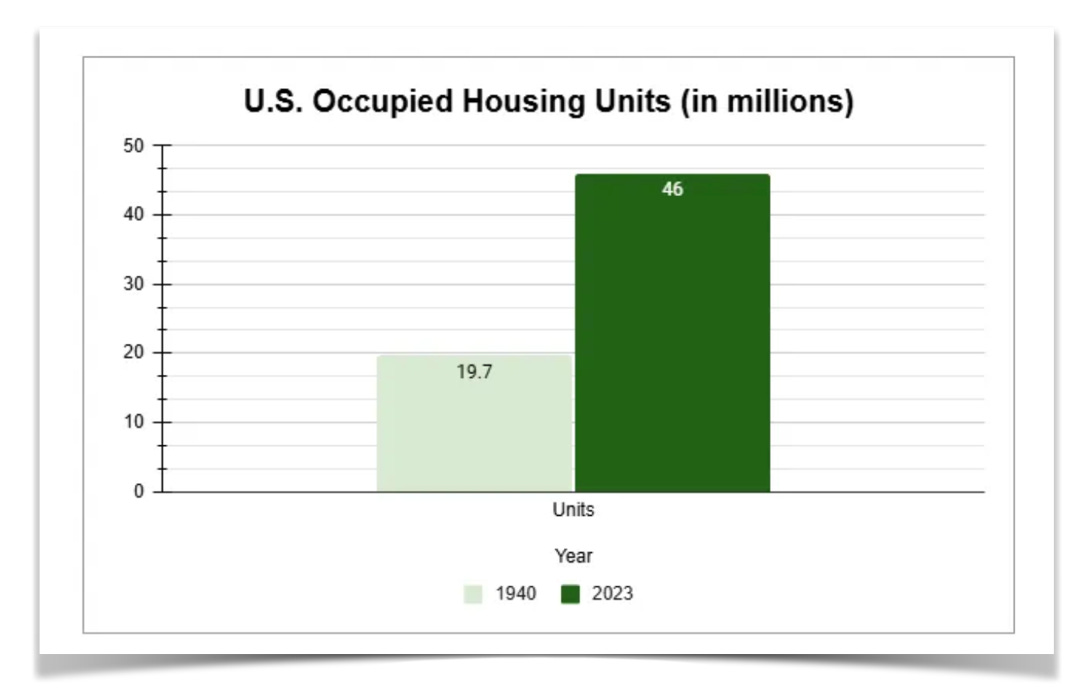

Recession Resistant TAM in a Low Churn Vertical

The property management software market exhibits strong defensive characteristics, serving a recession-resistant end market. Renter-occupied units in the United States have consistently increased by approximately 1.0% annually since 1940. This market demonstrates high customer stickiness, evidenced by AppFolio's industry-leading churn rate of under 3%. This low churn enables significant reinvestment into product development and up-market expansion into higher-value segments, where customers are more receptive to adopting value-added services.

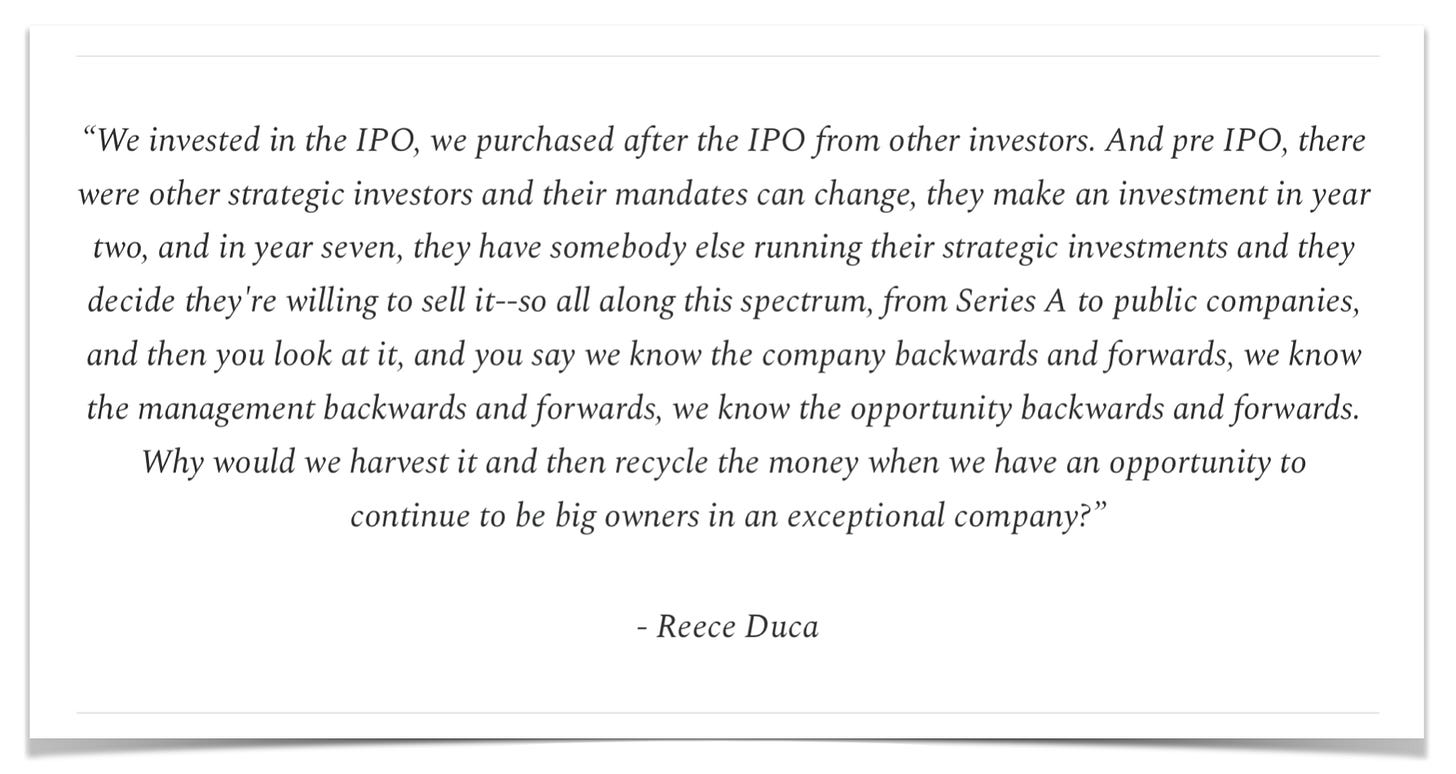

Sidecar Investment Opportunity with IGSB Directors

IGSB, as a long-term investor, prioritizes maximizing FCF/Share over short-term growth for the purpose of exiting an investment. This focus is evident in AppFolio's minimal share dilution, with only a 1% increase in outstanding shares between 2019 and 2024, contrasting sharply with the frequent and significant dilution observed among typical SaaS companies. This long-term perspective is further reinforced by the substantial personal investment of Tim Bliss and Reece Duca, senior partners at IGSB, who collectively retain approximately 25% of AppFolio's shares, representing ~40 of the Class B voting power.

Déjà vu Arising from Sell-Side Misunderstanding of Fintech

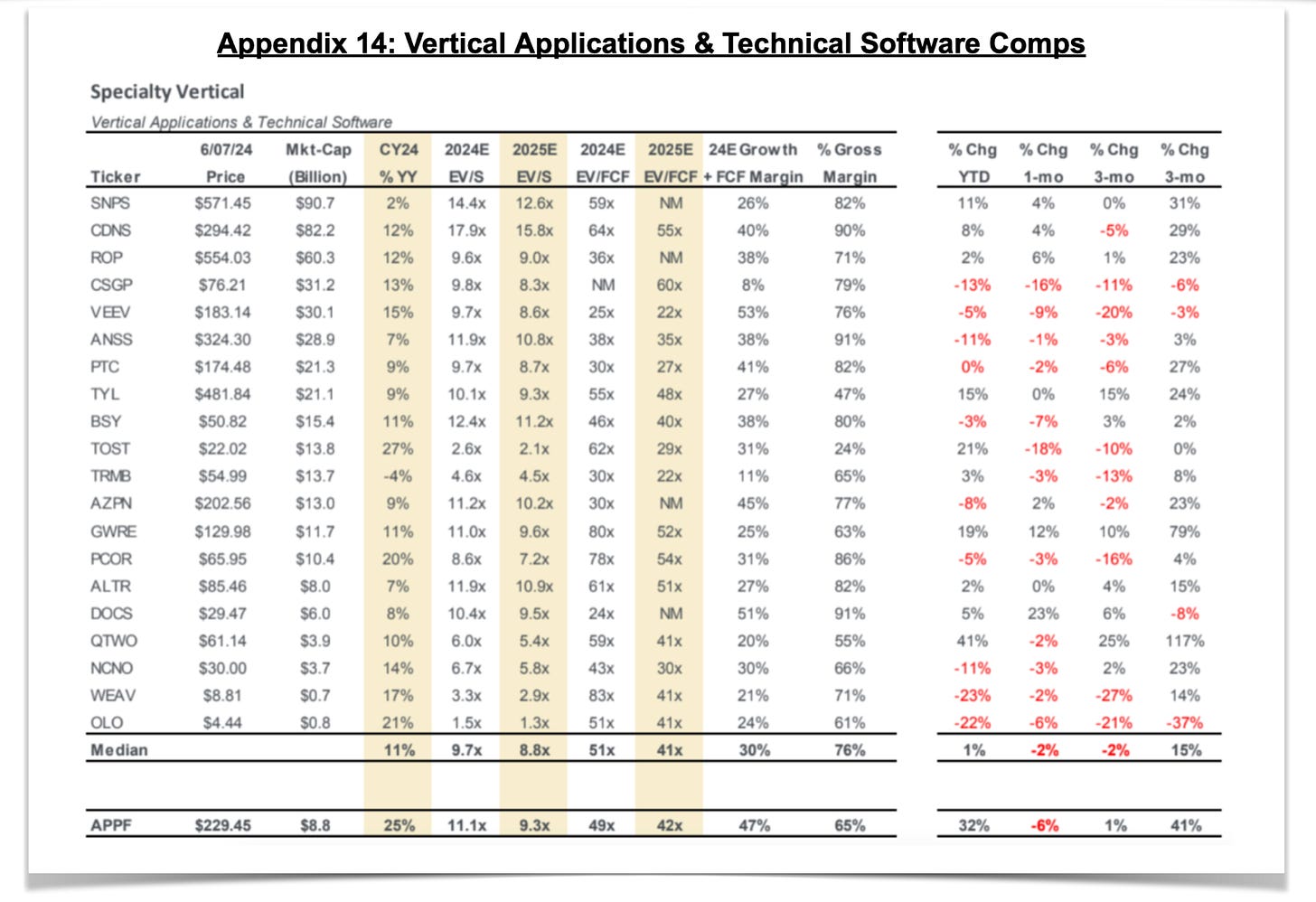

AppFolio's implementation of new ACH fees in July 2023 has accelerated value-added ARPU growth. However, sell-side analysts anticipate a normalization of this growth and are forecasting the company's growth based on combined gross margins of 67% and operating margins of 23-25%. We believe that the sell-side significantly underestimates the potential for margin expansion driven by the company's payments business. We project that AppFolio can achieve steady-state operating margins exceeding 35%. Historically, sell-side analysts have demonstrated a tendency to misinterpret AppFolio's results, previously issuing EPS and FCF forecasts based on breakeven operating margins.

Business Description

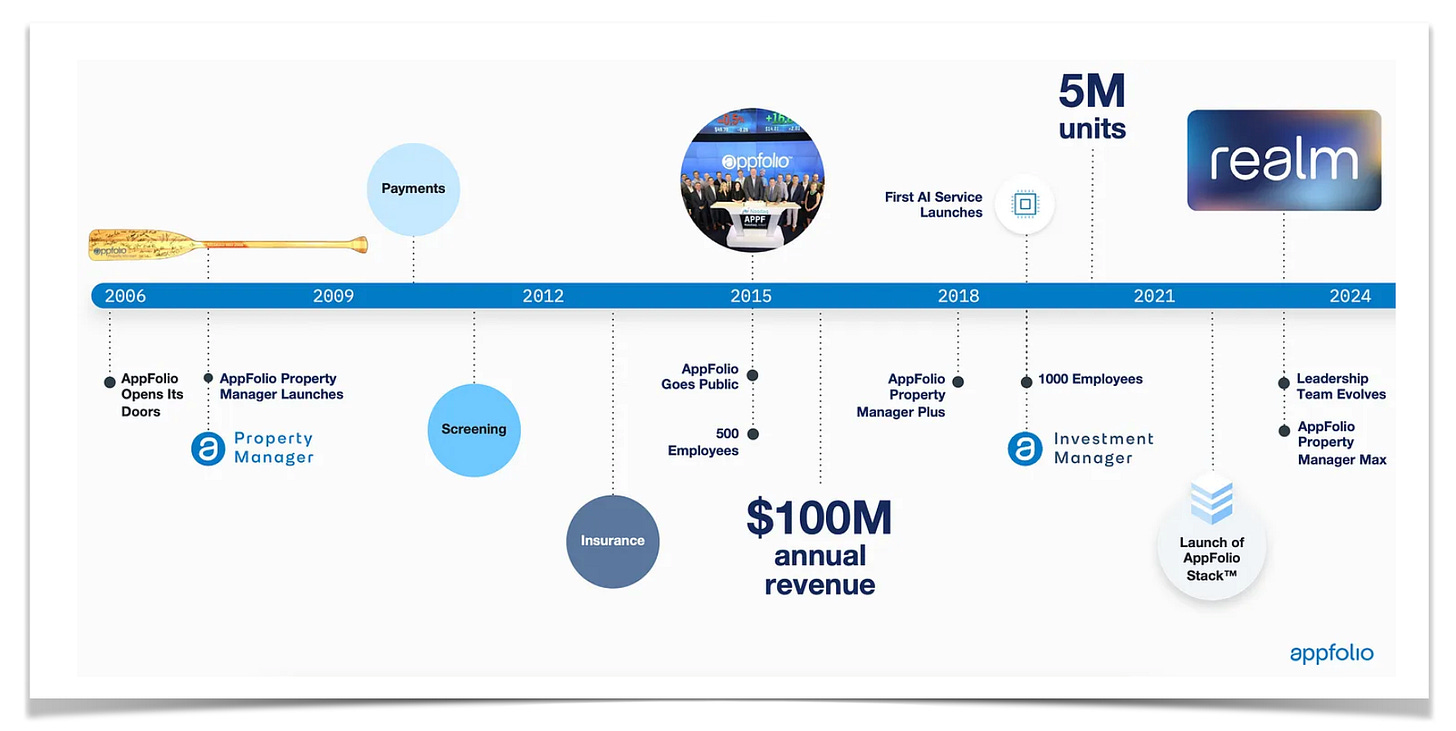

AppFolio, established in 2006 by Klaus Schauser and Jon Walker, emerged from Schauser's successful entrepreneurial past. He founded ExpertCity in 1997, which he later sold to Citrix Systems for $225 million. Recognizing a market gap for cloud-based Enterprise Resource Planning (ERP) systems tailored to small and medium-sized businesses (SMBs) across various sectors, Schauser and Walker embarked on their AppFolio venture.

Their unique approach involved a customer-centric development model, securing firm commitments before commencing product development. This "build-to-order" strategy initially focused on the property management industry, leading to the launch of AppFolio Property Manager (APM) in 2008.

Today, AppFolio stands as a leading provider of cloud-based business management solutions for the real estate sector. Their solutions are designed to empower property managers (PM’s) with the tools they need to digitally transform their operations, streamline critical processes, and enhance customer experiences. In today's digital age, embracing technology is not merely an option but a necessity for business success, and AppFolio provides the robust software solutions that drive this transformation.

AppFolio received a significant $14 million investment from the Investment Group of Santa Barbara (IGSB) in 2012, following their Series B round in 2008. IGSB maintained a substantial stake in AppFolio, holding 26% of the company's shares until 2020.

While IGSB has since dissolved the venture funds that previously held these shares, Tim Bliss and Reece Duca, the firm's senior partners, continue to hold a significant personal stake in AppFolio of ~25%, representing ~46% of the class B voting power.

IGSB maintains a strong presence on AppFolio's board, with Tim Bliss occupying one seat and Alex Wolf, a younger partner, holding the other.

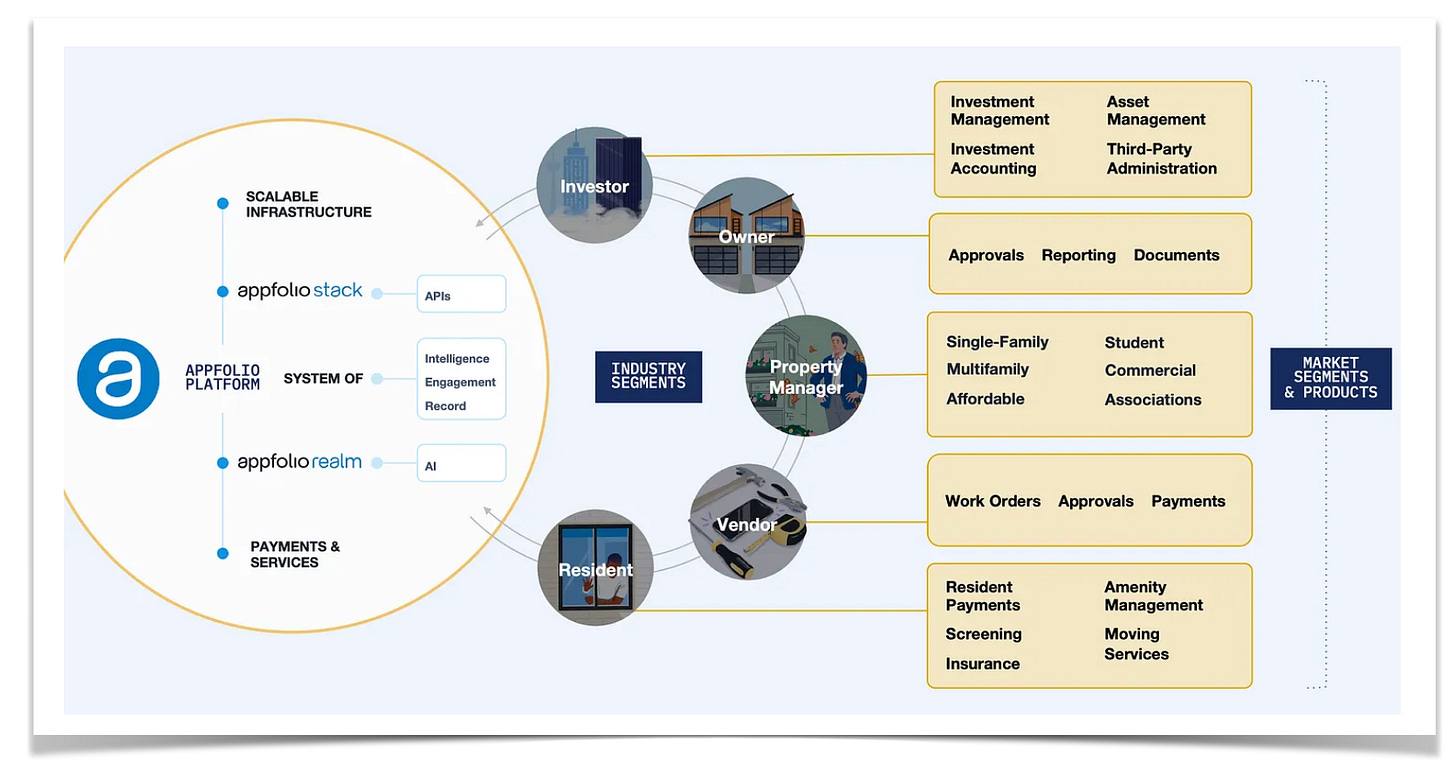

Business Model & Offering

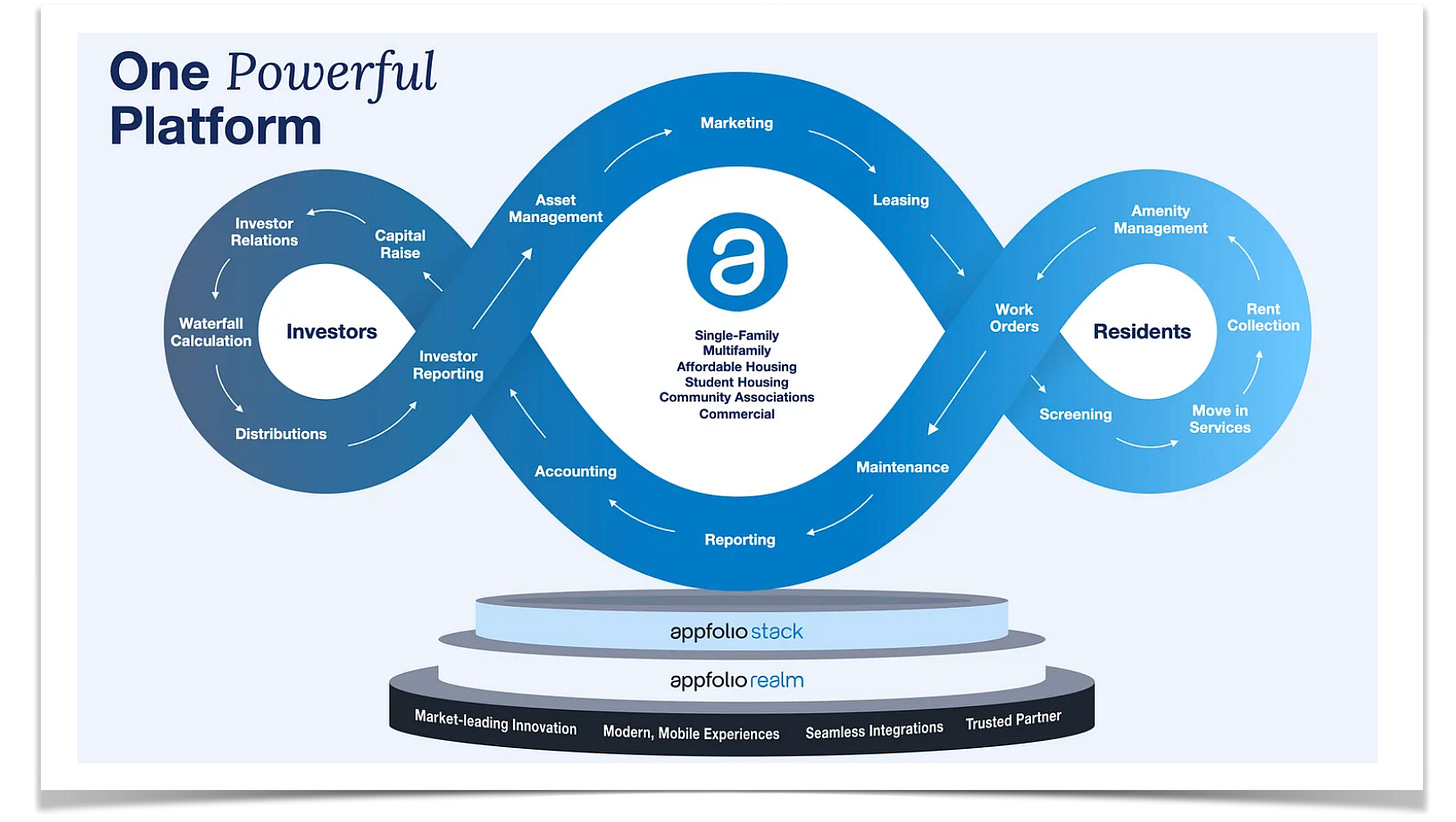

AppFolio provides a cloud-based platform that enables customers to operate their businesses efficiently through process automation and optimized workflows. This platform is further enhanced by AppFolio Realm, a suite of AI-powered tools that leverage generative AI to assist with leasing, maintenance, and accounting tasks, as well as automate common workflows. Additionally, the platform integrates with AppFolio Stack, a partner ecosystem that allows customers to connect with specialized technologies and services offered by third parties. AppFolio consistently updates the platform to incorporate new innovations and adapt to evolving market trends and customer requirements.

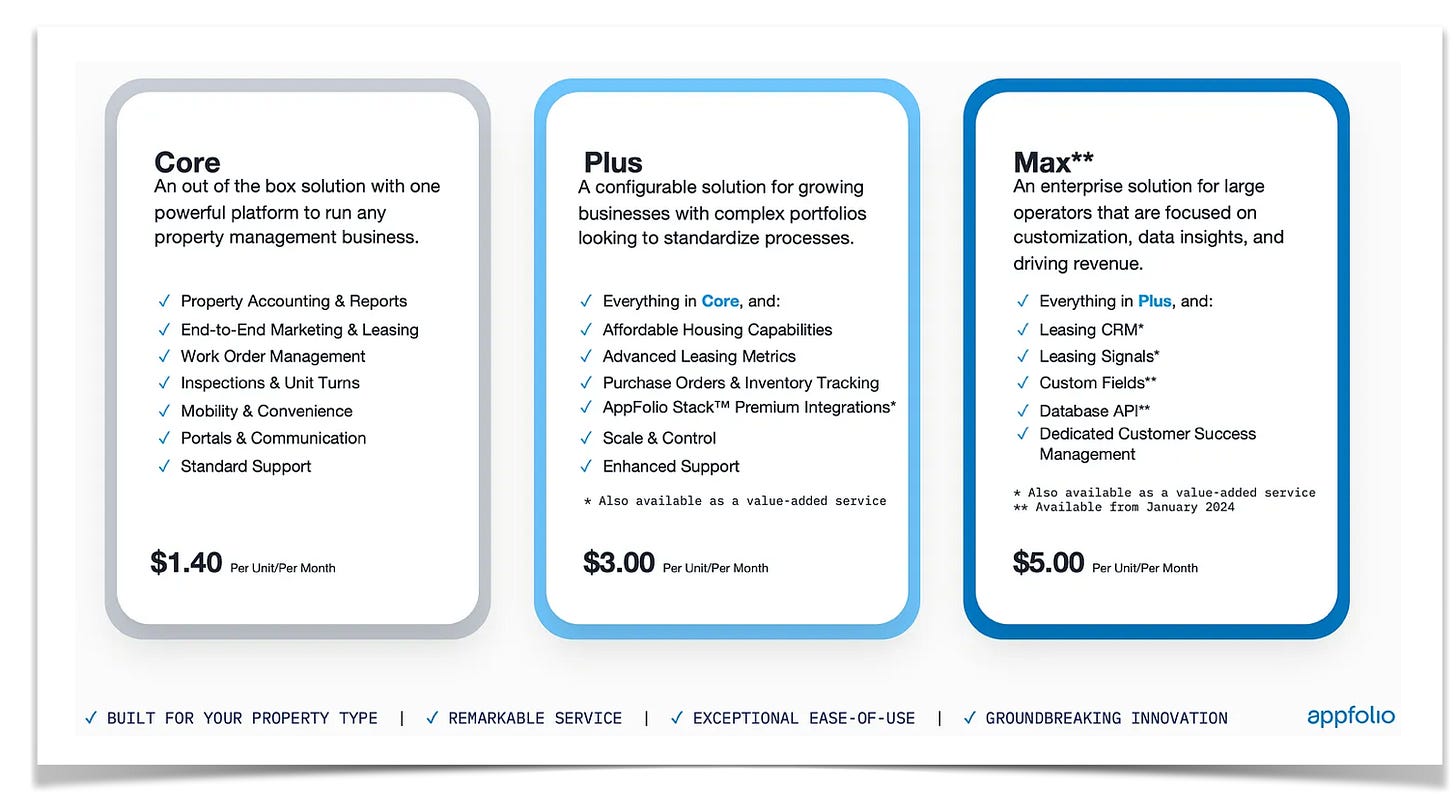

SaaS Products

AppFolio Property Manager Core provides the foundational functionalities necessary for managing a property management business. Serving as the central system of record, it tracks and records all critical transactions, providing customers with access to essential data. Furthermore, it acts as the system of engagement, facilitating interactions with key stakeholders, including residents, property owners and investors, and vendors. These two aspects seamlessly integrate, ensuring that daily interactions, such as rent payments through the AppFolio Property Manager mobile app, are instantly reflected in the system of record. AppFolio Property Manager Core is particularly well-suited for smaller property management companies seeking a comprehensive yet user-friendly system.

AppFolio Property Manager Plus expands upon the core functionalities of AppFolio Property Manager Core, catering to the evolving needs of larger and more complex property management businesses. This enhanced version supports specialized management requirements, such as affordable housing and student housing, accommodates more intricate accounting needs, provides deeper insights into leasing activities, and offers features such as bulk actions, role-based permissions, and Stack integrations to enhance platform functionality.

AppFolio Property Manager Max, the most comprehensive offering, builds upon the features of AppFolio Property Manager Plus, addressing the specific needs of even larger property management organizations. This includes a comprehensive end-to-end leasing funnel with integrated CRM capabilities, increased customization options through user-defined fields, unrestricted access to the customer database via an application programming interface, and dedicated customer success management support.

Value Added Services

AppFolio value added services that enhance core functionalities, automating and streamlining critical business processes and workflows. These services, often mission-critical, are built upon existing core solutions and typically fall within the categories of marketing and leasing, electronic payment services, business optimization, and risk mitigation.

Payments: services that streamline receivables and payables. These services facilitate secure online and mobile payments from various stakeholders, such as applicants, residents, vendors, and property owners, covering a wide range of transactions, including application fees, security deposits, rent payments, and other tenant charges, as well as owner contributions and community association dues. Furthermore, electronic fund disbursements to property owners, vendors, and the management company itself are also supported.

Tenant screening: services encompass background checks, credit checks, income verification, and streamlined rental history verifications, facilitating a more efficient and comprehensive rental application process.

Risk mitigation: FolioGuard Smart Ensure is a software tool that enables property managers to enforce insurance coverage requirements within leases by tracking property coverage and facilitating the addition of uncovered units to a qualifying landlord insurance policy through a licensed insurance broker. Additionally, FolioGuard Renters Insurance, provided by AppFolio Insurance Services, Inc., a wholly-owned subsidiary of AppFolio, offers protection for renters' personal belongings and the property itself from certain unforeseen damages.

Revenue Model & Unit Economics

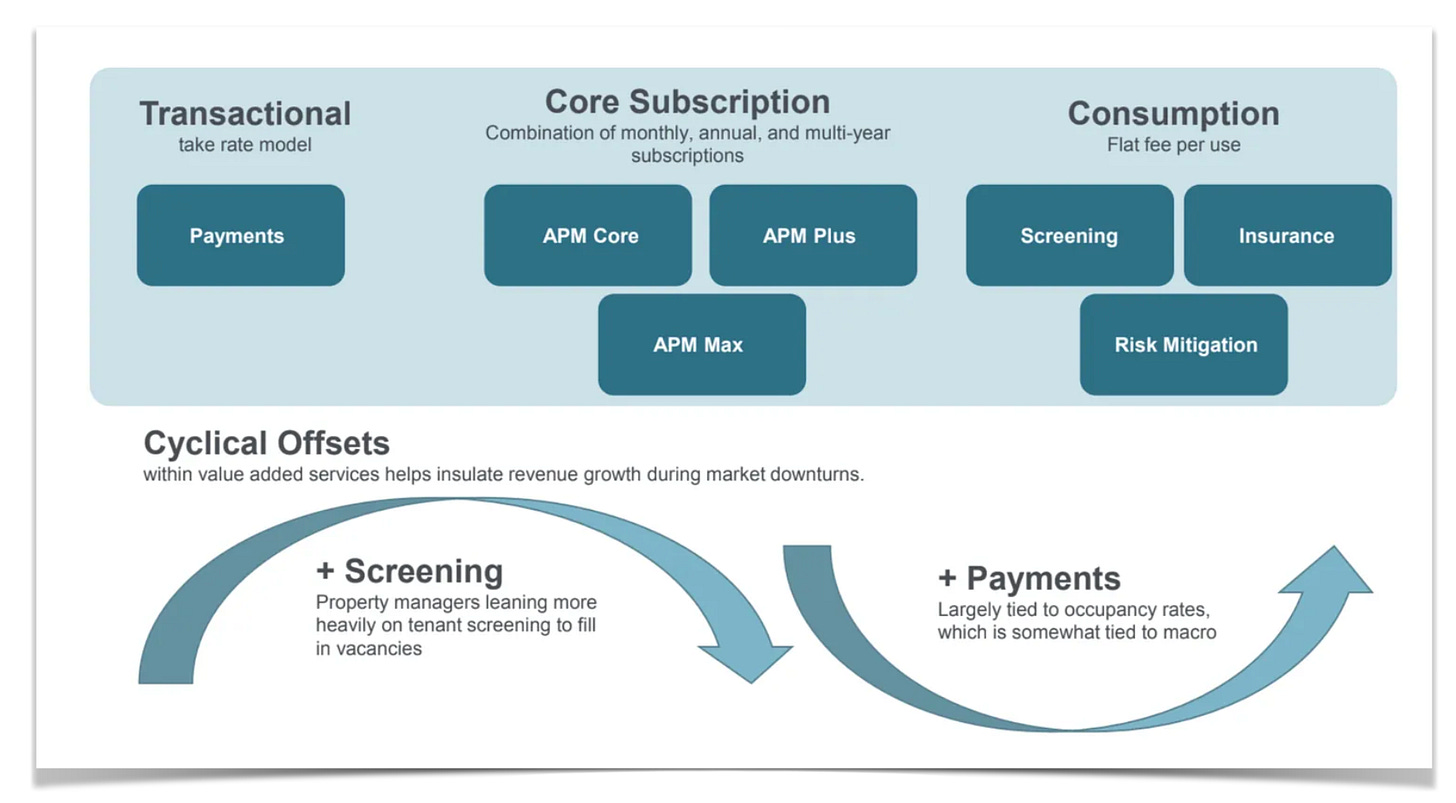

AppFolio employs a diverse pricing model, reflecting the variety of its products and value-added services. This model encompasses core subscription offerings, as well as transactional and consumption-based pricing.

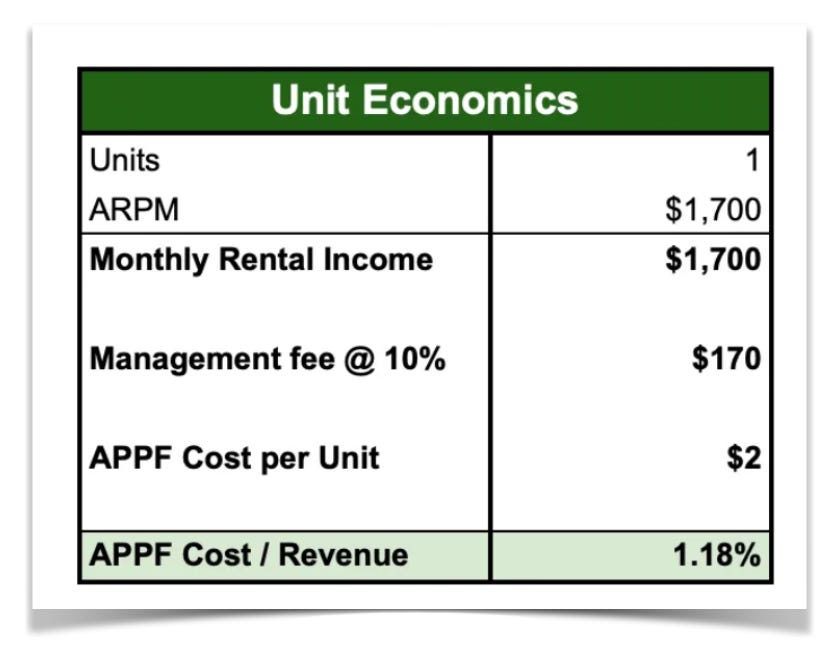

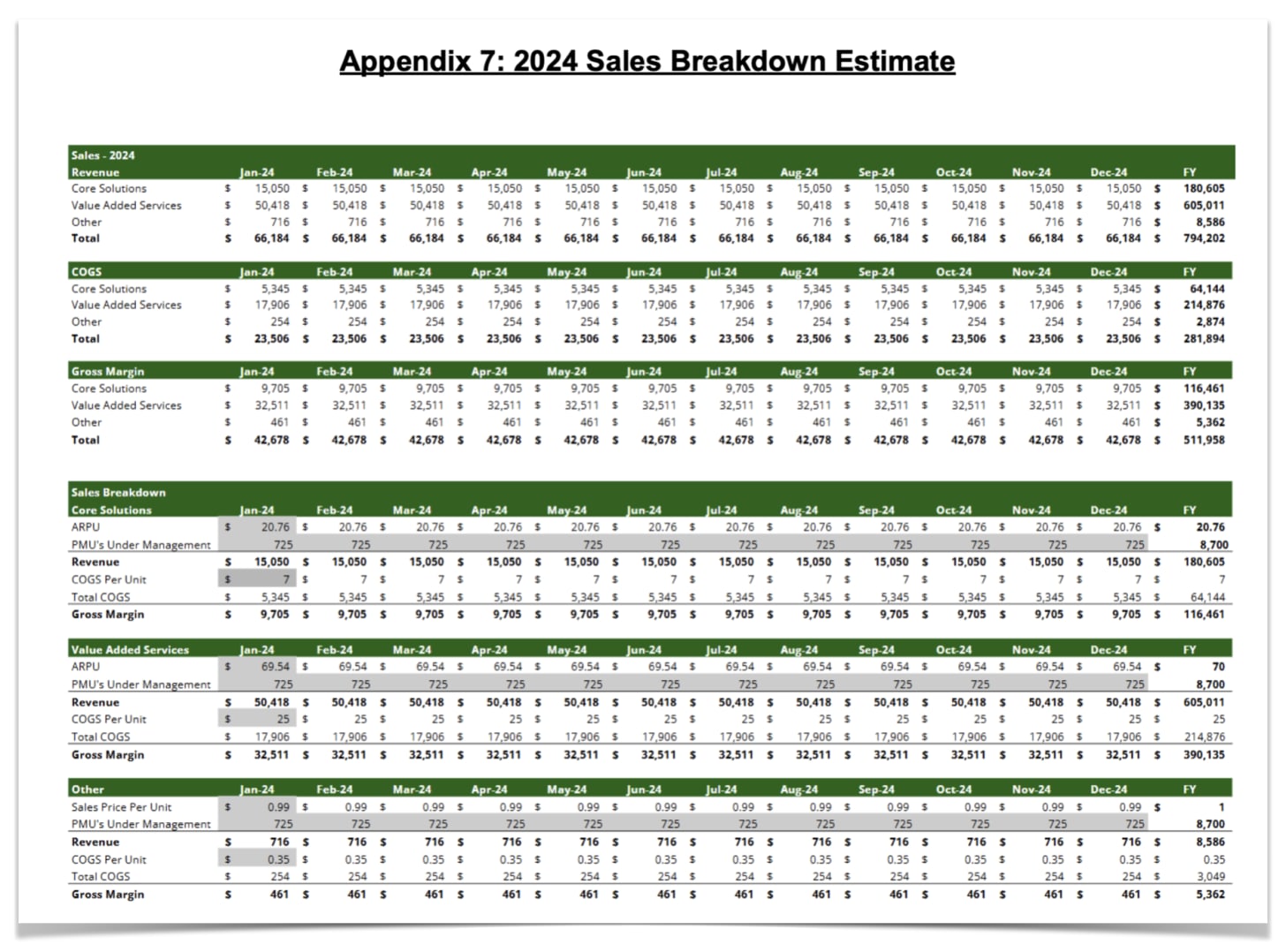

AppFolio, on average, generates revenue of approximately $6 to $7 per unit per month. This revenue stream typically comprises $1.70 from core software subscriptions and roughly $5.00 from value-added services such as tenant payment processing, maintenance coordination, and tenant screening. It's important to note that property managers often pass a significant portion of these value-added service costs onto their tenants. In fact, property managers themselves generate profit margins from many of the value-added service workflows for which AppFolio charges the landlord.

Property managers typically earn a management fee of approximately 10% of the rental income per unit. Property Management is a labor-intensive industry, requiring staff to handle various tasks such as marketing, scheduling and conducting rental viewings, coordinating maintenance, and managing accounting and reporting for property owners. Labor costs often constitute over 75% of their overall expenses. AppFolio's platform digitizes these core workflows, streamlining operations and increasing efficiency, which ultimately helps Property Managers save significant time and money.

Since PM’s typically pass through the cost of value-added services to tenants, the cost of AppFolio's core software represents less than ~2% of the PM's overall revenue.

Rental Workflow on AppFolio

To understand the value of the APPF platform, let's analyze the rental process from the PM’s viewpoint, starting with the onboarding of a new unit from an owner.

Marketing & Leasing

AppFolio seamlessly integrates with 82 of the most popular listing sites, including Zillow and Realtor.com, to effectively market rental units. PM’s can easily list properties with detailed descriptions and photographs on the AppFolio platform, which then automatically distributes this information across these third-party sites.

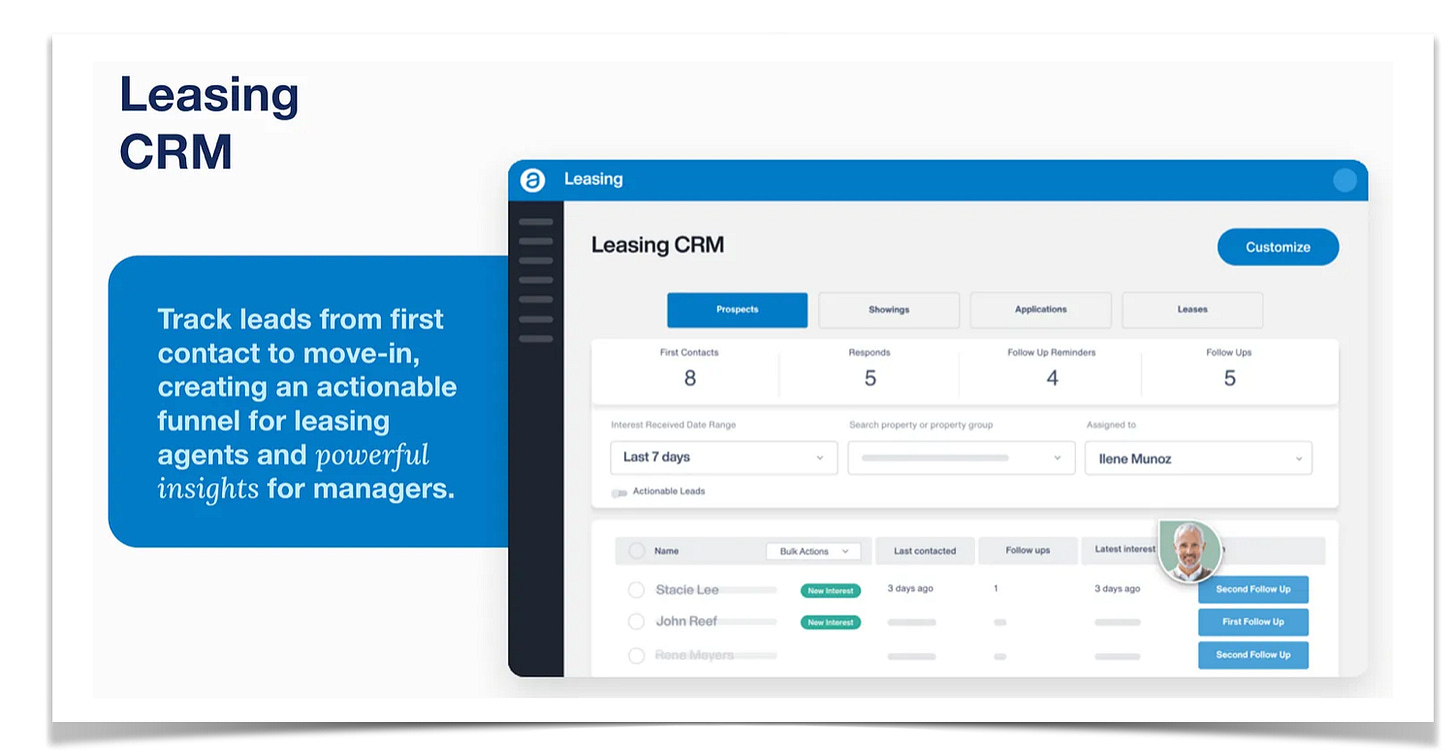

When a potential tenant expresses interest in a listed property, AppFolio presents inquiries directly within the platform. These tenant leads can be efficiently managed within AppFolio's Leasing CRM, which is available as an add-on, or integrated with third-party CRM solutions.

Traditionally, property managers relied heavily on leasing agents to handle inquiries, qualify leads, and schedule property viewings. AppFolio offers an innovative solution with "Lisa," an AI-powered leasing assistant that automates the scheduling process, significantly streamlining the leasing workflow.

Managing a high volume of leasing inquiries, potentially hundreds or thousands for larger portfolios, demands significant labor resources. Lisa, AppFolio's AI leasing assistant, is designed to streamline this process, saving Property Managers both time and money. Lisa is priced at approximately $2 per unit per month. Similar to other AI based tools at the moment, the quality of Lisa, requires quality and accurate data input from the PM. Customer have had issues in the past where Lisa was scheduling multiple tours a day at homes that were still occupied. As of right now, Lisa appears to be more suitable for a multi-family building where the model unit could be shown repeatedly, however, over time we expect Lisa to improve dramatically.

Screening

The PM's responsibilities after a successful viewing include conducting thorough tenant screenings, encompassing both credit and criminal background checks.

AppFolio's embedded screening tool enjoys an 80% penetration rate, highlighting its strong position within the screening market. While screening can be considered a relatively commoditized service, AppFolio's strategic advantage lies in its deep integration within its existing platform, enabling it to capture a significant share of the screening market as its customer base continues to grow. A key differentiator for AppFolio lies in its vertically integrated technology stack. Unlike competitors like Yardi and RealPage, which rely on integrations with third-party screening companies, AppFolio operates its own credit reporting agency. This vertical integration streamlines the user experience, reducing costs and processing time compared to competitors.

AppFolio charges PMs approximately $20 per tenant screening, while PMs typically charge tenants $50 for this service. This results in reported gross margins exceeding 70% for AppFolio, after accounting for payments to Experian and other third-party providers. Screening processes are subject to strict compliance regulations to prevent discrimination. Notably, the screening process differs significantly between single-family and multi-family properties compared to affordable housing, where PMs can’t earn additional margins for Section 42 (low income) tenants.

It's important to acknowledge that some PMs refrain from conducting criminal background checks due to concerns about potential legal repercussions, specifically the risk of facing lawsuits related to disparate impact and unintentional discrimination. In 2023, AppFolio recorded a $7 million liability stemming from a legal settlement, as outlined below:

On February 10, 2023, AppFolio was named as a defendant in a lawsuit filed in the First Judicial District Court of New Mexico (Murphy v. AppFolio, Inc., No. D-101-CV-2022-02100). The lawsuit alleged violations of the New Mexico Unfair Practices Act and negligent misrepresentation in connection with the company's tenant screening services.

In late November 2023, the parties reached a settlement agreement, and a notice of settlement will be filed with the court. It is important to note that this settlement does not constitute an admission of wrongdoing by AppFolio.

AppFolio has conducted an assessment of the potential liabilities associated with this matter and determined that a loss is probable. As of December 31, 2023, the company recorded a $7.0 million liability in Accrued Expenses to reflect this potential loss.'

Insurance

Upon successful tenant screening, all tenants gain access to the tenancy portal. This online platform enables tenants to view upcoming rent payments, submit maintenance requests, and explore insurance options.

Recognizing the strategic value of this segment, AppFolio has vertically integrated its insurance offerings. The company owns and operates AppFolio Insurance Services and Terra Mar Insurance Company, subsidiaries specializing in landlord and tenant insurance and reinsurance.

With approximately 8.4 million tenants accessing the platform daily, AppFolio leverages this significant reach to effectively distribute its insurance products. For instance, while making a rent payment, tenants are conveniently presented with the option to purchase renters insurance for as little as $20 per month. The sign-up process is streamlined and entirely online, facilitated by AppFolio's existing access to tenant information such as rent payment history and social security numbers. This vertical integration enhances the customer experience and contributes to the rapid growth of AppFolio's insurance business, currently demonstrating an estimated attach rate of approximately 25% with ongoing expansion. We estimate insurance is less than 2% to AppFolio's overall revenue.

AppFolio directly issues policies and assumes the associated risks, supported by a robust reinsurance framework. This direct-to-consumer model offers a significant advantage: in periods of low claim activity, AppFolio directly participates in the resulting profitability.

Maintenance

Maintenance is a critical aspect of property management, significantly impacting tenant satisfaction and retention. However, it also presents a significant labor burden for PMs.

Traditionally, AppFolio offered a basic phone-answering service for maintenance requests, charging PMs approximately $1 per unit per month. This service involved AppFolio employees receiving tenant calls and then scheduling maintenance appointments with the PM's internal or external vendors.

In 2022, AppFolio introduced Smart Maintenance, a more comprehensive solution priced at $2-3 per unit per month. This module enables tenants to submit work orders and upload photos directly through the AppFolio mobile or desktop app. Smart Maintenance operates 24/7 and leverages AI to intelligently diagnose and route maintenance requests to preferred vendors.

Property Managers often pass on the cost of maintenance services to tenants, generating a profit margin on these services. This revenue stream is typically more lucrative than screening for PMs. Maintenance charges are typically based on the nature of the work and whether it can be handled in-house or requires the involvement of external vendors.

While AppFolio aims to increase its pricing power for maintenance services, the availability of low-cost alternatives, such as outsourcing call center services to regions with lower labor costs, may limit AppFolio's ability to do so.

Payments

AppFolio owns a payment processor that constitutes a significant portion of its revenue, estimated to be between 60% and 65% of AppFolio's total revenue. In 2023, AppFolio introduced a $2.49 fee for processing Automated Clearing House (ACH) payments. Landlords have the option to either absorb this fee themselves or pass it on to tenants. Our research indicates that over 80% of AppFolio's payment revenue originates from tenant rent payments, with the remainder derived from payments to owners and other vendors. Approximately 85% of AppFolio's customer base currently utilizes its payment processing service.

AppFolio records payment revenue on a gross basis and negotiates interchange fees for credit and debit card payments as well as processing fees for ACH transactions. Tenants can utilize various payment methods, including ACH, debit or credit cards, checks, money orders, and cash. The preferred payment method among tenants varies depending on factors such as the type of rental unit and geographical location. According to iPropertyManager, the overall rental payment mix in the United States is as follows:

Payments made via credit/debit card are 18% of card payments online.

eCheck payments are 59%.

Scanned checks have decreased to 21% of rent payments.

Rent paid via money orders has not changed, remaining at 3%.

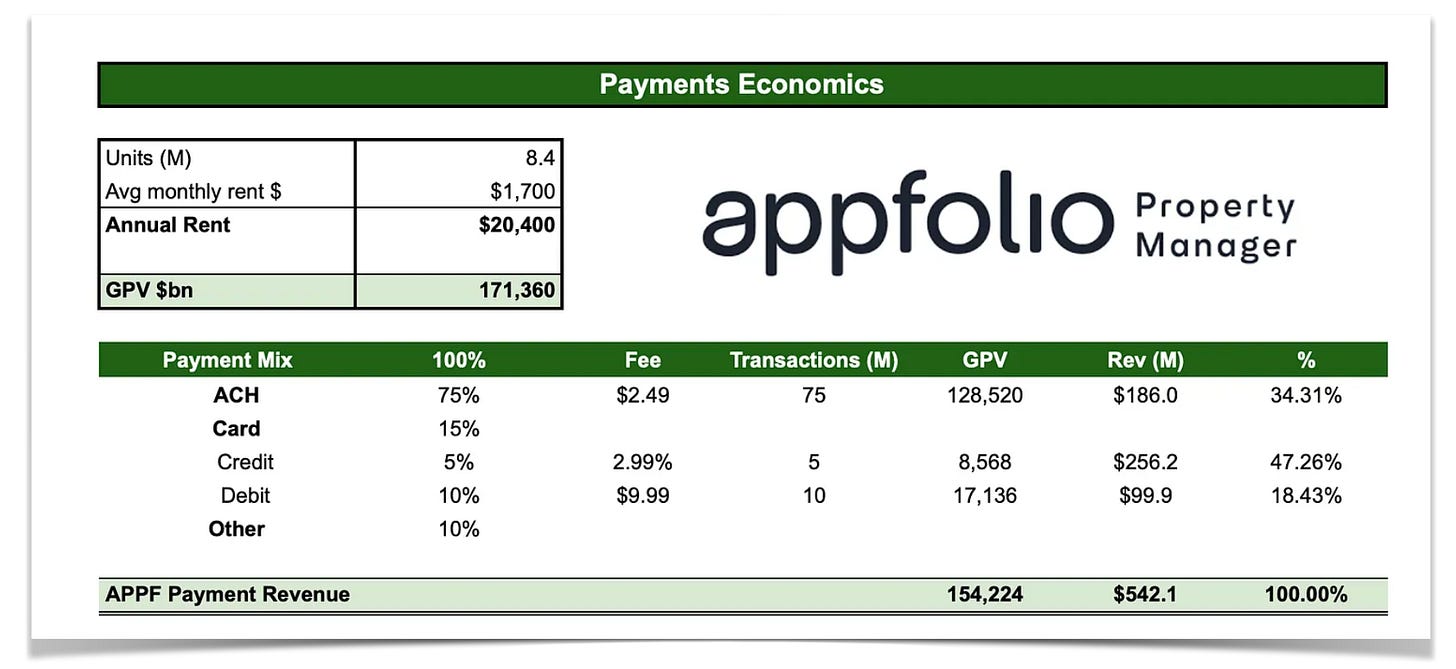

Based on internal channel checks and considering AppFolio's focus on market-rate properties, we estimate that approximately 75% of its payment volume is processed through Automated Clearing House (ACH) transactions. AppFolio charges $2.49 per ACH transaction, 2.99% for credit card transactions, and $9.99 per debit card transaction.

Assuming an average monthly rent of $1,700 for multifamily units in the U.S., the current payment mix for AppFolio may be approximated as follows:

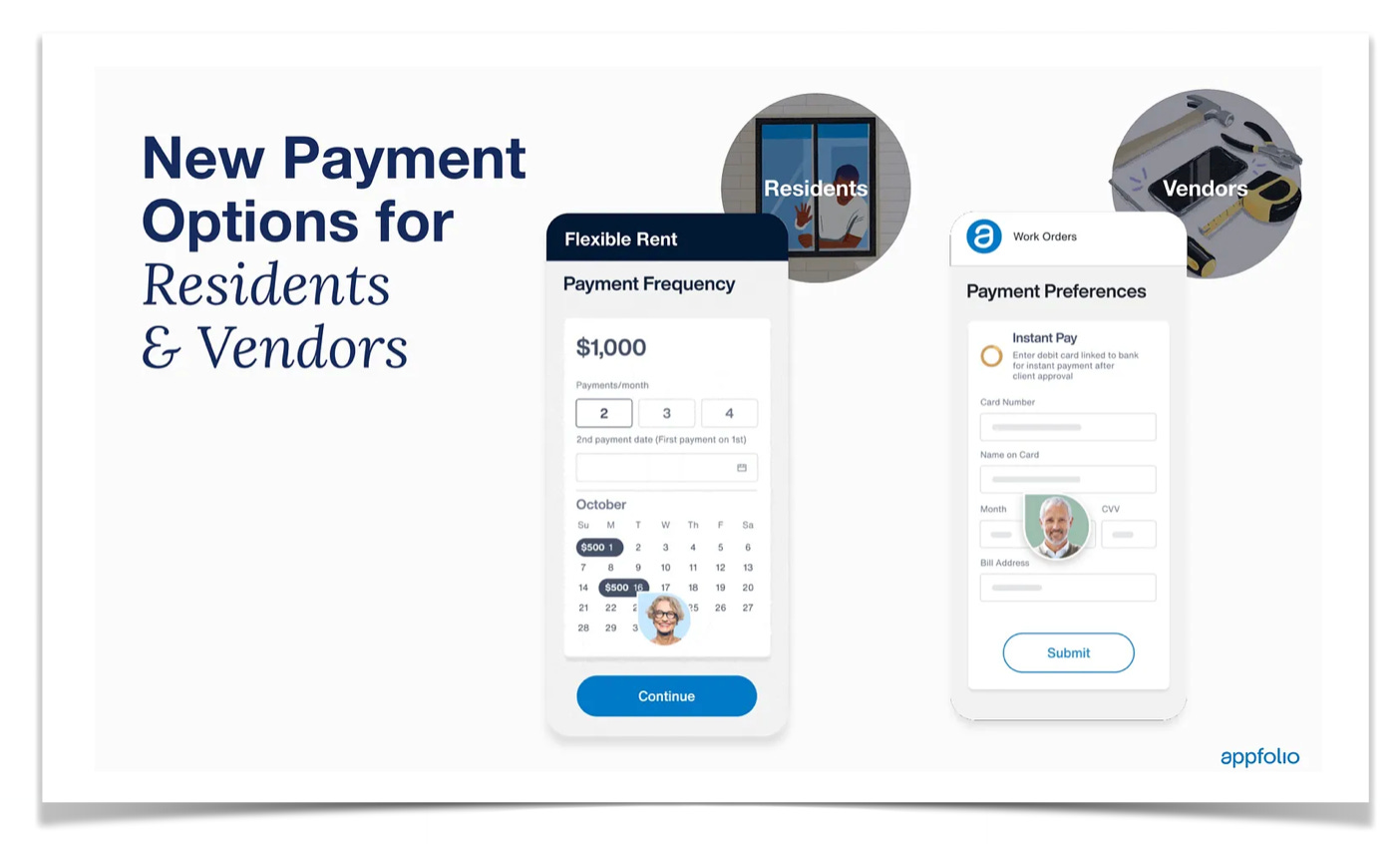

In 2023, AppFolio introduced Flex Payments, a new feature allowing tenants to make multiple smaller rent payments throughout the month instead of a single full payment. Since AppFolio charges a fixed fee per ACH transaction, the adoption of Flex Payments has the potential to increase payment revenue.

While credit card transactions may account for a relatively small portion of overall payment volume (approximately 5%), they can generate a substantial portion of AppFolio's payment revenue, potentially reaching 50% of total payment revenue and 25% of overall company revenue. AppFolio's ability to negotiate favorable interchange rates with card networks, typically in the range of 200-250 basis points, results in significant interchange margins on these transactions.

Financial Overview

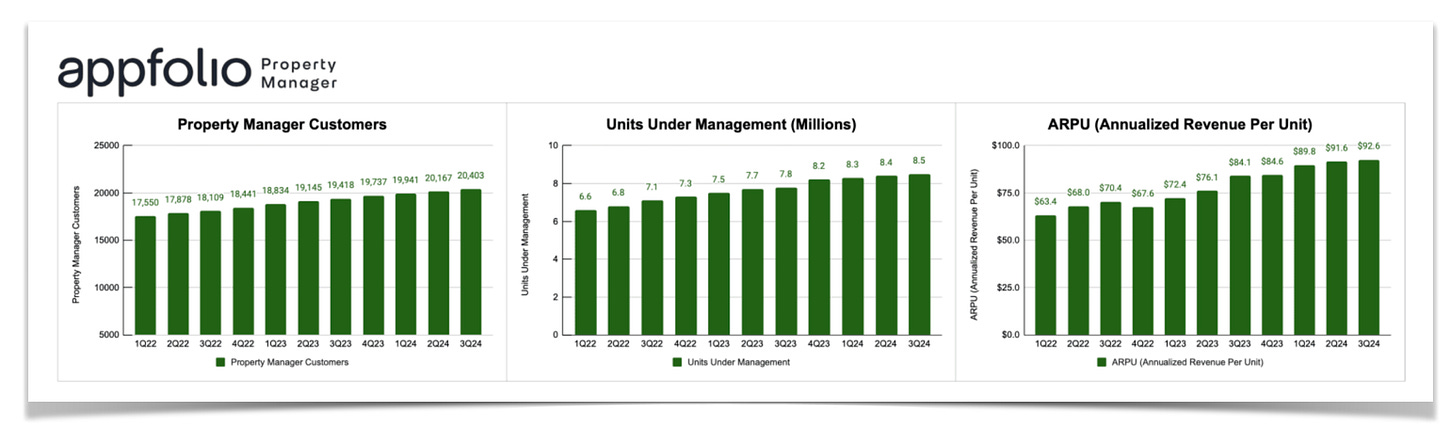

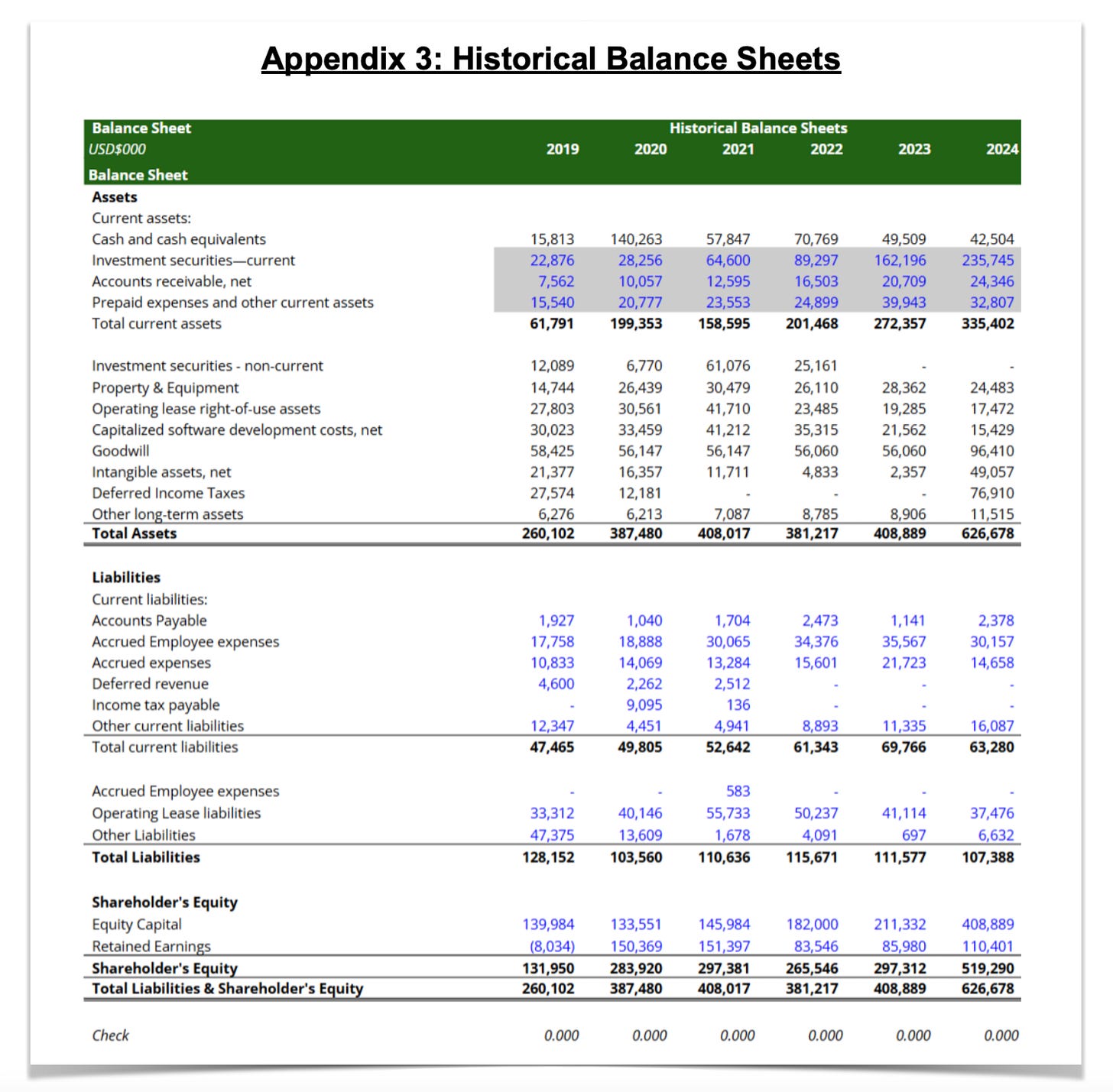

Since its IPO, AppFolio has shown remarkable growth. The company has operated with strong capital efficiency, raising just $100 million since its founding (comprised of $25 million in private funding and $75 million at its IPO), while keeping management dilution low at only 0.7% per year. Looking back to 2014, AppFolio has achieved significant growth in key areas. Units under management have grown by approximately 19% annually, and average revenue per user (ARPU) has increased by about 10% each year. Furthermore, revenues have compounded annually at a rate of 33%, and gross profits have seen an even stronger compound annual growth rate of 35%.

This highlights their ability to attract customers and increase revenue over time. More recently, since the first quarter of 2022, AppFolio has maintained strong quarterly growth, with ARPU increasing by 4%, units under management by 3%, and customer count by 1.52%.

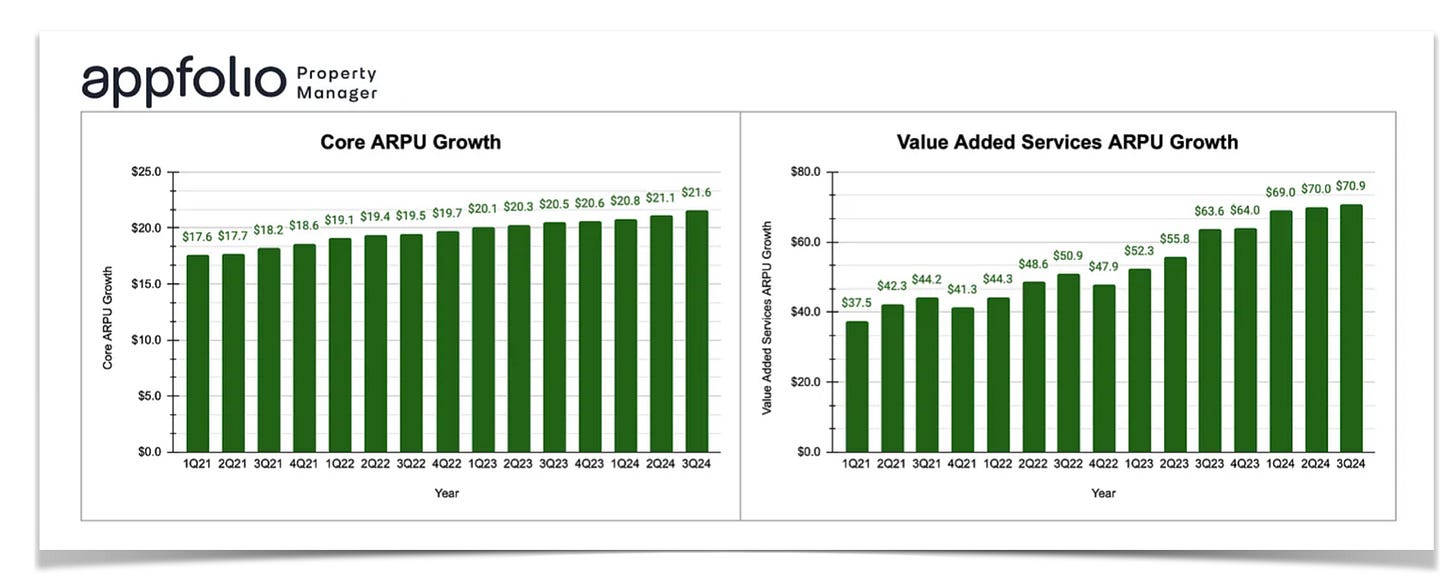

AppFolio's growth is primarily driven by two segments: core subscription growth and value-added services growth. Core subscription fees have seen a 5.7% compound annual growth rate (CAGR) since the first quarter of 2021, fueled by increased adoption of higher-tier offerings like Plus and Max as customers seek more advanced features such as database APIs, CRM, Stack partner solutions, and Realm AI capabilities.

However, value-added services have been the strongest driver of ARPU growth. Increased payment fees, higher payment attach rates, and new fintech services have resulted in an exceptional 23% CAGR for value-added ARPU since Q1 2021. This segment now represents 76% of AppFolio's revenue mix, a significant increase from 46% in 2013.

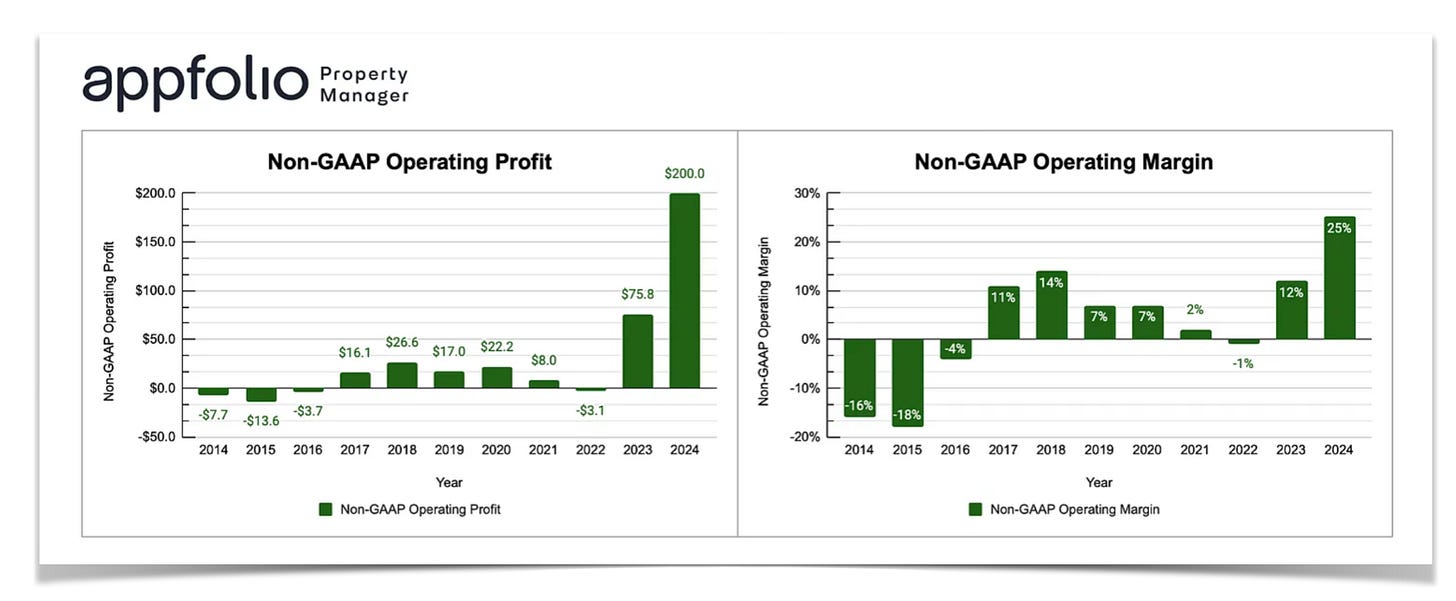

New innovations around product, pricing, fintech services, and AI features have the potential to supercharge vertical SaaS business models, in our view. Several new monetization levers have repositioned APPF for accelerating top-line growth and improving profitability. Revenue growth on TTM basis has accelerated to 28% vs. prior three-year average of 23% while operating profits reached $200 million (exceeding the prior ten years combined). All of the above is good for a “rule of 40” of 46%.

Skin in the Game: Aligning Incentives at AppFolio

IGSB, as a long-term investor, prioritizes maximizing FCF/Share over short-term growth for the purpose of exiting an investment. This focus is evident in AppFolio's minimal share dilution, with only a 1% increase in outstanding shares between 2019 and 2024, contrasting sharply with the frequent and significant dilution observed among typical SaaS companies. This long-term perspective is further reinforced by the substantial personal investment of Tim Bliss and Reece Duca, senior partners at IGSB, who collectively retain approximately 25% of AppFolio's shares, representing ~40% of the Class B voting power while founder and board observer, Klause Schauser controls 20.9% of the voting power. While this doesn’t guarantee success, it does help to know your capital is invested alongside what appears to be long-term oriented owners.

Total Addressable Market & Competitive Landscape

Total Addressable Market

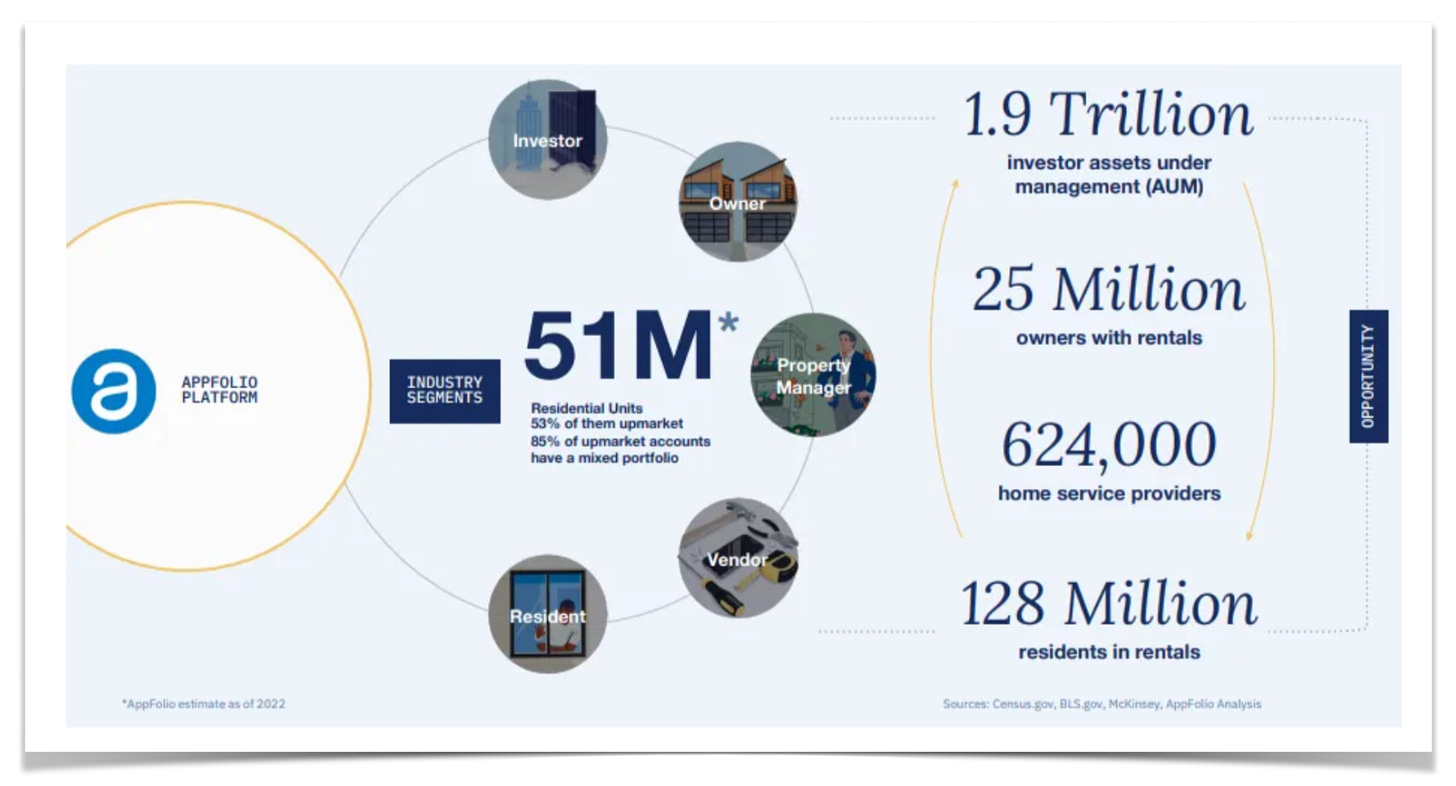

In 2023, the US had approximately 46 million residential units, growing at a 20-year CAGR of 1.4%. The number of rental units is influenced by factors such as housing supply, affordability, and relative yields compared to mortgage rates and now makes up ~35% of the U.S. housing industry.

After refocusing on residential units during it’s 2023 analyst day de-emphasizing ~ 28 million community association units, AppFolio estimates its total addressable market (TAM) at 51 million units, encompassing various property types including single and multi-family, student housing, senior living, mobile homes, and privatized military housing.

Industry leader ALN data indicates that the 46 million rental units are roughly distributed as follows:

~ 4 million units owned by the top 50 multifamily owners

~16 million other multifamily units

~ 12 million single-family institutional units and;

~ 14 million single-family non-institutional units

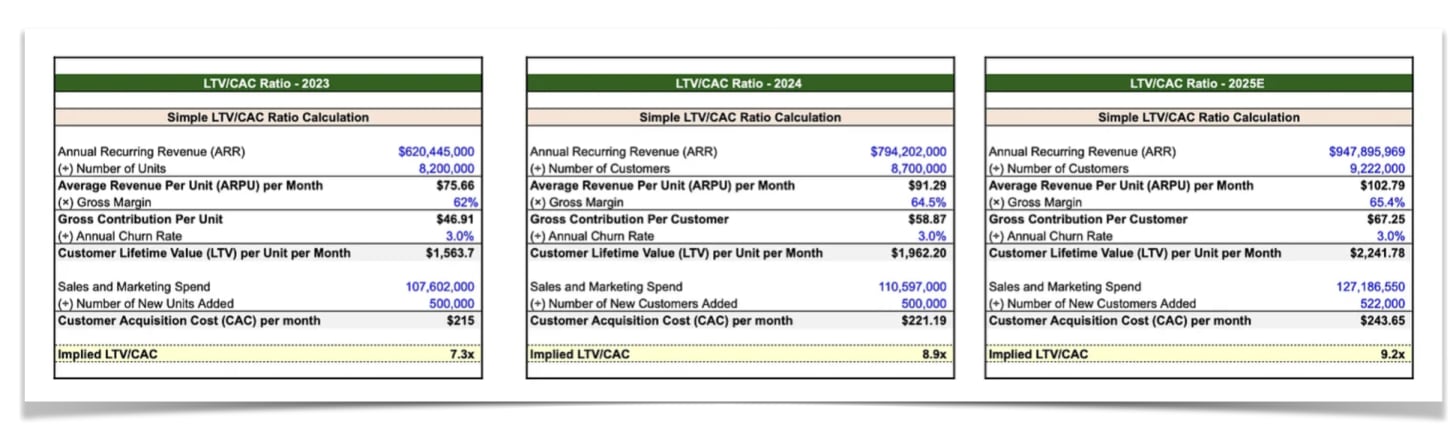

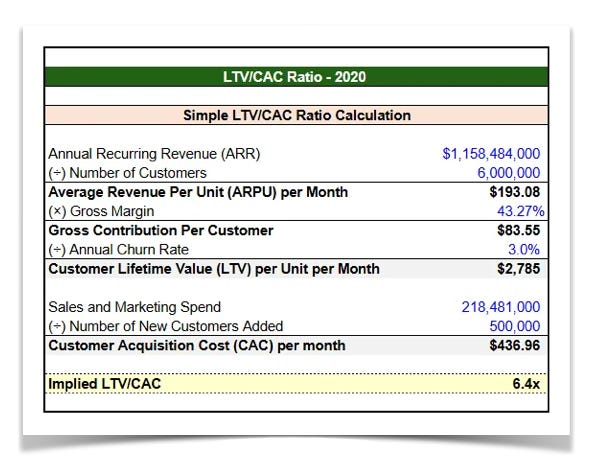

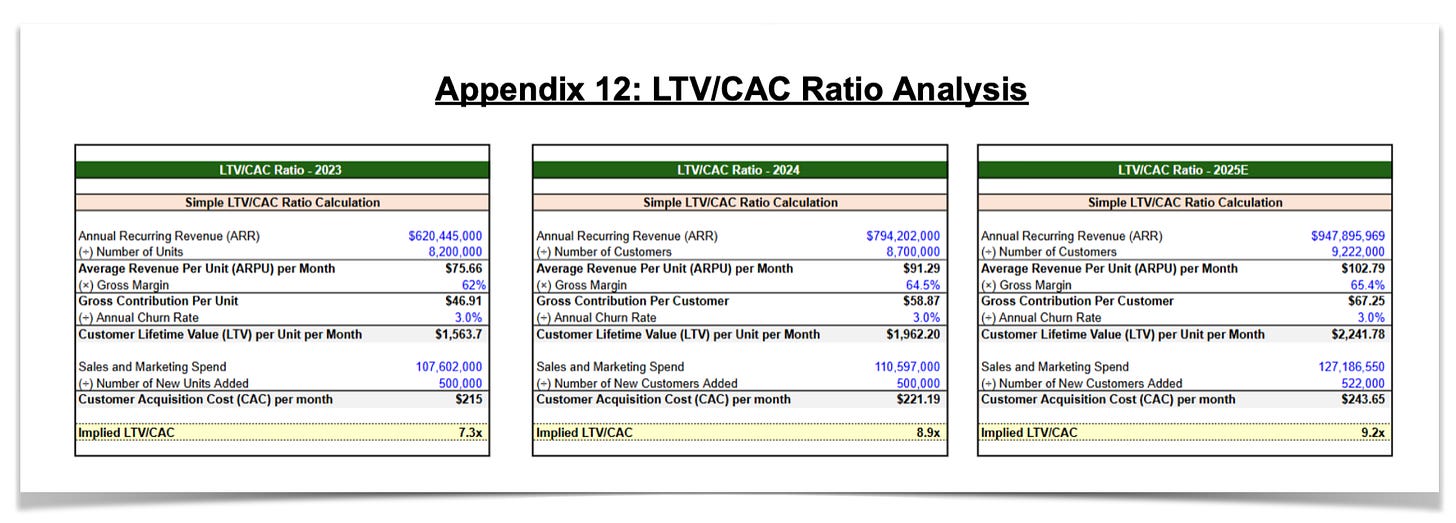

We believe that the 14 million non-institutional units are likely not addressable for AppFolio, as many individual owners manage properties with basic tools like Excel and QuickBooks. AppFolio focuses on customers managing at least 50 units because the investment is better spent on customers who will not churn at the lower end. This is evident based on our CAC/LTV estimates presented below:

Considering the addressable market of approximately ~30m million residential units, we estimate that AppFolio has about 27% market share of units based on the following breakdown:

Yardi, with ~8-12m units based on some estimates.

RealPage, with ~ 8m units. This is ~6m core ERP customers + ~2m units that Buildium had when RealPage acquired them.

AppFolio, with 8.7m units.

Entrata, with ~2.6m units. as of 2022, but we estimate they could have 3.5m units by end of 2024.

Despite the seemingly saturated US residential market, AppFolio has gained market share from Yardi and RealPage due to its superior product and modern architecture. AppFolio reports that approximately 53% of its TAM is "upmarket," with 85% of upmarket customers managing mixed-use properties. Upmarket customers, typically managing 1,500 units or more, require a sophisticated ERP to handle diverse property types and workflows.

In 2020, RealPage estimated its TAM at 65 million units, including commercial and vacation rentals. They projected a $16 billion annual market for property management software, with estimated annual revenue per unit ranging from $310 for single-family to $500 for multi-family units. AppFolio currently generates less than $100 in annual revenue per unit.

Competitive Landscape

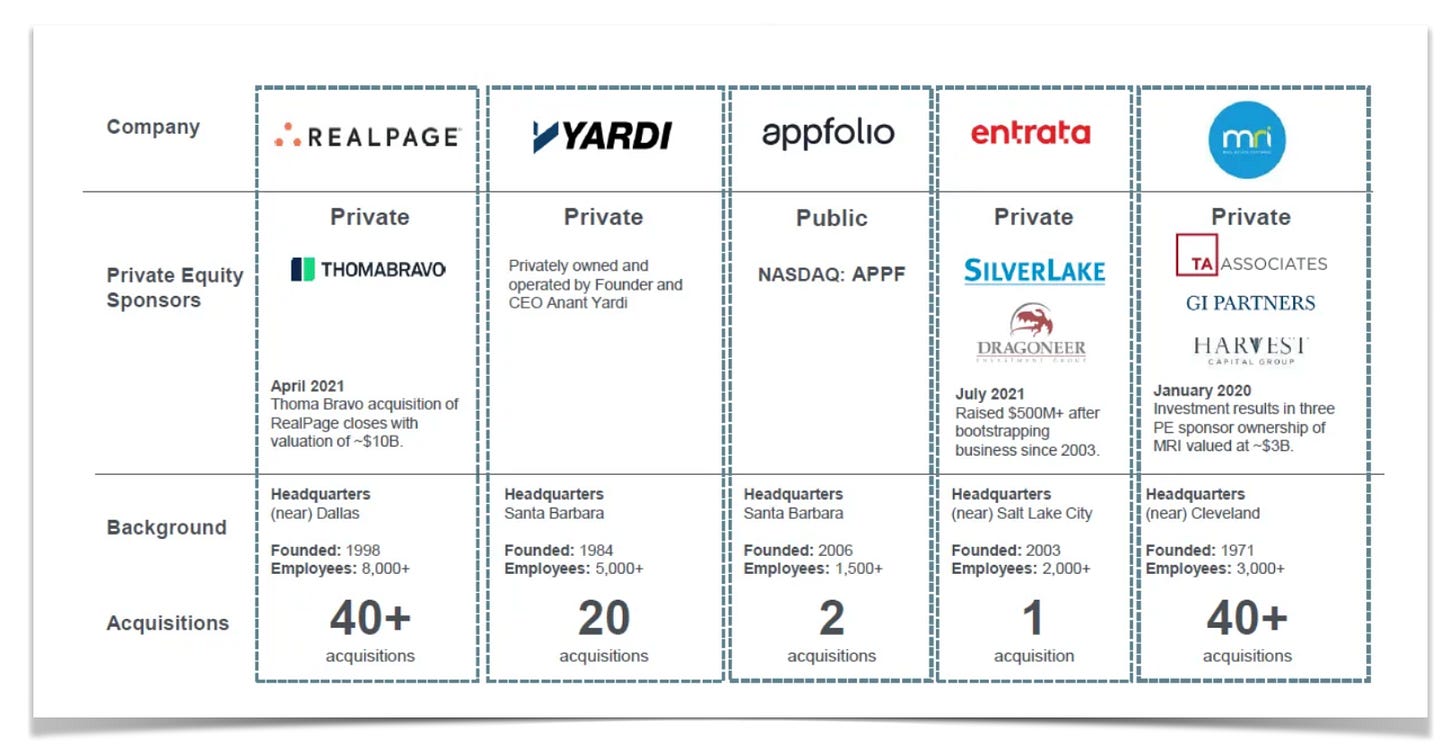

The property management software market has consolidated over the past 30 years and we estimate that ~ 80% of aggregate market share is controlled by the top five players.

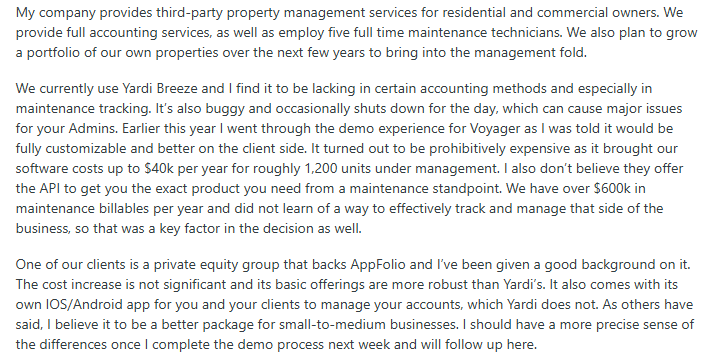

The market however, is dominated by three main players: AppFolio, Yardi Systems and RealPage. Yardi, established in 1982, is known for Voyager, its legacy enterprise solution. Voyager, akin to Oracle in complexity and cost, caters primarily to the largest players in the market and specializes in its accounting features. In response to AppFolio's success with SMBs and its upmarket expansion, Yardi launched Breeze, a web-based offering. However, Breeze has received limited R&D investment compared to AppFolio's solutions, resulting in AppFolio maintaining a competitive advantage in deal wins.

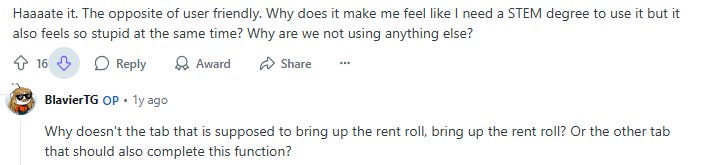

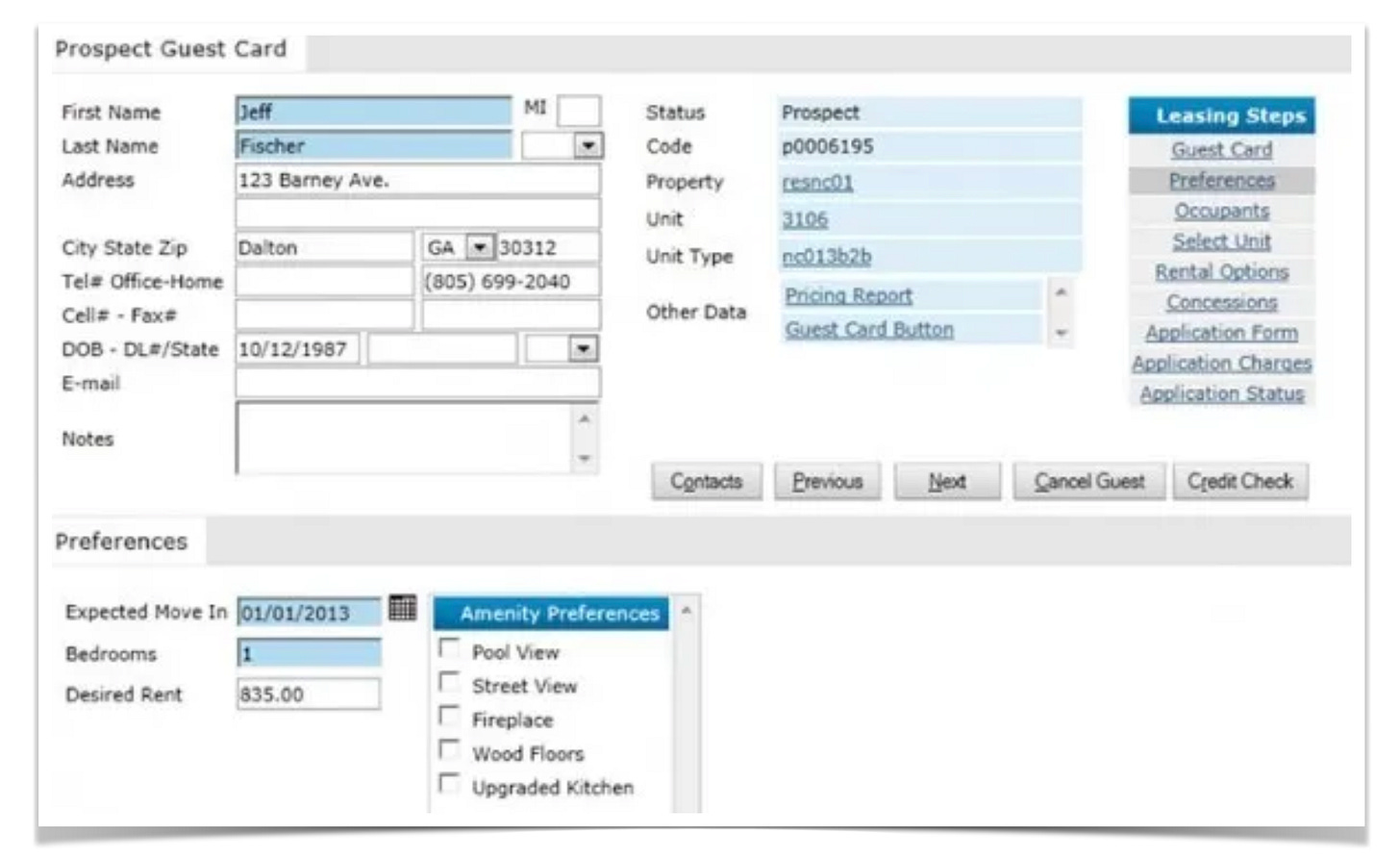

RealPage, an amalgam of acquired software and services, suffers from underinvestment and a lack of product integration, leading to customer frustration. Since its 2021 acquisition by Thoma Bravo, RealPage has prioritized cost-cutting and margin expansion, potentially neglecting product innovation, which could further enhance AppFolio's competitive advantage. RealPage's financial leverage, rated 7x by Fitch, presents a significant risk. This, coupled with the ongoing litigation and the company's less efficient reinvestment strategy (detailed in the reinvestment section of this memo), creates a competitive disadvantage versus AppFolio. Beyond the user experience issues (discussed further below), these factors raise concerns about RealPage's ability to compete effectively.

Elevating & Scaling the Customer Experience

AppFolio's unified, vertically integrated platform offers a superior customer experience, intuitive UI design, and enhanced overall efficiency. We believe these factors are key differentiators, positioning AppFolio as best-in-class and driving its continued success. As one investor told us, “AppFolio is the "Apple" of the industry whereas Yardi is like a Nokia flip phone. The best part of Yardi is the accounting features, but outside of that the rest of the modules are terrible.”

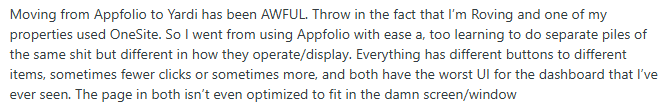

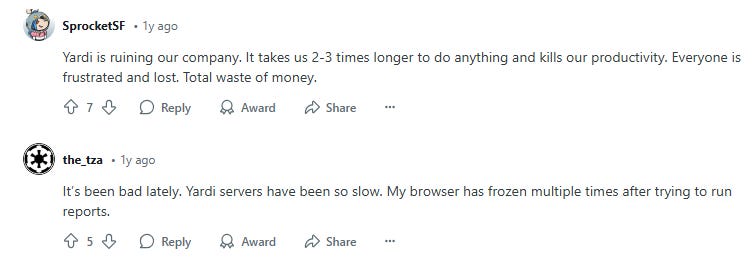

A review of online sentiment regarding Yardi compared to AppFolio reveals consistent themes, including:

These examples, while numerous, illustrate a consistent pattern in customer feedback comparing RealPage/Yardi toAppFolio: RealPage is frequently criticized for its clunky user experience. A cursory examination of UI’s reinforces this perception; its dated design evokes MS-DOS more than a modern SaaS platform.

Furthermore, RealPage is currently embroiled in a lawsuit concerning its "Revenue Management Software." The complaint alleges that RealPage facilitates anticompetitive information sharing among landlords and utilizes this data in pricing algorithms that artificially inflate rents for multifamily housing. This was actually stated by their own employee that this is the only thing that differentiates their product and now that’s going away. We think this is a big deal and would be yet another reason to switch away from RealPage.

Retention

Market research and industry interviews conducted by In Practise indicate a 10% average annual churn rate for Property Management Systems (PMS), translating to a 10-year average customer lifespan. This aligns with the methodology employed by AppFolio, as described by a former SVP, who confirmed their practice of assessing market size (number of units) and calculating the available Total Addressable Market (TAM) based on this 10% annual churn. Applying this to a hypothetical 50 million unit residential market suggests 5 million units annually are in flux, highlighting the significant long-term value of acquired customers. Notably, internal AppFolio data revealed a sub-3% churn rate for customers switching to their platform, implying a significantly longer 20-year customer lifetime value for acquired accounts.

Organic Growth Drivers & Cash Profitability

Organic Growth Drivers

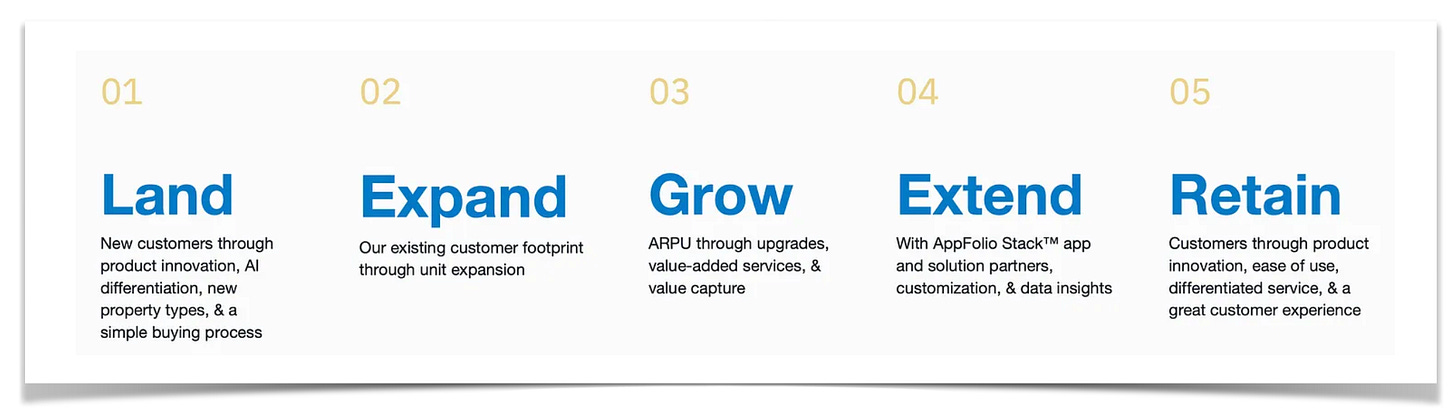

We anticipate future growth will be driven by the following factors:

An increase in the number of units managed - this is the most important factor for APPF’s organic growth. We expect units managed to grow at 6% through 2026, slowing to 3% by 2029.

Deeper penetration of AppFolio Property Manager Plus.

Increased monetization of transactional revenues.

New value-added services.

Price increases - we expect price increases to grow at the same pace of inflation at a rate of 2-5% annually.

Cash Profitability

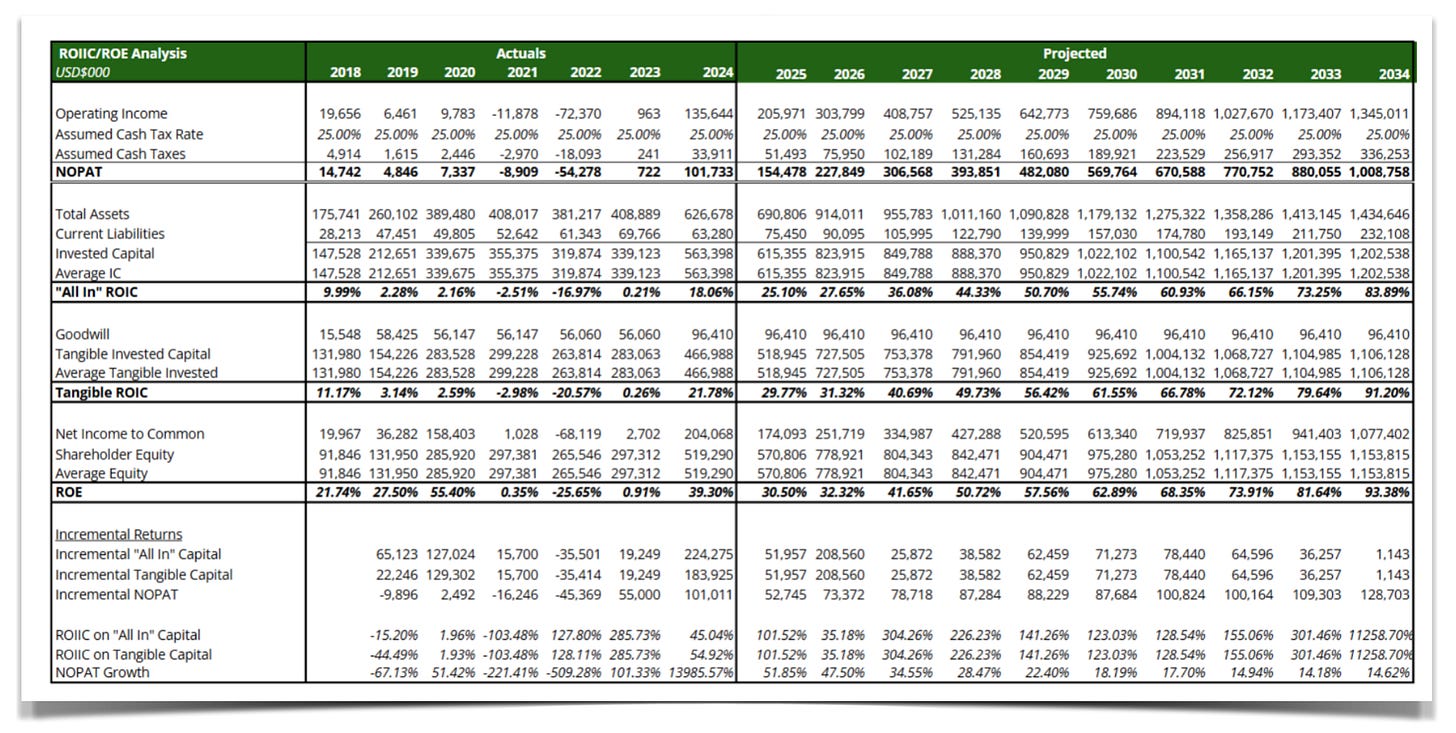

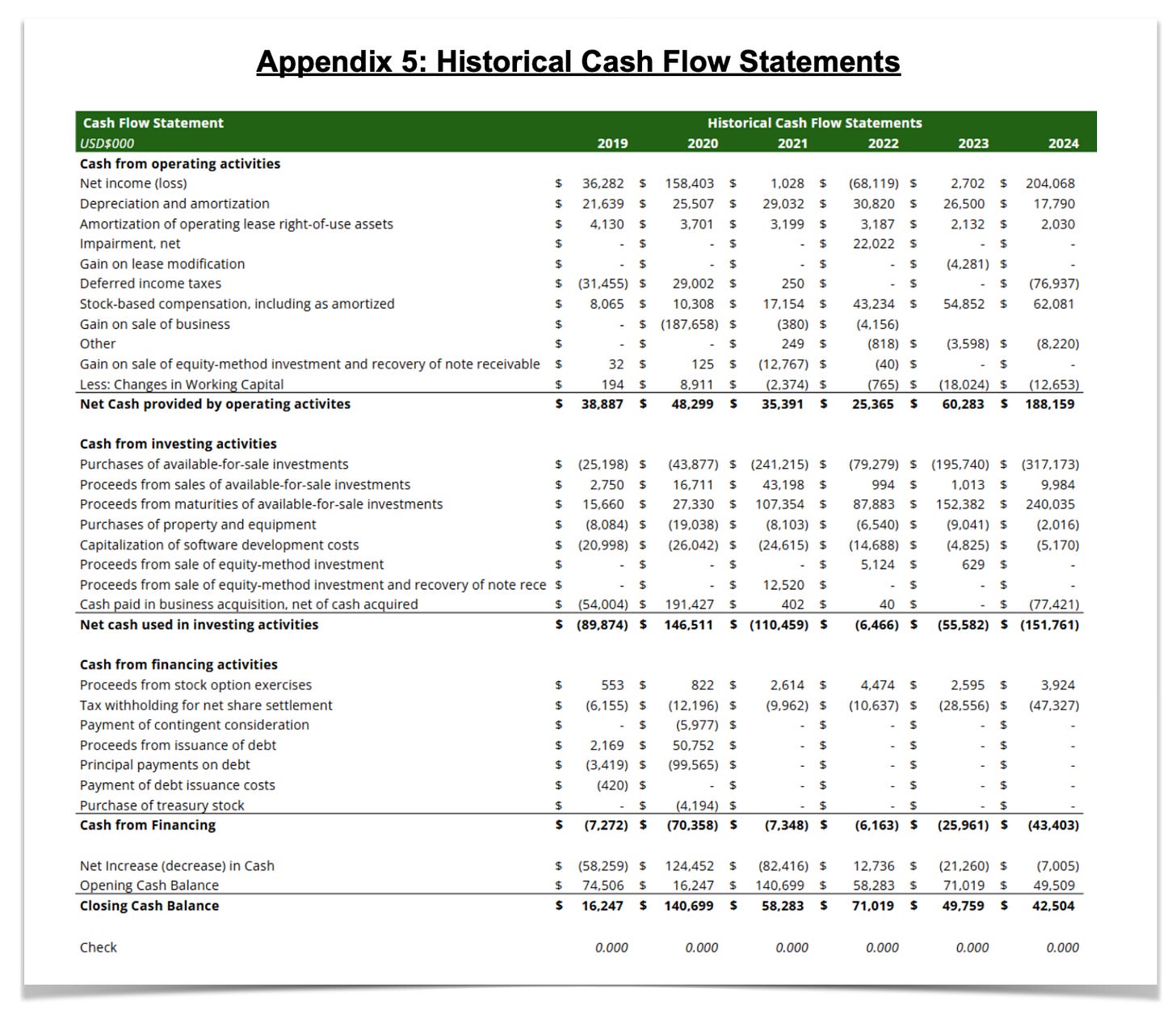

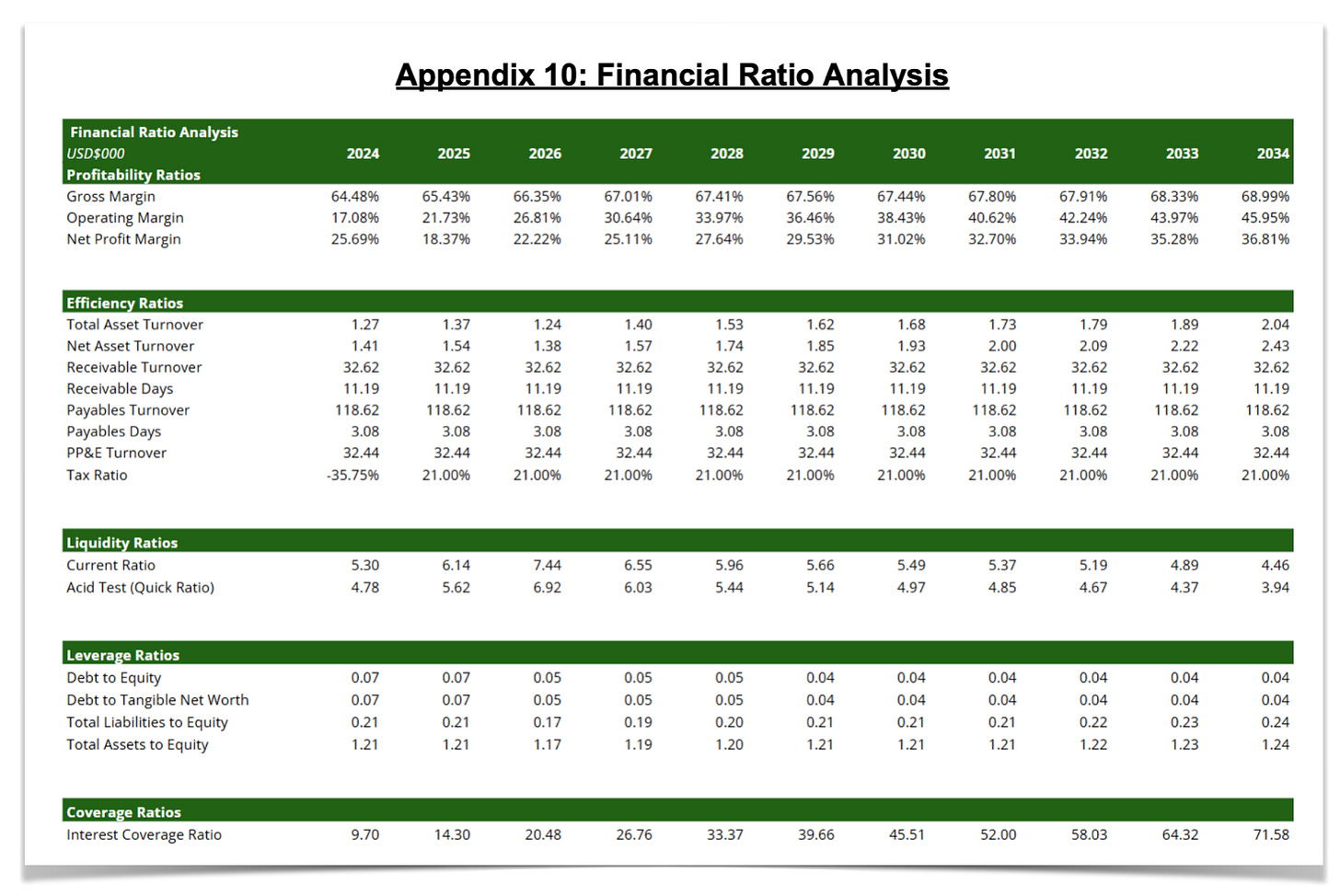

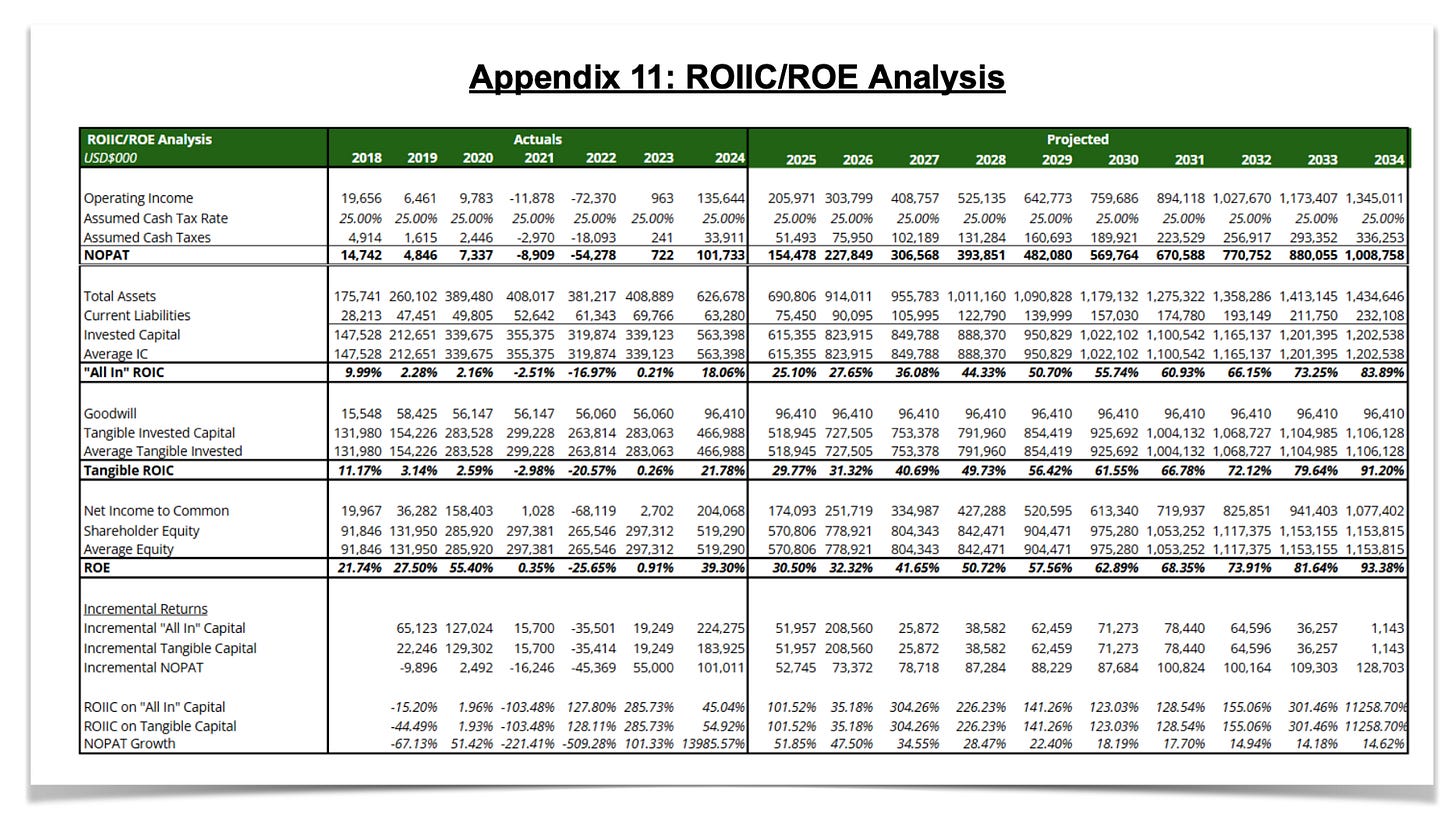

Below is our estimate of net operating profit after tax, ROIC, ROIIC and returns on equity:

AppFolio's cumulative diluted earnings per share over the past five years are misleading due to significant non-recurring items. The $4.62 GAAP EPS in 2020 was primarily driven by the MyCase sale, while the -$1.95 GAAP EPS in 2022 was an outlier due to the Covid-19 pandemic. These figures are not representative of normalized earnings. Operating leverage began to emerge in 2024, providing a clearer picture of the business's true potential.

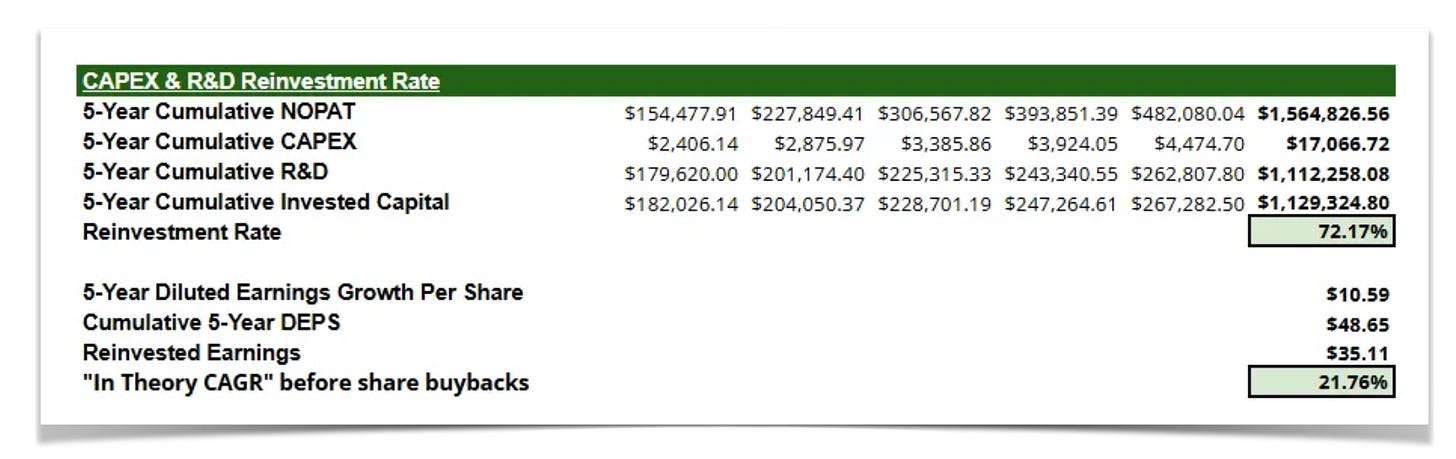

Looking ahead to 2025-2029, we project cumulative earnings per share of $48.50. We anticipate a reinvestment rate of 72.17%, primarily focused on R&D as AppFolio pursues upmarket opportunities, with minimal CAPEX requirements. Assuming these estimates are realized and excluding the impact of anticipated share buybacks beginning in 2027, AppFolio is projected to generate $10.59 of diluted EPS growth over the next five years. This implies a 21.76% CAGR, with $35.11 per share of the cumulative $48.50 reinvested back into the business. We then estimate the remaining cash to be used for buybacks.

Capital Allocation & Reinvestment Potential

The playbook for AppFolio below is not unlike many other vertical SaaS companies focused mainly on organic growth.

AppFolio's next phase hinges on successfully penetrating the upmarket segment and demonstrating the scalability and reliability of its solution against established competitors like RealPage and Yardi. Several key data points support our belief in their ability to achieve this. Notably, IGSB's recent appointment of a new management team with extensive experience in scaling enterprise software solutions signals a clear focus on this upmarket expansion.

AppFolio's management (Note: Fay Sien Goon, former CFO has been replaced by Interim Chief Financial Officer Tim Eaton) has significantly ramped up R&D investment, demonstrating their commitment to competing with larger incumbents in the upmarket segment. AppFolio's R&D investment has grown significantly, from approximately $39.5 million (15% of revenue) in 2019 to $160.4 million (20% of revenue) in 2024. This contrasts with competitors like RealPage, whose 2020 product development spend of $134 million represented only 12% of their $1.12 billion revenue base, and was spread across a fragmented portfolio of over 50 platforms. AppFolio's significantly higher R&D spend, nearly double that of RealPage as a percentage of revenue, is focused on a single, unified platform. This targeted investment is driving customer satisfaction and is expected to fuel AppFolio's continued success in capturing up-market share.

Analysis of RealPage’s 2020 financials (their last year as a public company) reveals a significantly lower implied Lifetime Value to Customer Acquisition Cost (LTV/CAC) ratio compared to AppFolio, estimated to be 30-40% lower. This efficiency gap is believed to be widening. While RealPage claims approximately 18 million units, this likely includes customers using any single module, not just their core ERP. Our research suggests a core ERP customer base of approximately 6 million units. In 2020, RealPage generated $1.12 billion in revenue, yielding an ARPU of $193.08, and spent $218 million on Sales & Marketing (20% of revenue). Assuming 500,000 new unit acquisitions in 2020, RealPage's customer acquisition cost (CAC) appears to be roughly double that of AppFolio, despite a comparable revenue base.

These substantial investments by AppFolio is clearly yielding results. As CEO Shane Trigg noted in the Q4 2024 earnings call:

In May, we won our largest customer to-date. In September we won our largest customer to-date. And again in November we won our largest customer to-date. More customers are choosing our Plus and Max plans for their flexibility and extensibility to power their growth. In fact, one in five of our customer units is now on one of these premium plans. One of our many new customers in 2024 is the Breeden company in Virginia Beach, Virginia with 9,800-plus units spanning multifamily and commercial.

Breeden evaluated and ultimately chose AppFolio for our shared commitment to innovation. After seamlessly migrating their entire portfolio, Breeden is now live on our Max plan and has adopted many of our services from payments to AppFolio's stack FolioGuard; AI leasing assistant Lisa; smart maintenance; screening; and websites. According to Bonnie Moore, Breeden's President of Property Management, "We built such a wonderful partnership with AppFolio and that partnership means everything to us. Their team truly listens to everything we have to say and values our input to help us improve." Along with innovation, another way we're standing out in the market is by delivering exceptional service at scale which is a top priority for our customers.

We exited 2024 with a 361% year-over-year increase in instant support case resolutions and a service satisfaction score of 92%. Throughout the year, we consistently earn top recognition from peer-to-peer software marketplace G2, thanks to the feedback from the people who matter most, our customers. The third pillar of our strategy is great people and culture. You've heard about the innovative ways we're differentiating ourselves to win and delivering value efficiently to our customers and it's all made possible through our people.

Further evidence of AppFolio's upmarket traction comes from a Keybanc-hosted call with a 3,000-unit AppFolio customer. This customer reported that AppFolio recently secured a significant 10,000-unit client in Portland, who is in the process of migrating all data to the AppFolio platform. The combination of high incremental margins on new units and increased average revenue per unit (ARPU) makes the ongoing investments in R&D and customer success a highly compelling long-term reinvestment opportunity.

Differentiated View

We are significantly more bullish on AppFolio's revenue growth and future cash generation than the current market valuation and limited sell-side coverage suggest. We see a pattern of déjà vu in sell-side estimates. Recall the prior misinterpretation of AppFolio's reported growth, which declined from 35% in 2019 to 21% in 2020 and 16% in 2021, coupled with near-zero EBIT margins. Analysts at that time incorrectly concluded that the business model lacked operating leverage. This was demonstrably wrong, as AppFolio went on to generate record operating margins of 25% in 2024, exceeding the combined operating income of the prior decade.

This prior miscalculation stemmed from overlooking key factors. Reported growth was distorted by the MyCase sale in September 2020. The core property management business actually grew 23% in 2020 and 26% in 2021, accelerating to 28% and 32% in the last two quarters of that year. The 2020 slowdown was largely attributable to the pandemic, as property managers focused on tenant safety and rent collection. Furthermore, AppFolio's historically conservative guidance, including the current 17% FY25 revenue growth midpoint, continues to be misinterpreted. While the 2024 ACH fee increase contributed to recent growth, analysts are now projecting a slowdown based on the perceived commoditization of payments and downward pressure on ACH fees. This ignores AppFolio's ability to drive value beyond basic payment processing.

Analysts also consistently underestimate the growth potential of vertical market software, assuming limited market size, particularly after AppFolio's exit from the legal vertical. Our analysis, however, points to AppFolio's strong competitive position and significant runway for market share gains and revenue per unit expansion.

Looking ahead, AppFolio's next phase involves strategically reinvesting through the income statement (R&D and Sales & Marketing) to capture up-market share. Analysts are incorrectly assuming these investments will yield diminishing returns, citing the industry's low churn rate. We believe these investments will drive further growth.

Our conviction is rooted in our analysis of unit economics and ownership alignment, which reinforces a long-term focus on maximizing free cash flow per share. The recurring revenue model, low churn, and high gross margins provide a solid foundation.

Finally, the market is undervaluing AppFolio's investment management business, potential expansion into new verticals, and accretive capital allocation opportunities (including M&A, which are not included in our base case forecasts). The investment management platform, a CRM and investor portal for property owners, offers substantial growth potential by leveraging AppFolio's existing real estate customer base.

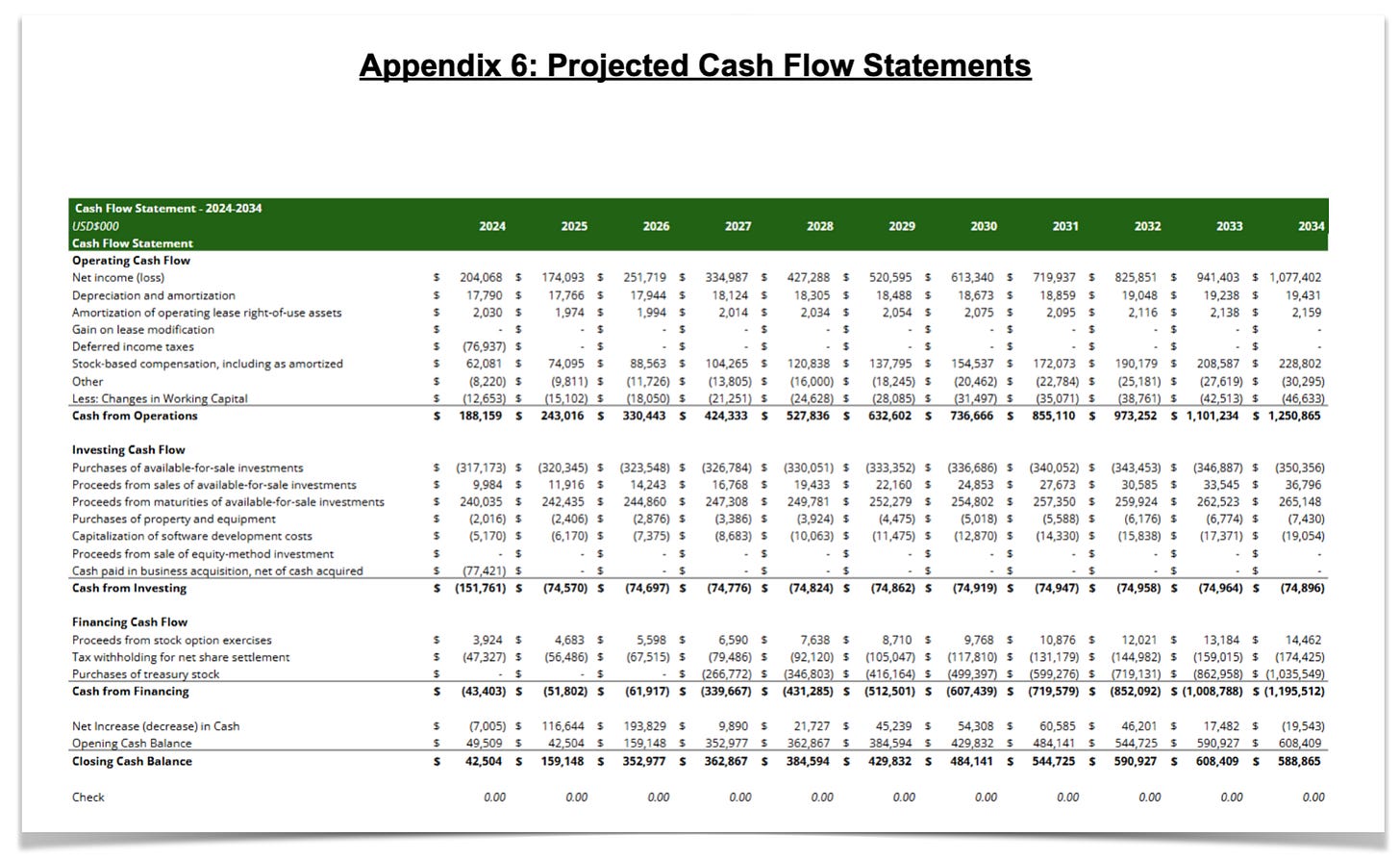

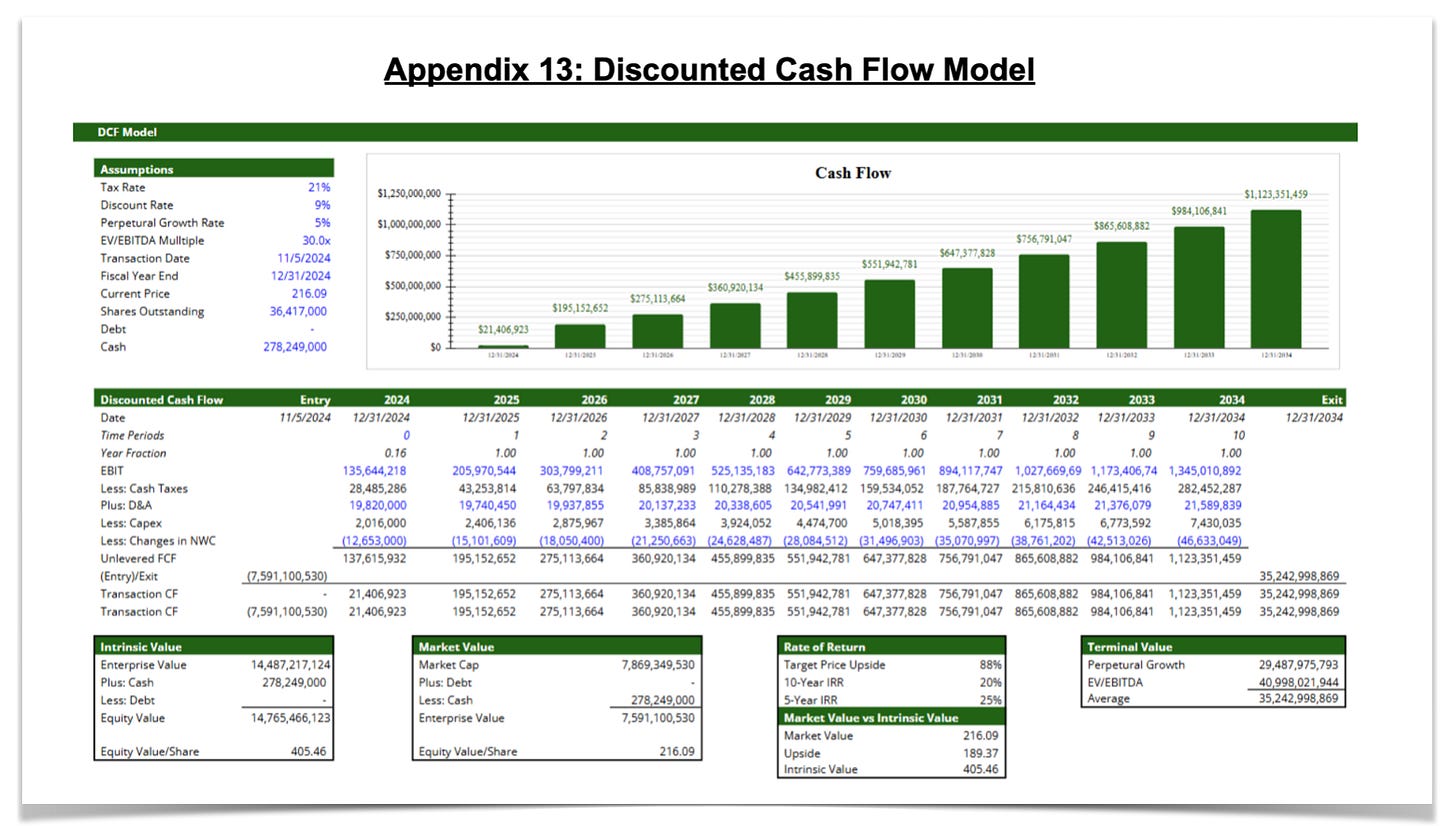

Valuation Model

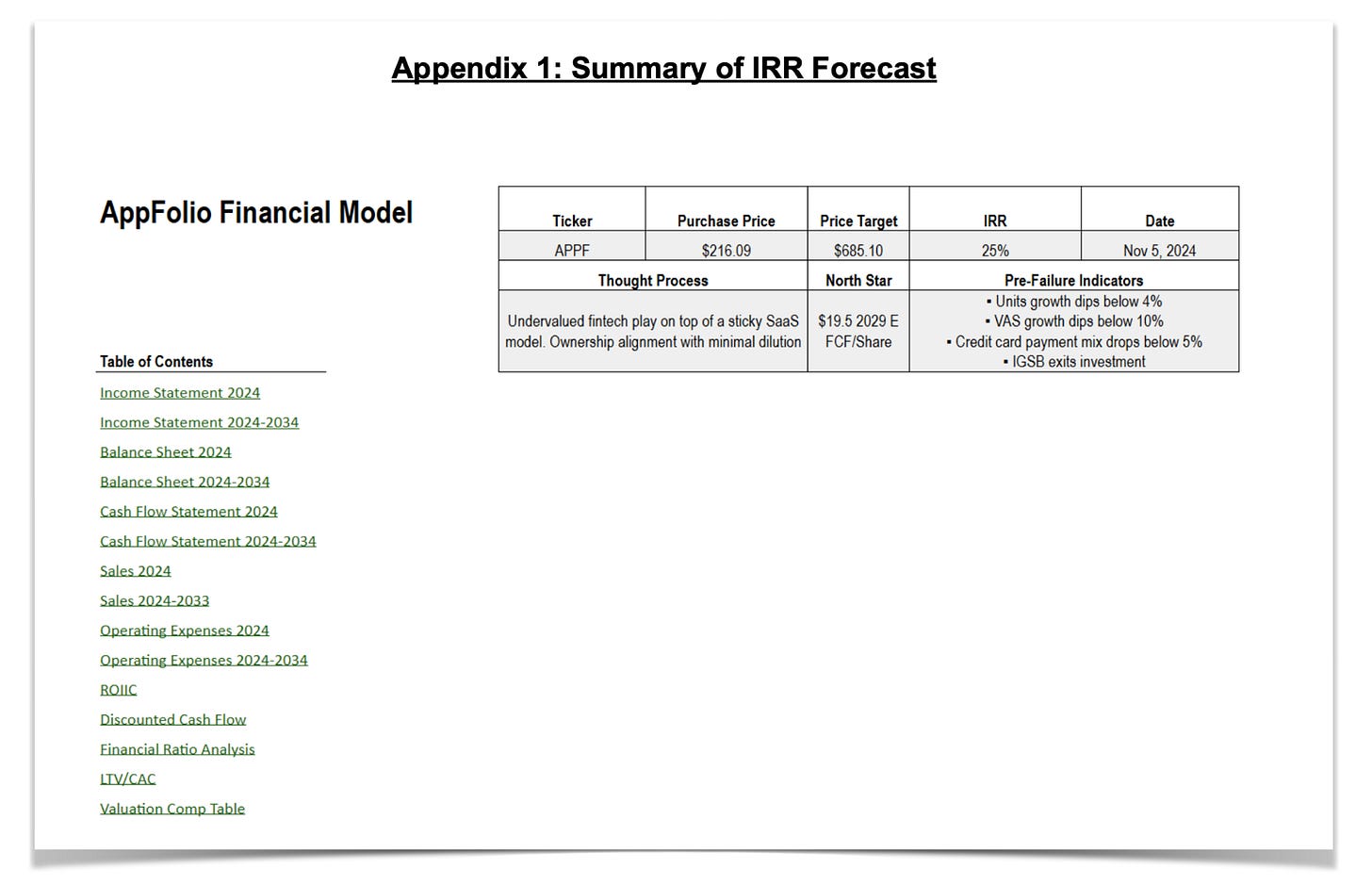

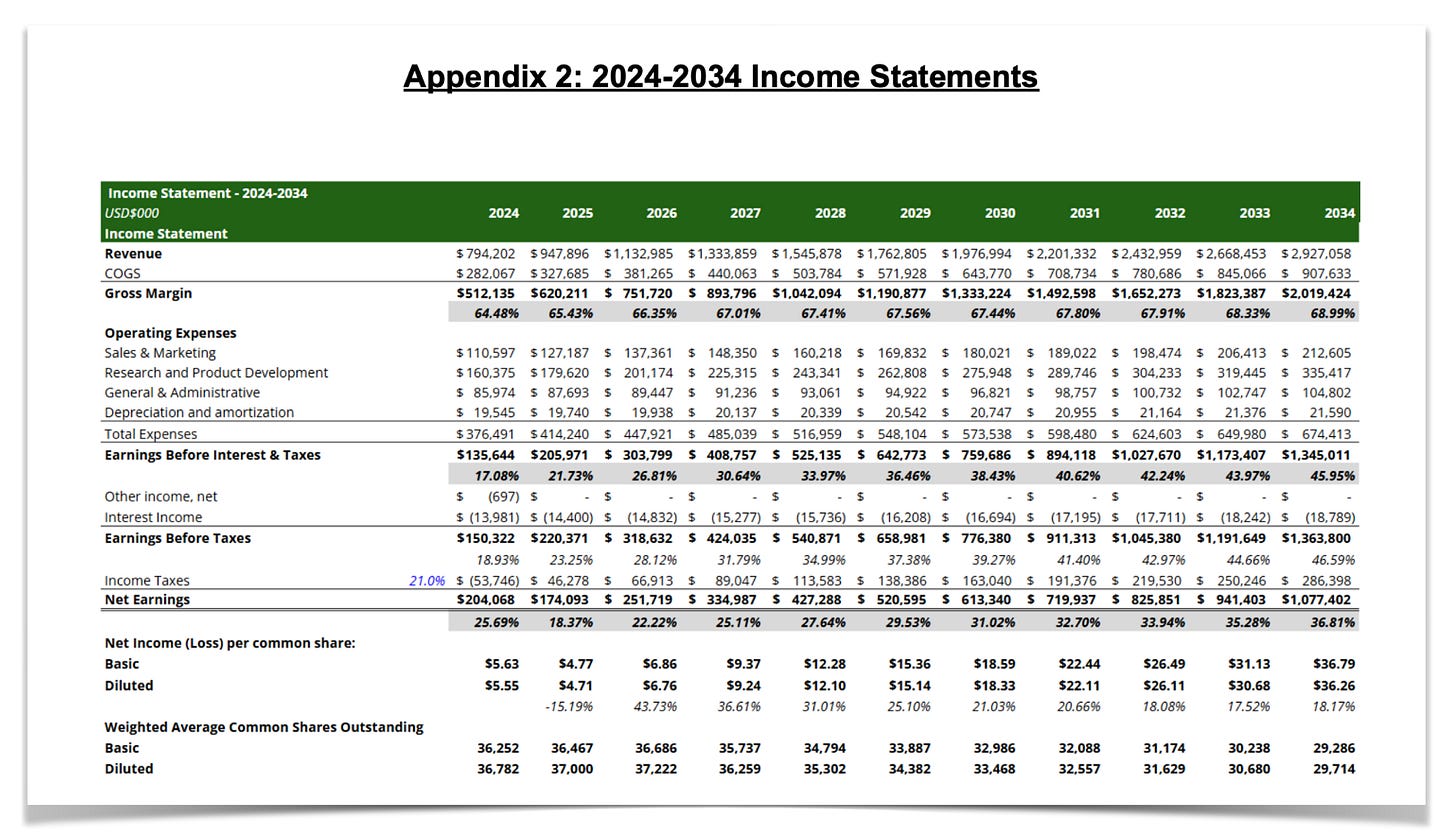

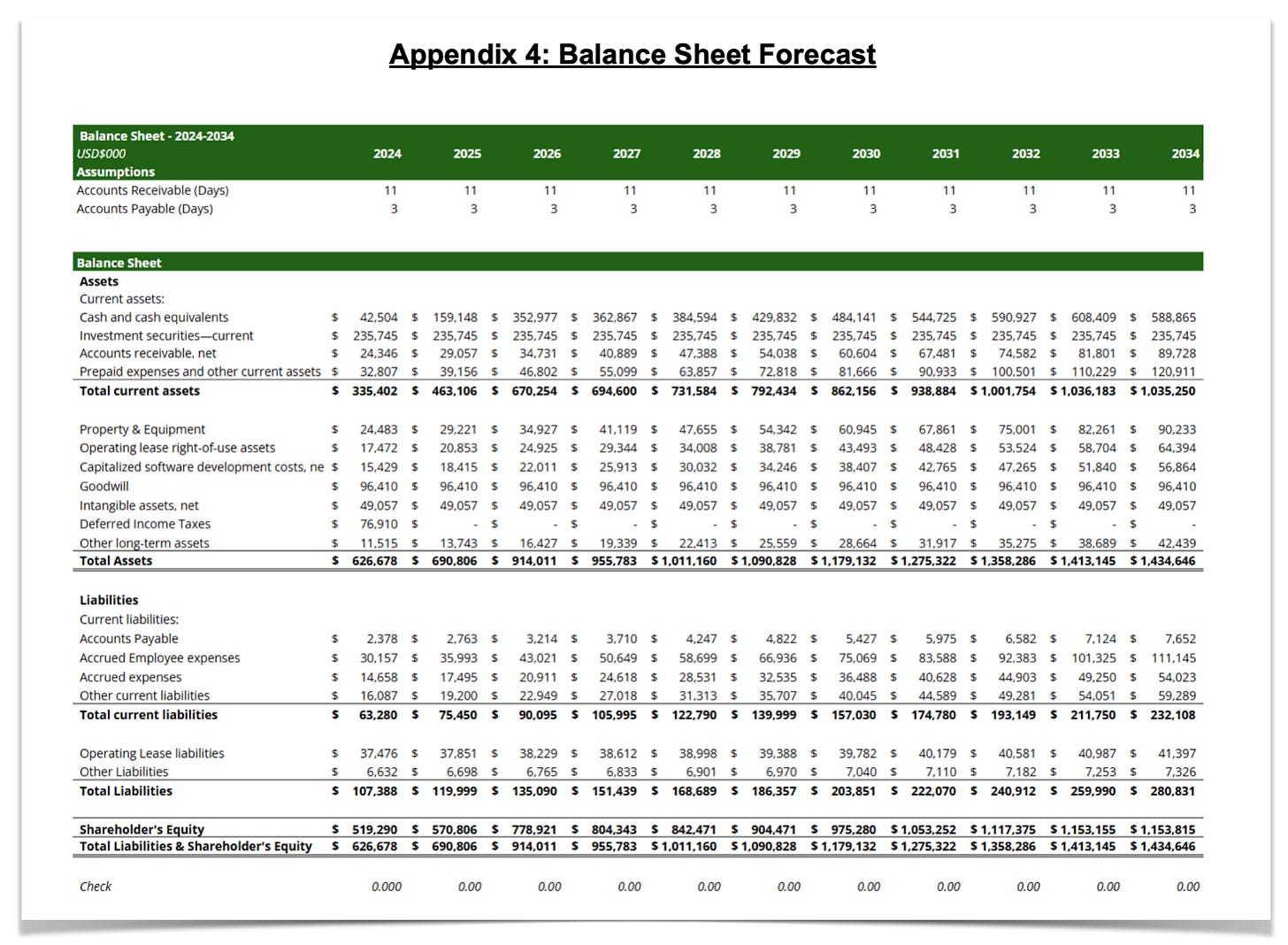

We have valued AppFolio using five-year and ten-year projections, anticipating revenue growth to $1.8 billion and FCF per share of $19.5 by 2029. Our analysis of unit economics and comparable vertical market SaaS companies supports a projection of steady-state EBIT margins exceeding 35%. We utilize a 30x exit EV/EBITDA multiple in 2029, acknowledging the expectation of continued mid-to-low double-digit earnings growth beyond that point. Based on our entry price, our base case model generates a 25% five-year IRR and a 20% ten-year IRR. The 25% IRR target is derived from an estimated share price of $685.10 in 2029 and an “intrinsic value” per share at our entry date of November 5, 2024 of $405.46. These IRR targets are derived from our comprehensive financial statement model (including income statement, balance sheet, and cash flow projections) and a discounted cash flow (DCF) model, which employs a 9% discount rate and the aforementioned 30x EV/EBITDA exit multiple. Supporting details, including a summary of our DCF analysis, are available in the appendices below.

Key Model Assumptions

Revenue: A key element of our investment thesis rests on the significant and sustained uplift APPF should experience beyond unit growth, driven by the digitization of traditionally manual real estate processes. COVID-19 appears to have catalyzed a structural shift towards digital solutions in this sector. Real estate has historically lagged other industries in digital adoption, creating a fertile ground for expansion.

Considering the breadth of processes being digitized (vendor payments, accounts payable conversion from checks, instant landlord deposits, etc.), a growth rate below 15% for the foreseeable future seems conservative. We’re modelling 21% growth in 2025 and 23% growth in 2026, which then tapers down to 12% at the end of our forecast period in 2034.

Several proxy points support a robust growth outlook:

Mastercard's U.S. volumes continue to expand at a 5% annual rate in 2024, while international volumes have posted impressive growth of 13% and 15% over the past two years.

Payment networks have consistently demonstrated double-digit volume growth over the last decade.

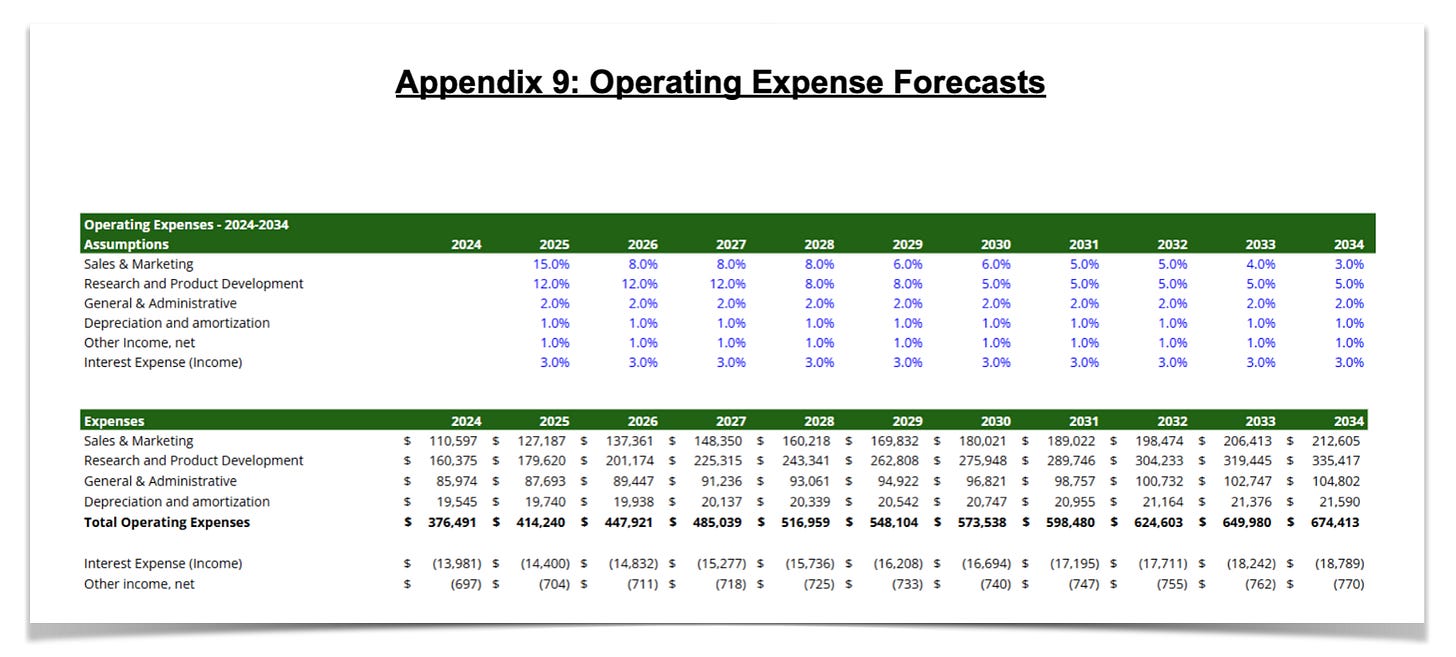

Operating Expenses: AppFolio's strategic focus on higher-value enterprise clients requires increased investment in Sales & Marketing (S&M) and Research & Development (R&D). This investment is critical for capitalizing on the upmarket opportunity and fueling sustainable growth. We believe AppFolio's management, particularly given the influence of IGSB, will maintain a disciplined approach to spending, ensuring that investments are tied to demonstrable revenue growth. Our financial model reflects this philosophy and incorporates the following projections:

R&D: We anticipate a 12% annual growth rate in R&D spending from 2025 through 2027, reflecting the need to enhance product functionality and cater to the more complex requirements of larger clients. This growth rate then tapers to 5% by the end of our forecast period, as the platform matures and development efforts shift towards maintenance and incremental improvements.

S&M: We project S&M expenses to increase by 15% in 2025 to support the initial push into the enterprise market. This rate then gradually decreases to 3% by the end of the forecast period. This tapering reflects the inherent dynamics of vertical software markets, where established players typically require less aggressive S&M spending to maintain market share.

Buybacks: As detailed in the appendices, AppFolio's business model is projected to generate substantial free cash flow. Our research indicates that beyond small, strategic acquisitions, share repurchases represent the most likely use of this excess capital. Consequently, we forecast that AppFolio will initiate share buybacks in 2027, utilizing 2-3% of outstanding shares annually from 2027 through 2034. This capital allocation strategy reflects our view of the company's strong cash generation potential and its commitment to maximizing shareholder value.

Investment Risks

Payment Mix Shift & Moving Upmarket

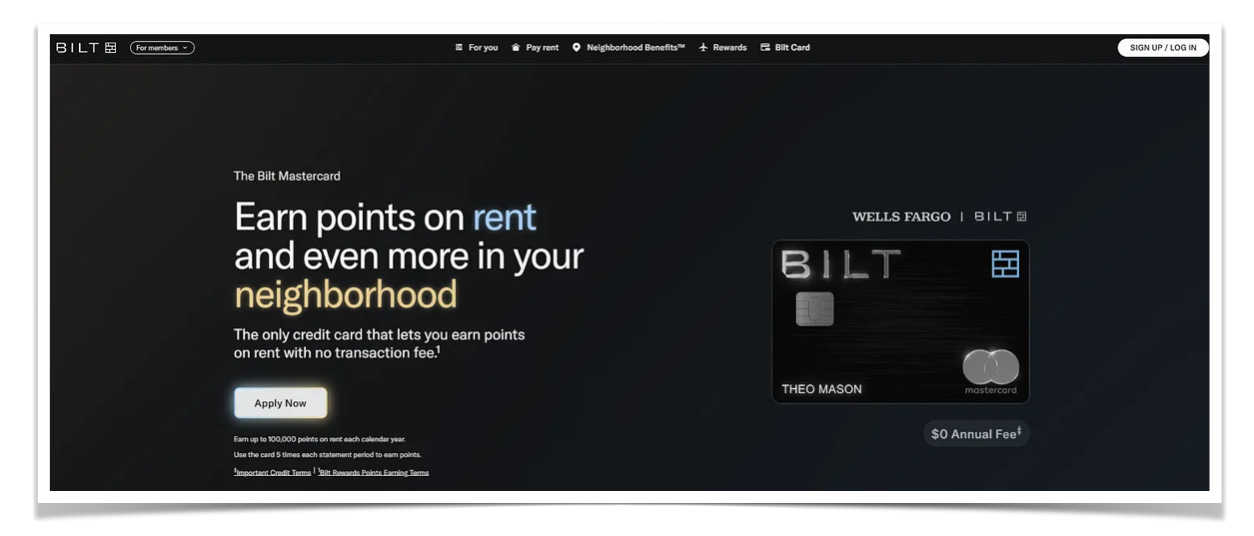

One of the bear cases for AppFolio is that payment revenue could be affected by regulatory changes impacting credit card payments or rent processing fees. Additionally, the rise of loyalty reward programs, such as Bilt, poses a significant and emerging threat according to the bears.

Background of Risk

Bilt allows tenants to earn points on rent payments, attracting a substantial user base—reportedly representing half of APPF's unit count. With over $400 million in funding and a ~$20 billion transaction run-rate, Bilt's influence is undeniable.

Bilt's business model hinges on generating revenue from non-rent transactions to offset the cost of rent rewards. While Mastercard waives interchange fees for rent, Bilt incurs costs by purchasing points from partners like airlines and hotels. The success of their model depends on tenants using the Bilt card for everyday spending.

This poses a challenge to PMS providers. Bilt's strategy involves two approaches: the Bilt Alliance and virtual account numbers. Within the Alliance, tenants pay rent directly through Bilt's app, bypassing the PMS payment system. Bilt then sends the rent payment to the landlord via ACH or check. The specifics of ACH fee sharing between Bilt, the PMS (like RealPage), and landlords within the Alliance are unclear and vary by agreement. Some landlords have even negotiated waivers of ACH fees for tenants using Bilt. Yardi's recent waiver of ACH fees and launch of its own rewards program further exemplifies this competitive pressure. Bilt's presence within the Alliance threatens to disintermediate PMS providers or squeeze them on ACH processing revenue.

For properties outside the Bilt Alliance, tenants use a Bilt-generated virtual account number within the existing PMS (e.g., AppFolio). Bilt then sends an ACH payment, with the PMS (like APPF) typically charging the tenant a fee (e.g., $2.50). This can create confusion for tenants who believe they are using a "no-fee" rent payment method.

The core risk for APPF and other PMS providers is the potential loss of rental payment processing fees. Bilt's strategy of offering free rent rewards necessitates finding alternative revenue streams, such as non-rent interchange fees, ACH processing fees, or potentially charging tenants for the card itself. This competition for payment processing revenue represents a significant challenge for PMS providers.

While Bilt's growth is a concern, its immediate impact on APPF may be limited. A former Bilt director estimated that roughly 60% of Bilt's rental volume originates from its Alliance network, which primarily consists of high-rise, urban rentals. Since APPF's customer base leans towards smaller property managers, its exposure to Bilt Alliance properties appears to be lower.

However, this raises questions about APPF's potential to move upmarket. Bilt's strong presence among larger property managers in its Alliance could mean that APPF captures a smaller share of ACH processing fees due to potential revenue sharing with Bilt. This suggests that the customer acquisition cost (CAC) and lifetime value (LTV) for APPF's expansion into larger accounts may be less predictable than before Bilt's emergence in 2021. Even with revenue sharing, though, the ACH fee, while smaller per transaction, is still a portion of a larger total dollar amount with minimal added cost to APPF.

Our Take

We have concerns regarding Bilt's long-term viability. Reports suggest significant losses for Wells Fargo, Bilt's co-branded credit card partner, with estimated losses of $10 million per month. These losses are attributed to inaccurate internal projections regarding key revenue drivers, such as cardholder balance carry rates. This echoes the challenges faced by similar ventures, such as Uber's attempted credit card partnership with Barclays, which ultimately resulted in Barclays issuing generic replacement cards. Based on these factors, we believe Bilt's business model is unsustainable, and we assess a significant risk of bankruptcy.

A key risk to AppFolio's performance lies in the potential disruption of its payment processing revenue. While credit card transactions constitute only ~5% of AppFolio's volume, they contribute ~50% of its payment revenue. Consequently, a decrease in credit card utilization for rent payments would disproportionately impact AppFolio's financials. Furthermore, as AppFolio targets larger property management companies, its lack of support for platforms like Bilt could become a competitive disadvantage, potentially hindering up-market penetration.

IGSB Exits Investment

A key risk to our investment thesis would be IGSB's divestment from AppFolio. Our positive outlook on AppFolio's capital allocation strategy relies partly on IGSB's backing, which we believe ensures responsible management and disciplined investment focused on revenue growth. IGSB's departure could alter this dynamic.

Appendices

Suggested Reading

Investment Memos

Quarterly Letters

Legal & Disclaimer

The information contained in this publication is not and should not be construed as investment advice, and does not purport to be and does not express any opinion as to the price at which the securities of any company may trade at any time. The information and opinions provided herein should not be taken as specific advice on the merits of any investment decision. Investors should make their own decisions regarding the prospects of any company discussed here based on such investors own review of publicly available information and should not rely on the information contained herein.

The information contained in this publication has been prepared based on publicly available information and proprietary research. The author does not guarantee the accuracy or completeness of the information provided in this document. All statements and expressions herein are the sole opinion of the author and are subject to change without notice.

Any projections, market outlooks or estimates herein are forward looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and the author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials.

The author may currently have long or short positions in the securities of certain of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. In addition, nothing presented herein shall constitute an offer to sell or the solicitation of any offer to buy any security.